Keller and Heckman - Amazon Web Services

BEST PRACTICES FOR ACQUIRING

TELECOMMUNICATIONS SERVICES

By

C. Douglas Jarrett, Partner, Keller and Heckman LLP

Jarrett@khlaw.com

www.khlaw.com and

Rick Sigel, CEO and Founder Silver Lining Telecom

RickSigel@silverliningtelecom.com

www.silverliningtelecom.com

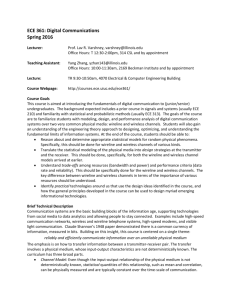

PROCUREMENT CYCLE

MONITOR

MILESTONES &

COMMITMENTS

DATA

COLLECTION

IMPLEMENTATION

CURRENT / FUTURE

REQUIREMENTS

FINAL

CONTRACTS

NEGOTIATIONS

SOURCING

EVENT

CARRIER DUE

DILLIGENCE

TOPICS

Part I -- Scope of Services

Part II -- Procurement Cycle

Part III -- Developing RFPs

Part IV – Decision Making and Validation

Part V -- Terms and Conditions -- What’s Really Important

SCOPE OF SERVICES

Wireless Services

Generally Available Voice and Data & Data-Only

Services Plans

Wireless voice and data services offered to businesses and consumers on carriers’ authorized frequencies operating on carrier-determined transmission technologies (GSM, CDMA,

LTE)

Subsidized handsets, smartphones, tablets, and air cards

In-building repeaters for customer’s high-traffic locations

(negotiable)

Principally domestic with international roaming options

SCOPE OF SERVICES

Wireless Services (cont’d)

Business-Only Wireless Services

Push-to-Talk-Services

Includes subsidized handsets

M2M Services

Wireless data service for which application restrictions apply

Offered over 3G or 4G networks

Interconnects to customer’s MPLS service, not the public

Internet

Carrier-approved devices/modems, not subsidized by carrier

SCOPE OF SERVICES

Wireline Services

Local Exchange Services

Special Construction Arrangements

Enterprise Services

1.

2.

3.

4.

Basic Transport Services

Dedicated High Speed Internet Access Service

Layered Services

Rest-of-World Services

SCOPE OF SERVICES

Wireline Services (cont’d)

Local Exchange Services

Regulated intrastate voice services–PRIs, PBX Trunks, FB

1s

Straight volume discounts and term commitments

Typically acquired under state-specific tariffs/contracts

Special Construction Arrangements

Examples

Dark fiber ring

Physical extension of carrier’s network to a customer facility

Offered by local telcos or IXCs pursuant to contracts sometimes tariffed

SCOPE OF SERVICES

Wireline Services (cont’d)

Enterprise Services Agreements

Almost always interstate and international services

Commercial agreements, not tariffed in USA

1. Basic Transport Services

Circuit switched interexchange voice and VoIP inbound and outbound

Dedicated access services—DS-1, DS-3 and Ethernet

Private Line Service-- DS-1, DS-3 and Ethernet

Multiprotocol Label Switching (“MPLS”) Service*

Virtual Private LAN Service (“VPLS”)

Satellite service

2. Dedicated Internet Access Services*

SCOPE OF SERVICES

Wireline Services (Cont’d)

Enterprise Services Agreements

3. Layered Services

Hosting

CPE/Network Management

Firewall

Data Center (Collocation)

Many network-based conferencing services

Content delivery services

Cloud computing

4. Rest-of-World Services

Typically MPLS and Private Line

Some Layered Services—CPE/Network Management

TOPICS

Part I -- Scope of Services

Part II -- Procurement Cycle

Part III -- Developing RFPs

Part IV – Decision Making and Validation

Part V -- Terms and Conditions -- What’s Really Important

PROCUREMENT CYCLE

WHEN TO START?

Timing and leverage is always key— Don’t wait to renegotiate !

Uncommitted spend

New business or technology upgrades – know what the account teams want to sell

Term Extensions

Know current detailed demand set/inventory and contract milestones

Maintain credible threat of loss or migration – minimum 6 - 9 month lead time for data collection, sourcing strategy, negotiations and possible migrations

WHY D O IT?

Drive savings /cost reductions, obtain market leading rates, terms and conditions

Typically 20% - 25% gap to market on contracts over 12 months old

No linear relationship between spend, commitment and price among customers

Knowledge, preparation, benchmarks and leverage are the keys to any negotiation

Remain open to options and alternatives

Carriers usually “hold the cards” on benchmarking and T’s & C’s

Drive to more level playing field

Timing+Flexibility+Knowledge >>>> Uncertainty for carriers = Better overall result

PROCUREMENT CYCLE

WHAT’S INVOLVED?

First understand different carrier perspectives and current environment

Wireless gets attention; wireline accounts for 50% - 75% of typical enterprise spend

Local services = low profits. Traditional Voice services less attractive to carriers

Carriers highly value data services

– “stickier” with higher margins and more viable choices

Power of incumbency

Less staff on customer side creates major bias in favor of incumbent - Carriers know this!

Carriers trying to increase contractual commitments both in Term and

Spend (in addition to individual circuit/SOA Terms)

Pricing continues to go down – not as fast, but still declining

Competition continues in the form of technology choices (Ethernet,

VoIP/SIP, Wireless)

Account Team Realities

TOPICS

Part I -- Scope of Services

Part II -- Procurement Cycle

Part III -- Developing RFPs

Part IV – Decision Making and Validation

Part V -- Terms and Conditions -- What’s Really Important

DEVELOPING RFP S

Determine which vendors to invite

Due diligence based on current/future requirements

Develop clear outline of process steps and timetable

Schedule (in-person) Bidders’ Conference

Recognize that carriers always want more time

Provide detailed demand set—“Book of Business”

Usage profiles / details for voice and wireless

Geographic info i.e. sites, addresses, CPE, # of users etc.

Required Terms and Conditions

Term – 3 Years Wireline / 2 Years Wireless

Commitment level and structure for each

Periodic Rate Review with remedies

Implementation and other SLA’s with remedies

Customized rate plans for wireless

Business Change/Downturn/Divestiture with specific remedies

Billing Issues – resolution timing, remedies

Account Team performance obligations

DEVELOPING RFP S

Develop and require standardized format for responses

Carrier worksheets for side-by-side comparison analysis

Scorecards helpful for T’s & C’s i.e. relative importance

Require Senior Exec direct contact information for escalations

Include non-recurring pricing aspects such as implementation/migration costs and assistance, equipment, demo’s and tests

Encourage creative/alternative solutions or technologies

Determine finalists

Negotiate to “Best and Final” offers

Ensure implementation, migration, and billing are correct

Execute new agreements

TOPICS

Part I -- Scope of Services

Part II -- Procurement Cycle

Part III -- Developing RFPs

Part IV – Decision Making and Validation

Part V -- Terms and Conditions -- What’s Really Important

DECISION MAKING AND VALIDATION

Analytics—Model Potential Award Scenarios

Financial Impact and Trade-Offs

Savings, Increased Bandwidth, Equipment Upgrades etc.

Geographic Coverage

Wireless and Wireline

Technology Roadmap

Internal Resource Requirements

Hard and Soft Implementation/Migration costs

Number of Vendor Relationships or Applications to Manage

Require Formal Tracking and Review Process

1 st Bill Review with Account Team(s)

Quarterly Reviews with Vendor – Billing, SLAs, Optimizations,

Implementations, Outages etc.

TOPICS

Part I -- Scope of Services

Part II -- Procurement Cycle

Part III -- Developing RFPs

Part IV – Decision Making and Validation

Part V -- Terms and Conditions -- What’s Really Important

TERMS AND CONDITIONS

WHAT’S REALLY IMPORTANT

Services agreements are drafted by and for the carriers

Separate Wireline and Wireless agreements

Major components

Master Agreement

Schedules and Attachments

On-line pricing, terms and conditions—Authorized User Policies

TERMS AND CONDITIONS

WHAT’S REALLY IMPORTANT

Make sure the good stuff you negotiated is in the agreemen t

Pricing expressed as fixed rates

All agreed upon credits

Pricing Review, Business Downturn and Technology Migration

Clauses

Account team support

Low minimum revenue commitment; no service-specific minimums

Line minimums-only in Wireless deals

Accelerated handset refresh periods

In-Building repeaters for major locations

TERMS AND CONDITIONS

WHAT’S REALLY IMPORTANT

Key Issues to Overcome in Carriers’ Agreements (directly or indirectly)

Limited damages for carrier

Limited termination rights for customer

Service Level Agreements

Wireline SLAs don’t address chronic issues

Not an issue with Wireless Service—No SLAs

Address M2M differences

2-year term impractical

M2M services requires service levels/right to terminate

Understand application/operational limitations

Customer indemnity obligations minimized

Carrier-preferred dispute resolution provisions for billing & other issues

TERMS AND CONDITIONS

WHAT’S REALLY IMPORTANT

Key Subjects to Consider, Include or Address

Value of a “low” minimum revenue commitment

Reasonable (extended) transition period upon expiration or any early termination

Customer’s standard vendor insurance obligations, and workplace safety and access rules—particularly if carrier accesses customer premises or equipment

Account Team support commitments

Cybersecurity Considerations

Carriers disclaim responsibility for unauthorized access to customer data

Obligation to assist in troubleshooting a cyber attack

Different principles must apply if layered services are part of deal

PROCUREMENT CYCLE

MONITOR

MILESTONES &

COMMITMENTS

DATA

COLLECTION

IMPLEMENTATION

CURRENT / FUTURE

REQUIREMENTS

FINAL

CONTRACTS

NEGOTIATIONS

SOURCING

EVENT

CARRIER DUE

DILLIGENCE