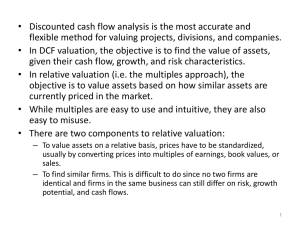

Discounted cash flows

advertisement

Corporate Financial Strategy 4th edition Dr Ruth Bender Chapter 14 Valuations and forecasting Corporate Financial Strategy Valuations and forecasting: contents Learning objectives Valuing companies – header slide Three approaches to company valuation Balance sheet methods of valuation Discounted cash flow valuation using WACC Terminal value (narrative) Terminal value (graph) Valuation on multiples Valuation on multiples – generic equations Problems with valuation on multiples Valuing a loss-making business Corporate Financial Strategy Forecasting – header slide Process of forecast preparation Triangulate the forecasts The declining base case Sensitivity analysis Changing forecast drivers Some common psychological biases 2 Learning objectives 1. Apply the three main methods of valuing a company – assets, multiples, and discounted cash flow. 2. Appreciate the advantages and disadvantages of each method of valuation, and the need for sensitivity analysis. 3. Explain why a suite of forecasts needs to comprise an integrated income statement, cash flow, and balance sheet. 4. Question the assumptions underlying any forecast by understanding some common behavioural biases. Corporate Financial Strategy 3 Valuing companies Corporate Financial Strategy 4 Three approaches to company valuation (Net) Assets bases Based on equity in the balance sheet. Multiples of profits After-tax profits multiplied by appropriate price/earnings ratio May reflect revaluation of assets, or assets at replacement price, or liquidation values. EBIT or EBITDA multiplied by appropriate ratios Discounted cash flows Forecast the free cash flow for many years ahead, and discount it back to today at an appropriate cost of capital In practice, several different valuation methods will be used, to check reasonableness Corporate Financial Strategy 5 Balance sheet methods of valuation Balance sheets are backward-looking Historic cost convention distorts values Intangible assets are only included if they were acquired Debt can be stated at market value rather than the sums owing Accounting policies can vary considerably For most businesses, the balance sheet does not provide a useful valuation mechanism Corporate Financial Strategy 6 Discounted cash flow valuation using WACC The value of the company represents the present value of the future cash flows it is expected to generate 1. Determine a suitable time frame 2. Calculate Free Cash Flow over that period • • • • Operating profit, adding back depreciation and amortization (EBITDA) Less tax Less expenditure on fixed assets Add/less changes in working capital 3. Determine a Terminal Value 4. Discount these cash flows at an appropriate rate • Normal to use Target WACC 5. Add in the value of non-operating assets This gives the Enterprise Value 6. Deduct net debt This gives the Equity Corporate Financial Strategy value 7 Terminal value Take an initial period for which you can reasonably forecast − 10 years? At the end of that period assign a Terminal Value − Based on assets? − Based on a multiple of profits? − Based on cash flow as a perpetuity? [cash flow discount rate] − Based on cash flow as a growing perpetuity? [cash flow (discount rate – growth rate)] − Other?? It is helpful in valuation to use several different methods for terminal value, as they will all give different answers Corporate Financial Strategy 8 Terminal value Free cash flow Perpetuity growing at g% per year FCFn Perpetuity 0 Time n Initial period Perpetuity value is FCFn ÷ Discount rate Growing perpetuity value is (FCFn x (1+g) ÷ (Discount rate – g) Corporate Financial Strategy 9 Valuation on multiples Valuation on multiples compares a company with peers whose market value is known, and values on a comparative basis Valuation on a P/E basis compares the eps of companies with their share prices − For the whole company, this is net income and market capitalization Valuation on other multiples can eliminate differences due to capital structures − Enterprise value is calculated and compared with EBIT, or EBITA, or EBITDA Valuation on multiples can be done on a historic or prospective basis The income figures used should be ‘sustainable’, adjusted for one-off items affecting a year’s results Corporate Financial Strategy 10 Valuation on multiples – generic equations Valuecomparators = (Average profit)comparators x (Average multiple)comparators Therefore, for our target company in the same business we can assume that Valuetarget = (Profit)target x (Average multiple)comparators Corporate Financial Strategy 11 Problems with valuation on multiples It is difficult to find true comparator companies Sustainable profit levels might be difficult to determine, for the target company or the comparators Market values might not be ‘correct’ − E.g. during the dot.com bubble, or if there is low trading liquidity Corporate Financial Strategy 12 Valuing a loss-making business Why do you want to buy this company? − That might give you an idea where the future value is coming from Assets basis − If it’s never going to make profits, just break it up and sell the assets separately Multiples basis − Valuation on multiples is about future sustainable profits. Can you see such profits arising? If so, maybe do a valuation on multiples for, say, 3 years’ time when you expect profits to arise, and then discount that sum back to today DCF methods − Probably the most useful – forces you to examine the underlying cash flow forecasts and see if/when/how the company will start generating profits Corporate Financial Strategy 13 Forecasting Corporate Financial Strategy 14 Process of forecast preparation Determine the reason for the forecast and the required timescale Obtain the supporting data Prepare the forecast Revise assumptions and forecasts as the picture becomes clearer Analyse the forecast Do a sensitivity analysis Corporate Financial Strategy 15 Triangulate the forecasts Income statement Cash flow forecast Corporate Financial Strategy Triangulation is necessary but not sufficient to ensure sensible forecasts 16 Balance sheet The declining base case Trajectory if we undertake investment Current trajectory for the business Trajectory if we fail to invest Corporate Financial Strategy 17 Sensitivity analysis Change each input individually by a certain amount Corporate Financial Strategy Reverseengineer the forecast to determine tolerance on each input Prepare several different scenarios 18 Monte Carlo analysis Changing forecast drivers Some examples of changes to explore Sales volumes Decrease or increase by x%; slow (or accelerate) the sales growth plan by one year, or two years; change the rate of growth of the market as a whole, or the market penetration rate. Profit margin Change input costs individually; assume selling prices fall over time; assume that production costs or expenses change in a different pattern to that anticipated; look at the effect of a movement in the ratio of fixed and variable costs. Tax rate Flex the tax rate. Working capital Change the assumptions for inventory days, and debtor or creditor terms. Examine the impact of price changes in the future, and of delaying or bringing forward capacity changes. Consider the impact of leasing rather than buying. Capital expenditure Run the forecast for one year more, or one year fewer, to see the Timescale of competitive advantage impact. Change the terminal value assumptions in a DCF analysis. Cost of capital Corporate Financial Strategy Flex the cost of capital. Change the timing of interest payments and loan repayments where appropriate in a forecast to evaluate funding requirements. 19 Some common psychological biases Anchoring Framing Over-optimism Over-confidence Representativeness Cognitive dissonance Confirmation bias Ambiguity avoidance Corporate Financial Strategy 20