LF2013

advertisement

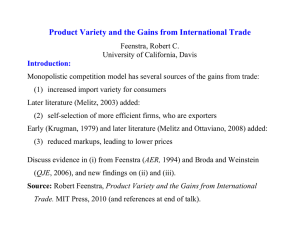

Question 1 a) We see that foreign has an absolute advantage in the production of both goods since MPL is greater. The relative superiority of foreign is different, and in order to assess the pattern of comparative advantage we need to look at relative prices: Home: PW 1/ 3 2 PC 1/ 6 Foreign: PW 1 4 PC 1/ 4 The relative price of W is lowest in Home so Home has a comparative advantage in W and Foreign in Cheese. b) This is shown in the figure below. The cut off quantity on the W axis is 120/6 = 20 and the cut off on the C axis is 120/3 = 40. A consumption of 10 W is half the available capacity so the remaining 60 hours is used to produce 60/3 = 20 C. With a world relative price of 3, Home will export W and import C. c) This is shown in the figure above. In the Ricardian model we have complete specialization so that Home produces 20 W. With an export of 8 units of W, 24 C can be imported since the world relative price is 3. Consumption is therefore 12 W and 24 C, more of both goods than in the pre trade situation. Trade increases welfare. d) The real wage in Home with trade is 1/6 W or ½ C since the relative price of W is 3. In Foreign the real wage is 1 C or 1/3 W. The real wage is higher in Foreign due to their absolute advantage. Real wages are determined by absolute and not comparative advantage. Question 2 a) The Heckscher – Ohlin model is covered in chapter 4 in Feenstra/Taylor. b) This is also covered in chapter 4 in Feenstra/Taylor. It may be a valid conclusion that the models explanatory power is weak. c) Nation A is capital abundant and therefore exports a capital intensive good. After trade starts, the price of the export good PX increases. The Stolper-Samuelson theorem (covered in chapter 4 in Feenstra/Taylor) tells us that the real return to the factor used intensively in the production of the export good increases (here capital rental R), while the returns to the scarce factor labour (wages = W) falls. The long run change in factor prices can be summarised in the following equation: W / W 0 PX / PX R / R for an increase in PX Question 3 a) Intra Industry Trade means trade within broadly similar product groups, often goods that are differentiated. b) The gravity equation is main tool for empirical investigation of international trade flows and it is explained in chapter 6 in Feenstra/Taylor. Trade B GDP1 GDP2 distancen In Tinbergen’s original specification, the trade volume between a pair of countries is proportional to the product of their market sizes, as measured by the GDP of each country. The factor of proportionality differs across country pairs according to impediments to their bilateral trade flows such as distance. Larger countries have a higher number of firms and hence a higher number of product varieties in monopolistic competition. Consumers love variety and the volume of trade increases. c) This is explained in detail in chapter 6 in Feenstra/Taylor. d) In addition to lower prices, increased product varieties increases utility. Question 4 a) We have that the domestic price in both cases is 50 (which means that in A a tariff of 10 is levied on imports. The following equilibrium emerges Demand: Supply: Imports: 50 = 120 – Q 50 = 20 + Q Q demanded is 70 Q supplied by domestic suppliers is 30 70 – 30 = 40 In country B, therefore, the quota is 40 units. b) We know from the start that since the quota rent is captured by the domestic government, welfare is the same in each nation. Since we in d) needs to find the change in welfare, we can compute the relevant items here: Consumer surplus Producer surplus Government Welfare (120 – 50) * 70/2 (50 – 20) * 30/2 10 * 40 = 2 450 = 450 = 400 = 3 300 In country A the import tariff collected is 400 and in country B the auction revenue is 400. c) Now the world price falls to 30. Country A still has an import tariff of 10, so that the domestic market price falls to 40. This gives the new equilibrium: Demand: Supply: Imports: 40 = 120 – Q 40 = 20 + Q Consumer surplus Producer surplus Government Welfare Q demanded is 80 Q supplied by domestic suppliers is 20 80 – 20 = 60 (120 – 40) * 80/2 (40 – 20) * 20/2 10 * 60 = 3 200 = 200 = 600 = 4 000 This is an increase of 700 compared to the situation with a world price of 40. In country B, the quota is still 40 units. The total supply is S + q, where q = 40 and represents a shift of 40 in the supply curve for a price above the world price. Since nothing happens to the level of imports since it is fixed by the quota so the domestic market price does not change. Therefore, neither consumers nor producers are affected at all in terms of quantity consumed or produced. The government benefits from the lower world price to the quota rent doubles to 800. We have therefore: Consumer surplus Producer surplus Government Welfare (120 – 50) * 70/2 (50 – 20) * 30/2 20 * 40 = 2 450 = 450 = 800 = 3 700 The import quota reduces the welfare gain from a fall in the world price. Question 5 Fixed and floating exchange rates is covered in chapter 19 in Feenstra/Taylor. A good answer should concentrate on the main variables of symmetry and integration. In addition, Feenstra/Taylor discuss how fixed exchange rates promote trade, how they diminish monetary automy, increased output volatility possibly promotion of fiscal discipline. Question 6 a) This is covered in chapter 20/21 in Feenstra/Taylor and in chapter 15 in Baldwin/Wyplosz. It is important to stress that asymmetric shocks only affect one or a few participants. b) The choice of the correct real exchange rate is problematic because what is correct for one is incorrect for the other. c) A good answer may include the model used in chapter 15 in Feenstra/Taylor. A mobile labour force reduces the macroeconomic costs of an asymmetric shock by migrating from the area hit by a negative shock into the area not affected by the shock. This prevents unemployment in the country negatively affected and inflationary pressures in the recipient country. A flexible labour force is a less painful adjustment method than changes in prices and wages.