Inequality in the Adequacy of Safety Net Benefits

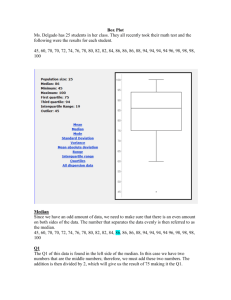

advertisement

INEQUALITY ACROSS THE US STATES Geographic Inequality in Social Provision and Redistribution Sarah K. Bruch - University of Iowa Inequality Workshop The Graduate Center, CUNY June 5, 2015 Motivation Leveraging variation but also normative concerns. Subnational variation in social provision and redistribution is a form of inequality. State inequalities in social provision results in unacceptably different social contracts for economically vulnerable families. Why do we have subnational variation in provision and redistribution? Part of the answer is about policy design – the degree of decentralization. Unequal by Design: Social Provision in the US Welfare State Key Dimensions of Safety Net Policies Adequacy of benefits = what recipients receive on average. Direct expenditures for recipient benefits Program caseload or recipients Adjusted for inflation (in constant $2012) Adjusted for cost-of-living differences across states. Value add of measure: vs. max benefit or aggregate spending Key Dimensions of Safety Net Policies Inclusiveness of receipt = proportion of potentially needy that get assistance. Program caseload or recipients Potentially needy population Potentially needy population estimated with the Annual Social and Economic Supplement (March CPS). Adjusted for cost of living differences across states. Value add of measure: vs. caseloads Defining the State-Level Safety Nets Include programs in which states have some policymaking authority, or financial or administrative responsibility. Program Funding • Partial/joint funding of programs & block grant structure • Implication = Variation in availability and stability of funding Program Administration • Flexibility in administering programs • Implication = Variation in outreach, application, and accessibility. Policymaking Authority • Authority to make rules regarding eligibility and benefits • Implication = Variation in eligibility criteria and benefit levels. State-Level Safety Net 11 programs that provide support for economically vulnerable families with children. CA: cash assistance (AFDC/TANF) FS: food assistance (Food Stamps/SNAP) HI: health insurance (Medicaid and SCHIP) CS: child support (enforcement and collections) CC: child care (subsidies – CCBG/CCDF and TANF) ECE: early childhood education (Head Start and public pre-k) UI: unemployment insurance WA: work support (JOBS w/ AFDC and TANF work support) SS: disability assistance (SSI for disabled children) HS: housing assistance (Section 8) ST: state income taxes (liability threshold and credits) SNAPSHOT OF CURRENT SOCIAL PROVISION Adequacy of Safety Net Benefits (2013) Average Yearly Benefit in Median State - 2013 8,000 10,000 $13,660 $7,529 2013 Poverty thresholds: 2p/1k = $16,057 3p/2k = $18,769 4p/2k = $23,624 $7,224 6,000 $5,981 $6,153 4,000 $5,018 $3,962 $3,525 $2,934 2,000 $2,301 0 $0 CA FS CS UI SS ST EC HI WA CC HS Inclusiveness of Safety Net Benefits (2013) Proportion Potentially Needy Receiving Benefits in Median State - 2013 CA .194 FS 1.21 CS .819 UI .428 SS .7 ST .453 EC .206 HI 1.19 WA .162 CC .141 HS .244 0 .5 1 1.5 INEQUALITY ACROSS STATES SOCIAL PROVISION Inequality in the Adequacy of Safety Net Benefits 0 2,000 4,000 6,000 8,000 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Adequacy of Safety Net Benefits 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 0 2,000 4,000 6,000 8,000 Cash Assistance 25th = $3,162 75th = $5,020 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Adequacy of Safety Net Benefits 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 0 2,000 4,000 6,000 8,000 Food Assistance 25th = $3,071 75th = $3,728 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Adequacy of Safety Net Benefits 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 0 2,000 4,000 6,000 8,000 Unempl. Ins. 25th = $4,131 75th = $5,758 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Adequacy of Safety Net Benefits 2,000 4,000 6,000 8,000 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 0 State Prek/HS 25th = $6,124 75th = $8,143 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Adequacy of Safety Net Benefits 2,000 4,000 6,000 8,000 10,000 Adequacy of Social Provision - Extent of State Variation - 2013 0 Child Care 25th = $4,620 75th = $6,752 CA FS CS UI SS ST EC HI CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Inclusiveness of Safety Net Benefits 0 .5 1 1.5 Inclusiveness of Social Provision - Extent of State Variation - 2013 CA FS CS UI SS ST EC HI WA CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Inclusiveness of Safety Net Benefits .5 1 1.5 Inclusiveness of Social Provision - Extent of State Variation - 2013 0 Cash Assistance 25th = 0.10 75th = 0.25 CA FS CS UI SS ST EC HI WA CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Inequality in the Inclusiveness of Safety Net Benefits .5 1 1.5 Inclusiveness of Social Provision - Extent of State Variation - 2013 0 Unempl. Ins. 25th = 0.36 75th = 0.49 CA FS CS UI SS ST EC HI WA CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. Variation in the Inclusiveness of Safety Net Benefits 1 1.5 Inclusiveness of Social Provision - Extent of State Variation - 2013 0 .5 Child Care 25th = 0.11 75th = 0.21 CA FS CS UI SS ST EC HI WA CC HS Note: Colored box indicates IQR (25th & 75th percentiles), w/ median highlighted; the length of the whiskers are at 1.5 times the IQR; values outside of that range are represented by dots. STATE CHANGE OVER TIME SOCIAL PROVISION State Change Over Time in Safety Net Benefits Absolute Value Change in Cash Assistance Adequacy 1994 to 2013 AK HI VT RI MA CA MN WI WA CT MI NH NY ME ND OR IA PA KS MT UT NM NE OH SD NJ OK CO WY IL AZ MO ID DE NV MD IN GA WV FL VA NC KY AR SC TN LA TX AL MS 2000 4000 6000 8000 Benefit Change 1994 to 2013 10000 State Change Over Time in Safety Net Benefits Absolute Value Change in Food Assistance Adequacy 1994 to 2013 AK HI LA KY SD TX NM AL MS WV SC IN MO AZ GA WY OK AR OH FL ND TN MT IL DE UT KS NC IA ID CO MI WI NE NV WA RI PA OR MD ME NJ VA CA MN NY NH MA VT CT 2500 3000 3500 Benefit Change 1994 to 2013 4000 4500 State Change Over Time in Safety Net Benefits Change in Food Assistance Adequacy 1994 to 2004 HI AK LA KY SD TX NM AL MS WV SC IN MO AZ GA WY OK AR OH FL ND TN MT IL DE UT KS NC IA ID CO MI WI NE NV WA RI PA OR MD ME NJ VA CA MN NY NH MA VT CT States Ordered by 1994 Benefit Level HI AK LA KY SD TX NM AL MS WV SC IN MO AZ GA WY OK AR OH FL ND TN MT IL DE UT KS NC IA ID CO MI WI NE NV WA RI PA OR MD ME NJ VA CA MN NY NH MA VT CT 2000 Change in Food Assistance Adequacy 2004 to 2013 2500 3000 3500 4000 Benefit Change 1994 to 2004 4500 2000 2500 3000 3500 4000 Benefit Change 2004 to 2013 4500 State Change Over Time in Safety Net Benefits Absolute Value Change in Cash Assistance Inclusion 1994 to 2013 AK RI ME OH DE MI GA WI IA MO IL CT CA MN PA MD VT NJ HI NC MA TN WA NY CO NE WV VA FL NV NH KY ND MT UT KS AZ IN OR WY NM LA MS OK SC TX SD AR AL ID 0 .2 .4 .6 Coverage Change 1994 to 2013 .8 State Change Over Time in Safety Net Benefits Absolute Value Change in Food Assistance Inclusion 1994 to 2013 GA ME MO NE VT CO VA TX TN WV DE RI OH MD IA LA AL MI PA MS ND MN UT NV HI AZ AR OK NC NJ IL WI IN OR FL AK NM KY CA MA SC WA KS MT CT WY NY NH SD ID .6 .8 1 1.2 Coverage Change 1994 to 2013 1.4 1.6 State Change Over Time in Safety Net Benefits Change in Food Assistance Inclusion 1994 to 2004 GA ME MO NE VT CO VA TX TN WV DE RI OH MD IA LA AL MI PA MS ND MN UT NV HI AZ AR OK NC NJ IL WI IN OR FL AK NM KY CA MA SC WA KS MT CT WY NY NH SD ID States Ordered by 1994 Coverage GA ME MO NE VT CO VA TX TN WV DE RI OH MD IA LA AL MI PA MS ND MN UT NV HI AZ AR OK NC NJ IL WI IN OR FL AK NM KY CA MA SC WA KS MT CT WY NY NH SD ID .6 .8 1 1.2 1.4 Coverage Change 1994 to 2004 Change in Food Assistance Inclusion 2004 to 2013 1.6 .6 .8 1 1.2 1.4 Coverage Change 2004 to 2013 1.6 CURRENT SNAPSHOT REDISTRIBUTION Data Annual Social and Economic Supplement (March CPS) Household level income measures: adjusted for household size (square root of hh size) inflation (CPI-U-RS), and cost of living differences across states (BEA all items RPP). Dollar figures reported are per equivalized person in the household in 2012 dollars. Household type: working-aged households (head age 18-64) with children Market Inequality and Disposable Inequality for HHs w/ Kids 2012 WY IA ND UT SD NH NE MN VT KS AK CO MD WI SC DE VA ID HI OH OR PA IN TN MT MI WV NV OK NC ME KY MA CT NJ RI AR WA AZ FL TX MO GA AL LA MS IL NY CA NM 0 .1 .2 .3 Gini Coefficient .4 .5 .3 .4 Market and Disposable Inequality for HHs w/ Kids 2012 NM .2 WY IL TX NY FL WA AL GA NJ LA CT AZMO NVMA RI MS AK VA IN PA TN MI OK NC AR ME KY CO MD HI OHMT WV WI DE KS NHNE VT SC ID OR ND SD MN UT IA CA .3 .35 .4 .45 Market Inequality .5 .55 Inequality Reduction among Working-Aged HHs w/ Kids 2012 NM CA NY IL MS LA AL GA MO TX FL AZ WA AR RI NJ CT MA KY ME NC OK NV WV MI MT TN IN PA OR OH HI ID VA DE SC WI MD CO AK KS VT MN NE NH SD UT ND IA WY Centralized transfers overall reduction Decentralized transfers State taxes Federal taxes .3 .35 .4 .45 Inequality Reduction .5 .55 Market Relative Poverty and Disposable Relative Poverty for HHs w/ Kids 2012 ND NH WY IA NE MN SD VA UT MD CT CO WI VT PA AK MO MA ME OH IL NJ KS WA OK MI IN HI OR ID RI AL FL TN WV GA NC SC NV TX MT DE LA AR MS AZ KY CA NY NM 0 .1 .2 Relative Poverty .3 .4 .1 .2 .3 .4 Market and Disposable Relative Poverty for HHs w/ Kids 2012 -.1 0 ND CA NY NM AZ TXDE AR KY NV LA NJ HI SC FLTN AL GA MS IN NC MT IL WV RI MI AK WA MA ME PAMO OH OKOR CT ID KS VA MDCO WI VT NH NE SUT D MN WY IA .1 .2 .3 Market Relative Poverty .4 Relative Poverty Reduction among Working-Aged HHs w/ Kids 2012 NM NY CA KY AZ MS AR LA DE MT TX NV SC NC GA WV TN FL AL RI ID OR HI IN MI OK WA KS NJ IL OH ME MA MO AK PA VT WI CO CT MD UT VA SD MN NE IA WY NH ND Centralized transfers overall reduction Decentralized transfers State taxes Federal taxes .1 .15 .2 .25 Relative Poverty Reduction .3 .35 Absolute Poverty Reduction among Working-Aged HHs w/ Kids 2012 NM MS KY LA AR TN AL WV SC AZ GA NC MT TX NY MI CA MO OH IN RI DE NV FL OK ID KS OR ME WI IL PA MA WA AK HI NJ SD CO NE VT VA CT MN IA MD WY UT ND NH .05 .1 .15 .2 Absolute Poverty Reduction .25 .3 Conclusions Social provision in the US is inadequate in terms of benefit levels and the inclusiveness, and that this varies substantially across states. States start out and end up in different places in terms of levels of poverty and inequality – and these in part reflect policy choices. The decentralized structure of the safety net is one of most crucial and least carefully studied structural features of the U.S. welfare state. Social provision that is inadequate and unequal hampers our ability to address high and rising levels of inequality, insecurity, and poverty.