Cerritos College Business Accounting/Finance

advertisement

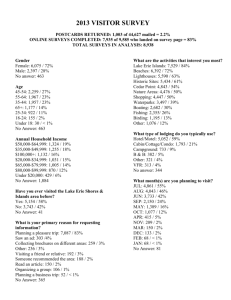

Cerritos College Business Division Accounting/Finance Department Advisory Committee Meeting June 13, 2008 BUSA/BUSF Advisory Committee Meeting June 13, 2008 Agenda Welcome and Introductions About our Department and Programs BUSA/BUSF Certificate Programs Trends and Implications – Update on Industry New Insurance Certificate Results of Program Review Update on SLO’s; BUSA 100 progress and SLO’s for BUSA 101 Promotional/Marketing Efforts VTEA priorities Accounting Club Update New on-line courses in progress Votes to be taken using the Student Response System “clickers” Question & Answer Period Closing You are important to us The guidance and perspective you bring helps us with our programs. You are partners in helping us train students to either transfer to a 4-year institution or to prepare them for work. We are thankful for your input and cooperation. We welcome your feedback!!!! About Our Program: Our Courses Our “core courses” are designed to meet transfer needs. We offer a myriad of computerized courses. Our popular Finance Courses help students with financial planning. We also offer advanced courses. Our Core Courses BUSA 100 – Introduction to Accounting Entry-level course designed to give students the basic concepts of business transactions and how they are recorded in the accounting records. Students use an on-line tool to complete homework. BUSA 101 – Fundamentals of Acct. ITransfer level course in financial accounting which explores the accounting process in depth. Students also use an on-line homework tool to complete homework. BUSA 102 – Fundamentals of Acct. II Transfer level course in managerial accounting which explores the process for gathering and analyzing financial information to make business decisions. This course focuses on how businesses use accounting information to make business decisions. Computerized Courses Our Finance Courses Personal Finance (also offered on- line) This course uses the web and Quicken software to explore various topics in personal financial planning. Retirement Planning/Investing This course explores the process of establishing a plan to accumulate assets in tax-deferred accounts, from determining annual savings necessary to asset allocation concepts. Stockmarket and Investments This course explores the fundamentals of investing in the equity markets. Our Insurance Courses o INS 101 - INTRODUCTION TO INSURANCE o INS 102 - INSURANCE CODE AND ETHICS o INS 121 - INSURANCE PRINCIPLES: PROPERTY AND LIABILITY o INS 122 - PERSONAL INSURANCE o INS 123 - COMMERCIAL INSURANCE o INS 171 - INSURANCE OCCUPATIONAL WORK EXPERIENCE Our courses are designed to serve the needs of both transfer students and students seeking job related skills. Certificates Available Business Accounting Microcomputer Accounting Clerk Advanced Accounting Advanced Microcomputer Accounting Clerk Payroll Administration Insurance Curious about our courses? You can visit some of our faculty websites: http://www.cerritos.edu/dschmidt http://www.cerritos.edu/mfronke http://www.cerritos.edu/mfarina http://www.cerritos.edu/talenikov http://www.cerritos.edu/pmoloney Trends – CPA’s As of 2007, 42 states and the District of Columbia required CPA candidates to complete 150 semester hours of college coursework—an additional 30 hours beyond the usual 4-year bachelor’s degree. Several other states have adopted similar legislation that will become effective before 2009. Colorado, Delaware, New Hampshire, and Vermont are the only states that do not have any immediate plans to require the 150 semester hours. In response to this trend, many schools have altered their curricula accordingly, with most programs offering master’s degrees as part of the 150 hours. Prospective accounting majors should carefully research accounting curricula and the requirements of any states in which they hope to become licensed. Trends in Industry Accountants and auditors held about 1.3 million jobs in 2006. They worked throughout private industry and government, but 21 percent of accountants worked for accounting, tax preparation, bookkeeping, and payroll services firms. Approximately 10 percent of accountants or auditors was self-employed. Many management accountants, internal auditors, or government accountants and auditors are not CPAs; however, a large number are licensed CPAs. Most accountants and auditors work in urban areas, where public accounting firms and central or regional offices of businesses are concentrated. Some individuals with backgrounds in accounting and auditing are full-time college and university faculty; others teach part time while working as self-employed accountants or as accountants for private industry or government. THREE OF THE LARGEST EMPLOYERS IN THE NATION LAST YEAR (in terms of entry level positions) 4. Internal Revenue Service: 5,000 entry level positions 7. Deloitte and Touche: 3,500 entry level positions 10. Ernst & Young: 3,180 entry level positions Earnings – Updated 2007 POSITION SALARY RANGES Executive Chief Financial Officer $ 150,000 -$ 250,000 + Vice President of Finance $ 120,000 -$ 135,000 + Director of Audit $ 110,000-$ 130,000 + Director of Finance $ 110,000-$ 130,000 + Treasurer $ 100,000-$ 120,000 + Controller $ 95,000-$ 115,000 + Management Assistant Controller/Accounting Manager $ 80,000-$ 90,000 Cost Accounting Manager $ 80,000-$ 85,000 Tax Manager $ 80,000 - $ 90,000 Audit Manager $ 75,000 -$ 80,000 SEC Manager $ 75,000 -$ 80,000 Finance Manager $ 75,000 -$ 80,000 Payroll Manager $ 65,000 -$ 70,000 Credit/Collections Manager $ 65,000 - $ 75,000 Staff Senior Financial Analyst $ 75,000-$ 80,000 Financial Analyst $ 65,000-$ 70,000 Credit Analyst $ 60,000-$ 65,000 Sr. Cost Acct./Analyst $ 75,000-$ 85,000 Cost Accountant/Analyst $ 65,000-$ 75,000 Revenue Accountant $ 65,000-$ 70,000 Tax Accountant $ 70,000-$ 85,000 Accounting Supervisor $ 60,000-$ 75,000 Internal Auditor $ 70,000-$ 80,000 Senior Accountant $ 60,000-$ 75,000 Staff Accountant $ 40,000-$ 45,000 Junior Accountant $ 32,000-$ 35,000 Earnings Updated 2007 Support Full Charge Bookkeeper $ 40,000-$ 45,000 Bookkeeper $ 38,000-$ 42,000 Senior Clerk $ 34,000-$ 40,000 Payroll Clerk $ 28,000-$ 36,000 AR/Credit & Collections Clerk $ 24,000-$ 34,000 Accounts Payable/Billing Clerk $ 24,000-$ 34,000 Accounting Clerk $ 24,000-$ 34,000 Insurance Certificate INSURANCE-PROPERTY AND CASUALTY CERTIFICATE OF ACHIEVEMENT DIVISION/DEPARTMENT REQUIREMENTS: INS 101 INS 102 INS 121 INS 122 INS 123 INS 171 BA 100 BA 113 OR BL 111 BA 156 OR BCOM 147 ACCT 101 ACCT 133 CIS 101 UNITS INTRODUCTION TO INSURANCE INSURANCE CODE AND ETHICS INSURANCE PRINCIPLES: PROPERTY AND LIABILITY PERSONAL INSURANCE COMMERCIAL INSURANCE INSURANCE OCCUPATIONAL WORK EXPERIENCE FUNDAMENTALS OF BUSINESS LEGAL ENVIRONMENT OF BUSINESS BUSINESS LAW MOTIVATIONAL PRESENTATION SKILLS FOR MANAGERS BUSINESS COMMUNICATIONS FUNDAMENTALS OF ACCOUNTING I SPREADSHEET ACCOUNTING I INTRODUCTION TO COMPUTER INFORMATION SYSTEMS TOTAL CERTIFICATE REQUIREMENTS: This is an unofficial document - Catalog for official document Fall 2008 1.0 1.0 3.0 3.0 3.0 1.0 3.0 3.0 (3.0) 3.0 (3.0) 4.0 3.5 3.0 31.5 Results of Program Review The entire department fully participated in this process. We were complimented on the final product by both the Chair of the Committee and the Dean. Our program review document is available on the web as a model for future programs. It was a lengthy process, but one that brought our group together. We truly believe we have a solid program. STUDENT LEARNING OBJECTIVES FOR BUSA 101 DRAFT FOR DISCUSSION Define and use accounting and business terminology. Record transactions for current asset, plant asset, current liability, and longterm liability accounts. Prepare a balance sheet, income statement, and retained earnings statement for a corporation. Record transactions to issue common stock, repurchase common stock, and declare and pay dividends. Vote to approve S.L.O.’s Marketing and Promotional Efforts The college overall has experienced a decrease in enrollment. Our night enrollment has decreased. We believe this is primarily caused by administration’s refusal to hire a full time accounting faculty member. We have met with Mr. Mark Wallace, Director of Public and Government Relations, and his staff. We have selected specific students for college advertisements. Our accounting and insurance programs have been targeted for increased marketing efforts. The department has developed a flyer. We expect public relations to help us develop targeted mailing lists, and to help increase our presence through print and radio advertising. We would like advice from any insurance specialists to help us promote the new insurance program. VTEA Priorities Equipment Updates Software Updates Vote to recommend VTEA funds be used for equipment and software updates, and staff training. Accounting Club Update The Accounting Club, led by Mr. Peter Moloney, has been very busy this year. Here are a few of their highlights during last year: 3/8/07 Crystal Conley, USC 4/17/07 Berenice Manzo, UCSB 4/26/07 Mike Farina - Retirement/Investments 8/30/07 Clarence Banks, UCLA 9/27/07 Berenice Manzo, UCSB 10/4/07 Peter Moloney - accounting careers 10/25/07 Crystal Conley, USC 41 attendees 22 attendees 40 attendees 71 attendees 29 attendees 32 attendees 56 attendees The club also recently had a partner from Ernst & Young speak about recruiting and interviewing tips. It was also well attended. The club is growing and vibrant and many students are in the process of transferring to universities They have used their networking skills to obtain internships, scholarships, and to gain entrance into universities of their choice. On-Line Courses Under Development These are currently offered only as traditional classes. We are in the process of creating the curriculum documentation needed to supplement our online offerings. BUSA 60 - QuickBooks BUSA 250 – Income Tax Accounting BUSA 270 – Auditing Vote to recommend that these courses be offered on-line. Thank you for joining us We look forward to meeting the needs of your future employees! We appreciate your advice! The Accounting/Finance Department extends its appreciation to our business/industry partners and community members who volunteer their time to serve on the advisory committee.