Chapter 15 Completing the Tests in the Sales and Collection Cycle

advertisement

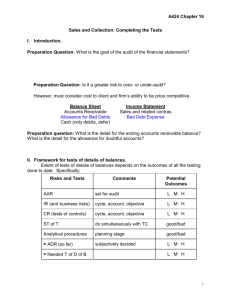

Chapter 16 Completing the Tests in the Sales and Collection Cycle: Accounts Receivable (See Phase III in Figure 16-1 on page 485) Now is the time to test the details of balances. Presentation Outline I. Analytical Procedures II. Designing Tests of Details of Balances III. Confirmation of Accounts Receivable IV. Sample Audit Program I. Analytical Procedures for Accounts Receivable A. Analytical Procedures Defined B. Account Receivables that Deserve Special Attention C. Some Typical Analytical Procedures A. Analytical Procedures Defined When analytical procedures in the sales and collection cycle uncover unusual fluctuations, the auditor should make additional inquiries of client management. Client responses should be critically evaluated to determine their adequacy and whether they are supported by other corroborative evidence. B. Account Receivables that Deserve Special Attention Large balances may be overstated. Accounts that have been outstanding for a long period of time may not be collectible. Receivables from affiliated companies, officers, directors, and other related parties may need separate disclosure. Significant credit balances may need to be reclassified as a liability. C. Some Typical Analytical Procedures Analytical Procedure Possible Misstatement Compare gross margin percentage with previous years (by product line). Overstatement or understatement of sales and accounts receivable. Compare sales returns and allowances as a percentage of gross sales with previous years (by product line). Overstatement or understatement of sales returns and allowances and accounts receivable. Compare bad debt expense as a percentage of gross sales with previous years Uncollectible accounts receivable that have not been provided for. Compare allowance for uncollectible accounts as a percentage of accounts receivable with previous years. Overstatement or understatement of allowance for uncollectible accounts and bad debt expense. II. Designing Tests of Details of Balances A. Tie-in of Aged Trial Balance B. Existence of Accounts Receivable C. Completeness of Accounts Receivable D. Accuracy of Accounts Receivable E. Proper Classification of Account Receivable F. Correct Cutoff of Sales and Receivables G. Realizable Value H. Client Rights to Accounts Receivable I. Presentation and Disclosure of Accounts Receivable A. Tie-in of Aged Trial Balance Most tests of accounts receivable and the allowance for uncollectible accounts are based on the aged trial balance (See Figure 16-3 on page 491) The aged trial balance should be tied into the control account on the general ledger before other tests begin, in order to ensure that the total population is being tested. B. Existence of Accounts Receivable When customers do not respond to confirmations, auditors also examine supporting documents to verify the shipment of the goods and evidence of subsequent cash receipts to determine if accounts were collected. These additional audit procedures are not as imperative when customers respond to confirmations. C. Completeness of Accounts Receivable The understatement of sales and accounts receivable is best uncovered by substantive tests of transactions for shipments made but not recorded, and by analytical procedures. D. Accuracy of Accounts Receivable Confirmation of individual customer accounts is the most common test of details for balances for accounts receivable. Supporting documentation for shipments and cash receipts can also be examined to support individual entries to customer accounts. E. Proper Classification of Accounts Receivable The aged trial balance can be reviewed for material receivables from affiliates, officers, directors, and other related parties. Such balances often require segregation from accounts receivable and disclosure. Significant credit balances in accounts receivable should be reclassified as accounts payable. F. Correct Cutoff of Sales and Receivables Sales cutoff – the proper cutoff of sales can be easily verified when a client uses sequential prenumbered shipping documents. Sales returns and allowances cutoff – most companies record sales returns and allowances in the period they occur, assuming that they occur in fairly constant amounts over time. Cash receipts cutoff – auditor may check to see if client is holding the cash receipts book open, by tracing recorded cash receipts to subsequent period bank deposits on the bank statement. A delay of several days could indicate a cutoff misstatement. G. Realizable Value GAAP requires that accounts receivable be stated at the amount that will ultimately be collected (total A/R less allowance for doubtful accounts). A common method of evaluation is to examine noncurrent accounts on the aged trial balance. The collectibility of more current accounts must also be assessed. H. Client Rights to Accounts Receivable A portion of the receivables may have been pledged as collateral, assigned to someone else, or sold at a discount. Customer confirmations will not uncover this since customers are often unaware of the arrangements. A review of the minutes, discussions with the client, confirmation with banks, and the examination of debt contracts may uncover such arrangements. I. Presentation and Disclosure of Accounts Receivable Receivables from officers and affiliated companies must be segregated from accounts receivable from customers if the amounts are material. Account receivable footnote disclosure includes information about the pledging, discounting, factoring, assignment of accounts receivable, and amounts due from related parties. III. Confirmation of Accounts Receivable A. The Confirmation Requirement B. Types of Confirmations C. The Acceptability of Negative Confirmations D. Follow-up of Nonresponses to Positive Confirmations E. Analysis of Differences F. Factors Affecting Sample Size Although auditing standards require confirmation of accounts receivable, there are three situations where they are deemed unnecessary. A. The Confirmation Requirement Accounts receivable are immaterial Auditor considers confirmations to be ineffective evidence because response rates will likely be inadequate. The combined level of inherent risk and control risk is low and other substantive evidence can be accumulated to provide sufficient evidence. B. Types of Confirmations Positive Confirmations Recipient is requested to reply to the auditor whether the balance of the account is correct or incorrect More reliable than negative confirmations. See Figure 16-5 on page 498. Negative Confirmations Recipient is requested to reply to the auditor only if the balance is incorrect. The uncertainty associated with no response makes them less reliable than positive confirmation. See Figure 16-6 on page 499. Note: It is also common to use a combination of confirmations, sending the positives to accounts with large balances and the negatives to those with small balances. C. The Acceptability of Negative Confirmations All three of the following conditions must be met before an auditor can use negative confirmations: Accounts receivable is made up of a large number of small accounts. Combined assessed control risk and inherent risk is low. Recipients of the confirmations are likely to give them adequate consideration. D. Follow-up of Nonresponses to Positive Confirmations Failure of customers to respond to initial confirmations often results in 2nd and possibly even 3rd confirmations being sent. When positive confirmations are used, SAS 67 requires follow-up procedures for unreturned confirmations. Alternative procedures include: Examination for subsequent cash receipt of the receivable. This approach is generally considered to be the best alternative procedure. Verifying the issuance of the sales invoice and date of billing. Examination of shipping documents to determine if an actual shipment occurred. Examining correspondence of disputed amounts between the client and their customer. Note: In some cases auditors will assume that nonresponses are 100 percent overstatement amounts. E. Analysis of Differences Payment has already been made – customer has made a payment before the confirmation date, but the client has not received the payment in time for recording before the confirmation date. Goods have not been received – client records the sale at the date of shipment and the customer records the acquisition when the goods are received. Goods have been returned – client’s failure to record a credit memo could result from timing differences or the improper recording of sales returns and allowances. Clerical errors and disputed amounts – customer states that there is an error in the price charged for the goods, the goods are damaged, the proper quantity of the goods was not received, etc. Note: The analysis of differences is important because even immaterial errors may add up to a considerable amount when combined with other misstatements. F. Factors Affecting Sample Size Tolerable misstatement Inherent risk Control risk Achieved detection risk from other procedures Type of confirmation (negative form requires more confirmations) IV. Sample Audit Program See Table 16-5 on page 504 for an Illustration of an Audit Program for Tests of Details of Balances for the Sales and Collection Cycle. Summary Analytical Procedures and Accounts Receivable Needing Special Attention The 9 Test of Balances Assertions Positive and Negative Confirmation Alternative Procedures for Lack of Customer Responses to Positive Confirmation.