File

advertisement

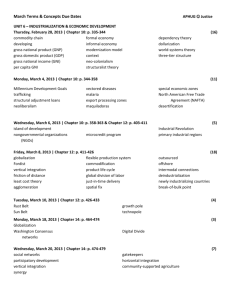

The Legion of Superheroes has hired you as a summer intern in their software applications area. Wonder Woman has asked you to prepare a weekly payroll report for the six Superheroes listed in the table below. The pay for fighting crime isn’t great, but it’s very rewarding! EMPLOYEE NAME (Superhero working) Batman Captain America Iron Man Spider-Man Superman Wonder Woman RATE per HOUR (amount paid per hour) $40.00 $29.00 $33.50 $22.75 $37.50 $25.00 HOURS WORKED (total number per week) 46.75 40.5 18.5 24 51 38 DEPENDENTS (number of super kids) 5 4 2 4 1 3 PAYROLL TABLE SUPERHEROES WEEKLY PAYROLL Employee (Superhero) Batman Captain America Iron Man Spider-Man Superman Wonder Woman Totals Average Highest Lowest Rate per Hour Hours Worked Dependents (Kids) Gross Pay Federal Tax State Tax Net Pay (1) Enter the worksheet title SUPERHEROES WEEKLY PAYROLL in cell A1 Merge & Center A1 to H1 Use italics for row 2 (Alt + Enter to type a new line underneath text) Change the height of row 2 to 30.00. (2) Use the following formulas to determine the GROSS PAY, FEDERAL TAX, STATE TAX and NET PAY for the first Super Hero (hey, Super Heroes have to pay taxes too!). BIG HINT: Pay attention to parenthesis and the “order of math operations”. To verify that your formula totals are correct, use a calculator (Start/Programs/Accessories/Calculator). GROSS PAY (cell E3): RATE multiplied by the HOURS WORKED o Example: =RATE*HOURS WORKED FEDERAL TAX (cell F3): 20% multiplied by (GROSS PAY minus DEPENDANTS multiplied by 38.46) o Example: =20%*(GROSS PAY-DEPENDANTS*38.46) Must change 20% into a decimal STATE TAX (cell G3): 3.2% multiplied by the GROSS PAY o Example: =3.2%*GROSS PAY Must change 3.2% into a decimal NET PAY (cell H3): GROSS PAY minus (FEDERAL TAX plus STATE TAX) o Example: =GROSS PAY-(FEDERAL TAX+STATE TAX) Autofill (drag the corner) the formulas for the first Superhero to the remaining employees Change row height of row 9 to 5.00 and fill with the color of your choosing. Calculate the totals for GROSS PAY, FEDERAL TAX, STATE TAX, and NET PAY in row 10. o Use AUTOSUM…make sure selection is correct (4) Use formulas to determine the AVERAGE, MAX and MIN values of each column in rows 11, 12, and 13. Use AUTOSUM…make sure selection is correct Format “Hours Worked” as a NUMBER with 2 decimal places Format “Dependents” as a NUMBER with 0 decimal places (5) Bold the worksheet title. Apply Currency Style “$” (except for Kids and Hours). Add a background color in cells A2 to H2. Apply all the formatting (borders, centering, right and left alignment, etc) exactly as you see in the worksheet above. (6) Change the widths of columns A through H for best fit, and MERGE & CENTER A9-H9. (7) Use the CONDITIONAL FORMATTING command to display bold font on a colored background for any Gross Pay greater than $1050.00 in the range E3:E8. Use the help feature or the Internet if you do not remember how to use conditional formatting. (8) Sort the employee names (Superheroes) by listing them alphabetically from A to Z. (9) Insert a Pie Chart of your choice to reflect all the Superheroes and the Net Pay amounts only (select names hold control select net pay). Position the Chart below your data. Make sure your chart has a Title (above), labels (in a legend), and dollar amounts (inside end). See example for ideas. Format Chart background to the color of your choosing. Format Chart Title to a WordArt of your choice (format WordArt Styles) Bold Text in chart Round edges of chart (right click format chart area border styles rounded corners) (10) Insert image of your favorite superhero next to chart (OPTIONAL) (11) Save as Last-Superhero (12) Upload to Google Drive