Taxes, Rising Rates Will Hit Rich in the Wallet, Experts Say

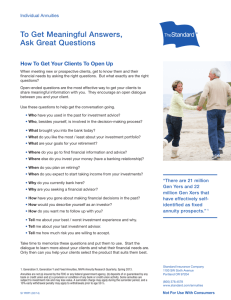

advertisement

Cover white space with photo or image. To add your title and otherwise alter this slide, go to the “View” menu, click “Master,” then click “Title Master.” ADVANCED TAX PLANNING STRATEGIES Harnessing the Power of Asset Location RETIREMENT AND WEALTH STRATEGIES Not FDIC/NCUA insured • May lose value • Not bank/CU guaranteed Not a deposit • Not insured by any federal agency This presentation is meant to provide education on the content being presented and is intended for an audience with a basic understanding of the financial industry. It is not intended for use with the general public. CMC9299CEPPT 04/13 IMPORTANT DISCLOSURES Before investing, investors should carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options. The current contract prospectus and underlying fund prospectuses, which are contained in the same document, provide this and other important information. Please contact your representative or the Company to obtain the prospectuses. Please read the prospectuses carefully before investing or sending money. This material was prepared to support the promotion and marketing of Jackson® variable annuities. Jackson, its distributors and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Please consult your own independent advisor as to any tax, accounting, or legal statements made herein. Annuities are long-term, tax-deferred vehicles designed for retirement. Variable annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed and may be subject to a 10% additional tax if withdrawn before age 59½. Optional benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity. Guarantees are backed by the claims-paying ability of the issuing insurance company. Tax deferral offers no additional value if an annuity is used to fund a qualified plan, such as a 401(k) or IRA. It also may not be available if the annuity is owned by a “non-natural person” such as a corporation or certain types of trusts. Although asset allocation among different asset categories generally limits risk and exposure to any one category, the risk remains that management may favor an asset category that performs poorly relative to the other asset categories. Other risks include general economic risk, geopolitical risk, commodity-price volatility, counterparty and settlement risk, currency risk, derivatives risk, emerging markets risk, foreign securities risk, high-yield bond exposure, noninvestment-grade bond exposure, index investing risk, industry concentration risk, leveraging risk, market risk, prepayment risk, liquidity risk, real estate investment risk, sector risk, short sales risk, temporary defensive positions, and large cash positions. Jackson is the marketing name for Jackson National Life Insurance Company ® (Home Office: Lansing, Michigan) and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York). Jackson National Life Distributors LLC. OSJ: 7601 Technology Way, Denver, CO 80237 Phone: 800/565-8797 CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. IMPORTANT DISCLOSURES A message from the Florida Department of Financial Services An entity that is required to be licensed or registered with the Florida Office of Insurance Regulation but is operating without the proper authorization is identified as an unauthorized insurer. All persons have the responsibility of conducting reasonable research to ensure they are not writing policies or placing business with an unauthorized insurer. Any person who, directly or indirectly, aid or represent an unauthorized insurer can lose their licenses or face other disciplinary sanctions. Please see section 626.901, Florida Statutes, to read the laws. Lack of careful screening can result in significant financial loss to Florida consumers due to unpaid claims and/or theft of premiums. Under Florida law, a person can be charged with a third-degree felony and also held liable for any unpaid claims and refund of premiums when representing an unauthorized insurer. It is the person's responsibility to give fair and accurate information regarding the companies they represent. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. INTRODUCTION: HISTORICAL TAX RATES Gross Public Debt: Total Pct. GDP & Avg. Tax Rate Sources: Tax Foundation, Tax Data, U.S. Federal Individual Income Tax Rates History, 1913-2011; Treasury Direct, Historical Debt Outstanding – Annual (1929-2010); U.S. Department of Commerce, Bureau of Economic Analysis, National Income and Product Accounts Table, Table 1.1.5. Gross Domestic Product (1929-2010); The White House Office of Management and Budget, Historical Tables for 2011-2016. Data includes actual historical data from 1929-2011 and projected data from 2012-2016. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. INTRODUCTION: TAXES PAID Total Taxes Paid - 1989 Top 10% Total Taxes Paid - 2009 Top 10% 29% 44% 56% Everyone Else Some taxpayers are already paying a larger percentage of the total federal tax bill CMC9299CEPPT 04/13 71% Everyone Else Adjusted Growth Income > $112,000 puts one in the top 10% For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING Source: David Leonhardt, The New York Times, July 12, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING Source: Investment News, June 5, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING InvestmentNews.com, June 2011 Source: Robert N. Gordon, Investment News, October 23, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING New York Times, July 2011 InvestmentNews.com, June 2011 Source: Jeff Benjamin, Investment News, November 6, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING New York Times, July 2011 Source: Gil Weinreich, Advisor One, November 28, 2011. InvestmentNews.com, June 2011 CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING New York Times, July 2011 AdvisorOne.com, November 2011 InvestmentNews.com, June 2011 Source: Catherine Rampell, The New York Times, December 8, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING “Over and over again Courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everyone does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands..." AdvisorOne.com, November 2011 New York Times, July 2011 Ed SlottJudge Learned Hand, 2nd Circuit Court of Appeals - 1934 InvestmentNews.com, June 2011 Source: Legal Information Institute, Judge Learned Hand's comment in his dissenting opinion in Commissioner of Internal Revenue v. Newman, 159 F.2d 848, 850—851 (CA2 1947), data pulled June 21, 2012. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX PLANNING • Tax planning is an important consideration in: – Wealth Accumulation – Retirement Income Distributions – Estate Planning – Wealth Transfer • Mistakes can be very costly • You must understand the rules and plan accordingly CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. OVERVIEW • The Changing Tax Environment • Treatment of Common Investments • Taxes and Investment Returns • The Importance of Tax Deferral* • Tax-Deferral Strategies • Things to Remember About Asset Location * Tax deferral offers no additional value if an annuity is used to fund a qualified plan, such as 401(k)or IRA and may not be available if the annuity is owned by a “non-natural person” such as a corporation or certain types of trusts. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE CHANGING TAX ENVIRONMENT Expiration of the Bush Tax Cuts • Higher Ordinary Income Tax Rates – Highest rate in 2012: 35% – Highest rate in 2013: 39.6% (43.4% including healthcare tax) • Higher Capital Gains Tax Rates – Long-term rate changing from 15% to 20% for individuals with taxable income above $400K for Single and $450K for MFJ 2012 Marginal Tax Rates $0 - $8,700 $8,701 - $35,350 $35,351 - $85,650 $85,651 - $178,650 $178,651 - $388,350 $388,351+ 10% 15% 25% 28% 33% 35% 2013 Marginal Tax Rates $0-$8,925 $8,926-$36,250 $36,251-$87,850 $87,851-$183,250 $183,251-$398,350 $398,351-$400,000 $400,001+ 10% 15% 25% 28% 33% 35% 39.6% The slide is our summarization of information from CCH Tax Briefing, American Taxpayer Relief Act of 2012, "President Signs Eleventh-Hour Agreement to Avert Fiscal Cliff," January 2, 2013. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: RETIREMENT ACCOUNTS • Income taxable every year at ordinary income or capital gains tax rates Taxable Accounts – Brokerage accounts, mutual funds, CDs, SMAs (may offer a tax control feature – “tax harvesting”) • Income taxable only when distributed, subject to ordinary income tax rates Taxdeferred Accounts CMC9299CEPPT 04/13 – Qualified retirement plans, traditional IRAs, SEP IRAs, SIMPLE IRAs, 403(b)s, 457s, nonqualified annuities For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: 4 TYPES OF TAX TREATMENT • Exempt from tax at federal and/or state and local level Taxexempt Accounts – Municipal bonds (exempt from federal tax and state/local tax if the owner resides in the state of issue) – U.S. Treasuries (exempt at state and local level) • Distributions not subject to taxation – Roth IRAs qualified distributions – Life insurance death benefits Tax-free Accounts CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: MUTUAL FUNDS Mutual Fund Taxation • Shareholder tax liability arises in two ways – Income realized by the mutual fund • Capital gains distributions – Long-term capital gains (taxed at preferential rate) – Short-term capital gains (taxed at ordinary rates) • Dividend distributions – Qualified dividends (taxed up to 20%) – Nonqualified dividends (taxed at ordinary rates) – Capital gains realized by shareholders liquidating fund shares • $200K for Singles and $250K for MFJ will also be subject to 3.8% Obamacare tax on net investment income This slide is our summarization of information from CCH Tax Briefing, American Taxpayer Relief Act of 2012, "President Signs Eleventh-Hour Agreement to Avert Fiscal Cliff," January 2, 2013. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: MUTUAL FUNDS Portfolio Turnover • A measure of how frequently assets within a fund are bought and sold • High turnover implies short holding periods which may result in STCG taxed at ordinary income rates • High turnover increases transaction costs • Average alternative mutual fund turnover is 185.8%1 • Equity funds = 87.8% • Tax-exempt income funds = 27.5% • Taxable fixed income funds = 163.4% • High turnover creates tax inefficiency 1 Source: Tom Roseen, Lipper Research Study, "Asset Location Strategies for the Taxable Investor," December 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: MUTUAL FUNDS Phantom Income • Income paid to a taxpayer during the tax year that is not constructively received at the taxpayer's year end but still results in income tax liability to the taxpayer Example1 • Investor owns 10 shares of XYZ fund - $10/share. XYZ passes through a $2 short term capital gain. Assuming automatic reinvesting and fund distributions to pay taxes: – Initial value: $10 x 10 shares = $100 – STCG = $2 share x 10 shares = $20 reinvested – NAV drops by distribution: $10 - $2 = $8 – Reinvestment at $8/share: $20/$8 = 2.5 shares purchased – New account value: 12.5 shares @ $8 = $100 – $20 STCG taxed at 35% = $7 • Investor has to pay $7 in income tax despite no actual gain on their investment Source: 1 Tom Roseen, Lipper Research Study, "Asset Location Strategies for the Taxable Investor," December 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: MUTUAL FUNDS Embedded Gains / Losses • When fund shares are purchased, investors purchase the current embedded gains in the fund portfolio, even though they did not own the fund at the time the gains were earned. – Shareholder purchases fund one day before ex-dividend and can have both long-term and short-term taxable distributions the next day. • Embedded losses from 2008 have reduced tax liability for mutual fund investors over the last few years. The information on this slide is our summarization of information from Tom Roseen, Lipper Research Study, "Asset Location Strategies for the Taxable Investor," December 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TREATMENT OF COMMON INVESTMENTS: MUTUAL FUNDS The Impact of Tax Loss Carry Forwards the steep losses witnessed in 2008 and the rapid market rise “inWith 2009 and 2010, we cannot be sure of the longevity or magnitude of tax loss carry forwards in the near future. ” investors and their advocates would do well to become “...taxable more cognizant of the impact taxes have on fund returns. ” Source: Lipper Research Study, "Taxes in the Mutual Fund Industry," April 2010. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAXES AND INVESTMENT RETURNS: TAX DRAG Tax Drag • Reduced investment return resulting from taxation • Alternative investments have notoriously high tax drag Alternative Funds Tax Drag Precious Metal Funds 2.93% Real Estate Funds 1.96% Global Real Estate Funds 1.71% Absolute Return Funds 1.57% Global Flexible Portfolio Funds 1.57% International Real Estate Funds 1.55% Flexible Portfolio Funds 1.12% Long/Short Equity Funds 1.02% Equity Market Neutral Funds 0.72% Source: Tom Roseen, Lipper Research Study, “Asset Location Strategies for the Taxable Investor,” December 2011. For an audience with a basic understanding of the financial industry. Not intended for use with the general public. CMC9299CEPPT 04/13 TAXES AND INVESTMENT RETURNS: TAX DRAG • Taxable investors gave up 1.03-1.96% in annual returns due to taxes in alternative mutual funds. • In years when tax loss carry forwards were not so prevalent, tax drag on equity funds was as high as 2.5-3% annually. • Funds that have high portfolio turnover or other tax-inefficient characteristics are best located in tax-advantaged accounts. Five Year Period Ending 12/31/2010 1.84% 1.37% 2.00% 0.93% 1.50% 1.00% 0.50% 0.00% Fixed Income Alts Equities The information on this slide is our summarization of information from Tom Roseen, Lipper Research Study, "Asset Location Strategies for the Taxable Investor," December 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAXES AND INVESTMENT RETURNS: TAX DRAG How Long Will it Take Your Investment to Double? xxx The Rule of "72" The Rule of "72" 17.91 20 15 Rule of 72 Rule of 72-33-50 12 11.94 8 10 5 0 6% Return CMC9299CEPPT 04/13 9% Return For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAXES AND INVESTMENT RETURNS: ASSET LOCATION • Asset allocation is widely utilized in retirement planning • Asset location is equally important – Goal: divide assets among taxable and taxed-advantaged accounts to defer taxes and gain the best after-tax wealth for the portfolio. • Tax efficient assets often held in taxable account • Tax inefficient assets often held in tax-deferred accounts – Crucial to wealth accumulation over an investor’s lifetime CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAXES AND INVESTMENT RETURNS: ASSET LOCATION Tax-deferred investing can be valuable because: • It allows investors to earn the pre-tax return on assets. • Pre-tax returns can compound over time. • The value of tax-deferred investing depends on which assets are held in tax-deferred accounts. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. o r r e p r e s e n t a t i v e u s e o n l y . N o t THE IMPORTANCE OF TAX DEFERRAL Tax Deferral • Allows growth to compound faster than currently taxable investments • Gives client control over when to recognize taxable income • Provides a tax shelter for tax-inefficient assets f o r p u b l i c d i s t r i b u t i o n . CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX DEFERRAL Tax deferral is especially important for taxinefficient assets. • Bond funds, REITs, alternative investments, and actively managed investments tend to be tax inefficient. • By placing tax-inefficient assets in tax-deferred accounts, returns potentially can increase by as much as 100 basis points without increasing risk. Source: Laurence P. Greenberg, LifeHealthPro, "Estate Planning With Annuities," October 1, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX DEFERRAL: ANNUITY DISTRIBUTION Taxation of Withdrawals • Distributions consist of gain first • Gains are taxed at ordinary income tax rates • If gains have been depleted, then cost basis is returned tax free • Gain is determined at the time of withdrawal Gain: $20,000 Gain: $20,000 Cost Basis: $100,000 $100,000: Cost Basis CMC9299CEPPT 04/13 $30,000 Distribution Tax Free: $10,000 Remaining Cost Basis: $90,000 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THE IMPORTANCE OF TAX DEFERRAL: ANNUITY DISTRIBUTION Blended Tax Rates • Ordinary income tax treatment is often cited as a disadvantage • No one actually pays taxes at the marginal tax rate • Progressive tax system blends rates • $100k AGI is in the 25% marginal bracket (filing jointly) but effective tax rate is less than 17% • $100,000 - $72,500 = $27,500 * 25% = $6,875 + $9,983 = $16,658 • $16,658/$100,000 = 16.7% 13.8%-19.4% Effective Tax Rates Blended Tax Rate 25% Marginal Rate 39.6% Cap This slide is our summarization of information from IRS document Rev. Proc 2013-15. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: HEALTHCARE Tax Deferral and Healthcare Reform • Healthcare Reform - Penalty Taxes for High-Income Earners. – 3.8% on Net Investment Income starting in 2013. • $200k+ for Singles. • $250k+ for Married. – Net Investment Income Includes: • Capital gains, annuity income, interest, rents, royalties... • Does not include distributions from qualified plans, IRAs, Simples, SEPs, and Roth IRAs. – Top rate projected to be 43.4% Source: Congressional Healthcare Caucus, Healthcare Reconciliation Act of 2010, "New 3.8% Medicare Tax on 'Unearned' Net Investment Income." CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: TRUST FUNDING Deferred Annuities and Non-natural Owners • Trust taxation may expose low amounts of income to high tax rates 2013 Single 0 - $8,925 $8,926 - $36,250 $36,251 - $87,850 $87,851 - $183,250 $183,251 - $398,350 $398,351 - $400,000 $400,001+ 2013 Trust Tax Rates 10% 15% 25% 28% 33% 35% 39.6% $0 - $2,450 $2,451 - $5,700 $5,701 - $8,750 $8,751 - $11,950 $11,951+ 15% 25% 28% 33% 39.6% This slide is our summarization of information from IRS document Rev. Proc 2013-15. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: TRUST FUNDING Deferred Annuities and Non-natural Owners • Non-natural owners generally do not receive tax deferral under IRC 72(u). – Owners that lose tax deferral include businesses, corporations, partnerships, charities, CRTs, foundations, endowments, and municipalities. – EXCEPTION: Trusts that are acting as an agent for a natural person will receive tax deferral. This slide is our summarization of information from Cornell University Law School, Internal Revenue Code 72 (u), data pulled June 20, 2012. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: TRUST FUNDING “Pass-In-Kind” Titling Annuity 1 Owner: Trust Annuitant: Andy Beneficiary: Trust Annuity 2 Owner: Trust Annuitant: Ben Beneficiary: Trust Annuity 3 Owner: Trust Annuitant: Cathy Beneficiary: Trust At the trustee’s request, these annuities are passed “in kind” to the beneficiaries. Annuity 1 Owner: Andy Annuitant: Andy Annuity 2 Owner: Ben Annuitant: Ben Annuity 3 Owner: Cathy Annuitant: Cathy Ownership is changed to the beneficial owner without triggering a taxable event. Any annuity benefits that have accrued during trust ownership continue after the ownership change. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: TAX-FREE EXCHANGES Buy and hold…for a while • The average holding period for mutual funds is 3.29 years1 • Liquidation of mutual funds creates a taxable event • Deferred annuities can be 1035 exchanged for another annuity contract allowing growth to remain tax deferred • Annuity subaccounts can be rebalanced without taxes or transaction costs Source: 1 Dalbar, Inc., Quantitative Analysis of Investor Behavior, April 2012. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: TAXATION OF DEATH BENEFITS How Are Death Benefits Taxed? • No step-up in cost basis • Full death benefit value includable in taxable estate • Death benefit paid out in excess of basis is taxable as ordinary income Death Benefit Paid CMC9299CEPPT 04/13 Remaining Cost Basis Taxable Amount For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: IRD Step 1 Step 2 Calculate estate tax Step 3 Take out IRD items and recalculate estate tax Gross estate $6,000,000 Gross estate $6,000,000 Adj. tax estate $6,000,000 Adj. tax estate $6,000,000 Less: IRD assets Adj. taxable estate without IRD Tax @ 40% $2,345,800 Tax @ 40% - $500,000 $5,500,000 Fed estate tax Fed estate tax without IRD items $300,000 - $100,000 Tax attributable to IRD $200,000 deduction $2,145,800 Less unified credit - $2,045,800 Less unified credit - $2,045,800 Fed estate tax Fed estate tax $300,000 Calculate IRD tax deduction $100,000 This slide is our summarization of information from the Internal Revenue Service Publication 950, “Introduction to Estate and Gift Taxes,” November 21, 2011; The Internal Revenue Code Section 691 “Recipients of Income in Respect of Decedents,” 2012; P.L. 111-312 (The 2010 Tax Act); P.L. 107-16, EGTRRA; IRS document Rev. Proc 2013-15. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. TAX-DEFERRAL STRATEGIES: STRETCH Nonqualified Stretch • Provides clients with a simple legacy planning tool • Allows beneficiaries to pay taxes on only required distributions • Continues to grow tax deferred • IRD can be used to offset income taxes owed on distributions • Creates opportunity to educate beneficiaries and retain assets on your book • Provides a platform to control spendthrift beneficiaries CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. THINGS TO REMEMBER ABOUT ASSET LOCATION GOAL: Reduce the tax burden while maintaining an optimally diversified portfolio. • Portfolio turnover, tax drag, phantom income, and embedded gains can all have an impact on returns • Tax deferral and beyond: IRD, non-natural ownership taxation, pass-in-kind strategy, and stretch distributions • Research shows that simply by locating assets based on their tax treatment (taxable vs. tax-deferred), tax deferral can potentially increase returns by as much as 100 basis points1 Source: 1 Laurence P. Greenberg, LifeHealthPro, “Estate Planning With Annuities,” October 1, 2011. CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. Thank You CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. IMPORTANT DISCLOSURES Before investing, investors should carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options. The current contract prospectus and underlying fund prospectuses, which are contained in the same document, provide this and other important information. Please contact your representative or the Company to obtain the prospectuses. Please read the prospectuses carefully before investing or sending money. This material was prepared to support the promotion and marketing of Jackson® variable annuities. Jackson, its distributors and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Please consult your own independent advisor as to any tax, accounting, or legal statements made herein. Annuities are long-term, tax-deferred vehicles designed for retirement. Variable annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed and may be subject to a 10% additional tax if withdrawn before age 59½. Optional benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity. Guarantees are backed by the claims-paying ability of the issuing insurance company. Tax deferral offers no additional value if an annuity is used to fund a qualified plan, such as a 401(k) or IRA. It also may not be available if the annuity is owned by a “non-natural person” such as a corporation or certain types of trusts. Although asset allocation among different asset categories generally limits risk and exposure to any one category, the risk remains that management may favor an asset category that performs poorly relative to the other asset categories. Other risks include general economic risk, geopolitical risk, commodity-price volatility, counterparty and settlement risk, currency risk, derivatives risk, emerging markets risk, foreign securities risk, high-yield bond exposure, noninvestment-grade bond exposure, index investing risk, industry concentration risk, leveraging risk, market risk, prepayment risk, liquidity risk, real estate investment risk, sector risk, short sales risk, temporary defensive positions, and large cash positions. Jackson is the marketing name for Jackson National Life Insurance Company ® (Home Office: Lansing, Michigan) and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York). Jackson National Life Distributors LLC. OSJ: 7601 Technology Way, Denver, CO 80237 Phone: 800/565-8797 CMC9299CEPPT 04/13 For an audience with a basic understanding of the financial industry. Not intended for use with the general public. Cover white space with photo or image. To add your title and otherwise alter this slide, go to the “View” menu, click “Master,” then click “Title Master.” ADVANCED TAX PLANNING STRATEGIES Harnessing the Power of Asset Location RETIREMENT AND WEALTH STRATEGIES This presentation is meant to provide education on the content being presented and is intended for an audience with a basic understanding of the financial industry. It is not intended for use with the general public. CMC9299CEPPT 04/13