Development in the Middle East and North Africa: Achievements

advertisement

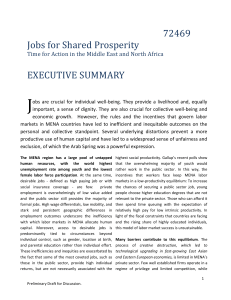

Institutional Change and Development in the Middle East and North Africa Mustapha K. Nabli Senior Advisor, World Bank Inaugural Lecture CREMed Universitat Pompeu Fabra (UPF) Barcelona, 7 November 2008 Three main messages about MENA A development path in MENA more complex than commonly recognized with major social and human development achievements but daunting new labor market and environmental challenges The most critical challenge of institutional change: moving from an old development model to a new and more adapted model has proven very difficult Root causes are to be found in the political economy of institutional change OUTLINE I- Background and Long Run Development Outcomes II- A major challenge of institutional change III- Challenge #1: Employment and Private Sector Development IV. Challenge #2: Education V. Challenge #3: Water VI. Political Economy I. Background and Long Run Development Outcomes 1. 2. 3. Background: a diverse region Poverty reduction and human development : major gains Economic growth: mediocre, volatile and hesitant (1) A diverse region: Three Major Country Groupings Resource-poor, labor-abundant (RPLA) or emerging economies: Egypt, Jordan, Lebanon, Morocco, Tunisia, West Bank and Gaza Population: 124 Mill. GDP: $US 225 billions Resource-rich, labor-abundant (RRLA) or transition economies: Algeria, Iran, Iraq, Syria, Yemen Population: 168 Mill. GDP: $US 400 billions Resource-rich, labor-importing (RRLI) or rich economies: GCC (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE) +Libya Population: 40 Mill. GDP: $US 666 billions GDP per capita $ 2005 RPLA GDP/Cap $ US PPP RRLA RRLI RPLA GDP/Cap. $US RRLA RRLI 0 5000 10000 15000 20000 25000 GDP per capita $ PPP 2005 RPLA Max RRLA Average Min RRLI 0 20000 40000 60000 80000 (2) Dramatic poverty reduction and low absolute poverty % of Poeple living below $1.25 a day % of People Living Below $2 a day 70 60 60 50 50 40 40 30 30 20 20 10 10 0 0 1981 1984 1987 1990 1993 1996 1999 2002 2005 MENA region All regions 1981 1984 1987 1990 1993 1996 1999 2002 2005 MENA region All regions Huge progress in terms of health indicators— Fertility, infant mortality, life expectancy Fertility rate, total (births per woman) Life expectancy at birth, total (years) Mo rt a lit y ra t e , inf a nt ( pe r 1, 0 0 0 liv e 80 birt hs ) 7 75 138 6 5 4 East Asia Latin Americ a MENA 118 70 Lati n Amer i ca 98 65 MENA Lat in America 78 60 58 MENA East Asi a 3 55 East Asia 38 50 18 2 1960 1970 1980 1990 2000 2004 Source: World Development Indicators 1960 1970 1980 1990 2000 2004 45 1960 1970 1980 1990 2000 2004 (3) Economic growth: mediocre and volatile GDP per capita growth I MENA and other regions (percent) 8 7 6 5 4 3 2 1 0 -1 -2 1970s 1980s 1990s 2000s East Asia & Pacific Europe & Central Asia Latin America & Caribbean South Asia Sub-Saharan Africa Middle East & North Africa …and varied across sub-regions and countries GDP per capita growth in the MENA region 6 4 2 1970s 1980s 0 RRLI -2 -4 -6 RRLA RPLA 1990s 2000s II. A most critical challenge of institutional change Started with an old development model based on an unwritten social contract, with central role of the state Major achievements but breaks down in the 1980s Move to a new development model with different role of the state and central role for individuals, markets, private sector Changes in many policies but failure to see needed institutional change Old social contract and central role of the state—1950s to 1970s Institutional and policy characteristics: Widespread state ownership of assets and limited role of the private sector Preference for the state and state planning rather than markets in managing economies Heavy inward orientation Strong redistribution and very active social agenda, with state provision of public services and safety nets Limited political voice and participation Dominant role of security and military establishments Major gains but crises and collapse of old social contract- mid-1980s Major gains as we will see later First signs of difficulties—macroeconomic crises in the 1970s/Tunisia, Egypt Generalized crises in the 1980s and growth bust by the mid-1980s Macro and structural adjustment programs since the early 1980s Slow and hesitant transformation to a new social contract—since the 1980s From public sector to private sector driven: Emergence of private sector More open economies: slow external liberalization Towards more liberalization and deregulation of markets More diversified economies Continuation of many old redistributive policies (subsidies) Continued limited political voice and participation Failure to meet many critical challenges requires deeper institutional change Employment challenge Higher expectations by a younger and more educated population Pressures of globalization Critical water and environmental challenges Critical institutions which need to change Transition to institutions with less prevalence of “personal exchange” both in the political and economic domains Economic institutions with strong private property rights, less rent-seeking, more open markets, rules-based government regulation and intervention Political institutions with greater voice and accountability Three case studies to illustrate Three recent major flagship reports by the World Bank: Policies, Institutions and Credibility of Market Governance in MENA: Breaking through Barriers of Private-Led growth (forthcoming) The Road Not Traveled: Making the Most of Scarcity : Education Reform in the MENA Region (2008) Accountability for Better Water Management Results in the Middle East and North Africa (2007) III. Challenge #1: Employment and Private Sector Development Slow/delayed demographic transition, surge in labor force growth, and job creation as the most critical challenge Private sector development is the key to job creation and facing the labor market pressures Private sector has not been up to the challenge yet Demographics: surge in population growth followed by steep decline Population Trends in MENA, 1950-2050 3.5 600.0 Population 3 500.0 2.5 400.0 2 300.0 1.5 200.0 1 100.0 0.5 0 0.0 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050 Population (in millions) Average Annual Growth (percent) Population grow th … a delayed demographic transition leading to major surge in labor force growth in MENA … Dynamics of Labor Supply in MENA Countries, 1950-2020 (percent) - NEW 4 64 Participation rate (end of decade, left axis) 62 Working age population growth (right axis) 60 Labor force growth (right axis) 3.5 3 58 2.5 56 54 2 52 1.5 50 48 1 1950s 1960s Source: ILO 1996 (pre-1980), ILO 2005. 1970s 1980s 1990s 2000s 2010s Average annual growth Participation rate (percent) 66 Three major periods Period I 1960s to Mid-1980s Period II Mid-1980s to Early-2000s Period III Since 2000s Labor force growth Low High High Economic growth High Low High Migration High Low Low Employment creation Large in public Low High in private Unemployment Low High (youth, Lower female) Recent improvements in labor markets, MENA 2000-2005 Includes: Algeria, Bahrain, Egypt, Iran, Jordan, Kuwait, Morocco, Qatar, Saudi Arabia, Tunisia, United Arab Emirates, West Bank and Gaza. 6.0 5.1 5.0 4.5 3.6 4.0 3.0 2.8 2.0 1.0 0.0 WAP LF JOBS GDP Unemployment rates have fallen but remain high 16 2000 14.3 2005 14 12.2 12 10.8 11.3 10.3 10 9.9 8 6 4 2 0 MENA Excl Alg Excl Alg, Eg, Irn Need to create better quality jobs 7 6 Agriculture Industry 5 Services Work at home 4 0.1 2.5 3 1.5 2 1 0.8 2.1 0.9 3.6 0.8 0.5 1.9 1.9 0.6 0.3 -1.4 1.4 1.9 0.4 0.4 0 -1 2.5 1.4 0.0 ALG JOR EGY IRN TUN MOR WBG -2 …at the same time labor force growth will continue to be high for the next 15-20 years (new numbers) 4.0 3.5 % growth per year 3.0 SSA MENA 2.5 2.0 SA LAC 1.5 1.0 0.5 EAP 0.0 ECA -0.5 2000-2005 2005-2010 2010-2020 Private Sector is Key for Job Creation Challenge of : Quantity of jobs, Quality, and Flexibility and Adaptation to globalization But performance has been weak Progress on reforms mixed Credibility of policies and reforms and accountability remain critical issues Private Sector Performance (1) weak compared to other regions 1985-89 Middle-East North Africa 1990-94 1995-99 2000-04 2005-07 Sub-Saharan Africa Latin America & Caribbean Europe and Central Asia South Asia East Asia * Or most recent available year. 0% 5% 10% 15% 20% 25% 30% Private Sector Performance (2) low growth of private investment Private Investment Growth (per annum - weighted average) 14% 13.14% 12% 10% 8.62% 8% 6% 3.66% 4% 3.01% 2.80% 2.47% 2% 0% 1984-06 EAP (4) 1981-05 SAS (4) 1985-05 SSA (30) 1995-04 ECA (18) 1982-04 MENA (6) 1980-03 LAC (14) Private Sector Performance (3) varied across sub-groups of countries Figure 2. Private Investment in MENA 19 percent of GDP 17 15 13 11 9 7 5 1995 1996 1997 1998 1999 RPLA 2000 RRLA 2001 2002 RRLI 2003 MENA 2004 2005 2006 Progress on Reforms for Private Sector Development (1) during the last 20-25 years efforts to increase the role of the private sector in the economies of the region all countries of the region undertook to reform their policies and institutions and made progress in shifting their economic systems to be more private sector market driven. progress with reform has been mixed and varied significantly across areas of reform, and across individual countries and country groupings. Progress on Reforms for Private Sector Development (2) Summary Reform area Macroeconomic Environment Resource-poor Resource-rich Resource-rich Labor-abundant Labor-abundant Labor-importing 0 +1 +2 -1 +1 (Lebanon: -2) 0 Trade Policies (Algeria: +1) 0 Regulatory Environment -1 +2 -2 +2 0 -2 -2 +1 -2 +1 (Jordan: +1, Egypt: -2) Financial Sector +1 ( Lebanon: +2) Weight of public sector Quality of public administration (Egypt: -1) What are the possible explanations for this lack of progress and weak response? Incomplete reform agenda; need just to do more? Need to overcome resistance of special interests? Long lags in response; just wait? More fundamental institutional problems? As suggested by some pieces of evidence to follow. As evidenced by the lack of trust between public and private sectors … Governments and a private sector that do not trust each other. How would you rate the respective roles of the government and the private sector in your country's development? 5 4.2 3.7 4 Average score government respondants 3 2 1 1.3 Average score private sector respondants 1.2 0 On the role of the private sector. On the role of the government. Source: survey of 103 government officials and 114 private sector representatives at various conferences (2006/2007). …the concerns of the private sector about policy uncertainty …. Policy uncertainty and the unequal implementation of rules are leading constraints to businesses Leading constraints to MENA firms. (simple average of country's share of firms ranking a constraint as "Major or severe ") 60% 49.8% 50% 46.2% 43.7% 42.5% 35.9% 33.6% 30.7% 30.1% Skills and education of workers 35.9% Business licensing/operating permits 37.2% 40% 30% 20% 10% Access to land Tax rates Tax administration Regulatory policy uncertainty Anti-competitive or informal practices Corruption Access or cost of financing Macroeconomic uncertainty 0% …and the negative perceptions about the consistency and predictability in the application of rules and regulations. Perceptions about the consistency and predictability of rules and regulations as they are applied in MENA countries Interpretations of regulations are consistent and predictable. (% of respondents disagreeing) 80 60 41.2 42.3 Ye me n Jordan 57.7 60 Alge ria Morocco 66.2 66.6 We st Bank and Gaz a Le banon 40 21.5 20 0 Saudi Arabia Reforms and progress of private sector hinge on major institutional changes Rules based and less discretion in the business environment Less room for rent-seeking and more for innovation and entre Greater credibility of commitment to respect of property rights and respect of rules and regulations IV. Education Another major challenge linked to the demographics and employment challenge Received high priority by governments and major progress in terms of access But problems with quality and weak results in terms of efficiency Reforms hinge on progress in accountabilities Major gains in access to education Average Years of Schooling in MENA of the Population Aged 15 and Above Gross Enrollment Rates in MENA (19702003) (%) 100 8 90 Primary 80 7 6 70 5 60 Seco nd ary 50 4 40 3 30 2 20 East Asia MENA 1 10 0 Latin America T ert iary Source: Statistical Appendix 1970 1980 1990 0 Source: Barro and Lee (2000) 2000 2003 1960 1980 2000 Good achievements in terms of the quality of human capital Adult Illite racy Rate s, 1980 and 2003 TIMSS score (math and science) 1998 and 2003 60 Top country Int'n'l avg. 50 Lebanon 40 Jordan Iran 2 30 Tunisia Egypt 20 Bahrain 10 WBG Morocco 0 MENA Ea st Asia 1980 2000 La t in Ame ric aSaudi Arabia 0 100 Math Science (1998) Source: UNESCO Statistical Yearbook 1998 and UIS database. Source: TIMSS 2003 Highlights 200 300 Science 400 Math 500 600 But very low economic returns Pri vate Rate s of Re tu rn , 1970-1998 (vari ou s ye ars s u bje ct to data avai l abi l i ty) 25 20 15 10 5 0 P rimary MENA Source: Source: Allen, 2001; CRESUR, 2004. Secondary East Asia T ert iary Lat in America Despite very heavy investments by governments (and private sector). Public Expenditure as a % of GDP 6 5 Public Spending as a % of Government Budget, most recent year during 2000-2004 35 MENA 30 25 Latin America 4 3 20 15 East Asia 10 5 2 0 Source: World Development Indicators 0 1965 1975-84 1985-94 1995-2002 MENA Yemen Tunisia Syria Qatar Oman Morocco Libya Lebanon Kuwait Jordan Iran UAE Egypt Djibouti West Bahrain Saudi Algeria 1 Source: World Development Indicators, UNESCO Institute for Statistics, UNICEF, National Sources and Author’s Calculations, ..and a host of other problems going forward MENA countries need to deal with a youth bulge not seen elsewhere The challenge of globalization and the knowledge economy The challenge of financing education Reforming Incentives and Institutions of Accountability is key Based on experience in the region and elsewhere three key factors: Successful reformers have better engineering and more aligned incentives. The better performers engage the private sector in providing education to a larger extent, especially at higher levels of instruction Countries with higher public accountability produced better education outcomes Countries need to consider the following several critical reform perspectives From Engineering Inputs to Engineering for Results Promoting More and “Smarter” Non public Provision of Education From Hierarchical Control to Incentive-Compatible Contracts for the Teachers Greater Accountability to the State versus Accountability to the Public Greater School Autonomy and Accountability Effective Information Dissemination Systems to Promote Accountability Quality Assurance Mechanisms Promoting Reforms in Migration and Labor Polices to Maximize Returns on Education V. Water One of the most critical challenges in the region Becoming even more critical with impact of climate change Meeting the challenges illustrates the role of institutions and institutional change Situation is already critical: lowest water availability in the world Annual renewable water resources per capita Australia & New Zealand Latin America & Caribbean North America Europe & Central Asia Sub-Saharan Africa East Asia & Pacific (incl. Japan&Koreas) Western Europe South Asia Middle East & North Africa 0 10 20 1000 m^3 / year 30 40 The region has already stored almost all of the water it can store Proportion of regional surface freshwater resources stored in reservoirs 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% id dl e E lo b al A ve ra g e ca Af ri th G as t & N or th N or A m er ic a /N Z Au s M ca ar a n Af ri si a Su b -S ah tr a lA e op Eu r op e & te C en rn & W es tA si a Ea s Eu r P As ia th an So u C ar ib be & ic a m er A tin La ac ifi c 0% Deterioration of water quality is already costly Cost of Environmental Degradation of Water 2.5 2 1.5 1 0.5 Tu ni sia ia Sy r co or oc M on ba n Le rd an Jo Ir a n pt Eg y ria 0 Al ge Share of GDP 3 Growing population will recue per capita water availability by half by 2050 and climate change likely to reduce rainfall by at least 20% MENA countries are spending heavily on water S au di A lg e ria a ni si Tu n Ira em en Y A ra b ia o oc c M or gy pt 4 3.5 3 2.5 2 1.5 1 0.5 0 E percent Public spending on water as share of GDP (various years) Not getting full benefits from public investment Algeria : Underexploitation of water stored in dams '000 ha 600 500 400 300 200 100 0 Area that could be irrigated with stored water Area equipped for irrigation source: Min Agriculture Need to Reduce consumption to sustainable levels and achieve sustainable water management at minimal social cost From…. To…. Additional resources • Conventional • Non-conventional • Reduce losses Consomm actuelle Ress renouv actuelles Consomm future Ress renouv futures 1) Through better water policies Policies to limit consumption, especially in agriculture Investments to reduce losses Limit consumption Strong enforcement of limits Compensate farmers for reduced consumption with help to improve water productivity Mobilize additional water sources Better tariff policy 2) Through other interventions in “nonwater” sectors Energy prices Public finance Employment opportunities Trade policies 3) Through improved public accountability 1.0 0.9 Index of quality of service 0.8 Countries with accountability below MENA avg Countries with accountability above MENA avg 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Access Urban utility cost recovery 1-Urban water losses Water use in agric Greater accountability helps all aspects of water management Improves water supply services Provides information necessary for making and enforcing decisions that reflect everyone’s needs Ensures that governments and service providers see consequences of actions Helps improve how well public money is spent The region has history of adapting to water scarcity but needs major adaptation now Societies developed over millennia institutions to deal with scarcity More recently public institutions led investments in large infrastructure systems Institutions need to adapt now to new realities VI. The Political Economy of Reform A theory of political economy has to explain why this slow and hesitant pace of reforms and inability to achieve major required institutional changes: 1. Reforms have failed to tackle the central challenges 2. Reforms have mostly relied on top down decree-type measures, and do not threaten the political equilibrium 3. Reforms which require institutional changes in public accountability mechanisms slow and hesitant The political economy of reform in MENA countries shaped by 3 major factors: Large oil revenues and rents Pervasiveness and persistence of conflict and violence Authoritarian political systems Large natural resource wealth and revenues Reduces incentives of rulers to seek broad-based economic growth Creates soft budget constraints which allow continuation of unsustainable policies for a long while Creates a disconnect of accountability between rulers and the public Conflicts are pervasive Reinforce authoritarian regimes Lead to allocation of large resources to security Creates risk aversion to reforms Authoritarian Regimes Figure 5. Democracy Trends in MENA (Average Index Polity IV 1960-2006) 10 8 6 4 2 0 -2 1960 1966 1972 1978 1984 1990 1996 -4 -6 -8 -10 OECD MENA Other Developing 2002 Governance gap: Indicators of governance are well below potential in MENA. Governance and Per Capita Income in MENA 2 MENA Index of Governance Quality Rest of the world MENA trend 1 Rest of the world trend 0 -1 MENA gap in quality of governance -2 6 8 Log of Per Capita GDP Source: Per capita GDP, WDI 2002; Governance quality, World Bank 2003a. 10 Authoritarian Regime Dilemma Benefits from stronger private sector: more growth, greater wealth base to tax, ability to redistribute and satisfy supporters, minimize contestation Accrual of these benefits requires: inclusive broad-based private sector, limits on ruler discretion Risks to rulers: greater ability of private sector to organize and revolt against ruler if reneges on guarantees Implications (1): Weak Demand for Reforms Collective action more costly under nondemocratic regimes Prevalence of influence of privileged insiders Weak processes of internal and external accountability: more risk aversion to reforms Implications (2) Reforms are supply driven and lack credibility Reforms are shaped to maximize the benefits to the ruling groups, including staying in power Lack of credibility of commitments to reform and respect of promises Political Economy Calculus of Incumbent Rulers Initial conditions/resistance to reforms by existing interest groups Incentives for rulers (1): Availability of Large rents Incentive for rulers (2): higher growth and more “taxation” Incentives for rulers (3): higher growth and employment Incentives for rulers (4): threat of contestation Conflict Total (1) Expected progress on reforms Total (2) Credibility of reforms RPLA/ emerging RRLA/ transition RRLI - -- ++ 0 - - ++ 0 0 ++ ++ + -- -- 0 + --- 0 ++ - -- ++ Implication: improving governance will be critical to move forward on more difficult reforms. Region’s inability to tackle deeper and more complex reforms points to limitations of top-down approach of reform by decree Deeper economic reform cannot proceed without reform of incentive structures in which reforms are embedded Governance reforms cannot be viewed as a separate agenda, to be pursued at its own pace, but integral to all other reforms. The most crucial and critical institutions to focus on are institutions of public accountability institutions for the enhancement of credibility of commitments