medicine outlets - World Health Organization

advertisement

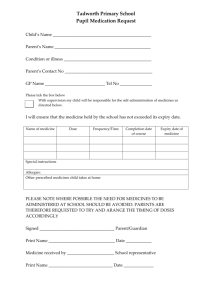

Paying the price: Medicine prices, availability and affordability across the globe Alexandra Cameron Department of Essential Medicines and Pharmaceutical Policies World Health Organization November 2008 Presentation outline 1. International efforts to improve medicine prices 2. Generating reliable evidence: how to measure medicine prices and availability 3. What have we learned about medicine prices, availability and affordability? 4. Evidence to policy: what can be done? Wider problems of medicine prices • Medicines have variable and often high prices, and are unaffordable for large sectors of the global population and a major burden on government budgets • Burden falls directly on most patients in developing countries – but little is known about the prices people pay and how these prices are set, from the manufacturers’ selling price to the patient price • Many developing countries do not have pricing policies But, the prices of medicines are well above their production costs so there is great scope for reductions WHO/HAI Project on Medicine Prices & Availability improve the availability and affordability of essential medicines • Outcome of the WHO/public interest NGOs Roundtable on Pharmaceuticals and WHA resolution • Develop a reliable methodology for collecting and analysing price and availability data across healthcare sectors and regions in a country • Price transparency; survey data on a freely accessible website allowing international comparisons • Provide guidance on pricing policy options and monitoring their impact WHO/HAI standard methodology • Survey tool to measure: • medicine prices • medicine availability • affordability of treatments • components in the supply chain • 1st edition launched at WHA 2003 • About 60 surveys conducted to date • Results publicly available on HAI website • 2nd edition launched at WHA 2008 • adjustments to methodology • practical advice based on surveys • new guidance on international comparisons, policy options, advocacy & regular monitoring • additional tools and resources Medicine price and availability surveys to date using WHO/HAI methodology Completed or nearing completion Underway Analyses • Regional analyses: Africa, India, Middle East, Central Asia • Therapeutic group analyses: asthma, diabetes cardiovascular • Price & availability data included in report on MDG 8 • Secondary analysis across 36 countries in The Lancet Work in progress • • • • Evidence to policy Measuring affordability Total costs for treating chronic diseases Regular monitoring of prices, availability and affordability • Further development of database and website • Etc., etc., etc.! 2. Generating reliable evidence: how to measure medicine prices and availability How is the survey conducted? Trained data collectors visit a sample of "medicine outlets" and record information on the price and availability of selected medicines Data on government procurement prices are also collected During medicine outlet visits, data are recorded on hard copy Medicine Prices Data Collection forms At the end of fieldwork, completed forms are entered into the electronic survey Workbook by data entry personnel The Workbook automatically generates analyses of the survey data Medicine price components are also identified by tracking medicines through the supply chain and identifying add-on costs What medicines are surveyed? 50 medicines: – 30 pre-determined by WHO/HAI to enable international comparisons (14 global medicines and 16 regional medicines) – 20 selected nationally for local importance Predetermined dose forms & strengths, & recommended pack sizes For each medicine, two products are surveyed: 1. Originator brand 2. Lowest-priced generic equivalent (at facility) Where are data collected from? Patient price and availability data collected by data collectors visiting a sample of medicine outlets in up to 4 sectors: public sector - health centres private sector - retail pharmacies 1-2 other sectors e.g. dispensing doctors Government procurement prices Centralised system: collect from procurement office or Central Medical Store Decentralised: at outlet level How is the sample of medicine outlets selected? • Data is collected in 6 regions of the country ("survey areas") – Area 1 = capital city – 5 other regions within 1 days’ travel of capital, randomly selected • In each survey area: – the main public hospital + 4 public outlets, randomly selected from those within a 3 hours drive of the main hospital, are selected – the private sector outlet closest to each public outlet is selected – The other sector medicine outlet closes to each public sector outlet is selected Survey structure COUNTRY Survey area 1 Survey area 2 Survey area 3 Survey area 4 Survey area 5 Survey area 6 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 5 public outlets 5 private outlets 5 "other 1" outlets 5 "other 2" outlets TOTAL: 20 Data entry, quality assurance & analysis Training workshop & pilot test for data collectors and supervisors At outlet visit, data are recorded onto the Medicine Prices Data Collection Form. Form checked that day by supervisor and verified in 20% of outlets At the end of fieldwork, all completed forms are entered into the Excel Workbook by trained data entry personnel Data are entered twice and checked for errors Automated data checker identifies possible errors An additional data quality control check is conducted by HAI or WHO before posting on the website How are data analyzed? Availability: % of outlets where medicine was found on the day of data collection Price: median local prices expressed as ratios to international reference prices Medicine Price Ratio (MPR) = median local unit price International reference unit price – MSH international reference prices used: recent procurement prices offered by not-for-profit suppliers to developing countries for multi-source generic equivalent products. – Medicine must be found in at least 4 outlets for MPR to be calculated Price comparisons: innovator brand and lowest priced generics; public, private and other (e.g. mission) sectors; districts/states/provinces, countries Affordability: how many days wages would the lowest paid government worker need to spend to pay for treatment Price Components • Add-on costs tapplied to medicines as they move through the supply chain, from manufacturer to patient Examples: insurance & freight costs, port & inspection charges, handling charges, import duties, import, wholesale & retail mark-ups, VAT/GST, dispensing fees • 2-part methodology: 1. Central level data collection on national policies that affect pharmaceutical prices – 2. Collected through interviews with importers, Ministry of Health, Ministry of Trade, Customs office, etc. Identification of the price components of selected medicines as they move along the supply chain. – – Identified by tracking 5-7 medicines backwards through the supply chain At each stage (retailer, wholesaler etc) charges are recorded Price components are analysed by stage of the supply chain Price components data analysis • Data are entered into the electronic survey Workbook; standard analyses are automatically generated Price components are analysed by: – cumulative per cent mark-up: how much greater a certain price is above the MSP – % contribution of each stage to the final price • Comparisons by sector, region, medicine type (e.g. originator vs. generic, import vs. local) Percentage contribution of price com ponents to final price, Am oxicillin 250m g cap/tab, Private Sector, Im ported Generic 0% 17% 11% 59% 7% 6% Manufacturer's selling price Insurance and freight Stage 2: Landed price Stage 3: Wholesale Stage 4: Retail Stage 5: Dispensed price 3. What have we learned about medicine prices, availability and affordability? Median % availability by World Bank income group 100% max 90% min 80% mean 70% 60% 50% 40% 30% 20% 10% 0% India low lower- upper- India low (n= 7) income (n= 15) (n= 9) (n= 2) middle middle (n= 7) income income income (n= 17) (n= 11) (n= 2) public sector generics lower- upper- India low middle middle (n= 7) income middle middle income income (n= 17) income income (n= 11) (n= 3) private sector generics lower- private sector originator brands upper- Government procurement prices for lowest priced generics 6 5.37 5 4 max 3 min 2.94 mean 2 1.45 1.17 1 0.78 0.47 0.27 0 India (n=7) 1.36 1.17 0.90 0.33 0.09 low income countries (n=16) lower middle income countries (n=12) upper middle income countries (n=3) MPR = 1 Government procurement prices in 10 African countries 6 75th percentile 25th percentile Median 4 Price (MPR) n= number of medicines 3.29 2 1.69 1.3 0.95 0.8 0.57 0 0.88 0.61 0.66 0.71 Public sector patient prices • In many countries medicines are free but availability is often very poor • Where patients pay, even cheapest generics can be expensive e.g. in the Western Pacific Region the median price was about 12x international reference prices • Good procurement prices are not always passed on to patients • In some countries, public sector prices are similar to private sector prices, e.g. China, Shanghai Patient prices vs. procurement prices, public sector, lowest-priced generics 3.1 3 2.9 n = number of medicines 2.4 2.2 2.2 2.1 2.1 2 2.0 P rice (MP R ) 1.4 1 n/a 0 C had (n=13) K enya (n=22) G hana (n=22) E thiopia (n=36) S enegal (n=27) C ameroon Mali (n=29) (n=22) Tanzania (n=26) Nigeria (n=16) Uganda (*) Patient prices in the private sector: median of Median Price Ratios, by WHO region n=6 WPR n=5 n=8 SEAR n=9 Lowest priced generic n=5 EUR n=5 Originator brand n=11 EMR n=11 n=1 AMR n=2 n=9 AFR 0 10 20 n=9 30 40 50 Median MPR across basket of 15 meds 60 70 Patient price in the public and private sector lowest-priced generics, matched pairs of same medicines 16 P rivate 14.9 P ublic P ric e (MP R ) 12 n = number of medicines 9.3 7.3 8 5.3 4.0 3.5 4 4.0 3.3 3.1 2.0 2.4 1.8 1.3 2.9 2.1 3.9 3.5 2.9 2.6 2.0 1.3 0 0 C ameroon (n=17) C had (n=5) Mali (n=30) Tanzania (n=28) S enegal (n=20) G hana (n=30) E thiopia (n=36) K enya (n=28) Zimbabwe (n=25) Nigeria (n=19) Uganda (n=38) (*) Originator brand vs lowest-price generic prices captopril 25mg tabs, private pharmacies Cameroon Kenya Ghana Lowest priced generic Originator brand Malaysia India, Maharashtra Pakistan Indonesia Peru Kuwait China, Shandong 0 5 10 15 median price ratio 20 25 Differences between originator brands & lowest priced generics, matched pairs, private sector 400% 1000.3% 1464.7% 1464.7% 350.2% 337.7% 300% 265.3% max min 200% mean 167.7% 157.4% 147.1% 100% 100.0% 55.9% 26.0% 0% 6.0% 0.0% India (n= 7) 0.0% low income (n= 14) lower-middle income (n= 12) upper-middle income (n= 2) all countries (n = 35) Affordability: mean number of days wages of the lowest paid unskilled govt. worker needed to buy 60 glibenclamide 5mg tabs, for diabetes, in the private sector (by WHO region) n=4 WPR n=3 n=8 SEAR Lowest priced generic n=8 Originator brand n=4 EUR n=1 n=11 EMR n=7 n=1 AMR n=7 AFR n=7 0 1 2 3 4 5 No. of days' w ages 6 7 8 9 Price components Cumulative percentage mark-ups between manufacturer's selling price and final patient price, private sector Country Total cumulative % mark-up China (Shandong) 11-33% El Salvador 165-6894% Ethiopia 76-148% India 29-694% Malaysia 65-149% Mali 87-118% Mongolia 68-98% Morocco 53-93% Uganda 100-358% Tanzania 56% Pakistan 28-35% Price components – private sector Multiple taxes are applied: •Peru: VAT 12% IGV 19% Municipal promotion tax 2% (eliminate taxes cumulative mark-up is reduced 238% → 149%) •Indonesia: VAT 10% - charged twice •Philippines: Import tariff 4% national taxes 3-6% VAT 12% •Yemen Customs duty 5%, Taxes 5% Wholesaler mark-ups: 2% (Pakistan) - 380% (El Salvador) Pharmacy mark-ups: 10% – 552 % (El Salvador) In some cases the manufacturer's selling price (MSP) is the largest contributor to the final price E.G. Pakistan - MSP for locally-produced generic amoxicillin represented 78% of the final medicine price in the private sector Public sector mark-ups can also be significant Large mark-up on a low-priced generic can result in a lower final price than a small mark-up on a high priced product Malaysia: atenolol 50mg tab, private retail pharmacies Originator (patient price: 72 RM) 4: Retail 20% 3: Wholesale 13% 1: MSP, CIF 56% 2: Landed 11% Generic (patient price: 24 RM) 1: MSP, CIF 40% 4: Retail 50% 3: Wholesale 3% 2: Landed 7% 4. Evidence to policy: what can be done? Surveys of medicine prices and availability reveal that: • Availability is often low, particularly in the public sector • Prices of even the lowestpriced generics can be several times international prices • Originator brands are more costly than generics • Treatment of chronic diseases is often unaffordable, especially when combination therapies are used High prices, low availability and poor affordability can have many causes • Low public sector availability: lack of resources or under-budgeting; inaccurate forecasting, inefficient procurement / distribution, low demand/slow-moving products • High private sector prices: high manufacturer’s selling price, high import costs, taxes and tariffs, high mark-ups Many policy options exist • Improve procurement efficiency (e.g. national pooled purchasing, procurement by generic name) • Ensure adequate, equitable, and sustainable financing, e.g. – Health insurance systems that cover essential medicines – schemes to make chronic disease medicines available in the private sector at public sector prices • Prioritize drug budget, i.e. target widespread access to a reduced number of essential generic medicines, rather than attempting to supply a larger number of both originator brand and generic medicines. • Promote generic use: – preferential registration procedures, e.g. fast-tracking, lower fees – ensure the quality of generic products – permit generic substitution and provide incentives for the dispensing of generics – educate doctors/consumers on availability and acceptability of generics I DON’T TAKE CHANCES I ONLY USE ORIGINALS Policy options (cont'd) • Separate prescribing and dispensing • Control import, wholesale and/or retail mark-ups through regressive mark-up schemes • Provide tax exemptions for medicines • Where there is little competition, consider regulating prices • Patented medicines – use the flexibilities of trade agreements to introduce generics while a patent is in force – differential pricing schemes whereby prices are adapted to the purchasing power of governments and households in poorer countries. Must watch for unintended negative effects • Price controls may lead to excessive prices when the price is not adjusted to consider changes in the market • Setting prices too low can discourage production/stocking of a product • Regulating mark-ups can provide incentive to sell higher-priced products • Eliminating taxes can provide an opportunity for retailers to increase their margin (i.e. savings not passed on to patient) Examples of policy changes following medicine price and availability surveys Tajikistan • Elimination of 20% VAT on medicines in May 2006. Supply chain add-on costs decreased from 122% to 85% for imported medicines. Lebanon • • • Price reductions on >1000 individual medicines has reduced prices by 14% overall Policy of fixed mark-ups irrespective of FOB price (cumulative 71.4%) to variable depending on FOB price; estimated retail price reductions of 3-15% Retail prices and pharmacy margins published on a public website Examples of policy changes (cont’d) United Arab Emirates • Government reduced prices by an average of 7–8% through modification of its procurement practices following price comparisons with other countries. Indonesia • Pharmaceutical industry association announced that from 1 July 2006 it would reduce the price of 100 branded generic medicines, containing 34 active substances. • Branded generics should not cost more than 3 times the price of true generics – has not happened for all products East African Community: • 10% cut on import duties on medicines. Increased financial support and differential pricing can have a dramatic impact on medicine availability Availability of Artemether/lumefantrine 20/120 mg in Kenya 100 91 90 86 86 80 76 % availability 70 72 68 61 60 58 public sector facilities private sector facilities mission sector facilities 50 40 36 30 31 20 10 3 4 0 Global Fund Apr-06 grant start date (02/2006) Jul-06 Oct-06 Jan-07 Constituency Building • Presentations & posters at ~40 meetings • Brochure & quarterly bulletin • Monitor supplement & articles • Synthesis reports • WHA 2006 briefing & paper • Publications: Bulletin, Lancet • Analysis of MDG Target 8.E BUT……Are these the best policies for improving access to affordable medicines??? Our current challenge: what are the most effective policy actions in different contexts? WHO/HAI and international pricing policy experts are developing guidelines on options for policies affecting medicine prices and their impact in various settings: - mapping current policies & interventions - commissioning policy review papers - drafting policy briefs - identifying research needs