as_with_most_things_in_economics

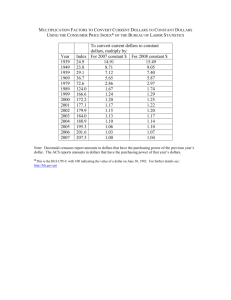

advertisement

As with most things in economics, taxation is a mixed blessing. It is a blessing for those who receive dollars from taxpayers, which is about 40% of the population; and it is a nuisance for those who have to pay the taxes. The objective of this unit is to help you understand taxes and understand how they affect your life and the economy. The income tax system began in earnest in 1913 with the Sixteenth Amendment to the Constitution that gave Congress legal authority to tax income. A rudimentary income tax system was tried during the Civil War but was eventually declared unconstitutional. There was no income tax during the high watermark of America's industrial capitalism, beginning in about 1870 and continuing to 1910. If you made money in that era, you kept it. Many of the most famous capitalist names emerge from this era: Rockefeller, Carnegie, McCormick, Swift, and Vanderbilt. Two major disasters in our economic history, the Great Depression and World War II, changed the role of taxation and government forever. Beginning in the mid-1930s, following the ideas of John Maynard Keynes, the U.S. government began to spend money much more aggressively. In the past, government believed mostly in a balanced budget, but that changed when the Great Depression lingered for an entire decade. Later, to finance a two-front, world war, taxes were raised to about 90%. Thus began the era of big taxes to pay for big government. Taxes, of course, have fallen from that lofty peak to a more modest 35% marginal tax rate at present, but the number of taxes has increased exponentially. All but six states have an income tax; likewise, many counties and cities have an income tax. Though there are many ways to slice the tax onion, perhaps the best is the following: Progressive taxes: This is a tax system in which tax rates increase as income increases. In other words, the more money you make, the more taxes you pay. This system places a greater burden on those best able to pay and almost no burden on the poor. For example, according to Internal Revenue Service (IRS) statistics, the top 50% of earners pay 97% of the taxes. The top 1% of earners pays 30% of all income taxes. On the other hand, over fifty million people, or one-third of the adult population in the United States, pay no taxes whatsoever. Regressive taxes: In theory, these are the opposite of progressive taxes; these tax strategies fall more heavily on the poor. Common sense would suggest that these would be rarely used in a wellorganized economy, but in fact, they are among the most commonly used because of their relative invisibility. Sometimes called the nickel and dime tax, regressive taxes tend to be small for each individual event; therefore, they are not widely noted. A good example of a regressive tax is the sales tax. It takes a much larger percentage of a poor person’s income than the income of someone of wealth. The reason there is no protest is that it takes such a small amount of money on each event, typically 7%. Other examples of regressive taxes are the Social Security tax and Medicare tax. Social Security takes 6.2% of your gross income, plus 1.45% for Medicare. Of American workers, 70% pay more to Social Security and Medicare than to income taxes. Proportional tax: The third type of tax system is a proportional tax; it is sometimes called a flat tax. A flat tax system would place a single tax rate on all members of society—say 15%. Proponents argue that everyone would pay the same rate of taxes; therefore, it would be more fair. In exchange for the simplicity of a flat tax, taxpayers would need to give up all deductions. Therein lays a major problem because millions of homeowners would lose the deductibility of real estate taxes and interest payments. The Federal Government The Federal Government is the single largest influence on the U.S. economy. There are two main areas in which the government can impact the economy: fiscal policy and monetary policy. Through its spending and taxing policies, the government raises revenues and purchases vital goods and services for the country. When the government spends and taxes, this is known as fiscal policy. Monetary policy describes the actions of the central bank, known as the Federal Reserve. The central bank helps to regulate interest rates and the activities of all the commercial banks in the country. Fiscal Policy In a democracy, elected officials of the government create programs for the general welfare of the population. To pay for these programs, the government taxes individuals and firms. In this way, the government redistributes income from those it taxes to those who receive goods and services. Two significant Federal Government programs are Social Security and Medicare. Social Security provides for the needs of the elderly and disabled and is primarily funded through a tax on wages. Medicare is a Federal Government insurance program that covers the health care needs of the elderly. These two programs, in combination, have greatly reduced the level of poverty among elderly Americans. The government also spends significant resources on areas like military and agricultural subsidies. Groups of individuals and firms can join together to create a special interest and lobby the government for tax breaks or special spending. Every year when the federal budget is passed, careful choices must be made in allocating scarce resources to various government programs. Monetary Policy Unlike fiscal policy, monetary policy is set by unelected officials. A group of economists is appointed by the executive branch and confirmed by the Senate to serve on the Federal Reserve Board, also known as the Fed. The central bank of the United States is thus quasi-independent from political influence and does not favor one political agenda over another. The Federal Reserve has regular meetings to discuss the future direction of the economy. Various economic factors like inflation, unemployment, and consumer spending are considered at each meeting. The Fed must then arrive at a set of optimal policy decisions to guide the economy on a path of low inflation and positive economic growth. This is not an easy task because the economic factors are often contradictory and the future is not always clear. Coordination of Fiscal and Monetary Policy The Fed is somewhat independent of government operations, so the possibility exists that fiscal and monetary policies could be working at cross-purposes. Twice a year the chairman of the Fed gives testimony to both houses of Congress to sketch out future Fed policies. The Federal Reserve is more adept at making policy changes than Congress because it has several economic tools it can operationalize immediately. For example, the Fed was able to act quickly in September of 2001 to help stabilize the economy. Wealth Creation The term wealth maximization is used in finance and investments for both individuals and corporations. In the corporate finance area, wealth refers to shareholder value or net worth on a market value basis. That is, total assets less total liabilities equals net worth or shareholder wealth. The corporation conducts its business to maximize shareholder value or shareholder wealth. It does this through its investing, financing, and operating activities. In the same regard, an individual creates an investment plan to increase net worth over a period of time. The wealth is measured on a market value basis as the difference between assets minus liabilities. Assets (market value) – Liabilities = Net worth or Total Wealth Individuals invest in assets that earn returns through income and appreciation. Wealth is accumulated through a process of systematically investing and reinvesting the earned income and net gains. Individuals will invest in various asset classes that earn different rates of returns and have different risk profiles. In general, a higher level of desired wealth will require a higher rate of return, which in turn, requires greater risk, so individuals must consider both the risk and return on their investment. Individuals can get in trouble when only expected returns are considered. Investment planning should consider both return and risk. The term risk averse explains that, given the same return for different investment alternatives, investors seek the investment with the least risk. Or, rather, given investment alternatives with the same risk, investors seek the one with the highest return. Investors will demand higher returns for higher risk investments. Thus, there is a risk-return trade-off. Low levels of uncertainty or risk are desirable, but the returns associated with low risk are also low. High levels of uncertainty or risk are not desirable, but they are associated with high returns. According to the American Association of Individual Investors (AAII) (2009), the annual returns for the past 60 years for the investments classes are as follows: Asset Class Risk Class Annual Return Treasury bills Low 4.5% Intermediate-term bonds Medium 6% Stocks High 11% Investors must accept some level of risk, but capital preservation and stability must be a part of a wealth accumulation program. Inflation Inflation relates to the purchasing power of the dollar over time. The inflation rate is the rate of change in prices for goods and services. Two popular measure of inflation are the consumer price index (CPI) and the producer's price index (PPI). These rates track the prices of a basket of goods and services over time periods: monthly, quarterly, and annually. Inflation is one of the risks of holding investments. Other risks include such items as interest rate risk, exchange rate risk, and default risk. Risk refers to the rate of variability in investment value and/or possible loss of value of investment. Risk equals loss of value. The rate of inflation is a measure of the purchasing power risk. It depends on price levels. If prices rise, inflation rises and purchasing power decreases. Thus, in terms of purchasing power, it takes more dollars to purchase the same level of investment. Thus, increasing inflation reduce investment value in terms of purchasing power. Although recent inflation rates have been low, financial planners have generally used inflation rates of 3–4% as a long-term inflation rates in investment models. Economists and financial planners will use the terms nominal rates and real rates of return. The nominal rate is the current stated rate of return, which includes inflation. The real rate of return is the nominal rate less inflation. For example, if the nominal rate of return is 10% and the inflation rate is 4%, the real rate of return is 6%. Reference American Association of Individual Investors. (2009). Retrieved from http://www.aaii.com Microeconomics Basics Microeconomics is the study of markets and choices of individuals over a period of different time intervals. This includes individual households, organizations (both for-profit and not-for-profit), and government agencies (Dolan & Lindsey, 1991; Boulding, 1950). According to David E. Laidler (1974), microeconomics is the behavioral study of individuals that develops foundations of the economic system: prices, outputs, and consumptions. On the other hand, macroeconomics is a general overview of the economy in a large-scale and broad viewpoint (Boulding, 1950). Melvin L. Greenhut (1963) notes that microeconomics is mainly considered to be comparing several different market types while revealing the economic laws. Microeconomics is not concerned about the fluctuations in total products (this would be considered macroeconomics); rather, it strives to analyze the market over different time periods. Price Elasticity Dolan and Lindsey (1991) define elasticity as the ratio of percentage change or a measure of a specific response of one variable or factor to a change within another variable or factor. The two types of elasticity are the price elasticity of demand, also known as demand elasticity, and the price elasticity of supply, also known as supply elasticity. Demand elasticity is the ratio of the percentage change in quantity of a good demanded to a given percentage change in its price (when all other factors are equal). The supply elasticity is the ratio of the percentage change in the quantity of a good supplied to a given percentage change in its price (when all other factors are equal) (Dolan & Lindsey, 1997). Long Run and Short Run Characteristics According to Chrystal and Lipsey (1997), the term short run is defined as the period of time over which a number of inputs (also referred to as fixed inputs) cannot be varied. The term fixed in a short run may consist of such things as resources (e.g., land, labor, and capital) within a corporation. A long run is "a period long enough for all the inputs to be varied" (Chrystal & Lipsey, 1997). The goal of a long run is to analyze the current available data prior to any changes that may have occurred from basic technological changes. Keep in mind that the short run and long run in economics are not based on actual time but instead are primarily based on the production changes via technology (i.e., new and improved products and new methods of production) (Chrystal & Lipsey, 1997; Greenhut & Scott, 1963). Economic Strategies One area of economic strategy is pricing. Firms can either price products aggressively with a low-cost strategy or differentiate on service/product quality and charge a price premium. Firms that pursue the low-cost strategy typically have a cost structure that is lower than that of competitors, and they have found a way to manufacture their goods, offer their service, or leverage their supply chains with less cost than the competition. These firms typically operate on thin margins (meaning that their gross or operating margins are not very high). Companies that pursue a differentiated service or product-offering strategy have typically developed a higher quality service offering a better product, or they are perceived to offer better quality than competitors. These firms may or may not have stronger margins, depending on their cost structure relative to competitors. Supply And Demand Market demand and supply explains the behavior and composition of markets for goods and services. Goods that are in strong demand or have few good substitutes typically offer supply firms an opportunity to charge a higher price, thus generating more revenue. Revenue is a major driver in cash flow. Firms with products that have a strong demand can generate significant cash flow and enhance firm value. On the supply side, producers can enhance cash flow by seeking to inhibit costs from growing more than the increase of profits or by driving costs down. This can be accomplished by employing more efficient production techniques through better technology or a more productive labor force, by purchasing lower cost goods, or by forming a better supply chain. All other things being equal, firms with more efficient production processes will have a lower unit cost than competitors, better profit margins, stronger cash flow, and higher valuations. References Boudling, K. E. (1950). A reconstruction of economics. New York: Wiley. Chrystal, K. A., & Lipsey, R. G. (1997). Economics for business and management. New York: Oxford University. Dolan, E. G., & Lindsey, D. E. (1991). Microeconomics (6th ed.). Chicago: Dryden. Greenhut, M. L. (1963). Microeconomics and the space economy: The effectiveness of an oligopolistic market economy. Chicago: Scott Forseman. Laidler, D. E. (1974). Introduction to microeconomics. New York: Basic. What enters your mind when you hear the word business? Do you think about IBM? Or do you think about the mom-and-pop grocery stores? Businesses range from small companies to large enterprises. Today’s businesses produce most of the goods and services we consume. These same businesses employ most of the working class in the United States and all over the world. The driving forces of business include the following: Labor Capital Entrepreneurs Physical resources Information resources Understanding economic systems is key in planning and running a business. There are several types of economic systems including the following: planned economy, such as communism and socialism, in which individuals contribute according to their abilities and thus receive economic benefits market economy, which is a mechanism for exchange between buyers and sellers of a particular product or service mixed market economy, which is a combination of the both planned and market economies socialistic planned economy, in which the government owns and operates major industries The success of a company is predicated on how productively it is managed. The basics of planning, organizing, directing, and controlling are taken to a new level when business is international. For example, Wal-Mart started out as a U.S. growth company but then realized the opportunity for foreign expansion. Wal-Mart aggressively opened new stores and purchased existing retail chains, quadrupling its foreign sales to $14 billion between the years of 1995 and 1999. With international expansion, there are barriers to trade, including social and cultural differences, such as language, culture, and business formalities. In Japan, it is considered an insult if you are given a business card that you glance at and then place in your pocket. economic differences. In dealing with mixed economies, the intervention of the government can play a critical role as how business is transacted. For example, the French government is heavily involved with all aspects of air travel and design. This makes dealing with planned economies like China and Vietnam difficult. legal differences. Many times, an accepted business practice in one country is illegal in another country. political differences. Governments can place laws and restrictions that can prohibit conducting business altogether. The Present Value of Future Income The effect of inflation on the dollar causes a drop in its value such that the dollar you earn tomorrow will not be worth as much. Even if there were no inflation, lenders would charge borrowers what they call the real rate of interest. The reasoning for this is a dollar that is loaned gains interest. The person borrowing the dollar is willing to pay the additional amount so he or she can spend the money today. To figure out the value of the income from a dollar that earns interest for any period of time, use the following formula: 1___ (1 + r)n r = interest rate and n = amount of time before the dollar was repaid For instance, if the interest rate were 7%, how much would $100 today be worth in a year? The answer is $107. When the interest rate rises, the value of future dollars will decline and when the rate falls, the value of the future dollars will rise. Interest Rates and Consumer Loans States have issued usury laws to place limits on how much interest can be charged on consumer loans. According to Merriam-Webster OnLine, usury is defined as charging "an unconscionable or exorbitant rate or amount of interest" (usury, 2009). Because there are a lot more borrowers in the market than lenders, these laws can create a shortage of loanable funds and interfere with the laws of supply and demand. When prices are low, buyers try to buy more; when they are high, sellers offer more goods and services. A high interest rate signals sellers to provide more loanable funds while discouraging borrowers from borrowing. A high enough interest rate can eliminate the shortage of funds. These laws can sometimes also hurt borrowers with low credit ratings. When loaners are willing to loan out money, it only goes to the people they consider to be the most creditworthy (Slavin, 2006). Perfect Competition Perfect competition is a situation in the marketplace in which there are many well-informed sellers and many well-informed buyers of an identical product, and there are no barriers to entering or leaving the market. A company that would be perfectly competitive would be a company that is working at the break-even point simply to survive and thus is operating at peak efficiency. Perfect competition, however, does not exist in any industry. There are several industries that are close to perfect competition, but none are perfect because perfect competition is an ideal economic state. Perfect competition would also mean the end to monopolies, monopolistic competition, and oligopolies. Now examine the different aspects of perfect competition. The first aspect of perfect competition to examine is the sellers. In perfect competition, there are so many companies that no one company has enough influence to affect the price of the good or service. There are so many companies in the market because there are low barriers to entry. The second aspect of the perfect competition is the numerous buyers in the marketplace. Again, there are so many buyers because the good or service is in demand or a necessity and because there are low barriers to buying the good or service. The third aspect is that all companies need to sell an identical or standardized product. This means that consumers cannot tell the difference between what one seller offers from what another seller offers, so the buyers think the goods or services are identical; therefore, consumers make their decisions based solely on the price of a good or service because all the products are identical. The final aspect to perfect competition is the low barriers to entry. In perfect competition, the barriers to entry into a marketplace must be so low or not exist at all for anyone to be able to enter the market as a buyer or seller. Usually, there are barriers to enter a market that prohibit new companies into a market; however, in perfect competition none of those barriers exist, which allows anyone to enter or leave the market as they wish. Low entry barriers may occur naturally because some industries simply do not require the financial and physical capital other industries do. The agriculture industry is an example of near-perfect competition. You have many sellers and many buyers of an identical product. Wheat farmers have to sell their wheat at the market price, entry and exit into wheat farming is relatively easy, buyers and sellers are numerous all over the world, and the product is perceived to be the same whether the wheat is from Texas or from South Dakota. Land and Rent Land is capital that is used in production. Owners of land are paid rent for allowing businesses to use their land. The amount of rent is based on the supply of land available and the demand for that available land. Land should not be confused with what is built on the land. The supply for land is fixed. There is only so much land on the planet. Likewise, there is only so much land available in any given location. In economics, the supply for land is fixed because more land cannot be gained. The demand for land is derived from a company's marginal revenue product (MRP) curve. Land will always go to the highest bidder, or whoever is willing to pay the most for the land. From the diagram below, one can see that the only way the price of rent changes is when the demand for land changes. If D1 is the normal demand for land, D2 is when the demand for land drops, thus dropping the price of land. References Slavin, S. L. Economics (8th ed.) New York: McGraw-Hill/Irwin. usury. (2009). In Merriam-Webster online dictionary. Retrieved October 16, 2009, from http://www.merriam-webster.com/dictionary/usury In the past, many nations protected their domestic businesses. Today, however, countries are realizing the financial benefits of foreign trade and are aggressively encouraging it. Coping with Inflation There following two alternative approaches, used to modify the accounting process to cope with inflation, have received much attention: Constant dollar (also called general price level) accounting approach: With this approach, historical costs in the financial statements are adjusted to the number of current dollars representing an equivalent amount of purchasing power. All amounts are expressed in units (current dollars) of equal purchasing power. Because a general price index is used in restating the historical costs, constant dollar accounting shows what happens when there is a change in the price of a product or service. Current cost accounting: With this approach, assets and expenses are shown in the financial statements at the current cost to replace those specific resources. The current replacement cost of a specific asset may rise or fall at a different rate from the general price level. Current cost accounting shows the effects of specific price changes rather than changes of prices of different products. To illustrate these approaches to inflation accounting, assume that in Year 1, you purchased 500 pounds of sugar for $100 when the general price index was at 100. Early in Year 2, you sold the sugar for $108 when the general price index was at 110, and the replacement cost of 500 pounds of sugar was $104. Unadjusted historical cost Adjusted for general inflation (constant dollars) Adjusted for changes in Specific Prices (current Costs) Revenue $108 $108 $108 Cost of goods sold 100 110 104 Profit (loss) $8 $(2) $4 Under each method, an amount is deducted from revenue to provide for recovery of cost; however, the value assigned to the cost of goods sold differs under each of the three approaches. The unadjusted historical cost method is used in current accounting practice. The use of unadjusted historical cost is based upon the assumption that the dollar is a stable unit of measure. Profit is determined by comparing sales revenue with the historical cost of the asset sold. In using this approach to income determination, accountants assume that a business is as well off when it has recovered its original dollar investment, and that it is better off whenever it recovers more than the original number of dollars invested in any given asset. In our example of buying and selling sugar, the profit figure of $8 shows how many dollars you came out ahead; however, this approach ignores the fact that Year 1 dollars and Year 2 dollars are not equivalent in terms of purchasing power. It also ignores the fact that the $100 deduction intended to provide for the recovery of cost is not sufficient to allow one to replace the 500 pounds of sugar. When financial statements are modified for changes in the prices of products, historical amounts are restated as the number of current dollars equivalent in purchasing power to the historical cost. Profit is determined by comparing revenue with the amount of purchasing power (as stated in current dollars) originally invested. The general price index tells us that $100 in Year 2 is equivalent in purchasing power to the $100 invested in sugar in Year 1. But you do not have $110 in Year 2 because you received only $108 dollars from the sale of the sugar. Thus, you have sustained a $2 loss in purchasing power. In the current cost accounting, profit is measured by comparing revenue with the current replacement cost of the assets consumed in the earnings process. The logic of this approach lies in the concept of the going concern. What will you do with the $108 received from the sale of the sugar? If you are going to continue in the sugar business, you will have to buy more sugar. At current market prices, it will cost $104 to replace 500 pounds of sugar; the remaining $4, therefore, is designated as profit. Current cost accounting recognizes in the income statement the costs. The resulting profit figure closely parallels the maximum amount that a business could distribute to its owners while still being able to maintain the present size and scale of its operations.