here - David C. Broadstock

advertisement

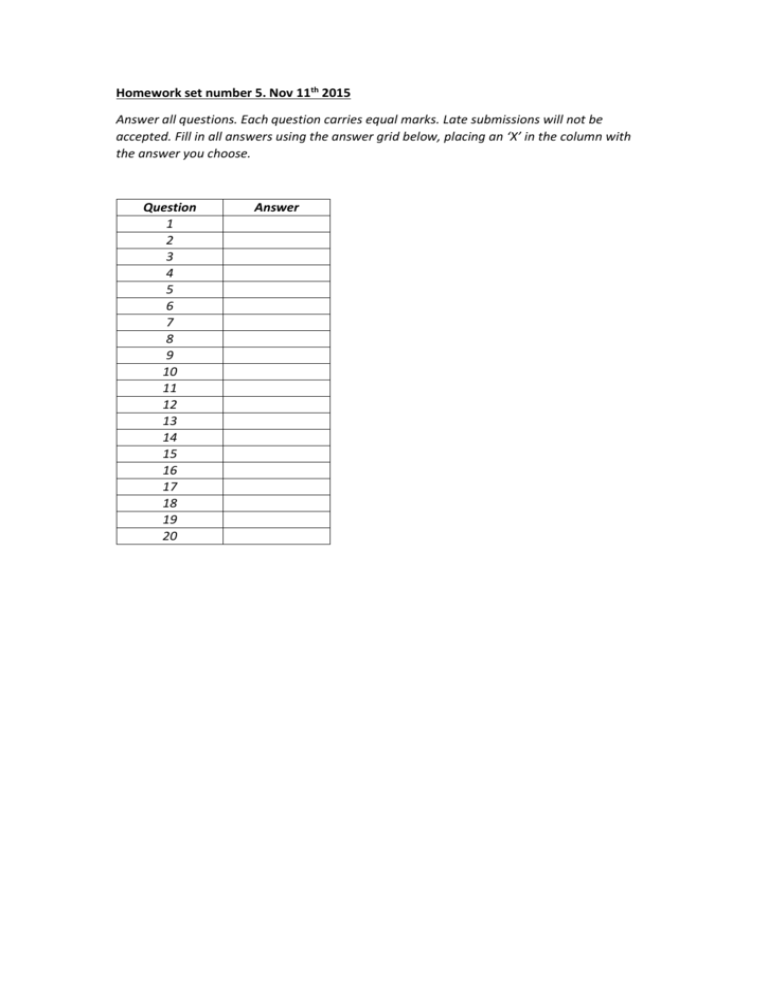

Homework set number 5. Nov 11th 2015 Answer all questions. Each question carries equal marks. Late submissions will not be accepted. Fill in all answers using the answer grid below, placing an ‘X’ in the column with the answer you choose. Question 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Answer Questions: Question 1. Which of the following observations would be consistent with the imposition of a binding price ceiling on a market? After the price ceiling becomes effective, a. a smaller quantity of the good is bought and sold. b. a smaller quantity of the good is demanded. c. a larger quantity of the good is supplied. d. the price rises above the previous equilibrium. Question 2. If the government removes a binding price ceiling from a market, then the price paid by buyers will a. increase, and the quantity sold in the market will increase. b. increase, and the quantity sold in the market will decrease. c. decrease, and the quantity sold in the market will increase. d. decrease, and the quantity sold in the market will decrease. Question 3. When a binding price ceiling is imposed on a market, a. price no longer serves as a rationing device. b. the quantity supplied at the price ceiling exceeds the quantity that would have been supplied without the price ceiling. c. all buyers benefit. d. All of the above are correct. Question 4. Panel (a) Panel (b) price price S S price ceiling price ceiling D quantity The price ceiling shown in panel (a) a. is not binding. b. creates a surplus. c. creates a shortage. d. Both a) and b) are correct. Question 5. 20 price 18 16 S 14 12 10 8 6 D 4 2 10 20 30 40 50 60 70 80 quantity Which of the following price ceilings would be binding in this market? a. $8 b. $10 c. $12 d. $14 D quantity Question 6. Minimum wage laws a. may encourage some teenagers to drop out and take jobs. b. create labor shortages. c. have the greatest impact in the market for skilled labor. d. All of the above are correct. Question 7. Which of the following is not correct? a. Taxes levied on sellers and taxes levied on buyers are not equivalent. b. A tax places a wedge between the price that buyers pay and the price that sellers receive. c. The wedge between the buyers’ price and the sellers’ price is the same, regardless of whether the tax is levied on buyers or sellers. d. In the new after-tax equilibrium, buyers and sellers share the burden of the tax. Question 8. Price 15 S2 12 S 8 9 1 6 Demand 3 40 80 105 120 160 Quantity Acme, Inc. is a seller of the good. Acme sells a unit of the good to a buyer and then pays the tax on that unit to the government. Acme is left with how much money? a. $8.00 b. $9.00 c. $10.50 d. $12.00 Question 9. Which of the following causes a surplus of a good? a. a binding price floor b. a binding price ceiling c. a tax on the good d. More than one of the above is correct. Question 10. In 1990, Congress passed a new luxury tax on items such as yachts, private airplanes, furs, jewelry, and expensive cars. The goal of the tax was to a. raise revenue from the wealthy. b. prevent wealthy people from buying luxuries. c. force producers of luxury goods to reduce employment. d. limit exports of luxury goods to other countries. Question 11. Elasticity is a. a measure of how much buyers and sellers respond to changes in market conditions. b. the study of how the allocation of resources affects economic well-being. c. the maximum amount that a buyer will pay for a good. d. the value of everything a seller must give up to produce a good. Question 12. How does the concept of elasticity allow us to improve upon our understanding of supply and demand? a. Elasticity allows us to analyze supply and demand with greater precision than would be the case in the absence of the elasticity concept. b. Elasticity provides us with a better rationale for statements such as “an increase in x will lead to a decrease in y” than we would have in the absence of the elasticity concept. c. Without elasticity, we would not be able to address the direction in which price is likely to move in response to a surplus or a shortage. d. Without elasticity, it is very difficult to assess the degree of competition within a market. Question 13. When consumers face rising gasoline prices, they typically a. reduce their quantity demanded more in the long run than in the short run. b. reduce their quantity demanded more in the short run than in the long run. c. do not reduce their quantity demanded in the short run or the long run. d. increase their quantity demanded in the short run but reduce their quantity demanded in the long run. Question 14. For a particular good, a 10 percent increase in price causes a 3 percent decrease in quantity demanded. Which of the following statements is most likely applicable to this good? a. The relevant time horizon is short. b. The good is a luxury. c. The market for the good is narrowly defined. d. There are many close substitutes for this good. Question 15. Which of the following is likely to have the most price elastic demand? a. lattés b. doctor’s visits c. eggs d. natural gas Question 16. When the price of a good is $5, the quantity demanded is 120 units per month; when the price is $7, the quantity demanded is 100 units per month. Using the midpoint method, the price elasticity of demand is about a. 0.55. b. 1.83. c. 2. d. 10. Question 17. When demand is perfectly inelastic, the price elasticity of demand a. is zero, and the demand curve is vertical. b. is zero, and the demand curve is horizontal. c. approaches infinity, and the demand curve is vertical. d. approaches infinity, and the demand curve is horizontal. Question 18. Consider luxury weekend hotel packages in Las Vegas. When the price is $250, the quantity demanded is 2,000 packages per week. When the price is $280, the quantity demanded is 1,700 packages per week. Using the midpoint method, the price elasticity of demand is about a. 1.43, and an increase in the price will cause hotels' total revenue to decrease. b. 1.43, and an increase in the price will cause hotels' total revenue to increase. c. 0.70, and an increase in the price will cause hotels' total revenue to decrease. d. 0.70, and an increase in the price will cause hotels' total revenue to increase. Question 19. You are in charge of the local city-owned aquatic center. You need to increase the revenue generated by the aquatic center in order to meet expenses. The mayor advises you to decrease the price of a day pass. The city manager recommends increasing the price of a day pass. You realize that a. the mayor thinks demand is elastic, and the city manager thinks demand is inelastic. b. both the mayor and the city manager think that demand is elastic. c. both the mayor and the city manager think that demand is inelastic. d. the mayor thinks demand is inelastic, and the city manager thinks demand is elastic. Question 20. An increase in the price of cheese crackers from $2.25 to $2.45 per box causes suppliers of cheese crackers to increase their quantity supplied from 125 boxes per minute to 145 boxes per minute. Using the midpoint method, supply is a. elastic, and the price elasticity of supply is 1.74. b. elastic, and the price elasticity of supply is 0.57. c. inelastic, and the price elasticity of supply is 1.74. d. inelastic, and the price elasticity of supply is 0.57.