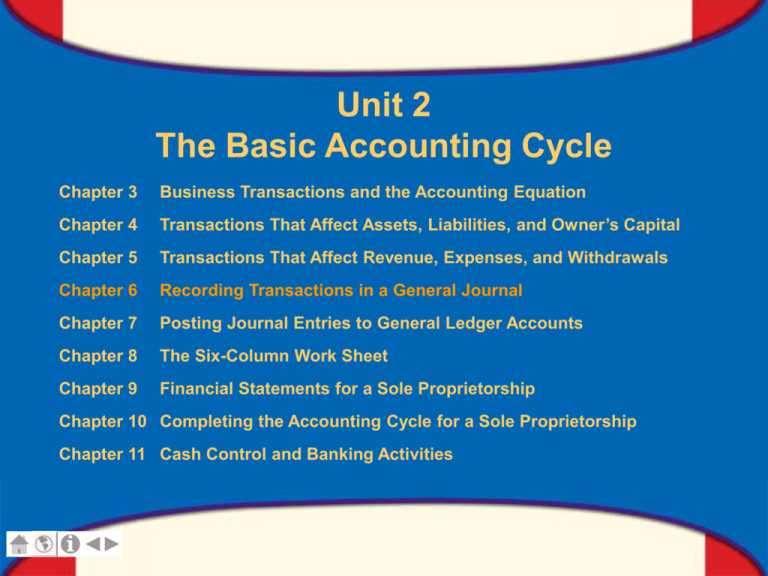

Unit 2

The Basic Accounting Cycle

Chapter 3

Business Transactions and the Accounting Equation

Chapter 4

Transactions That Affect Assets, Liabilities, and Owner’s Capital

Chapter 5

Transactions That Affect Revenue, Expenses, and Withdrawals

Chapter 6

Recording Transactions in a General Journal

Chapter 7

Posting Journal Entries to General Ledger Accounts

Chapter 8

The Six-Column Work Sheet

Chapter 9

Financial Statements for a Sole Proprietorship

Chapter 10 Completing the Accounting Cycle for a Sole Proprietorship

Chapter 11 Cash Control and Banking Activities

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

0

Chapter 6

Recording Transactions in a

General Journal

What You’ll Learn

Explain the first three steps in the accounting cycle.

Give and describe several examples of source

documents.

Explain the purpose of journalizing.

Apply information from source documents.

Describe the steps to make a general journal entry.

Make general journal entries.

Correct errors in general journal entries.

Define the accounting terms introduced in this

chapter.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

1

Chapter 6, Section 1

The Accounting Cycle

What Do You Think?

What happens if you do not keep financial records in an

orderly fashion?

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

2

SECTION 6.1

The Accounting Cycle

Main Idea

The accounting cycle is a series of steps done in each

accounting period to keep records in an orderly fashion.

You Will Learn

the steps in the accounting cycle.

the different types of accounting periods.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

3

The Accounting Cycle

SECTION 6.1

Key Terms

accounting cycle

source document

invoice

receipt

memorandum

check stub

journal

journalizing

fiscal year

calendar year

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

4

SECTION 6.1

The Accounting Cycle

The Steps of the Accounting Cycle

The accounting cycle, the activities a business

undertakes to keep its accounting records in an orderly

fashion, consists of nine steps. This chapter will cover

steps 1, 2, and 3:

Collect and verify source documents.

Analyze each transaction.

Journalize each transaction.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

5

SECTION 6.1

The Accounting Cycle

The Steps of the Accounting Cycle

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

6

SECTION 6.1

The Accounting Cycle

The First Step in the Accounting Cycle:

Collecting and Verifying Source Documents

A business has several transactions that take place daily. A

source document is created for each business transaction.

Commonly used source documents are:

an invoice

a receipt

a memorandum

a check stub

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

7

SECTION 6.1

The Accounting Cycle

The Second Step in the Accounting Cycle:

Analyzing Business Transactions

Determine the debit and credit portions of each transaction

by analyzing the source document. In the real world, you

must examine this document to determine what happened

in a business transaction.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

8

SECTION 6.1

The Accounting Cycle

The Third Step in the Accounting Cycle:

Recording Business Transactions in a Journal

Now the complete details of each transaction must be

entered in a journal, a record of the transactions of a

business. This is called journalizing.

A journal can also be called the book of original entry.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

9

SECTION 6.1

The Accounting Cycle

The Accounting Period

The accounting period is the length of time that

accounting records cover. A 12 month period is called a

fiscal year. If the fiscal year spans from January 1 to

December 31, it is a calendar year.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

10

SECTION 6.1

The Accounting Cycle

Key Terms Review

accounting cycle

Activities performed in an accounting period that

help the business keep its records in an orderly

fashion.

source document

A paper prepared as the evidence that a

transaction occurred.

invoice

A source document that lists the quantity,

description, unit price, and total cost of the items

sold and shipped to a buyer.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

11

SECTION 6.1

The Accounting Cycle

Key Terms Review

receipt

A source document that serves as a record of

cash received.

memorandum

A brief written message that describes a

transaction that takes place within a business.

check stub

A source document that lists the same information

that appears on a check and shows the balance

in the checking account before and after each

check is written.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

12

SECTION 6.1

The Accounting Cycle

Key Terms Review

journal

A chronological record of the transactions of a

business.

journalizing

The process of recording business transactions.

fiscal year

An accounting period of twelve months.

calendar year

Accounting period that begins on January 1 and

ends on December 31.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

13

Chapter 6, Section 2

Recording Transactions in the

General Journal

What Do You Think?

Why do you need to record transactions?

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

14

SECTION 6.2

Recording Transactions in the

General Journal

Main Idea

You can use the general journal to record all of the

transactions of a business.

You Will Learn

how to record a general journal entry.

how to correct errors in the general journal.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

15

SECTION 6.2

Recording Transactions in the

General Journal

Key Term

general journal

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

16

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

The most common accounting journal is the general

journal, in which all of the transactions of a business

may be recorded. The general journal has two columns:

the left column for recording debits

the right column for recording credits

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

17

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

This is an example of a general journal entry:

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

18

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

There are seven steps to determining each journal entry:

Identify the accounts affected.

Classify the accounts affected.

Determine the amount of increase or decrease for

each account affected.

Determine which accounts are debited and for

what amount.

Determine which accounts are credited and for

what amount.

Determine the complete entry in T-account form.

Determine the complete entry in general journal

entry form.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

19

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

Here is an example showing the analysis of a business

transaction and its general journal entry:

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

20

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

Here is an example showing the analysis of a business

transaction and its general journal entry:

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

21

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

Here is an example showing the analysis of a business

transaction and its general journal entry:

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

22

SECTION 6.2

Recording Transactions in the

General Journal

Recording a General Journal Entry

Here is an example showing the analysis of a business

transaction and its general journal entry:

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

23

SECTION 6.2

Recording Transactions in the

General Journal

Correcting the General Journal

If an error is found, it must be corrected.

Do not erase an error. Draw a line through it with a pen

and enter the correct information above the line.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

24

SECTION 6.2

Recording Transactions in the

General Journal

Key Term Review

general journal

An all-purpose journal in which all the

transactions of a business may be recorded.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

25

CHAPTER 6

Chapter 6 Review

Problem 1

Describe the general journal entry for the following event.

On January 16, 20-- On Time Delivery issued Check 243

to Comfort Space for $4,000 to buy office furniture.

(continued)

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

26

CHAPTER 6

Chapter 6 Review

Answer 1

First record:

The date in the Date Column

20-Jan. 16

(continued)

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

27

Answer 1

Then record:

The account debited in the Description column

The amount of the debit in the Debit column

20-Jan. 16 Office Furniture

4 0 0 0 00

(continued)

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

28

CHAPTER 6

Chapter 6 Review

Answer 1

Then record:

The account credited in the Description column. The

account name is indented under the debit account name.

The amount of the credit in the Credit Column.

20-Jan. 16 Office Furniture

Cash in Bank

4 0 0 0 00

4 0 0 0 00

(continued)

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

29

CHAPTER 6

Chapter 6 Review

Answer 1

Finally, in the Description column, record:

An explanation. Indent the explanation under the

credit account name.

20-Jan. 16 Office Furniture

Cash in Bank

Check 243

4 0 0 0 00

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

4 0 0 0 00

30

CHAPTER 6

Chapter 6 Review

Question 2

Why do businesses separate their accounting records

into accounting periods?

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

31

CHAPTER 6

Chapter 6 Review

Answer 2

Businesses use accounting periods to make financial

comparisons possible. Comparisons of business

performance would be impossible if fiscal periods varied

in length.

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

32

Resources

Glencoe Accounting Online Learning Center

English Glossary

Spanish Glossary

Glencoe Accounting Unit 2 Chapter 6 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

33