FINANCE 729 FINANCIAL RISK MANAGEMENT

advertisement

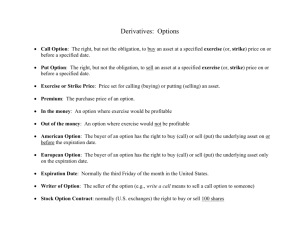

Math 476 / 567 Actuarial Risk Theory Fall 2015 University of Illinois at Urbana-Champaign Professor Rick Gorvett Options and Put-Call Parity August 27, 2015 Why is this Option Stuff So Important? Payoff Of Call Option X (Exercise price) ST (Value of Underlying Asset) Insurance is an Option Payment Under Insurance Policy X (Deductible) ST (Size of Loss) Insurance is an Option Payment Under Insurance Policy Ded. ST (Size of Loss) Policy Limit A Sampling of Options and Other Derivatives through History Ancient Greece “There is the anecdote of Thales the Milesian and his financial device… He was reproached for his poverty, which was supposed to show that philosophy was of no use. According to the story, he knew by his skill in the stars while it was yet winter that there would be a great harvest of olives in the coming year; so, having a little money, he gave deposits for the use of all the olivepresses in Chios and Miletus, which he hired at a low price because no one bid against him. When the harvest-time came, and many were wanted all at once and of a sudden, he let them out at any rate which he pleased, and made a quantity of money. Thus he showed the world that philosophers can easily be rich if they like, but that their ambition is of another sort…” - Aristotle, Politics, Book One, Part XI Phoenician Shipping Merchants and ship-owners used options to hedge their ships and cargoes Mesopotamia Mercantile forward contracts, written in cuneiform on clay tablets, circa 1700 BC China Forward contracts on rice, entered into prior to planting, circa 2000 BC Belgium and The Netherlands • Antwerp and Amsterdam • Grain • Herring • Tulips Tulip Bubble • Mid-1630s • Tulip demand exploded and prices skyrocketed • Options and futures were used to ensure price and supply • Bubble burst in 1637 America • 19th century – “Privileges” – Non-standardized / over-the-counter • Synthetic loans – Financier Russell Sage – Put-call parity – Get around usury laws Chicago Board Options Exchange • Began trading standardized options on April 26, 1973 • 911 contracts traded on first day (options on 16 different “underlying” companies) CBOE and Options “…any history of the excitement in finance in the 1960s and 1970s must mention the options pricing work of Black and Scholes (1973) and Merton (1973b). These are the most successful papers in economics – ever – in terms of academic and applied impact. Every Ph.D. student in economics is exposed to this work, and the papers are the foundation of a massive industry in financial derivatives.” - Eugene F. Fama, “My Life in Finance,” arXiv Modeling Underlying Assets “…distributions of stock returns are fat-tailed: there are far more outliers than would be expected from normal distributions – a fact reconfirmed in subsequent market episodes, including the most recent. Given the accusations of ignorance on this score recently thrown our way in the popular media, it is worth emphasizing that academics in finance have been aware of the fat tails phenomenon in asset returns for about 50 years.” - Eugene F. Fama, “My Life in Finance,” arXiv Options and their Characteristics A Type of Derivative • A forward is the obligation to buy or sell something at a pre-specified time and at a pre-specified price • An option is the right to buy or sell something at a pre-specified time (or during a pre-specified time-period) and at a prespecified price Types of Options • Call option: the holder has a right to buy the underlying asset • Put option: the holder has a right to sell the underlying asset • Counterparties: parties to the option agreement • One can buy (long) or sell (short) an option Question # 1 • Abby agrees to buy Ben’s car for $1,000 three months from now Abby’s position: ________ _________ (long or short) (forward or option) Ben’s position: ________ _________ (long or short) (forward or option) Question # 2 • Abby agrees to sell Ben her car for $500 three months from now, if it is worth less than $500 Abby’s position: ________ _________ (long or short) Ben’s position: (forward or option) ________ _________ (long or short) (forward or option) “Parameters” of Options • Exercise price = strike price = price at which the holder of the option can exercise the option (and thus buy or sell the underlying asset) • Premium = amount paid for the option • Expiration date • “Style” – American option: can exercise any time up to and including expiration date – European option: can exercise only on expiration date Examples of Options They’re Everywhere • Traded options – On stocks, indices, FX, interest rates, futures, swaps, options,... • • • • Warrants Convertible bonds Call provisions on bonds On projects – To expand, abandon, postpone • Insurance Value Of Options At Expiration C = Max [ST - X, 0] C = Call option value (or payoff) at expiration ST = Price of underlying asset at expiration X = Exercise price P = Max [X - ST, 0] P = Put option value (or payoff) at expiration Question # 3 • Abby sells Matthew a January European call option on one share of ABC stock • Suppose ABC stock is initially trading at 32.5 • Exercise price = 35 • Premium = 3 • In January, suppose: ST=30 ST=40 (Total payoff [profit/loss]) Abby: ___ [ __ ] ___ [ __ ] Matthew: ___ [ __ ] ___ [ __ ] Option Values • Prior to expiration: – In-the-money – At-the-money – Out-of-the-money Call St > X St = X St < X Put St < X St = X St > X • Intrinsic value: profit that could be made if the option was immediately exercised – Call: stock price - exercise price – Put: exercise price - stock price • Time value: the difference between the option price and the intrinsic value Option Values: Payoff Charts • Call -- long position: Payoff ST X • Call -- short position: X • Put -- long position: • Put -- short position: X X ST ST ST Payoff vs. Profit/Loss: Long a Call Option Payoff Profit/Loss ST Call Premium X Purposes of Derivatives • Speculative – Highly risky – Highly leveraged – Very volatile • Hedging – Combine with other securities – Hedge (minimize) risk from other securities Hedging • “Hedge”: Take a position that offsets a risk • “Risk”: “Uncertainty” regarding the value of the underlying asset • By hedging, one changes the risk inherent in owning the underlying asset • The return distribution of the underlying asset is not changed “Risk” vs “Uncertainty” • “The term ‘risk,’ as loosely used in everyday speech and in economic discussion, really covers two things which, functionally at least, in their causal relations to the phenomena of economic organization, are categorically different…. The essential fact is that ‘risk’ means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character…. It will appear that a measurable uncertainty, or ‘risk’ proper, as we shall use the term, is so far different from an unmeasurable one that it is not in effect an uncertainty at all. We shall accordingly restrict the term “uncertainty” to cases of the non‐quantit(at)ive type.” - Frank Knight, Risk, Uncertainty, and Profit, 1921 Using Options to Hedge • Combine the underlying asset with an option or options • Can reduce or eliminate downside risk while retaining upside potential • Can protect against falls in held asset values, or against increases in input prices Option Strategies • Protective put – Own stock (long position) – Own put (long position) • Covered call – Own stock (long position) – Sell call (short position) • Straddle • Spread Protective Put • Investor owns asset • Investor also buys (holds) a put on the asset • Guarantees investment portfolio proceeds are at least equal to the exercise price of the put + = Question # 4 • Suppose you own a share of stock, and you purchase a put option with an exercise price of 22.5 on that stock, for a premium of $ 0.75 ST : Premium: 30 25 20 15 ____ ____ ____ ____ ____ ===== ____ ____ ===== ____ ____ ===== ____ Put Payoff: ____ ===== Overall: ____ Covered Call • Investor purchases stock • Investor also sells (writes) a call option on the stock • Option position is “covered” by owning the underlying stock itself • (vs. “naked option”) • Provides additional (premium) income + = Question # 5 • Suppose you own a share of stock, and you write a call option with an exercise price of 35 on that stock, for a premium of $ 2.00 ST : Premium: 30 35 40 45 ____ ____ ____ ____ ____ ===== ____ ____ ===== ____ ____ ===== ____ Call Payoff: ____ ===== Overall: ____ Straddle • (Long) Straddle: buy both a call and a put on a stock • Each option has the same exercise price and expiration date • Believe stock will be relatively volatile • Worst-case: no movement in stock price Spread • Combination of options – Two or more calls, or – Two or more puts • Horizontal spread: sale and purchase of options with different expiration dates • Vertical spread: simultaneous sale and purchase of options with different exercise prices -- e.g., X2 X1 + = X1 X2 A “Spread” in the Context of Insurance Insurance Policy Limit Recovery From Loss Size of Loss Ded. Ded. + Policy Limit “Exotic” Options • Certain characteristics of “plain vanilla” options are adjusted to produce “exotic options” • Some characteristics of plain vanilla options: – American or European – Linear payoff – Does not “disappear” – Value of underlying at exercise Put-Call Parity General Concept • Arbitrage implies a certain relationship between put, call, and underlying asset prices • Assuming same exercise prices and expiration dates, and non-dividend-paying stock, two portfolios have, at payoff, identical values: – One European call option + cash of PV(X) – One European put option + one share of stock • C + PV(X) = P + S Put-Call Parity Specific Relationships • McDonald text terminology: Call – put = PV(forward price – strike price) C( K , T ) P( K , T ) erT ( F0,T K ) • For non-dividend-paying stock: C ( K , T ) P( K , T ) S 0 e rT K Put-Call Parity Specific Relationships (cont.) • For dividend-paying stock: C( K , T ) P( K , T ) S0 PV0,T ( Div ) e • For index options: C ( K , T ) P( K , T ) e T S 0 e rT K rT K Put-Call Parity Example • Find the value of the one-year (T = 1) put with exercise price (X) of 110 when C(110,1) = 10.16 S0 = 100 =0 r = 0.10 P(110,1) = 10.16 + 110 e -.10 × 1 - 100 = 9.69 Put-Call Parity Example (cont.) • Find the value of the one-year (T = 1) put with exercise price (X) of 110 when C(110,1) = 10.16 S0 = 100 = 0.02 (2% div yield) r = 0.10 P(110,1) = 10.16 + 110 e -.10 × 1 - 100 e -.02 × 1 = 11.67