Production Economics

advertisement

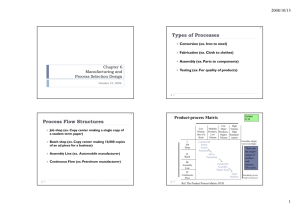

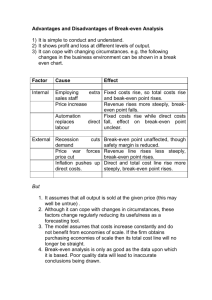

The Economics of Production Make or Buy Decisions Capacity Expansion Learning-Curves Break-even Analysis Production Functions Make or Buy? Let c1 = unit purchase price c2 = unit production cost (c2 < c1) K = fixed cost of production x = number of units required Produce if K + c2 x c1x or x K / (c1 - c2 ) Make or Buy Example • It costs the Maker Bi Company $20 a unit to purchase a critical part used in the manufacture of their primary product line – a thing-um-a-jig • It is estimated that the part could be produced internally at a unit cost of $16 after incurring a fixed cost of $20,000 for the necessary equipment. • What to do? a thing-um-a-jig What to do? Let c1 = $20 c2 = $16 K = $200,000 x = number of units required Produce if x K / (c1 - c2 ) = 20,000 /(20 – 16) = 5,000 Nonlinear Cost Function Let c1 = unit purchase price c2 = K + axb where K, a, b > 0 x = number of units required If c1 = 20 and c2 = 20,000 + 100x.7 , then c2 Cumulative Cost 90000 80000 70000 60000 50000 40000 30000 20000 10000 0 0 2000 4000 6000 x 8000 10000 12000 More on that Nonlinear Cost Function x 1900 1925 1950 1975 2000 2025 2035 2050 2075 2100 2125 2150 2175 2200 2225 2250 2275 Make $39,730 $39,911 $40,092 $40,272 $40,451 $40,630 $40,701 $40,808 $40,985 $41,162 $41,338 $41,513 $41,688 $41,862 $42,036 $42,209 $42,381 Buy $38,000 $38,500 $39,000 $39,500 $40,000 $40,500 $40,700 $41,000 $41,500 $42,000 $42,500 $43,000 $43,500 $44,000 $44,500 $45,000 $45,500 Strategic Decisions Capacity Expansion • Capacity Growth Planning – when to construct new facilities – where to locate facilities – how large to size a facility • Economies of scale – advantage of expanding existing facilities – share plant, equipment, support personnel – avoid duplication at separate locations Capacity Expansion competing objectives: maximize market share maximize capacity utilization number units number units demand time capacity leads demand demand time capacity lags demand We need a model let D = annual increase in demand x = time interval (in yrs) between capacity increases r = annual discount rate, compounded continuously f(y) = cost of expansion of capacity y assume y = xD, then cost = C(x) = f(xD) [1 + e-rx + (e-2rx ) + (e-3rx ) + …] = f(xD) [1 + e-rx + (e-rx )2 + (e-rx )3 + …] = f(xD) / [1 – e-rx] a assume f(y) = kya , then k ( xD) C ( x) rx 1 e find the x that minimizes C(x) A Diversion - the Geometric Series 1 1 y y ... y ... y 1 y n0 2 1 e e rx n rx 2 n ... e rx n ... e n0 You see? It does converge. rx n 1 1 e rx Discounting – another diversion Consider the time value of money $1.00 today is worth more than a $1.00 next year How much more is it worth? If r = annual interest rate, then it is worth (1+r) $1.00 After two years, it is worth (1+r)2 $1.00 (compounded) Compounded quarterly for 1 yr = 1 r / 4 4 Compounded continuously for one year = lim 1 r / n e r n n t 1 r / n ert After t years = lim n n More diversionary discounting A stream of costs: C1, C2, …, Cn incurred at times t1, t2,…, tn has a present value of: n C e i 1 rti i For an infinite planning horizon where x is the time between expansions: Ce i 1 irx C 1 e rx Why can’t you show us an example? The Example • Chemical firm expanding at a cost ($M) of f ( y) .0107 y .62 – where y is in tons per year. • Demand is growing at the rate of D = 5,000 tons per year and future costs are discounted at a rate of r = 16 percent .0107(5000 x).62 • Find x that minimizes C ( x) .16 x 1 e Capacity Expansion Solution C(x) - $M 15 14 13 12 11 10 9 8 0 2 4 6 8 years .0107(5000 x).62 C ( x) .16 x 1 e 10 12 5 5.1 5.2 5.3 5.4 5.5 5.6 5.7 5.8 5.9 6 10.35653 10.35042 10.3456 10.34203 10.33964 10.33839 10.33823 10.33911 10.34098 10.34382 10.34757 alternately set C’(x) = 0 solve for x. Learning Curves Based upon the observation that unit labor hours or costs decrease for each additional unit produced Direct labor hrs per unit Units produced Why does this happen? • • • • • • • • • • • Employee learning reduced set-up times better routing and scheduling of material (WIP) improved tool design more efficient material handling equip. (MHE) reduced lead-times improved (simplified) product design production smoothing quality assurance revised plant layout increased machine utilization Learning Curve (experience curves) Y(u) = labor hours to produce the uth unit assume Y(u) = au-b a = hours to produce the first unit b = rate at which production hours decline labor coming to work Learning Curves Assume hours to produce unit 2n is a fixed percentage of the hours to produce unit n Then for an 80 percent learning curve: b Y ( 2 n ) a ( 2 n) b 2 .80 b Y ( n) an ln .8 or b .3219 ln 2 ln(Pct/100) b ln 2 Observe the simple formula Learning Curves least-squares analysis Unit Number - x Direct Labor Hours -Y(x) 20 40 60 80 100 35.8 30.1 27.3 25.7 24.1 Fit Y(x) = ax-b using Excel Y(x) = 74x-.243 2-.243 = .845 or a 84.5% learning curve Learning Curves Cumulative Cost Y (i ) ai b hours to produce ith unit x x i 1 i 1 T ( x) Y (i ) ai T ( x) V ( x) x b cumulative direct labor hrs to produce x units average unit hours to produce x units Learning Curves Approximate Cumulative Cost x x b 1 ax T ( x) Y (i) di a i di b 1 0 0 b 1 b b ax ax V ( x) (b 1) x 1 b Example Y(x) = 74x-.243 2-.243 = .845 or a 84.5% learning curve .2431 .757 74 x 74 x T ( x) 74 i .243 di 97.75 x.757 .243 1 .757 0 x T (2000) 97.75(2000).757 30,833 hr. V(2000) 30,8333/2000 15.42 X 100 200 300 400 500 600 700 800 900 1000 T(x) 3192.396 5395.062 7333.268 9117.509 10795.36 12393.02 13926.95 15408.34 16845.28 18243.86 V(x) 31.92396 26.97531 24.44423 22.79377 21.59072 20.65504 19.89564 19.26043 18.71698 18.24386 Break-Even Analysis Let x = number of units produced and sold x = S-1(unit selling price) S(x) = unit selling price F = fixed cost g(x) = variable cost to produce x units Sam Even on a break then break-even point occurs when revenue = cost; or S(x) x = F + g(x) and profit = revenue – cost or P(x) = S(x)x – [F + g(x)] Break-Even Analysis $ Cost curve Revenue curve profit loss loss Diminishing returns F Break even pt x Max profit Break-Even Analysis Demand Curve S(x) x S(x) = d + e x + f x2 (quadratic) d, e, and f are constants to be determined Break-Even Analysis Demand Curve S(x) Approximate as linear S(x) = d + e x x S(x) = d + e x + f x2 d, e, and f are constants to be determined Break-Even Analysis Unit Cost Let M = direct material unit cost ($/unit) L = direct labor rate ($/hour) B = factory burden rate Y(x) = direct labor hours to produce unit x C(x) = cost to produce unit x C(x) = M + L Y(x) + L B Y(x) = M + (1+B) L Y(x) = M + (1+B) L a x-b Learning curve effect The Factory Burden Diversion Manufacturing Costs Direct costs Direct material Direct labor Factory burden Indirect material -Office & janitorial supplies -Paint Indirect labor -Supervision -Engineering -Maintenance Indirect expense -Heating -Lighting -Depreciation -Rent & Taxes Factory Burden - example Product A B C total Category Indirect material Indirect labor Indirect expenses total annual cost $ 6,120 42,800 22,900 $71,820 annual production 100,000 140,000 80,000 labor hours 1000 1400 1600 4000 burden rate = 71,820 /30,000 = 2.394 per direct labor $ rate wages $9/hr $9,000 $7/hr 9,800 $7/hr 11,200 $30,000 Administrative Costs Marketing Costs Development Costs General Overhead Costs Manufacturing Costs Profit Selling Price S(x) Demands Cumulative Cost Unit cost: C(x) = M + (1+B) L a x-b Learning curve b 1 ax T ( x) b 1 g(x) = M x + L (1+B) T(x) = M x + L (1+B) [a x1-b / (1-b)] total cost = F + M x + L (1+B) a x1-b / (1-b) where F is a fixed cost to produce product x Break-Even Analysis -Profit Profit = P(x) = S(x) x - [F + g(x)] letting S(x) = d + ex, e < 0 P(x) = (d + e x) x - F - M x - L (1+B) a x1-b /(1-b) = d x + e x2 - F - M x - g x1-b where g = L (1+B) a /(1-b) More Break-Even Analysis P(x) = (d - M) x + e x2 - g x1-b - F break-even: set P(x) = 0 and solve for x maximize profit: set dP(x) =0 dx and solve for x dP( x) d M 2ex (1 b) gx b 0 dx d 2 P( x) 1 b 2 e b (1 b ) gx dx 2 for e < 0, a max point can exist Break-Even Analysis - example Data: d = 100 e = - .01 F = $100,000 M = $4 B = .5 L = $20 / hr a = 10 b = .60 2-.6 = 66% P(x) = d x + e x2 - F - M x - g x-b+1 where g = (1+B) L a /(1-b) P(x) = 100 x - .01 x2 – 100,000 - 4 x – (1+.5) (20) (10) x.4 / .4 = 96x -.01x2 –750 x.4 –100,000 The Math P( x) 96x .01x – 750 x x 1382 2 P '( x) 96 .02 x 300 x 0.6 x* 4706 P ''( x) .02 180 x .02 x 180 1.6 0 1/1.6 296.07 0.4 0 –100, 000 0 The Graph P(x) $150,000 $100,000 x = 1382 $50,000 $0 0 1000 2000 3000 4000 5000 -$50,000 -$100,000 -$150,000 x = 4706 6000 7000 Production Functions A production function expresses the relationship between an organization's inputs and its outputs. It indicates, in mathematical or graphical form, what outputs can be obtained from various amounts and combinations of factor inputs. In its most general mathematical form, a production function is expressed as: Q = f(X1,X2,X3,...,Xn) where: Q = quantity of output and X1,X2,X3,...,Xn = factor inputs (such as capital, labor, raw materials, land, technology, or management) Production Functions There are several ways of specifying this function. One is as an additive production function: Q = a + bX1 + cX2 + dX3,... where a,b,c, and d are parameters that are determined empirically. Another is as a Cobb-Douglas production function Q = f(L,K,M) = A * (Lalpha) * (Kbeta) * (Mgamma) where L = labor, K = capital, M = materials and supplies, and Q = units of product. Cobb-Douglas Production Function Q = f(L,K,M) = A * (Lalpha) * (Kbeta) * (Mgamma) Properties of the Cobb-Douglas production function: Decreasing returns to scale: alpha + beta + gamma < 1 Increasing returns to scale: alpha + beta + gamma > 1 Let CL, CK, and CM = the unit cost of labor, capital, and material, then C(L,K,M) = CLL + CKK + CM M is the total cost function A Little Production Problem An interesting problem: Given a monthly budget of $B, how should the money be spent to obtain a specified output Q? Find L, K, and M where L = dollars spent on labor, K = dollars spent on facilities and equipment, and M = dollars spent on material Q f ( L, K , M ) 100 L.3 K .2 M .4 Subject to: L K M $1, 000, 000 M 3L; K 2( L M ) I know I can work this one. The Inevitable Example A 100 budget labor capital material alpha beta gamma 0.3 0.2 0.4 L K M $8,333 $66,667 $25,000 1 1 1 -3 1 -2 1 -2 Q 794,700 RHS 100,000 100,000 0 0 0 0 Stop the madness. Optimize your production system! profits homework: turn-in breakeven problem text: Chapter 1- 29, 30, 31, 32, 34, 35 36, 37 ,38, 43, 44