II. What Promoted Korean Companies to Invest in LAC?

advertisement

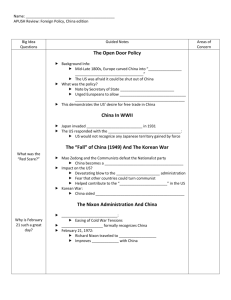

Will Korean Companies Increase Their Overseas Direct Investment in the ALADI Countries?: Implications of Investment Success Cases Hong, Uk Heon, Uiduk University, May 12, 2004 Contents I. Introduction: Small at Present but Great Potential II. What Promoted Korean Companies to Invest in Latin America and the Caribbean? 1. Which Korean Companies Invested in What Industries and How? 2. Why the ALADI Countries? III. How Did Korean Overseas Companies Operate in ALADI? 1. KOBRASCO Case 2. Samsung Tijuana Park Case IV. Conclusion: More Active for the Manufacturing of El Dorado I. Introduction 1. Small LAC (Latin America and the Caribbean) Share: - - US$3.5 billion (Accumulated Until Jan. 2004) - - 7.8% of Korean Total Overseas Direct Investment (ODI) 2. Small ODI, Compared to Korean Economy in the World: - ODI Amount: 3.0 billion US$ (2002) 0.4% of World FDI 0.4% of World FDI in LAC - Share in World GDP: 1.4% - Share in World Trade: 2.3% I. Introduction Graph 1. Composition of Korean ODI , Jan. 2004 Africa: 1.7% Oceania: 2.3% Europe: 16.6% Asia: 41.0% Latin America & the Caribbean: 7.8% North America: 28.8% Middle East: 1.8% I. Introduction 3. Korean Overseas Direct Investment Will Grow in LAC. Export-Oriented Economy. Trade Share in GDP: Over 80% Korean Firms Have Other Worldly Competitive Technologies than IT. Rising Domestic Labor Costs Need to Diversify Overseas Investment Market from China LAC Is Opening Its Market to Foreign Companies. Regional Blocs, NAFTA, MERCOSUR I. Introduction Graph 2. Rapid Growth from 1986-90 and 1996-00 500.0 462.2 400.0 Growth (% ) Asia Latin America & the Caribbean Total 300.0 200.0 154.9 100.0 124.7 151.4 57.3 26.2 96.7 21.0 0.0 Jan. 1986-Dec. 90 Jan. 1991-Dec. 95 -3.7 -7.3 18.4 Jan. 1996-Dec. 00 Jan. 2001-Dec. 03 -66.4 -100.0 II. What Promoted Korean Companies to Invest in LAC? 1. Which Korean Companies? Large Companies Are Dominant. Small Companies Are Important. - Business Services. - Textile & Clothing - Until 1990 II. What Promoted Korean Companies to Invest in LAC? 2. In Which Industries? Internet business holds the lion’s share. Manufacturing is following. - Before the Late1980s: Textile & Clothing - After then: ICT Equipments Mining and Wholesale & Retail Are Next. II. What Promoted Korean Companies to Invest in LAC? Table 1 . Korean ODI Value by Large Firms, until Jan. 2004 Asia Agriculture, Forestry & Fishing Mining Manufacturing Construction Wholesale & Retail Transportation & Storage Communication Banking & Insurance Restaurants & Hotels Real Estates & Business Services Others Total Middle East North America LAC Europe Africa Oceania Total 34.2 93.6 59.8 79.6 100.0 100.0 83.3 77.6 52.6 71.0 86.8 68.7 57.7 97.0 73.1 90.7 40.3 84.8 95.2 100.0 2.1 98.9 90.1 87.3 85.4 63.6 49.8 55.9 58.6 89.8 73.4 75.3 84.7 90.2 86.8 93.4 98.3 97.4 89.7 89.7 71.3 91.6 95.1 - 41.5 61.5 74.8 8.7 94.2 100.0 0 99.9 5.8 79.4 65.4 75.9 0 - 18.0 0.3 0.0 0 65.8 97.5 96.9 99.9 30.5 79.3 46.9 0 80.4 1.7 0 45.1 74.5 95.3 36.3 95.5 77.0 69.9 40.6 0 74.9 86.1 69.3 0.0 66.7 87.4 97.2 - - 12.4 II. What Promoted Korean Companies to Invest in LAC? Table 2. Korean ODI in Manufacturing in LAC by Firm Size, until Jan. 2004 Food & Beverage Textile & Clothing Shoes & Leather Timber & Furniture Paper & Printing Petroleum & Petrochemical Nonmetallic Mineral Iron & Steel Assembled Metal Machine Electronic Communication Equipments Transportation Machines Others Total Small and Medium Large Companies All Companies (%) (%) Companies (%) 4.5 4.6 4.3 34.2 19.7 74.3 2.2 1.9 2.9 0.7 0.4 1.3 0.0 0.0 0.1 7.3 8.6 3.7 0.2 0.1 0.3 9.7 13.2 0.0 0.9 0.0 3.5 0.8 0.4 1.7 5.5 1.1 1.3 100.0 49.5 1.2 0.4 100.0 37.8 1.2 0.7 100.0 II. What Promoted Korean Companies to Invest in LAC? Table 3. Korean ODI by Industry, until Jan 2004 Asia Middle North East America Agriculture, Forestry 0.6 0.0 0.4 & Fishing 3.3 84.1 2.7 Mining 67.7 7.5 47.7 Manufacturing 2.5 4.3 1.4 Construction 13.4 1.1 31.6 Wholesale & Retail Transportation & 0.8 0.2 0.5 Storage 3.0 0.0 3.2 Communication 0.0 0.0 0.1 Banking & Restaurants & 1.9 0.1 2.9 Hotels Real Estates & 6.8 2.6 9.5 Business Services 0.0 0.0 0.0 Others 100.0 100.0 100.0 Total (%) 18,307,625 811,309 12,881,444 Amount Latin America & the Caribbean Europe Africa 3.4 14.2 26.8 0.8 7.6 0.1 2.6 53.8 0.1 34.5 0.9 25.2 23.4 0.2 16.6 14.1 26.3 9.5 7.6 25.7 1.0 6.2 53.2 1.8 21.8 1.1 4.1 0.0 0.3 3.5 0.0 0.1 2.6 0.0 0.4 0.1 0.0 0.6 3.1 0.0 0.1 1.4 30.3 7.7 2.5 41.9 3.7 0.0 0.0 100.0 100.0 3,479,505 7,404,797 Oceania Total Areas 0.8 8.7 9.7 0.0 0.0 0.0 100.0 100.0 100.0 751,808 1,022,332 44,658,820 II. What Promoted Korean Companies to Invest in LAC? Table 4. Korean ODI in LAC by Project Size, 1985 (U$1,000) ALADI Chile Argentina Brazil Mexico Uruguay Venezuela Ecuador Central America Panama Honduras El Salvador Costa Rica The Caribbean Bermuda Dominican Rep. Cayman Irslands Puerto Rico Others Surinam Total Projects Projects' Projects of Projects' of Less Value of Less than Value of than I 5 Million Less than 5 Million Less than I US$ Million US$ US$ Million US$ 11 714 2 4,558 0 0 1 2,500 2 107 1 2,058 2 269 0 0 4 153 0 0 1 66 0 0 1 60 0 0 1 59 0 0 23 4,691 0 0 20 3,531 0 0 1 450 0 0 1 410 0 0 1 300 0 0 2 844 0 0 1 500 0 0 1 344 0 0 0 0 0 0 0 0 0 0 1 20 0 0 1 20 0 0 37 6,269 2 4,558 Total Total Projects' Projects 13 1 3 2 4 1 1 1 23 20 1 1 1 2 1 1 0 0 1 1 39 Value 5,272 2,500 2,165 269 153 66 60 59 4,691 3,531 450 410 300 844 500 344 0 0 20 20 10,827 II. What Promoted Korean Companies to Invest in LAC? Table 5. Korean ODI in LAC by Project Size, until Jan 2004 Projects of Less than 1 Million US$ AlADI Mexico Peru Brazil Argentina Venezuela Chile Bolivia Colombia Ecuador Paraguay Uruguay Central America The Caribbean Others Total (%) (1,000 US$) Projects of Projects of Projects of Less than 5 Less than 10 Less than 50 Million US$ Million US$ Million US$ Projects of Over 50 Million US$ Total Projects' Value 3.5 4.3 1.1 2.6 4.3 2.4 7.7 1.9 19.8 22.6 14.4 100.0 10.0 15.2 1.5 6.0 16.4 3.0 22.6 7.7 28.2 77.4 85.6 0.0 4.7 2.0 5.9 3.1 13.5 10.1 0.0 0.0 0.0 0.0 0.0 0.0 46.5 78.5 16.3 52.1 65.8 0.0 69.6 0.0 52.0 0.0 0.0 0.0 35.3 0.0 75.3 36.2 0.0 84.5 0.0 90.3 0.0 0.0 0.0 0.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 10.5 37.4 15.0 20.9 16.2 100.0 0.9 100.0 2.9 100,464 2.5 0.0 9.1 317,623 2.8 0.0 4.8 168,674 9.3 84.5 100.0 0.0 0.0 100.0 23.4 59.8 100.0 813,734 2,079,010 3,479,505 II. What Promoted Korean Companies to Invest in LAC? Table 6. Korean ODI by Project Size, until Jan. 2004 Asia Middle East North America Latin America & the Caribbean Europe Africa Oceania Total (1,000 US$) Less than Less than 1 million 5 million US$ US$ 13.3 17.6 2.7 5.0 7.1 8.6 2.9 9.1 1.8 4.0 2.5 5.5 11.5 13.6 8.4 11.6 3,729,480 5,170,774 Less than Less than 50 Over 50 10 million US$ million US$ million US$ 9.6 28.2 31.3 1.5 14.1 76.7 6.3 18.3 59.7 4.8 4.5 3.3 8.8 7.2 3,195,858 Total 100.0 100.0 100.0 23.4 59.8 100.0 28.0 61.8 100.0 58.0 30.7 100.0 36.3 29.8 100.0 25.4 47.6 100.0 11,325,707 21,237,001 44,658,820 II. What Promoted Korean Companies to Invest in LAC? Graph 3. Composition of Korean ODI in Manufacturing in LAC, until Jan, 2004 Shoes & Leather: 2.2% Food & Beverage: 4.7% Petroleum & Petrochemical: 7.2% Metals: 9.7% Textile & Clothing: 33.8% Others: 4.5% Electronic & Communication Equipments: 37.9% II. What Promoted Korean Companies to Invest in LAC? 3. In Which Countries Invested? ALADI Held the Lion’s Share of Manufacturing. - For Production and Market - For Development of Natural Resources Central America in the 1980s. - For Production and Export Bases - Textile and Clothing The Caribbean as Production Bases and Headquarters II. What Promoted Korean Companies to Invest in LAC? Table 7. Korean ODI in LAC by Country, until Jan. 2004 Projects AlADI Mexico Peru Brazil Argentina Venezuela Chile Bolivia Colombia Ecuador Paraguay Uruguay Central America The Caribbean Others Total 250 83 19 42 41 7 24 7 11 6 5 5 205 77 3 535 Amount % 46.7 15.5 3.6 7.9 7.7 1.3 4.5 1.3 2.1 1.1 0.9 0.9 38.3 14.4 0.6 100 (1,000 US$) 1,196,759 283,741 282,689 277,836 136,417 66,491 61,761 59,316 19,309 5,336 3,260 603 394,689 1,883,792 4,265 3,479,505 % 34.4 8.2 8.1 8.0 3.9 1.9 1.8 1.7 0.6 0.2 0.1 0.0 11.3 54.1 0.1 100 III. How Did Korean Overseas Firms Operate in ALADI? Quite Successful in General. 100% Ownership Was Dominant. - Few Joint Venture or Partly Stock Holding III. How Did Korean Overseas Firms Operate in ALADI? Table 8. Accomplishment of Korean ODI, until Jan. 2004 Asia Middle East North America Latin America & the Caribbean Europe Africa Oceania Average Number of Project Investment Amount Realized/Pl Invested/P Liquidated/ Realized/P Invested/Pl Liquidated/ anned lanned Realized lanned anned Realized Projects Projects Projects (%) (%) (%) Dollars (%) Dollars (%) Dollars (%) 83.6 79.5 4.8 58.1 79.6 24.3 78.3 49.6 36.6 82.0 34.7 63.7 90.4 79.5 12.1 73.6 78.2 25.7 81.7 84.6 74.2 84.2 84.8 67.3 71.4 55.6 73.5 78.3 17.6 15.6 25.2 12.7 7.7 68.8 71.1 62.4 30.4 63.7 88.6 81.6 74.6 85.5 79.8 9.5 18.7 30.7 25.7 23.5 III. How Did Korean Overseas Firms Operate in ALADI? Table 9. Completion of Korean ODI in LAC, until Jan. 2004 ALADI Peru Mexico Brazil Argentina Chile Venezuela Bolivia Colombia Ecuador Paraguay Uruguay Central America The Caribbean Others Total Total Realized Total Liquidated Total Realized Total Liquidated Cases/Total Cases/Total Amounts/Total Amounts/Total Planned (%) Realized (%) Planned (%) Realized (%) 80.8 13.0 52.4 10.0 86.4 5.3 54.3 8.1 80.8 7.1 67.1 12.8 79.2 16.7 44.3 1.3 85.4 14.6 42.6 12.3 78.1 8.0 87.9 43.7 87.5 28.6 67.3 10.2 77.8 14.3 34.8 1.1 73.3 9.1 56.0 8.3 75.0 33.3 30.7 1.9 85.7 16.7 41.7 3.6 71.4 80.0 61.2 85.9 82.4 23.3 68.1 27.4 82.1 16.7 86.3 5.4 100.0 33.3 79.2 0.5 81.7 17.6 68.8 9.5 III. How Did Korean Overseas Firms Operate in ALADI? Table 10. Type of Korean ODI in LAC, until Jan. 2004 Joint Venture Loan Private Financing Stock Investment Total Investment Cases (%) 1.1 1.1 1.5 96.3 100.0 Investment Dollars (%) 5.1 9.0 0.0 85.9 100.0 III. How Did Korean Overseas Firms Operate in ALADI? 1. KOBRASCO Case A. Brief Introduction - Companhia Coreano-Brasileira De Pelotizacao (KOBRASCO). Located in Vitoria, Espirito Santo, Brazil. Connected to Tubarao port. - Major Business: Production and sale of 4 million tons of pellet a year. - Foundation: March 6, 1996. - Total Investment Amount: U$220 million - Investment Type: Joint venture. POSCO: 50%, CVRD: 50%. - Employees: 80 persons. III. How Did Korean Overseas Firms Operate in ALADI? B. Short History - July 29, 1995: Agreement signing of joint venture and stock-holding type - Sept. 28, 1995: Firm site began to be constructed at CVRD’s yard. - March 6, 1996: A joint venture corporation was established. - Sept. 9, 1996: Main facility began to be constructed. - Oct. 9, 1998: Production began. - Nov. 16, 1998: Completion Ceremony of construction. Production (1,000 ton) Sale (1,000 ton) Sale to Posco Ratio of Sale to Posco (%) Total Sale (1,000 US$) Profit Profit after Tax Asset (1,000US$) Capital Debt 1998 1999 2000 2001 2002 2003 404 354 293 3,792 3,793 1,704 4,366 4,343 2,632 4,188 4,184 2,135 4,087 4,034 2,544 4,405 4,344 2,642 82.8 44.9 60.6 51 63.1 60.8 11,755 299 -1,633 220,562 43,887 176,674 117,238 25,943 -21,813 207,708 25,499 182,209 123,029 25,941 2,859 170,195 26,188 144,009 132,301 28,905 115 166,211 22,183 144,028 100,955 12,617 -28,692 99,999 -30,382 130,381 145,888 15,212 39,259 122,049 2,103 119,945 III. How Did Korean Overseas Firms Operate in ALADI? C. Kobrasco’s Success • • Stable Production and Import of Pellet Short Periods Consumed in Construction, Full Operation D. How Did It Achieve? • • • Joint Venture CVRD in Charge of Operation: Few POSCO Representatives Right Place near Resources and Good Transportation Infrastructure III. How Did Korean Overseas Firms Operate in ALADI? 2. Samsung Tijuana Park Case A. Brief Introduction - Samsung Tijuana Park: Three Plants 1) Samsung Mexicana (Samex): Television sets, computer monitors, cellular phones and computers. 2) Samsung Display Interface Mexicana (SDIM): Cathode-ray tube (CRT) monitors. In 1997, the plant began to produce Liquid Crystal Display (LCD) monitors. 3) Samsung Electro-Mecánicos Mexicana (SEMSA) Electronic Components for televisions, monitors. III. How Did Korean Overseas Firms Operate in ALADI? 2. Samsung Tijuana Park Case B. Major Features - Investment amount: Over US$ 200 million. Samsung Group owns 100% of stocks. - Employment: 6,000 full-time employees. - Operation rate: 96.2%. - Sales: 2,059 million US$ - Production: Monitor, 4 million sets (CDT models: 5, LCD models: 9); TV production, 3 million sets (TV models: 90); Assembled PCs, 100 thousand; HHP production, 900 thousand. III. How Did Korean Overseas Firms Operate in ALADI? 2. Samsung Tijuana Park Case C. How Did It Run? 1) Samsung Electronics initiated its SAMEX as a Maquiladora to assemble television sets in 1988. Aimed entirely at the North American Market. First Investment Capital: U$3,700 million 2) After NAFTA, its target market from North America to Mexico. 3) In 1994, Samsung Group inaugurated Samsung Tijuana Park 4) Integrate components and finished goods vertically. 5) Over 200 million US$ was invested. Until 2001, five new plants and renovation continued. D. How Successful? 1) 30 % to Mexico Market in 2003. 2) Turnover rates only 3% in 2003 3) No labor union yet. III. How Did Korean Overseas Firms Operate in ALADI? 2. Samsung Tijuana Park Case E. How Did They Succeed? 1) Active Risk-Taking by Samsung Group: Go Anywhere Market Is. 2) Emphasis on employee welfare and community services. various cultural, sports events, community service teams, Daycare Center and clinic, Scholarship to Mexican students. 3) Emphasis on employee training and education: Supported 16 to MBA program. 4) Localization and decentralization of management 5) Localize components production: Over 900 materials 6) Mexico Provided Favorable Environments after NAFTA 7) Tijuana is the television capital of the world. IV. Conclusion: More Active for the Manufacturing of El Dorado 1. Between Korea and LAC, economic environments for vital interactive investment: - Korean: export-orientation, need to diversify investment market, and competitive technologies - LAC: Market opening, regional economic blocs, And 1.5 times larger population than North America - Cultural, distance gaps get closer. IV. Conclusion: More Active for the Manufacturing of El Dorado 2. For Further Interactive Investment: - More Industrial parks with favorable business environments. - Localization of business operation. Kobrasco, Samsung Electronics at Querétaro. - Promote public relations with business information each other. - Foods and construction industries as alternative investment market for Korea and LAC. - Need better residence Safety and more flexible labor Acknowledgments Thank you for taking time with me!