Why New Approaches to Credit Risk Measurement and Management?

Why New Approaches to Credit

Risk Measurement and

Management?

Why Now?

Structural Increase in Bankruptcy

• Increase in probability of default

– High yield default rates: 5.1% (2000), 4.3% (1999,

1.9% (1998). Source: Fitch 3/19/01

– Historical Default Rates: 6.92% (3Q2001), 5.065%

(2000), 4.147% (1999), 1998 (1.603%), 1997 (1.252%),

10.273% (1991), 10.14% (1990). Source: Altman

• Increase in Loss Given Default (LGD)

– First half of 2001 defaulted telecom junk bonds recovered average 12 cents per $1 ($0.25 in 1999-2000)

• Only 9 AAA Firms in US: Merck, Bristol-Myers,

Squibb, GE, Exxon Mobil, Berkshire Hathaway,

AIG, J&J, Pfizer, UPS. Late 70s: 58 firms. Early

90s: 22 firms.

2

Disintermediation

• Direct Access to Credit Markets

– 20,000 US companies have access to US commercial paper market.

– Junk Bonds, Private Placements.

• “Winner’s Curse” – Banks make loans to borrowers without access to credit markets.

3

More Competitive Margins

• Worsening of the risk-return tradeoff

– Interest Margins (Spreads) have declined

• Ex: Secondary Loan Market: Largest mutual funds investing in bank loans (Eaton Vance Prime Rate

Reserves, Van Kampen Prime Rate Income, Franklin

Floating Rate, MSDW Prime Income Trust): 5-year average returns 5.45% and 6/30/00-6/30/01 returns of only 2.67%

– Average Quality of Loans have deteriorated

• The loan mutual funds have written down loan value

4

The Growth of Off-Balance

Sheet Derivatives

• Total on-balance sheet assets for all US banks = $5 trillion (Dec. 2000) and for all

Euro banks = $13 trillion.

• Value of non-government debt & bond markets worldwide = $12 trillion.

• Global Derivatives Markets > $84 trillion.

• All derivatives have credit exposure.

• Credit Derivatives.

5

Declining and Volatile Values of

Collateral

• Worldwide deflation in real asset prices.

– Ex: Japan and Switzerland

– Lending based on intangibles – ex. Enron.

6

Technology

• Computer Information Technology

– Models use Monte Carlo Simulations that are computationally intensive

• Databases

– Commercial Databases such as Loan Pricing

Corporation

– ISDA/IIF Survey: internal databases exist to measure credit risk on commercial, retail, mortgage loans. Not emerging market debt.

7

BIS Risk-Based Capital

Requirements

• BIS I: Introduced risk-based capital using 8%

“one size fits all” capital charge.

• Market Risk Amendment: Allowed internal models to measure VAR for tradable instruments

& portfolio correlations – the “1 bad day in 100” standard.

• Proposed New Capital Accord BIS II – Links capital charges to external credit ratings or internal model of credit risk. To be implemented in 2005.

8

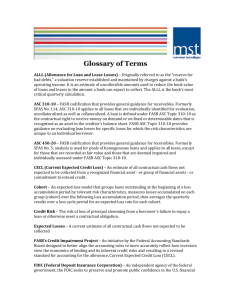

Appendix 1.1

A Brief Overview of Key VAR Concepts

• Banks hold capital as a cushion against losses. What is the acceptable level of risk?

• Losses = change in the asset’s value over a fixed credit horizon period (1 year) due to credit events.

• Figure 1.1- normal loss distribution. Figure 1.2 – skewed loss distribution. Mean of distribution = expected losses

(reserves).

• Unexpected Losses (UL) = %tile VAR. Losses exceed UL with probability = %.

• Definition of credit event:

– Default Mode: only default

– Mark-to-market: all credit upgrades, downgrades & default.

9

Figure 1.1 Normal loss distribution.

Probability

%

FIGURE 1.1

99.5th Percentile

(Maximum) Value

Conf idence

Interval

0.5%

EL

Expected

Losses

(EL)

EL

Unexpected

Losses, VAR

(UL)

Loss Distribution

Figure 1.2 Skew ed loss distribution.

Probability

%

Expected

Losses

(EL)

Unexpected

Losses, VAR

(UL)

Loss Distribution

11