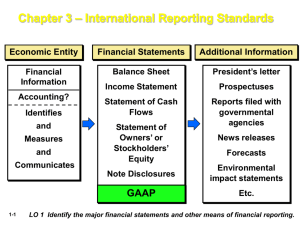

Practice Question 05 Correct! Varied – the SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed. The role of the Securities and Exchange Commission (SEC) in the formulation of accounting standards can be best described as it allows the FASB to develop all accounting standards by itself. varied – the SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed. non-existent. it develops all accounting standards by itself. Practice Question 06 Correct! As a result of the call for greater regulation after the stock market crash of 1929, the federal government established the SEC to help develop and standardize financial information for stockholders. Which of the following was established by the federal government to help develop and standardize financial information presented to stockholders? CAP (Committee on Accounting Procedure). SEC (Securities and Exchange Commission). AICPA (American Institute of Certified Public Accountants). FASB (Financial Accounting Standards Board). Practice Question 11 Correct! GAAP is as much a product of political action as it is of careful logic or empirical findings. Politics play no role in establishing GAAP (Generally Accepted Accounting Principles). True False Practice Question 14 Correct! The International Accounting Standards Board (IASB) issues International Financial Reporting Standards (IFRS). International Financial Reporting Standards (IFRS) are issued by the: SEC (Securities and Exchange Commission). FASB (Financial Accounting Standards Board). IASB (International Accounting Standards Board). EITF (Emerging Issues Task Force). Pre-Lecture Question 03 Correct! Providing information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors is the objective of financial reporting. Which of the following is the objective of financial reporting? To provide information: about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors. about the management and shareholders of an enterprise. that defines the process of how and at what cost money is allocated among competing interests. used to identify, measure, analyze and communicate financial information needed by management to plan, control and evaluate a company’s operations. Post-Lecture Question 05 Correct! Public corporations are required to file audited statements with the Securities Exchange Commission. Corporations whose securities are listed on a U.S. stock exchange are required to file audited financial statements with the Securities Exchange Commission. True False