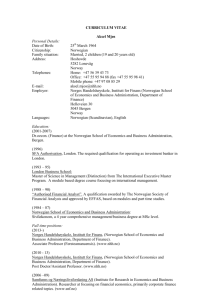

PowerPoint-presentasjon

advertisement

Financial Economics (FIE) NHH, August 13, 2015 Professor Øystein Thøgersen FIE: Introduction • FIE – the most popular profile at NHH - Approximately 35% of all masters students • Possible reasons - A really interesting and exciting subject A diverse portfolio of high-quality courses Strong job prospects Finansavisen August 2014: - “norske meglerhus domineres av tidligere NHH-studenter ” 2 Financial Economics Macroeconomics Investors Saving Capital management Capitalmarket Firms Pricing Investments Corporate Finance 3 The three "pillars" of the FIE profile • Investments, capital management • Corporate Finance • Macroeconomics • Designing the individually optimal course-portfolio - How much in-depth specialization? - How much diversity? - How much priority to "more advanced" courses? 4 Mandatory Courses • Mandatory Finance courses: At least two out of the following three courses - FIE 400 Investments/Financial Markets - FIE 402 Corporate Finance - FIE 403 Business Cycle Analysis • Mandatory methodological course: One out of the following three courses - FIE 401 Empirical Methods in Finance - ECN 402 Econometric Techniques - FIE 439 Empirical Analyses of Financial and Commodity Markets 5 A lot of flexibility… Choose wisely!! Note, the table should also include: -FIE423, "Renteinstrumenter" -FIE426, "Kapitalforvaltning" (Both course offered in the spring semester) 6 A quiz Who is who? – and what do they have in common?? 7 FIE: Basic structure • Each student is required to take at least - Six courses within Financial Economics • At least two of the core finance courses • One of the three methodological course • Electives in financial economics - Six other courses • A "minor" or exchange • Three courses from the overall NHH master course portfolio - Note: You must have at least 2.5 ECTS in ethics - Thesis • Time line - Take core courses and the methodological course early (first and second semester) - Move on and take electives (mainly in second & third semester) - Master thesis: The thesis is normally written in the fourth semester. But – start to think about the thesis much earlier!! 8 Corporate Finance • • • • • • • • • • • • • • • FIE 402 Corporate Finance / Foretakets finansiering FIE 428 Corporate Financial Management FIE 432 Personlig økonomi FIE 433 International Finance FIE 435 Financial Modeling FIE 436 Venture Capital, Private Equity, and IPOs FIE 437 Valuation FIE 443 Merges and Acquisitions FIE 441 Taxes and Business Strategy FIE 444 Banking FIE 445 Project Finance FIE 420 Corporate Governance ECO422 Advanced Corporate Finance FIE 401 Empirical Methods in Finance ECO 440 Økonomi og usikkerhet: Forsikring og finans 9 Investments/ Capital management • • • • • • • • • • • • • • • • • • • FIE 400 Investments / Finansmarkeder FIE 403 Business Cycle Analysis / (Konjunkturanalyse) FIE 420 Pengemarkeder og Bankvesen FIE 421 Long-term Macroeconomic Analysis FIE 422 Internasjonale finansmarkeder og og finansiell stabilitet FIE 423 Renteinstrumenter FIE 425 Derivatives and Risk Management FIE 431 Krakk og kriser FIE 432 Personlig økonomi FIE 426 Kapitalforvaltning ECN 430 Empirical methods and applications in macroeconomics and finance FIE 433 International Finance FIE 434 Behavioral Finance and Wealth Management FIE 435 Financial Modeling FIE 438 Applied Portfolio Management ECO 403 Time Series Analysis and Prediction ECO 421 Asset Pricing ECO 425 International Macroeconomics ECO 440 Økonomi og usikkerhet: Forsikring og finans 10 Macroeconomics and financial markets • • • • • • • • • • • • • • • FIE 400 Investments / Finansmarkeder FIE 403 Business Cycle Analysis / (Konjunkturanalyse) FIE 420 Pengemarkeder og Bankvesen FIE 421 Long-term Macroeconomic Analysis FIE 422 Internasjonale finansmarkeder og og finansiell stabilitet FIE 423 Renteinstrumenter FIE 431 Krakk og kriser FIE 426 Kapitalforvaltning FIE 433 International Finance FIE 434 Behavioral Finance and Wealth Management FIE 438 Applied Portfolio Management ECN 430 Empirical methods and applications in macroeconomics and finance ECO 403 Time Series Analysis and Prediction ECO 421 Asset Pricing ECO 425 International Macroeconomics 11 «Apetizers» • Finally, let’s consider two nice examples of selected issues discussed and analyzed in various FIE courses • 1. Capital management – illustrated by challenges facing the «petroleum fund» • 2. The stock market and the business cycle 12 Case 1: The largest SWF in the world… 13 Volatility in the return of the fund…. 14 …and volatility in excess returns 15 Rebalancing 16 Case 2:The stock market and the business cycle 17 Case 2b: Effect of 9/11 18 Maybe this will motivate you as well…? 19