FedACH Initiatives

advertisement

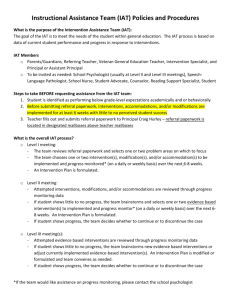

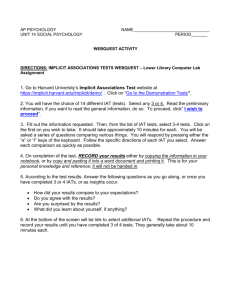

FedACH Initiatives Getting on the right path with ACH Risk and IAT Lance Wagner, AAP Federal Reserve Bank September 10, 2009 Nebraska Treasury Management Conference Agenda • Quick glance at payments • FedACH strategies for risk management • What’s this “IAT” thing all about? Are you kidding me... ACH Payments • Let’s not forget – the ACH network is a safe, reliable, high-quality payments system. • Changes in the payments system – more transactions moving to ACH ▫ How these transactions are handled - transactions initiated via media such as the Internet and telephone ▫ Payments moving to the back office ▫ Cross boarder payments FedACH Risk Suite of Services 8 ® FedACH Risk Management Services • FedACH Risk® Returns Reporting Service ▫ Provides the ODFI with a necessary tool for detecting and addressing poor origination practices or possible originator fraud. • FedACH Risk® Origination Monitoring Service ▫ Allows an ODFI to limit ACH origination exposure (credit and debit) for a routing number or Company ID. • FedACH® RDFI File Alert ▫ Gives an RDFI the opportunity to monitor incoming FedACH® files for “out of the ordinary” ACH file values and sizes that could impact ACH settlement or indicate possible fraud attempts. 9 Common Features & Benefits • Services are accessible through your existing electronic FedLine® Customer Access Service. • Turnkey, user friendly solutions. • E-mail alerts notify your institution when your monitoring thresholds are exceeded. • Helps strengthen and support your institution’s overall risk strategy. • Can replace potentially error-prone and time-consuming manual monitoring practices. • Reporting features help address audit and compliance concerns. 10 ® FedACH Risk Management Services Let’s look at each risk platform 11 Risk Returns Reporting Effective January 1, 2008, NACHA changed the requirement on reporting unauthorized returns ▫ Now 1% (down from 2.5%) ▫ For any originating ID with 1% or more of unauthorized returns during a 60 day window, you must report this activity to NACHA 12 FedACH Risk Returns Reporting Service Enables ODFIs to produce reports of returns by originator for a single day or up to a 10-day processing date range ▫ Within the previous 60 business days 13 Service Benefits • Establish thresholds at which an originator’s return volume will appear on a report • Set reporting threshold as low as one return for unauthorized returns and administrative returns ▫ R05, R07, R10, R29, R51 ▫ R03 and R04 14 Accessibility and fees • FedACH Risk Returns reporting service is available to any ODFI with an electronic connection to the Fed (FedLine Web) and access to the FedACH Information Services application • Free service ▫ No monthly maintenance fees ▫ No monthly service fee 15 FedACH Risk Returns Reporting Risk Returns Reporting View reports of returns by originator for a selected 10day processing date range within the previous sixty business days, or for a specific processing date. 16 ® FedACH Risk Management Services FedACH Risk® Origination Monitoring Service 17 FedACH Risk® Origination Monitoring Service Features and Benefits • Mitigate financial institution’s ACH origination risk for forward item batches through independent monitoring by FedACH. • Control ACH payments originated by FI’s customers regardless of the network entry point or their ACH software. • Tailor and self-administer the monitoring criteria to reflect their own risk management strategies and originator profiles. • Cumulative credit/debit value caps provide flexibility and limit exposure to origination across one or more processing days. 18 FedACH Risk® Origination Monitoring Service Features and Benefits • End-of-day default instructions provide automated processing when no decision to release or reject pended batches is made. • Augments existing systems that control origination only at the originator's point of creation. ▫ Supplements monitoring for strategic customer relationships ▫ Provides confidential monitoring when caps have not been communicated • Enables consistent, comprehensive, and centralized monitoring for both internal and external origination. 19 FedACH Risk® Origination Monitoring Service Features and Benefits ▫ Establish contacts who will receive email notification when a batch is pended due to breach of criteria or an undefined Company ID ▫ Assign specific access to individuals at their institution to release or reject pended batches ▫ Establish Release or Reject action as end-ofday default for any pended batches not responded to by end-of-day ▫ Self-administer criteria selection and changes 20 FedACH Risk Origination Monitoring ® Methods for Managing Originators • Routing Number Only ▫ Manage all batches by the ODFI’s routing number • Company ID Inclusive ▫ Manage batches by the Company IDs defined by the ODFI and pend all batches from an undefined Company ID • Company ID Select ▫ Manage batches by the Company IDs defined by the ODFI and process all batches from other Company IDs Risk Origination Monitoring Sample Set-up Screen Enter cap information. Select a cap time frame. Select an end of day default. An End-of-Day Default of “Release” will cause batches in a pend status to be released at the end of the process day. An End-of-Day Default of “Reject” will cause batches in a pend status to be rejected at the end of the process day. 22 Reporting Capabilities with Risk Origination Monitoring Service • Criteria Summary Report ▫ Provides a list of current day and next day management criteria • Historical Reporting ▫ Origination Monitoring Event History View historical reports of pended batches and the resulting release/reject decision. • Management Criteria Event History View changes to management criteria, including the user name of the person making the change. ® FedACH Risk Origination Monitoring Service How Does the Service Work? Batches ACH File Originating Depository Financial Institution ACH Operator FedACH® FedMail® Log-in to FedLine®: Release/Reject? ACH Operator - Risk Edits Generate E-Mail Notification Credit Cap($): OK Debit Cap ($): Breach Affected Batches: Pended 24 Customer feedback on service • Manual monitoring for risk was one hour, but using service to monitor risk takes 5 – 10 minutes • One consolidated point for managing origination limits even when we use a third party processor • Strengthens overall policy on risk by mitigating operational, credit and fraud risk 25 Service availability and fees • Service is available to all ODFIs with an electronic connection to the Fed. • Monitoring ACH origination by Routing Transit Number only, or monitoring one Company ID, is included in monthly FedLine® access solution fee! • 2009 Fees ▫ Tiered pricing structure One management criteria for free Sets 2-20 criteria - $8.00/month Sets 21-150 criteria - $4.00/month Sets 151 and above - $1.00/month ▫ Batch (per monitored batch) - $0.0025/batch ® FedACH Risk Origination Monitoring Subscriber Roles Subscriber Roles Service Criteria Maintenance Set / Edit Set / Edit Dual Control Set/Edit Criteria, Release Pended Batches (Dual Control) X Set/Edit Criteria, View Only Pended Batches (Dual Control) X Set/Edit Criteria, Release Pended Batches X Set/Edit Criteria, View Only Pended Batches X Release/Reje ct Pended Batches View Only Release / Reject View Only X X X X View Only Criteria, Release Pended Batches X View Only Criteria, View Only Pended Batches X Note: It’s important to make sure your institution has a sufficient number of subscribers, based on the roles you select. X X 27 ® FedACH Risk Management Services FedACH Risk® RDFI File Alert 28 RDFI File Alert Service Service Benefits Monitors incoming ACH files ▫ Provides notice of unusual conditions within a RDFI’s incoming FedACH files. ▫ Help alert the RDFI to potential fraud attempts and/or significant origination errors. 29 RDFI File Alert Service Service Benefits • Proactively manage your potential risks as a RDFI • Assist in alerting your institution to potential fraud attempts and/or significant originated errors • Strengthen your institution’s overall risk management strategy • Reporting features help address audit and compliance concerns 30 ® FedACH Risk RDFI File Alert Service How Does the Service Help Financial Institutions? • FedACH® compares debit and/or credit values and/or file size of each outbound file against thresholds defined by the FI. E-mail notification alerts are sent at time of file distribution if the thresholds set have been exceeded. • Expedites notice to FI when circumstances within ACH may impact their settlement account thereby helping them avoid daylight overdrafts. • Helps FI protect themselves and their customers from the consequences of originated operational errors or fraud. 31 RDFI File Alert – how it works • Monitors individual FedACH output files – one at a time • Does not interfere with or delay payments processing • RDFI selects file thresholds based on debit, credit dollar amounts and/or transaction count ▫ Item and addenda 32 RDFI File Alert – how it works... • Compares debit and/or credit values and/or file size of each outbound file against the thresholds RDFI has defined • Designated points of contact receive e-mail alerts at the time of FedACH file distribution on any file exceeding the pre-set thresholds ▫ Up to five contacts can be designated ® FedACH Risk RDFI File Alert Service How Does the Service Work? ACH Operator - Risk Edits ACH File ACH Operator FedACH® Credit Threshold ($): OK Debit Threshold ($): Breach Item/Addenda: OK FedMail® Generate E-Mail Notification Receiving Depository Financial Institution Log-in to FedLine®: File Information Sample File Alert set-up screen RDFI File Alert 35 Access and Service fees • Service is available to all RDFIs with an electronic connection to the Fed, AND access to the FedACH Information Services application. • No monthly service charge! • No monthly maintenance fee! IAT 37 Application of IAT format • IAT implementation – September 18, 2009 ▫ Forward CBR/ PBR transactions discontinued ▫ New SEC code for international ACH transactions will be IAT for both consumer and corporate transactions ▫ CBR/ PBR returns permitted until December 31, 2009 • Completely new format ▫ Use of multiple addenda records Common Misconceptions Fact or Myth? Myth Only DFIs that are receiving PBRs and CBRs today will be impacted Fact All DFIs may receive IAT after the September implementation date even if they do not receive CBRs and PBRs today Fact or Myth? Myth Only ACH entries that were originated outside the U.S. will be coded IAT Fact If an entry is funded by a foreign financial agency it must be coded as IAT even if it is originated within the U.S. Fact or Myth? Myth The ACH Operators will automatically screen all IAT entries for OFAC compliance Fact ACH Operators have no obligation to screen IAT entries for OFAC compliance Financial Institution ACH Operator Gateway Operator High-Level Differences • Financial Institution ▫ Originates outbound and receives inbound IATs for customers • ACH Operator ▫ Processes all IAT entries from US financial institutions and US gateway operators ▫ Manages risk according to NACHA Rules • Gateway Operator ▫ Acts as entry point to or exit point from the US ▫ Makes business decisions regarding cross-border services such as country reach, currencies and products offered ▫ Can be any financial institution or ACH operator Federal Reserve Banks • ACH OPERATOR • FedACH Services ▫ Processes inbound and outbound debits and credits in domestic payments stream ▫ IAT Testing for all FIs available Schedule testing using FedACH on-line scheduler: http://www.frbservices.org/HomePage/app/fedachTestReques t.jsp Sample IAT file templates available Customized test files are available upon request ▫ Does not conduct OFAC screening on inbound IATs coming from other gateway operators (that are ODFIs) ▫ Provides tools to assist RDFIs in identifying IAT transactions Federal Reserve Banks – Gateway Operator • FedGlobal® Services ▫ Allows outbound IAT credits for all international service countries Outbound debits are allowed to Canada only ▫ Allows inbound IAT credits from international service countries Inbound debits are not permitted ▫ Conducts OFAC screening on FedACH International inbound IAT items Populate Field 10 in Entry Detail Record “Gateway Operator OFAC Screening Indicator” with either a “1” to indicate a possible hit or a “0” to indicate there was no hit Required to send a daily report of possible matches (“1”) of OFAC Does not block, freeze, pend, or reject any IAT items, regardless of OFAC screening results ▫ ODFIs need to enroll in FedGlobal Services to participate Federal Reserve Banks – A Dual Role ACH OPERATOR vs. GATEWAY OPERATOR ACH Operator FedACH® Services Processes outbound credits Processes outbound debits Processes inbound credits Processes inbound debits Gateway Operator FedACH International® Services [Canada only] Performs OFAC screening Places screening indicator in appropriate field Reports suspect transactions to OFAC Blocks or freezes transactions Provides IAT tools for RDFIs Remember… ACH operator – Processes entries and manages risk according to NACHA Rules Gateway operator – Makes business decisions regarding international services such as countries, currencies and products offered 48 IAT Tools for RDFIs • IAT Output File Sort Optional service to receive IAT items separately from domestic items Same delivery timeframes as domestic files Eliminates need to interrogate entire output file, allowing for processing efficiencies • IAT Report in FedEDI Plus End of day report of IAT items Generated on a fixed schedule or request reports "on demand" Available at RDFI and corporate customer level 49 Going forward w/ IAT • Financial institutions may schedule testing using FedACH on-line scheduler: http://www.frbservices.org/HomePage/app/fed achTestRequest.jsp 50 Available Resources • FedACH IAT Resource Center www.frbservices.org/eventseducation/education/fedach_i at_resource_center.html • NACHA ▫ IAT Industry Information www.nacha.org/IAT_Industry_Information/ ▫ IAT scenarios document http://gpf.nacha.org/docs/IAT_Scenarios__Domestic_or_International.pdf ▫ 2009 Rules Changes and New Formats for International ACH Transaction (IAT) Entries sections in 2009 ACH Rules Book Questions Thanks for your participation! Lance Wagner, AAP FRB KC 800-257-6701, Ext. 12498