PowerPoint-Präsentation

advertisement

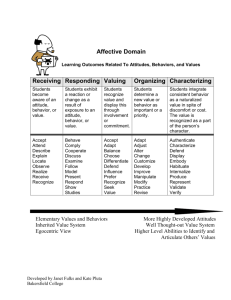

Tax Psychology (2) Social representations and communication Erich Kirchler University of Vienna, Austria TARC Master Class London - 2014 Economic understanding of adults Lay theories of economic relations (in contrast to expert knowledge of, for example, economists): • Are developed on the basis of daily experiences • Schematically simplified; stereotypes • Provide explanations and orientations for behaviour 2 1. Knowledge about taxes 3 Complexity of tax law Tax law is not always clear… Slemrod et al. (2001, p. 459): “… although one can assert that legality is the dividing line between evasion and avoidance, in practice the line is blurry; sometimes the law itself is unclear, sometimes it is clear but not known to the taxpayer, sometimes the law is clear but the administration effectively ignores a particular transaction or activity.” 4 Tax law is not always clear… Owens & Hamilton (2004) collected experiences and innovations in taxation in various countries. They state that in OECD countries, one of the major problems in tax administration is what tax administration has to administer, the tax laws and how to interpret them (complexity, ambiguity, incomprehensibility of the law). Tax laws have become so intricate that even experts, such as accountants, attorneys, and tax officers have difficulty interpreting many of the law’s provisions. Owens & Hamilton (2004) report that the number of words in the IRS Code (Income tax law, and entire tax code) increased steadily from 1955 to 2000. 5 Growth in number of words in the IRS Code from 1955 to 2000; adopted from www. taxfoundation/org/compliancetestimony.html; quoted in Owens and Hamilton (2004) Thousands of words 1800 1600 1400 1200 1000 Income taxes only Entire tax code 800 600 400 200 0 1955 1965 1975 1985 6 1995 2000 Tax law is not always clear… Moser (1994) undertook a linguistic analysis of tax laws and claims several bad habits which make it difficult for ordinary taxpayers to understand the law. Lewis (1982) reports that the necessary education to understand the law is between 12 and 17 years in USA, UK, and Australia, respectively. Readability is the ease with which text can be read and understood. Various factors to measure readability have been used, such as "speed of perception," "perceptibility at a distance," "perceptibility in peripheral vision," "visibility," "the reflex blink technique," "rate of work" (e.g., speed of reading), “eye movements” and fatigue in reading.“ The Flesch formulas: FleschKincaid readability test 7 Tax laws are not always clear… Efforts to simplify the law are undertaken in almost all countries. “I hold in my hand 1,379 pages of tax simplification.” U.S. congressman Delbert L. Latta 8 Subjective knowledge Tax law is complex. Sakurai & Braithwaite (2003) found in an survey with more than 2,000 Australian taxpayers that a relatively small percentage of respondents described themselves as fully competent: 36% denied fully the question, “I feel competent to do my own income tax return.”, 26% indicated to feel a little competent, 25% a fair bit, 12% very much. It is not surprising that more than three thirds rely on tax agents, 6.5% on tax office staff, and 20% on other people. According to Blumenthal & Christian (2004) close to 60% of the 128 million individual income tax returns in the USA filed for tax in 2001 were signed by a preparer. 9 Poor understanding of tax law, taxation and tax rates breed distrust. Low tax knowledge is correlated with low compliance. Using education as a proxy for tax knowledge, it was found that higher education correlates with compliance (Kinsey & Grasmick, 1993; Song & Yarbrough, 1978; Spicer & Lundstedt, 1976; Vogel, 1974). Schmölders (1960) reports in his influential study on tax morale in Germany that agreement with governmental activities and fiscal policy was higher in higher educated groups. Several survey studies found a positive relationship between (subjective or objective) tax knowledge and attitudes towards taxes and fairness assessments (Cuccia & Carnes, 2001; Kirchler & Maciejovsky, 2001; Niemirowski et al., 2002; Park & Hyun, 2003) Kirchler, Maciejovsky & Schneider (2003) assessed tax knowledge of fiscal officers, students of economics and business administration, business lawyers, and entrepreneurs, using a multiple choice test consisting of ten items, and correlated their knowledge with fairness judgments of tax avoidance, tax evasion and tax flight. Tax knowledge was neither correlated with the perceived fairness of tax evasion nor with the perceived fairness of tax avoidance. However, for business lawyers and entrepreneurs it was found that profound tax knowledge is positively correlated with perceived fairness of tax avoidance, indicating that the better the knowledge the fairer was tax avoidance 10 perceived. 2. Representations of taxes 11 Representations of taxes Fynantzer = Landbetrieger, derscrews die Leute Tax inspector = Impostor who umbs bescheisset peopleGeld for their money Basilius Faber, 1680 Thesaurus editionis scholasticae 12 Representations of taxes Peter Sloterdijk (2010) “The modern democratic state gradually transformed into the debtor state... This metamorphosis has resulted,… , from a prodigious enlargement of the tax base – most notably, with the introduction of the progressive income tax… … each year, modern states claim half of the economic proceeds of their productive classes and pass them on to tax collectors, and yet these productive classes do not attempt to remedy their situation with the most obvious reaction: an antitax civil rebellion.” Attitudes and tax morale Schmölders (1960): Tax morale is the “attitude of a group or the whole population of taxpayers regarding the question of accomplishment or neglect of their tax duties; it is anchored in citizens’ tax mentality and in their consciousness to be citizens, which is the base of their inner acceptance of tax duties and acknowledgment of the sovereignty of the state.” (p. 97f). Bruno Frey & Benno Torgler Tax morale = intrinsic motivation to comply Tax morale and size of shadow economy (Alm & Torgler, 2005) 30 Size of Shadow Economy (in % of the GDP) Attitudes drive behavior (Schmölders: tax morale) □ Italy 20 □ Belgium Norway □ Spain □ Portugal □ □ Sweden Finland□ Germany Netherlands □ □ Ireland □ □ Denmark France□ □Great Britain Austria □□ □USA Switzerland 10 0 0.0 0.5 1.0 1.5 2.0 2.5 3.0 Degree of Tax Morale 16 Lay theories Lay theories are often explained on the basis of the Theory of Social Representations (Moscovici, 1981) 17 Social representations [...] a system of values, ideas and practices with a twofold function; first, to establish an order [...] and secondly to enable communication to take place among the members of a community [...] (Moscovici, 1961/1973) • „Common-sense-theories” on fundamental issues that are of concern to the community (Moscovici & Hewstone, 1983); everyday knowledge • Combine psychological and sociological elements (social groups, strata) 18 Definition: Wagner (1994) Social representations are …: Metaphoric images, representations, conceptions of socially relevant phenomena; often pictographically-symbolically, linguistically expressed; unite cognitive, affective, evaluative and conative aspects Perspective of individual knowledge-systems Formation processes, change-dynamics and elaborations in social interactions, in everyday discourse, in social/societal discourse Perspective of collective discourse A concept, which makes it possible to refer social and individual analysis-systems to each other and to explain how social processes lead to individual, socially grounded representations Perspective of „macro-reduction of individual knowledge systems to social processes” 19 Social representations comprise: • Core: determines the meaning and identity of a social representation and consists of explicit or implicit fundamentals of the representations and • Periphery: protects the core, to adjust the social representation to context and time. Social representations develop through: • Anchoring: The unfamiliar is classified and ascribed with a meaning. • Objectification: The abstract concepts are turned into something concrete and assume real respectively physical representations (e.g. the word „bravery” is envisaged as a hero) 21 Sociogenesis of social representations (Wagner et al., 1999) Society, social groups Threatening or unfamiliar phenomenon or event (e.g. implementation of the Euro, publication of the theory of psychoanalysis) Collective examination, search for related contents, copies etc. Social identity The novel representations adds to the social identity of the society or social group The “world” of the society or social group is enriched by a novel representation Anchoring to and interpretation on the basis of familiar contents and representations. The social discourse leads to objectification, i.e. to representations in the form of pictures, metaphors, symbols, etc. Novel social representation The unfamiliar phenomenon becomes familiar and part of common sense 22 Attitudes Allport (1935, p. 810): “A mental and neural state of readiness, organised through experience, exerting a directive or dynamic influence upon the individual’s response to all objects and situations with which it is related.” Stroebe (1980): Attitudes towards an attitude object consist of The opinions on the object (cognitive aspect) The sympathy (affective aspect) and The behavioral intentions (conative aspect). 23 Attitudes Thomas (1991) Measurable independent variable Intervening variable Affect Attitude object (people, social groups, situations, actions etc.) Attitude Cognition Behavior Measurable dependent variable Reactions of the autonomic nervous system; verbal comments on emotions Perceptual judgments; verbally uttered opinions Manifest behavior; information on own behavior 24 Attitudes and behavior Attitudes cannot be observed directly, but represent a relevant basis of behavior. 25 Measuring attitudes • Psychobiological level: – E.g. pulse rate, electrodermal responses, ECG, EEG, fMRI (neuro-economics) – Registration of eye movements (search of information sequence of information search): „Spotlight – Viewer”: Selective attention of the consumers while watching advertisements Advantage: Little technical, financial, organizational, and temporal effort in comparison to classical eyetracking 26 Information search: the spotlight-viewer (…rather than eye tracking) (Berger, 2009) E.g., experiments on information search (audit probability, fines, social norms…) Measuring attitudes • Behavioral observation – E. g., “lost letters” • Surveys and interviews – Qualitative methods (e.g. in-depth interviews) – Quantitative methods (e.g. direct surveys) – Combined methods (e.g. associations) 28 Qualitative methods • In-depth interview: Collection of associations with the “object”: inquire all “object” attributes that are deemed important and then analyze the cognitive structure that lies behind them by repeatedly asking “why-questions” • Focus groups: The interaction provides an insight into complex behavioral patterns and personal motives: host, video or audio recordings • Qualitative-quantitative method: Associative network (see below) 29 Quantitative methods „Direct” attitude measurement How do you rate taxes [VAT, income tax, etc.]? Very bad Bad Neither Good Very good Remember: Not the attitude per se is measured “directly”, but the verbally uttered opinions are inquired directly. 30 Likert’s method of added ratings Attitudes as disapproval or approval of an attitude object Development of the scale: • • • • Collection of favorable and unfavorable statements Multi-point rating of agreement – disagreement Item analyses & selection, administration of the scale The added score of the answers represents the attitude index 31 Likert method – an example Strongly disagree Strongly agree Paying taxes on time is a citizen’s duty 5 4 3 2 1 Cheating on taxes is a minor crime 1 2 3 4 5 32 Multi-attribute-models Fishbein (1963), Fishbein & Ajzen (1975): • Only few object features/traits are perceived • Attitude as a function of the subjective probability and evaluation of these traits n Evaluation of trait k Aij = 1/n * ∑ (Pijk * Eijk) k=1 Probability that k is present 33 Multi-attribute-models - example Trait of X honest How likely is this trait? Unlikely 1 How do You evaluate this trait? Likely Bad Good 7 1 7 responsible Attitude = 1 / 2 * ( (3 * 5) + (5 * 1) ) = 10 2 mentioned traits „safe” „expensive” 34 Attitudes towards taking undue benefits and not declaring income (bar charts indicate percentages of judgments of morally wrong behaviour, lines indicate percentages of people who might show the behaviour; adopted from Orviska and Hudson (2002, p. 91) 60% Taking undue benefits Not declaring income Total sample 50% Sample below 40 years 40% 30% 20% 10% 0% Not wrong A bit wrong Very likely Fairly likely Wrong Seriously wrong Not wrong A bit wrong Wrong Seriously wrong Not very likely Not at all likely Very likely Fairly likely Not very likely Not at all likely 35 Morally wrong (bar charts) Would do (lines) Representations of taxes Although most citizens appreciate public goods and agree with policy regulations, people neither like to pay taxes to fund public goods nor to pay so called corrective taxes. People like public goods but claim taxes are too high! Task TAX-I 37 38 Semantic differential („classic” method; Osgood, 1970) Active Good Ugly Fast Weak Big Powerful Friendly … 1 1 1 1 1 1 1 1 1 A 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 B 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 Potency Passive Activity Bad Beautiful Valence Slow Strong Small Powerless Unfriendly … 39 Semantic differential (description vs evaluation; Peabody, 1985) Basic idea: separation of the evaluative and descriptive components Example: Description of the manner/demeanor of a company on the market via pairs of traits such as prudent/imprudent, timid/bold Use of prudent or bold → Evaluation of the company is positive Use of timid and imprudent → Evaluation of the company is negative Use of prudent or timid → Description of the company as risk-averse Use of bold or imprudent → Description of the company as willing to take risks 40 Semantic differential (description vs evaluation; Peabody, 1985) X Y thrifty stingy +3 -3 +2 -2 +1 -1 0 0 -1 +1 -2 +2 -3 +3 extravagant generous thrifty stingy +3 -3 +2 -2 +1 -1 0 0 -1 +1 -2 +2 -3 +3 extravagant generous Evaluative aspect = (scale a + scale b) /2 Descriptive aspect = |scale a – scale b| /2 or reverse one scale X evaluative aspect = (1 + 3) /2 = descriptive aspect = (-1 + 3)/2 = 2 1 Y evaluative aspect = (-1 + -1) /2 = descriptive aspect = (1 + -1)/2 = -1 0 41 Associative network (de Rosa, 1993) Too high 1 - Theft 4 - Burden 2 + Necessary 3 0 Unjust 5 + Evil 6 + Analyses: • Content of the associations • Evaluation (+/0/-): “polarity index”, “neutrality index” • Sequences: in combination with the frequency of “core” and “peripheral” • Links 42 Task - 0 0 0 0 0 0 0 0 0 0 0 0 + + + + + + + + + + + + Judgments of “typical taxpayers”, “honest taxpayers”, and “tax evaders” (Semantic Differential - Peabody) Descriptive dimensions Lazy versus hard-working Typical taxpayer Honest taxpayer Tax evader Stupid versus intelligent Typical taxpayer Honest taxpayer Tax evader Evaluative components Negative versus positive evaluation Typical taxpayer Honest taxpayer Tax evader Taxevader 44 Associations to taxes of entrepreneurs, civil servants, students, white, and blue collar workers (explained variance: Dimension 1 = 38%; Dimension 2 = 30%; Dimension 3= 17%; Kirchler, 1998) Technical tax terms Economic regulator STUDENTS ENTREPRE Financial loss Lack of clarity .89 Dimension 2 Public constraint NEUERS Not categorized Public goods Names of Bureaucracy Public deficit politicians BLUE COLLAR WORKERS and political institutions Criticism of the government Punishment and disincentive 0 Tax evasion Necessary evil Social security Salary and income WHITE COLLAR WORKERS Instrument for politicians -.77 CIVIL SERVANTS Criticism of politicians Social welfare Social justice -1.36 1.50 .86 0 Dimension 1 0 -.80 -.69 Dimension 3 45 Attitudes and behavior • Hidden measurment: • Haire (1950): Customers complained about the taste and smell of the novel product instant coffee. Judgments were seen as “rationalizations”, a negative attitude was suspected. Indirect method: Construction of two shopping lists of a hypothetic housewife, description of this housewife 46 Indirect attitude measurement (Haire, 1950) ½ kg bread 1 kg sugar 1 pack coffee beans 2 kg apples 1 salami 1 head of lettuce ½ kg bread 1 kg sugar 1 pack Nescafe 2 kg apples 1 salami 1 head of lettuce Described as „lazy”, „ill planning”, „wasteful”, „with little sense of family” 47 Indirect attitude measurement Imagine an entrepreneur who is married, with two children, runs a firm… evades taxes. Imagine an entrepreneur who is married, with two children, runs a firm… avoids taxes. Imagine an entrepreneur who is married, with two children, runs a firm… pays on time correct taxes. Describe the entrepreneur, the personality, etc. 48