Fourth Lecture Part 1

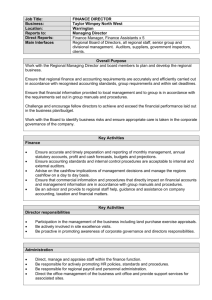

advertisement

EMGT 386

Mergers, Acquisitions and Valuation

Fourth Lecture

Part 1

Discounting and Cashflow

Discounting

The operating premise ..

The financial value of something today is typically

regarded as the future payment stream, however

calculated, discounted by some acceptable rate of

discount, to a present value.

For example, the value of a bond is equal to the value

of all future cash payments (interest and principal

redemption) discounted to the future the yield on

equivalent bonds.

This discount rate is typically some “opportunity cost”

yield.

The slides that follow explain the concept of discounting.

The Compounding Formula

What is the formula for calculating the future

value X f of the present value X pinvested at

interest rate r (compounded, annual) for n

years??

X p (1 + r) n = X f

An example ...

$10 invested for 10 years at 8% compounded

annually will be worth:

10

10 (1.08)

= 21.59

Present Value Formula

What is the present value X p of some

guaranteed future value X f , assuming the

opportunity to invest money today at some

compounded interest rate r??

Xp =

Xf

(1 + r)

n

Present Value Formula

What is the present value X p of some

guaranteed future value X f , assuming the

opportunity to invest money today at some

compounded interest rate r??

Xp =

Xf

(1 + r)

n

A question ...

What is the present value of a promise to pay

two payments of $ 100 each at a date 5 years

in the future and again 10 years in the future,

if money today can be expected to earn 12%

between now and then??

The California Lottery

What is the true present value of winning $10

million in the California lottery (paid in 20

equal and annual payments) assuming an

interest rate of 8%??

19

Value =

i=0

500k

(1.08)

i

= ???

The California Lottery

(continued)

Would would be today's value of the last

lottery payment made (in 19 years)??

19

$500,000 / (1.08)

= $115,856

WHY??

Because $115,856 invested at 8% per year

compounded for 19 years would accrue to

exactly $500,000.

A question ...

How would you evaluate the present market

value of a note or bond which had been

issued at some given coupon rate c if

prevailing market rates r are higher or

lower??

For example, what would be today's value of

a 30-year bond issued 10 years ago at 10% if

20-year bonds today yield only 6%?

Some partial answers ..

What would be the present market value of the

redemption value of this bond ($100 in 20

years)?

100

= $31.18

20

(1.06)

What would be the present market value of the

interest payment that will be received in 5

years??

10

= $7.47

5

(1.06)

Simple Bond Valuation Formula

.. for annual compound interest and annual payments

MV =

where:

{

n

C

(1 + r)i

}

+

Par

(1 + r)n

i=1

MV = Market value

n = # of years (or periods) to maturity

C = Coupon payment (par X rate)

r = prevailing market rate for equivalent

Present Discounted Cashflow

.. pro forma calculation

The true present value of a corporation today equals

the present discounted value of the cashflow stream

generated by that corporation.

Ultimately, value is increased by increasing that

cashflow stream.

Look at cashflow, the cashflow stream (estimates),

and the value drivers.

The two primary components

1. The near-term value

... generally uses some variation of the discount formula

2. The perpetuity

... uses some variation of the perpetuity formula

Some basics

Discounting

n

CF

PV

i

i 1 (1 r )

CF1

CF2

CF3

PV

2

3

(108

. ) (108

. )

(108

. )

Some basics (cont)

Value of a perpetuity cashflow

Constant cashflow:

CF 100

PV

$1250

r

.08

Cashflow growing at rate g:

CF (1 g ) 100(105

. )

PV

$3500

r g

.08 .05

The spreadsheet/proforma model

Variables:

PV: present value

FCF: free cashflow estimate from the proforma model

g: growth rate of FCF, estimated over the years of the

proforma forecast

FCFE: FCF estimate for the first year past the proforma

forecast, estimated by multiplying g times FCF in

the last forecast year.

r: discount rate (weighted average cost of capital or

long-bond plus X%)

The proforma formula

The proforma component:

5

FCFi

i

i 1 (1 r )

The perpetuity component:

1

FCFE6 (1 g )

6 X

(1 r )

r g

Part 2

Cashflow, free cashflow, and

cashflow analysis

Why cashflow matters

• Modern valuation techniques use

discounted present value free cashflow

• Cashflow prior to debt use represents the

true strength of the company

• To survive, a company must have sufficient

cashflow to meet amortized debt and similar

obligations

Why cashflow differs from earnings

• Some business activities contribute to

earnings or constitute expenses, but

corresponding cash payments are delayed

– payables, receivables, inventory

• Some business activities are expensed, but

there never is a related cash payment

– depreciation, amortization, amortization of

goodwill

Why cashflow differs (cont)

• Borrowing and the servicing of debt involve

expense and revenue entries that do not

correspond to concurrent cash transfers

– borrowing immediately adds cash but is not

directly expensed

– loan payments reduce cash, but only the interest

component is expensed

Debt and Buying Assets

When using debt to buy GFA:

• Borrowing increases cash at the time of the loan

• Buying the asset decreases cash at the time of the purchase

• The cost of the loan is expensed only as each payment is

made, and then only interest is expensed as interest

expense, principal reduction is not expensed.

• The fixed asset is not expensed at time of acquisition, but

is depreciated slowly over time.

Debt financing GFA

Activity

Borrow the money

Impact upon Impact upon

cash

earnings

None

+

Buy the equipment

-

None

Make loan payment

-

Expense interest

only

Expense

depreciation

Depreciate

equipment

None

Depreciation schedules .. 1st five years

Year

3

5

7

10

15

20

1

33.33

20.00

14.29

10.00

5.00

3.75

2

44.45

32.00

24.49

18.00

9.50

7.22

3

14.81

19.20

17.49

14.40

8.55

6.68

4

7.41

11.52

12.49

11.52

7.70

6.18

11.52

8.93

9.22

6.93

5.71

5

What is Goodwill??

When one company acquires another, it always does so

for more than the book value of the target company.

Because the assets and liabilities of the target company

are directly absorbed by the parent, the failure to adjust

for this premium would cause a discrepancy in the

books and would not represent the true value of new

assets acquired.

Therefore the difference between book value and

amount paid for the target is (more or less) recorded

as an asset under Goodwill. This amount is then

amortized over the years. Amortization of Goodwill is

not a cashflow outlay.

Components of cashflow

• Cashflow from operations

– adjustments for accruals and amortization

• Cashflow from financing

– new debt adds, debt payment substracts

• Cashflow for investment (GFA usually)

– theoretically seen as basis for future value

Adjustments to EBIT for cashflow

Accounts Receivable

Deferred Income Taxes

(-)

(+)

(-)

(-)

Depreciation

(+)

Amortization

(+)

(+)

Accounts Payable

Inventories

Amortization of Goodwill

Free Cashflow

... derivation from Gross Cashflow

• Gross Cashflow

–

–

–

–

less: Capital Expenditures

less: Financing

less: Notes Payable (t-1)

equals

• Free Cashflow

Cashflow Problems and

Solutions

Introductory Overview

Debt payments excessive

• Possible causes

–

–

–

–

paid too much for the property

leverage ratios too high (LBOs, junk bonds)

poor business

debt terms unacceptable

• Solutions

– arrange refinancing

– bankruptcy

Cashflow (ops) low relative to income

• Possible causes

– inventories too high

– days receivable too long

– days payable too short

• Solutions

– shorten days receivable or extend days payable

– get inventories under control

– don’t use receivables to inflate quarterly profits