Chapter 3 Homework Problems

advertisement

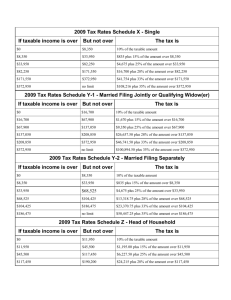

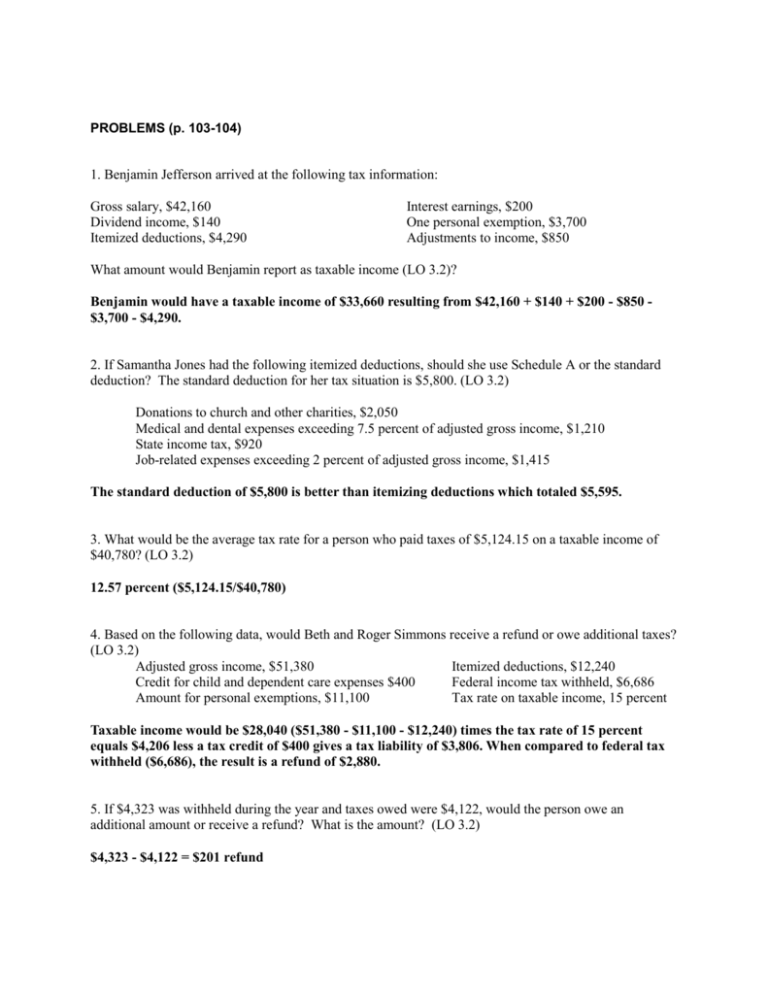

PROBLEMS (p. 103-104) 1. Benjamin Jefferson arrived at the following tax information: Gross salary, $42,160 Dividend income, $140 Itemized deductions, $4,290 Interest earnings, $200 One personal exemption, $3,700 Adjustments to income, $850 What amount would Benjamin report as taxable income (LO 3.2)? Benjamin would have a taxable income of $33,660 resulting from $42,160 + $140 + $200 - $850 $3,700 - $4,290. 2. If Samantha Jones had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is $5,800. (LO 3.2) Donations to church and other charities, $2,050 Medical and dental expenses exceeding 7.5 percent of adjusted gross income, $1,210 State income tax, $920 Job-related expenses exceeding 2 percent of adjusted gross income, $1,415 The standard deduction of $5,800 is better than itemizing deductions which totaled $5,595. 3. What would be the average tax rate for a person who paid taxes of $5,124.15 on a taxable income of $40,780? (LO 3.2) 12.57 percent ($5,124.15/$40,780) 4. Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes? (LO 3.2) Adjusted gross income, $51,380 Itemized deductions, $12,240 Credit for child and dependent care expenses $400 Federal income tax withheld, $6,686 Amount for personal exemptions, $11,100 Tax rate on taxable income, 15 percent Taxable income would be $28,040 ($51,380 - $11,100 - $12,240) times the tax rate of 15 percent equals $4,206 less a tax credit of $400 gives a tax liability of $3,806. When compared to federal tax withheld ($6,686), the result is a refund of $2,880. 5. If $4,323 was withheld during the year and taxes owed were $4,122, would the person owe an additional amount or receive a refund? What is the amount? (LO 3.2) $4,323 - $4,122 = $201 refund 6. Noor Patel is trying to decide between a $3,000 deduction for tuition and fees and a $2,000 education credit. Noor is in the 25% tax bracket. Which would be the better option for her? (LO 3.2) The deduction would reduce her taxes by $750 ($3,000 X 25%). The credit would reduce her taxes by $2,000. Therefore, the credit would be the better option. 7. Using the tax table on page 83, determine the amount of taxes for the following situations: (LO 3.3) a. A head of household with taxable income of $50,000. b. A single person with taxable income of $35,000. c. Married taxpayers filing jointly with taxable income of $70,000. a. A head of household with taxable income of $50,000. $12,150 * 10% = $1,215 ($46,250-$12,150) * 15% = $5,115 ($50,000 -$46,250) * 25%= $937.5 $1,215 + $5,115 + $937.5=$7,267.50 b. A single person with taxable income of $35,000. $8,500 * 10% = $850 ($34,500-$8,500) * 15% = $3,900 ($35,000 -$34,500) * 25%= $125 $850 + $3,900 + $125 = $4,875 c. Married taxpayers filing jointly with taxable income of $70,000. $17,000 * 10% = $1,700 ($69,000-$17,000) * 15% = $7,800 ($70,000 -$69,000) * 25%= $250 $1,700+ $7,800 + $250 = $9,750 8. If 300,000 people each receive an average refund of $1,500, based on an interest rate of 3 percent, what would be the lost annual income from savings on those refunds? (LO 3.2) 300,000 X $1,500 X .03 = $13,500,000 9. Using the tax table in Exhibit 3–5 (p. 91), determine the amount of taxes for the following situations: (LO 3.3) a. A head of household with taxable income of $90,625. b. A single person with taxable income of $90,001. c. A married person filing a separate return with taxable income of $90,305. a. A head of household with taxable income of $90,625 ($17,424). b. A single person with taxable income of $90,001 ($18,824). c. A married person filing a separate return with taxable income of $90,305 ($19,326). 10. Wendy Brooks prepares her own income tax return each year. A tax preparer would charge her $75 for this service. Over a period of 10 years, how much does Wendy gain from preparing her own tax return? Assume she can earn 3 percent on her savings. (LO 3.3) $859.80 = $75 x 11.464 (future value of annuity for 10 years, 3 percent) 11. Betty Sims has $30,000 of taxable income and $5,000 of medical expenses. She will be itemizing her tax deductions this year. The most recent tax year has a medical expenses floor of 7.5%. How much of a tax deduction will Betty be able to deduct? (LO 3.3) $30,000 * 7.5% = $2,250. $5,000 (medical expenses) - $2,250 (7.5% floor) = $2,750 (deductible medical expenses). 12. Each year, the Internal Revenue Service adjusts the value of an exemption based on inflation (and rounds to the nearest $50). If the exemption in a recent year was worth $3,700 and inflation was 1.2 percent, what would be the amount of the exemption for the upcoming tax year? (LO 3.3) $3,700 X 1.012 = $3,744.40, rounded to $3,750 13. Would you prefer a fully taxable investment earning 11.7 percent or a tax-exempt investment earning 9.1 percent? Why? (Assume a 25 percent tax rate.) (LO 3.4) Assuming a 28 percent tax rate, 11.7 percent times 0.75 equals 8.775 percent; a 9.1 percent taxexempt return would be preferred. 14. On December 30, you decide to make a $2,000 charitable donation. (LO 3.4) a. If you are in the 27 percent tax bracket, how much will you save in taxes for the current year? $540 tax savings ($2,000 X 0.27) b. If you deposit that tax savings in a savings account for the next five years at 8 percent, what will be the future value of that account? $540 1.469 = $793.26 15. Reginald Sims deposits $2,500 each year in a tax-deferred retirement account. If he is in a 27 percent tax bracket, what amount would his tax be reduced over a 20-year time period? (LO 3.4) $13,500 = ($2,500 x .27) x 20 years 16. If a person with a 33 percent tax bracket makes a deposit of $5,000 to a tax-deferred retirement account, what amount would be saved on current taxes? (LO 3.4) $5,000 x .33 = $1,650