CEMEX

advertisement

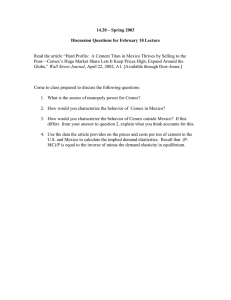

The Cemex Request-for-Proposal: An Auto-Generation Energy Project Emerging Markets February 24, 2003 Salsa by Sunday Andrea Fernandez Jason Haight Michael Philipse Doug Rodriguez Cesar Villaseñor AGENDA • INTRODUCTION—THE SETTING • CEMEX • MEXICO & THE MEXICAN ENERGY SECTOR • POWER GENERATION IN EMERGING MARKETS • THE TEG PROJECT • FRAMING THE DECISION TO BE MADE 2 /TEG International Tender for the Development, Engineering, Financing, Construction, Ownership,Operation and Maintenance of the TERMOELECTRICA DEL GOLFO PROJECT BIDDING RULES AND PROCEDURES 1998 Strictly Private and Confidential 3 CEMEX • The company – 1906 founded – 1985 International Expansion – 1996 diversification thru M&A • Entering markets whose economic cycles operate independently and which offer long-term growth – 1998 • World's third-largest cement company • Mexico 45% (Sales & Assets) 1996 Sales (MUSD) Operating Income (MUSD) Operating Margin Free Cash Flow (MUSD) D/E 3,577 853 24% 434 1.29 1997 3,872 915 24% 389 1.18 1998 4,300 1,174 27% 405 1.04 4 PEMEX & CEMEX • Cemex – Has a contractual, 20-year relationship with Pemex to take high quantities of petroleum coke • Petcoke: low-value by-product of petroleum refinery – Guarantees petcoke price and quantity supplied – Win-Win contract • Termoelectrica del Golfo (TEG) Synergies – Electricity generator using petcoke as fuel source – Demand=Supply, 1.75 Millions Tons of petcoke per year – Cemex guarantees petcoke supply for its cements plants (50%) and for the power plant (50%) – Cemex buys all energy produced by plant 5 ENERGY, ENVIRONMENT & CEMEX • Cement production is an energy-intensive process – 50% of its manufacturing cost related to energy • 60% thermal energy, 40% Electricity • Rationale for project: – Guarantees the energy supply for cement facilities – Reduces financial and operation risk by minimizing the volatility of energy prices – Leverages access to petcoke for cement and energy production – Minimizes environmental impact thru a eco-efficiency program 6 Energy Supply and Demand • 98% of Mexico´s energy is generated by two stateowned companies – Demand: growing at 6% – Public utilities do not have the resources to expand energy production Note: 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 Energy Deficit (historical and projected) 1 Petajoule= 10^15 joules (PJ) 0 -500 -1000 1 barrel of crude = 6,000 mega joules 7 Remedies and Power Politics • 1917 Constitution: All energy for “public use” must be produced by State. • 1992 Amendment: Changes definition of “public use” to exclude self-generation and independent producers • 1999 Reform Efforts: failure – Self-generation licenses issued (politics clouds legality) • Electoral Politics: politics creating uncertainty – PRI: old party line – PAN: limited private sector involvement in energy – PRD: ??? 8 Uncompetitive Prices are big disad for Cemex • Average electricity prices for industrial use: – World Average: US$.056 per KWHr • Uncompetitive relative to NAFTA partners: – Mexico: US$.0475 – USA: US$.0427 – Canada: US$.0386 • Cement production is energy intensive (50% of variable costs). • Cement production consumes 3% of Mexico’s energy. . 9 MEXICO´S ENERGY SECTOR Natural Gas Gasoline Petcoke 10 POWER GENERATION IN EMERGING MARKETS • Structure of independent power projects – – – – – Non-recourse (off-balance sheet) High leverage Construction, operating, some fuel risk with sponsor Take-or-Pay feature Regulation contained in contract 11 TEG PROJECT • Termoeléctrica del Golfo is the legal entity with a self-generation licence. • DFCOM of 230 MW petroleum coke-fired power plant • Project will generate electricity for thirteen cement plants • Surplus power will be sold to the Comisión Federal de Electricidad (“CFE”), the public electricity utility. 12 TEG PROJECT • Funding of $369 million – Debt: • Coface: • IDB: $100 million $75 million A loan $102 million B loan – Equity: • Cemex: 1% • Successful bidder(s) 99% 13 TEG PROJECT • SBS, S.A. – Extensive track record in power plant construction – Extensive operations experience as an operator (Africa, Asia, South America) 14 Discussion • • • • • Sovereign risks Operational risks Financial risks Environmental risks Social risks 15