Accounting 300 - Cal State LA

advertisement

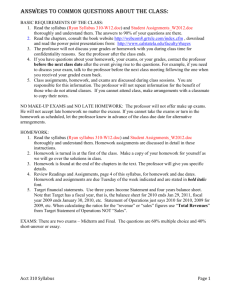

Accounting 310 Accounting Information for Decision Makers Winter 2012 Professor: Daniel Ryan Phone: 323-343-2830 Office ST 504 E-Mail Address: dryan@calstatela.edu Web Page: http://instructional1.calstatela.edu/dryan Office Hours: Tu 4:40PM – 6:00PM Final Exam: Tuesday, March 20, 2012 7:30pm – 10:00pm; Required: Yavari, Hansen, and Otto, Accounting Information for Decision Making, 2011, Great River Technologies, # 9781615492633 Prerequisites: Acct 210 and Acct 211 or equivalent introductory financial and managerial accounting classes. Course Description: Use of financial and managerial accounting information to plan, analyze, evaluate, and improve the activities and financial results of a firm. Course Objectives: At the end of the course, students should be able to use accounting information to assess the efficiency and effectiveness of operations and cash flow of an entity and use that information to make better managerial decisions. Students also should be able to use trend data and financial statement information to project future operations and financial statements. Finally, students should be able to assess the internal control and corporate governance of a firm. Grading: Homework Two Case Studies Annual Report Project Presentation Internal Control Report Midterm Final exam 20% 10% 15%* 10% 05% 20% 20% * The professor reserves the right to adjust the score on an individual student’s annual report project grade based on the results of the peer evaluation score. This means that if your group members gave you low scores on the peer evaluation, the professor may deduct points on the annual report project grade. Key Dates: January 17 Last day to drop the class without penalty. Withdrawals after this date are permitted only for Serious and Compelling reasons and require the instructor’s and department chair’s signatures and documentation as to why you are dropping the class. January 23 Last day to add the class. Holiday – None If you think you are eligible under the ADA for accommodation, please contract the office for students with disability at 323343-3140, located in the student affairs building, Room 115 Week 1 2 3 4 5 6 7 8 9 10 Reading and assignments Review of accounting cycle – Christy’s Lemonade Stand Journal entries, adjusting entries, posting, trial balance, income statement, statement of retained earnings, balance sheet Review of the Income Statement and Balance Sheet Readings: Chapters 1 and 2 Statement of Cash Flows; DuPont Formulas – ROSE Homework: Review Problem due Review the accounting cycle, Review the categories of ratios, comparability Profit Margin Analysis: Common sizing and trend analysis – where costs are “out of line” Ways to improve revenue, revenue variations Revenue recognition rules, how to increase revenue and analysis Readings: Chapters 3 and 4 Homework: Horizontal and Vertical analysis of Balance Sheet and Income Statement for Target Homework: Profitability ratios for Target Cost structure, cost behaviors, and cost analysis Costs/expenses – direct costs and indirect costs, variable and fixed costs Standard costing method/ABC costing method Review income statement – revenues, sales, COGS, expenses, profit Gross margin, contribution margin Operating leverage – capital intensive, labor intensive Readings: Chapters 5 and 6 In Class Case: ABC Case Homework: ABC Costing Problem Homework: Operating Leverage Problem Homework: Effectiveness ratios, Internal Control Time Value of Money, Capital Budgeting Readings: Chapters 15, 7, 8, 9 Homework: Capital Budgeting Problem Homework: Effectiveness Ratios Types of financing available, Financial Data research Solvency ratios, Financing choices and use of financial leverage Readings: Chapters 10 and 11 Homework: Solvency Ratios for Target Financial leverage and solvency Cash flows and liquidity Midterm 2/14 Readings: Chapters 12 Homework: Liquidity Ratios due Target Financial statement projection Income statement and balance sheet Comprehensive financial analysis Readings: Chapters 13 and 14 Internal Control Report Due Projecting cash flows Earnings management and fraud Homework: Forecasting Case Due Readings: Chapter 16 Corporate Governance and Sarbanes Oxley Act Readings: Chapter 17 Annual Report Project Presentations Annual Report Project Presentations Peer Evaluations due Annual Report Paper due