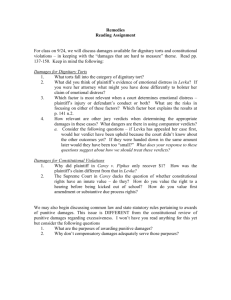

Ch. 23. Remedies

advertisement

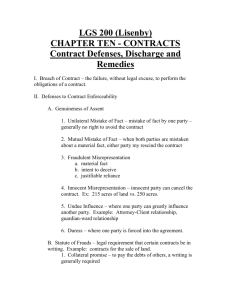

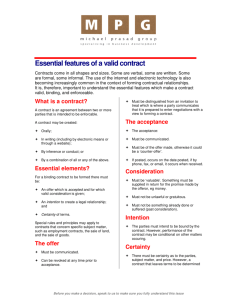

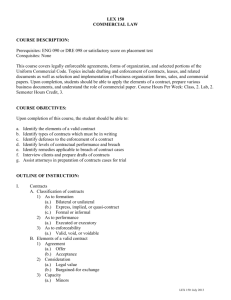

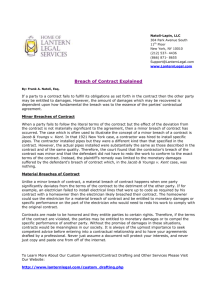

Chapter 23 Contract Remedies Lawrence Emmenbolu, Chad Presnell Breach of Contract: This is the refusal or failure of a party to perform an obligation imposed by a contract, without a legitimate legal excuse. In the case of a breach, the victim (non-breaching party) is discharged from all further obligations of the contract. Examples may include situations where a job is not completed, failing to pay in full or on time, not delivering the right goods, delivering defective goods, or indicating in advance that a party will not perform (anticipatory breach). Usually, a lawsuit for breach of contract is instigated by the victim, and then the court awards remedies designed to place the injured party in the position they would be in if not for the breach. Remedies for breach of contract include: - discharge, damages, arbitration (if the parties so provide) and specific performance (requiring breaching party to perform an action). For example: KirkMart, a stereo store signed a contract and paid Soney, a stereo manufacturer to deliver 100 stereos on June 1st. If Soney does not deliver the stereos on June 1st, or delivers the wrong type of stereos; Soney has breached the contract and KirkMart can sue for damages. Discharge: If you and I have a contract and I breach it, you are thereby discharged. This means you no longer have any obligation to proceed further with the contract. I. Damages In breach of contract, these are remedies that represent the loss directly and naturally resulting from the breach. Thus, it excludes speculative or possible losses that cannot be shown to have directly resulted from the breach. The aim of damages is not to punish non-performers for failing to live up to the terms of the contract, but to remedy the injuries or any distress caused by such failure. Suing for damages is the usual remedy for breach of contract. General Types of Damages: Chapter 23 Contract Remedies For example McCrapys contracts to buy potatoes from Jenkings Farms. Jenkings fails to deliver the potatoes and hence breaches the contract. McCrapys finds he can buy potatoes from Myrtle potatoes, and at a cheaper rate. He buys the potatoes and Myrtle delivers. If McCrapys sues Jenkings for breach of Page 1 contract, he will get only nominal damages. He was actually better off in his contract with Myrtle. Nominal Damages Compensatory Damages Punitive Damages A. Nominal: These types of damages occur when the plaintiff is able to prove that there was a breach of contract, but is unable to prove that there are any losses sustained due to the breach of contract. Nominal damages are intended as a proclamation that the conduct of the defendant should not be tolerated. This damage award reflects a plaintiff's contract rights have been violated through a breach of conduct. The court typically awards one dollar ($1) nominal damages, to signify the wrong done by the defendant to the plaintiff. Some people enter into cases knowing that they will receive nominal damages, but do so in order to establish a precedent in a dispute that is likely to reoccur in a continuing relationship. In some cases, a case with nominal damages may lead to punitive damages; this is unusual in contracts except in cases of fraud. B. Compensatory: These damages are awarded for the direct and foreseeable consequences of the defendant's wrongful act. It attempts to put the victim of the breach in the same financial situation that he or she would have been in if the contract was not broken. Compensatory damages typically remedy two results of a contract breach: 1. Gains Prevented 2. Losses Sustained For example, Uncle Sammy and KB contractors have a contract to build a house for $100,000. KB contractors half finish the house and stop working on it for no good reason, there is a deliberate breach of contract. Uncle Sammy will not have to pay anything to KB contractors. Gains Prevented means that when the defendant breached the contract, they prevented the plaintiff from achieving a profit of some sort. Losses Sustained means that the plaintiff actually lost money due to the defendant’s breach. The amount of compensatory damages, usually determined by jury, should not be so much that the plaintiff profits from the breach. As stated earlier, compensatory damages put the plaintiff into the financial position he would have been in had the defendant honored the contract. Speedy motors contracts to sell a car to Davis for $20,000. Davis refuses to take the car and Speedy has to sell the car to Susan for $18,000. Speedy sues for breach of contract. Speedy will get $2000 plus all expenses for making the second sale. Speedy could collect more damages if they can prove that they could have made two sales. Chapter 23 Contract Remedies Page 2 For example, Uncle Sammy and KB contractors have a contract to build a house for $100,000. KB finishes the house a week late, and Uncle Sammy has to stay in a hotel and pay for storage for his furniture. Uncles Sammy sues for breach of contract. KB contractors is liable for all of Uncle Sammy’s hotel and storage expenses, and any other expenses incurred because the house was not finished on time. to stay in a hotel and pay for storage for his furniture. Uncles Consequential damages, a type of compensatory damages, may also be awarded. Consequential damages are those that have resulted from the breach but are unexpected or unforseeable. That is, the loss suffered by a plaintiff may have been caused by the misconduct of the defendant, but, nonetheless, is instead a result of the defendant's action. The defendant is liable for these damages only if he/she knows about them (or should know about them) before the breach. The jury also considers loss of profit in Sammy sues for breach of contract. Kb contractors is liable consequential damages. for all of Uncle Sammy’s hotel and storage expenses, and any other expenses incurred because the house was not finished Concept Check: Explain how the concept of Gains Prevented applies to both of the following situations. on time. Steve has a used computer for sale. Rob contracts to buy it for $700 but later refuses to take or pay for the breach of contract. Uncle Sammy will not have to pay computer. Steve puts an ad in the paper that costs $10. Later he is able to sell the computer to Pam for $625. anything to KB contractors. He can sue Rob $75 in losses ($700-$625) plus the $10 amount for the ad. Xonix Computers sells a high end server to Rob for $3000. Rob backs out and will not pay. Later that day, Xonix sells the same computer to another buyer for $3000. It looks like Rob might be liable for only nominal damages. But if Xonix can prove that if Rob had not backed out and Xonix had several such computers in stock, Rob might be liable for the $3000 minus the cost that Xonix paid for it—essentially lost profit and overhead. C. Punitive (Exemplary) Damages: In most cases, the awarding of compensatory damages meets the requirements of justice. Normally, punitive damages are not given in contract cases. However, there are cases where compensatory damages are inadequate. In instances where the defendant’s conduct is found to be an intentional tort as well as a breach of contract, the court may also allow an award of punitive damages in addition to compensatory damages. Punitive damages are damages that are paid to the plaintiff as punishment to the defendant, not to compensate the plaintiff. The purpose of these damages is to prevent or deter the offender from similar conducts in the future as well as deter others from engaging in those behaviors. They aren't based on actual financial loss or pain and suffering like compensatory and consequential damages, but are intended to make an example out of the breaching party and punish them for their unjust behavior. Punitive damages are not usually awarded in contract lawsuits; however, if the breach constitutes fraud, or is accompanied by a malicious tort, punitive damages will be awarded. Punitive damages have been characterized as quasi-criminal because they are a cross between criminal Example: Villain motors, a car manufacturer, knowingly make and civil law. Although they are awarded to their Deceit 2000 model with inferior brake systems. The cars a plaintiff in a private civil lawsuit, they are are tested by Villain’s engineers, and the brakes fail numerous quality control tests. Harry Potty, a car dealer not compensatory and are similar to a Chapter 23 Contract Remedies buys contracts with Villain to supply 50 of the deceit 2000 cars. Villain receives payment and delivers, knowing that the Page 3 brakes are bad. Harry Potty later finds out about this after several customers have been in fatal accidents. Harry Potty can sue for breach of contract and get punitive damages. They have to prove though that Villain motors knew that the brakes were faulty. criminal fine. One of the most common circumstances where punitive damages are awarded is in a case of bad faith insurance. Bad faith insurance is when a legitimate claim is filed (by an insured party), but denied; without any reasonable basis for denying the claim. The insurance company breaches the contract, and the insured party can then file a law suit for the damages. The damages could include money that should have been paid on the claims, and may include additional expenses that arise out of suing the insurance company (like court costs and attorneys fees). IV. Limitations on Damages Limitations are put in place so that damages are awarded to victim(s) to compensate their loss without rewarding any negligent behavior on the injured party’s part. Limitations ensure that the injured party does its part in limiting the amount of the damages incurred. There are three main limitations: 1) Foreseeablity 2) Rule of Certainty 3) Rule of Mitigation A. Foreseeablity Example: A manufacturing company sends a part out for emergency repair using UPS and expects the part to be delivered the next day. Assuming that UPS is unaware that this part keeps a division of the manufacturing company from running; if UPS fails to deliver the part on time, then UPS cannot be held liable for the lost profits. Since the loss of profit was not foreseeable at the inception of the contract. The breaching party will not be held liable unless they could see that a breach in the contract would lead to a loss. B. Rule of Certainty In order for damages to be recovered by a plaintiff, the individual must show the amount with reasonable certainty. If a claim contains a portion of damages that are speculative in nature, that amount will not be recoverable, but the remaining amount will be. C. Rule of Mitigation A plaintiff cannot recover damages that could have been mitigated, or made less severe. In other words, if the plaintiff could have taken reasonable actions to make the loss smaller or avoid it acompletely, the defendant is not liable for that amount. D. Liquidated Damages During contract formation, both parties may agree on a certain amount of damages for the injured party to receive if a specific breach of contract occurs. These are known as liquidated damages, and will be upheld in court if they Chapter 23 Contract Remedies Example: Revisiting the Magenta Floyd example from the Rule of Certainty section, Page 4 suppose Magenta Floyd and BigDeal have a liquidated damage clause stating that the amount of royalties will be estimated at 25% of the band’s salary or $250,000. Upon contract formation, both parties believe the figure to be a reasonable estimate, and the amount of concert tickets, music, and merchandise is difficult to forecast; both requirements are met. When BigDeal repudiates the contract, Magenta Floyd will receive their $1 salary million and $250,000 in liquidated damages. meet two requirements. 1. The amount is a reasonable estimate of just compensation for the injured party and must be seen as not punitive. 2. The damages caused by the breach of contract must be difficult to quantify The damages may be related to a deposit, or based off of a specific formula. It is important to note that the goal of liquidated damage clauses is to make the injured party whole, not to punish for breach of contract. As the example shows, liquidated damage clauses eliminate the difficulty in the future of estimating damages and can save involved parties considerable frustration. V. Cancellation/Rescission There are two common scenarios when a contract may be cancelled. If a contract is formed, but one party refuses to complete its part, then the other party is not obligated to fulfill its end of the bargain. Also, if both parties agree to terminate a contract, then it is cancelled. This is a rescission. Example 1: Allan signs a contract with Zelda to purchase her car for $10,000. Zelda decides that she wants the car instead and tells Allan she will not turn it over to him. Allan has no obligation to pay her the $10,000, and he may sue for breach of contract The court may also choose to undo a contract, in effect cancelling it. This practice is commonly referred to as rescission. The goal is to maintain the status quo by returning the parties to their condition prior to the contract. The courts may use rescission if there is fraud, misrepresentation, unwarranted influence, mutual mistakes, an impossible scenario, extreme bias, insufficient terms, or unreasonable adversity associated with the provided result. VI. Specific Performance Example 2: Allan signs a contract with Zelda to purchase her car for $10,000. Zelda decides that she wants the car instead and decides not to turn it over. At the same time, Allan has a rough weekend in Las Vegas and has gambled away the money he was going to use to purchase the car. If both parties agree to cancel the contract, then neither party has an obligation to the other, nor is there any breach of contract. When a breach of contract occurs, the injured party can request in the judgment that defendant be forced to carry out its duties as stated in the contract. This right of specific performance is generally used when awarding monetary damages alone would be insufficient to cover the harm suffered by the plaintiff. The judge would likely not grant the right if it requires the use of excessive court supervision or other resources unless it was in the public interest, nor if another satisfactory remedy was already available. Specific performance is usually not applied to contracts involving construction, service, or Chapter 23 Contract Remedies Page 5 employment. It may occur with goods if they are unique and not available from another seller (e.g. art, historical items, etc) or if the seller does not have a sufficient source of money to fairly compensate the buyer after he has already paid. The right is common in real estate deals (e.g. a buyer has a contract to purchase a house at a certain price, but the seller refuses). However, if the seller has sold the same house multiple times, only one of the buyers can get the house. Study Table 1: Legal Remedies Remedy Availability Result Nominal Damages The injured party has not suffered a financial loss. Usually the plaintiff is awarded $1 and wrongdoing is proven but without damages. Compensatory Damages Injured party proves that the injury arose as a direct result of the breach of contract Compensated to make victim whole. Includes gains prevented and losses sustained. Punitive Damages Only available when the breach of contract involves a tort or bad faith insurance Wrongdoing is punished to set an example for other who would commit the same crime. Liquidated Damages Sets a reasonable predetermined amount to be paid in the event that the contract is breached. Breaching party pays the contracted amount, if qualifications are met. Cannot be punitive. Consequential Damages When circumstances that the breaching party is aware of or should be aware of cause the other party injury. The injured party is given all the damages they knew of. Study Table 2: Equitable Remedies Chapter 23 Contract Remedies Page 6 Remedy Availability Result Specific Performance The case situation is special, monetary damages is unnecessary, and/or there is no readily available substitute The breaching party has to fulfill the terms stated in the contract. Unless extreme court supervision required Injunction Put in place when there is an apparent threat of breach of contract. ( before breach has taken place) Court orders for one party either do or not do a particular action. Rescission Made available by breach of contract, mutual agreement, or by state statute. The contract is cancelled. Each party goes through restitution Restitution Takes place after rescission has been agreed to by both parties Each party returns any benefits or cash equivalent, and returns to the position they were before entering the contract. Problem Sets 1. Assume a buyer and a contractor contract to build a house for $100,000. Determine the legal outcome of the following breaches: a. The contractor finishes the house. It is fine and is on the buyer’s property. Buyer won’t pay. b. The contractor finishes the house. It is fine and is on the contractor’s property. Buyer won’t take the house. c. The contractor is half finished with the house and the buyer announces that the buyer won’t take the house. The house in on the buyer’s property. The contractor has projected total costs on the completed house at $80,000. d. The contractor is halfway finished with the house and the buyer announces they buyer won’t take the house. The house in on the contractor’s property. The contractor has projected total costs on the completed house at $80,000. e. The contractor finishes the house, but is one week late in completion. The buyer has to stay in a motel and have their furniture stored. Chapter 23 Contract Remedies Page 7 f. The contractor finishes the house, but it is a wood frame house rather than a brick house as agreed upon with the buyer. g. The contractor has half finished the house and stops work due to financial difficulties. The buyer hires another contractor that finishes the house for $60,000. h. The contractor has half finished the house and stops work due to financial difficulties. The buyer hires another contractor that finishes the house for $45,000. i. The contractor has half finished the house and stops work for no good reason. The buyer has to higher another contractor to finish the job for $60,000. Answers 1. a) The buyer owes the contract price of $100,000 as there is no reason for the breach. b) The buyer is liable for the expenses in making the second sale. They may also be liable for lost profits if the contractor could have sold two homes. This falls under the gains prevented theory. c) This is a situation where mitigation comes in to play. The contractor should stop construction to mitigate the damages. The contractor can sue for expenses incurred, which is half way of the completed cost, and the profits lost due to gains prevented. The contractor can sue for $40,000 + $20,000 respectively. d) Finishing the house so it can be sold to someone else is the best way to mitigate in this situation. Damages would depend on the reasonable selling price to another buyer and possibly the profits lost if two sales could have been made. e) This is a reasonable amount of extended time in a construction situation. The buyer will be stuck with these costs. f) The buyer can refuse to take this house as it is a substantial breach of the contract. The buyer would also not have to pay anything. g) Since this is not a deliberate breach, the fist contractor is still entitled to payment. The original contractor will be paid $40,000 due to ensure the buyer only has to pay $100,000 for the home. This keeps the buyer from sustaining any loses. h) This is still not a deliberate breach, so the original contractor is still entitled to payment. They will receive $50,000 and the buyer gets the benefit of the bargain with the second contractor, meaning the buyer saves $5,000. i) This is a deliberate breach of contract and the original contractor gets nothing. 2. Goods Contracts: Buyer Breaches a) The seller contracts to sell a car to Charlie for $30,000. Charlie gets the car but doesn’t pay for it. Chapter 23 Contract Remedies Page 8 b) The seller contracts to sell a car to Charlie for $30,000. Charlie refuses to take the car. The seller then sells the car to Baker for $29,000. c) The seller contracts to sell an antique car to Charlie for $30,000. Before delivery, the market price for such cars drops by one-third. Charlie refuses to take the car. The seller ends up keeping the car. d) A homebuilder contracts with a carpenter to build some custom-made cabinets for a subdivision. When the cabinets are partially built, the homebuilder announces that he doesn’t want them anymore. The contract was for $20,000. The carpenter has spent $3,000 on labor and $4,000 on materials so far but can sell some of the material as scrap for $500. The carpenter cannot sell the cabinets to anyone else but expected to make a $5,000 profit on the deal. Answers 2. a) Charlie should pay the contract price of $30,000. b) The seller can sue Charlie for the $1,000 in accordance with the losses sustained theory. The seller may also be able to get more under the gains prevented theory if they can prove they would have been able to sell two cars. c) The seller can sue Charlie for the contract price, $30,000, less the current fair market value, $20,000. The seller would then sue for $10,000. This would fall under the theory of gains prevented. d) The carpenter can use the theories of losses sustained and gains prevented in this situation. This means he can sue for his expenses plus his expected profit less his gain from the sale of the scrap. This ends up coming out to $5,000 profit + $7,000 labor and materials - $500 in scrap totaling a suit for $11,500. 3. Goods Contracts: Seller Breaches a) The seller contracts to sell a car to Charlie for $30,000 but then doesn’t deliver the car. It will cost Charlie $33,000 to buy the car at another dealer. Charlie buys the car at that price. b) The seller contracts to sell a car to Charlie for $30,000 but then doesn’t deliver the car. It will cost Charlie $33,000 to buy the car at another dealer. Charlie doesn’t buy the car. c) The seller contracts to sell a car to Charlie for $30,000. The car is supposed to have cruise control but doesn’t. It will cost Charlie $200 to have it installed. Answers 3. a) Charlie can sue the original seller for his losses sustained of $3,000 of the additional purchase price. Chapter 23 Contract Remedies Page 9 b) Charlie can sue for the Fair market value of $33,000 less the contract price of $30,000 and receive $3,000. c) Charlie can sue for $200 in an accordance of not sustaining a loss. 4. At Will Employment A common type of employment is at will employment. These are typically pretty loose terms of employment that gives the employers plenty of latitude when making personnel decisions. In recent years, “at will” employees have been winning more cases of implied contracts with their employers. These so called implied contracts mean that the employer has made the employee feel like they are doing a good job and will continue to have a job as long as they perform well. “Without cause” is another phrase that has been showing up in employment lawsuits. This one is easily understood too. It is the next step in at will employment basically stating that there needs to be a cause for employment to be terminated. Wrongful termination suits happen when an employer breaks an employment contract by firing an employee. They also can happen when an employee is terminated in violation of state or federal laws. For example, it is wrongful termination to fire someone protected by the whistle blower legislation or by anti-retaliation laws. Consider the following case. Mike has been an employee at Widgets Inc. for five years and does not have any bad marks on his record. He has always received top scores on his evaluations. a. One day Mike’s boss says that Mike is the best employee he has ever had and knows that he will be around for a long time. The next week the company decides to downsize and Mike is terminated. b. Mike blows the whistle on the company for illegal activities. Two weeks later the company decides to terminate his employment without reason. c. Mike has a great month of sales but the company takes a downfall and terminates Mike’s employment before they pay his commission in an effort to save some money for the company. Answers 4. a) Mike can argue that due to his always positive marks and his boss’s enthusiasm towards his future with the company, he felt that it was implied that he will have a job there as long as he keeps up the good work. Mike could be able to sue for reinstatement at his job or possibly for some amount of wages. Chapter 23 Contract Remedies Page 10 b) If the company cannot give a legitimate reason for the termination, Mike would be protected by federal whistle blower legislation. He could sue to have his job back or for lost wages and probably some future wages. c) Mike can sue for this money because he had an implied contract stating that he will be paid commissions unless he did something against company policy to cause his termination. Chapter 23 Contract Remedies Page 11