b. Estimate the value of equity, using an option pricing model.

advertisement

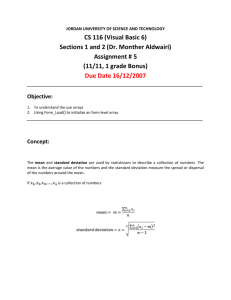

resource URL: http://people.stern.nyu.edu/adamodar/New_Home_Page/problems/optprob.htm Option Pricing 1. The following are prices of options traded on Microsoft Corporation, which pays no dividends. Call Put K=85 K=90 K=85 K=90 1 month 2.75 1.00 4.50 7.50 3 month 4.00 2.75 5.75 9.00 6 month 7.75 6.00 8.00 12.00 The stock is trading at $83, and the annualized riskless rate is 3.8%. The standard deviation in stock prices (based upon historical data) is 30%. a. Estimate the value of a three-month call, with a strike price of 85. b. Using the inputs from the Black-Scholes model, specify how you would replicate this call. c. What is the implied standard deviation in this call? d. Assume now that you buy a call with a strike price of 85 and sell a call with a strike price of 90. Draw the payoff diagram on this position. e. Using put-call parity, estimate the value of a three-month put with a strike price of 85. 2. You are trying to value three-month call and put options on Merck, with a strike price of 30. The stock is trading at $28.75, and expects to pay a quarterly dividend per share of $0.28 in two months. The annualized riskless interest rate is 3.6%, and the standard deviation in ln stock prices is 20%. a. Estimate the value of the call and put options, using the Black-Scholes. b. What effect does the expected dividend payment have on call values? on put values? Why? 3. There is the possibility that the options on Merck, described above, could be exercised early. a. Use the pseudo-American call option technique to determine whether this will affect the value of the call. b. Why does the possibility of early exercise exist? What types of options are most likely to be exercised early? 4. You have been provided the following information on a three-month call: S = 95 K=90 t=0.25 r=0.04 N(d1) = 0.5750 N(d2) = 0.4500 a. If you wanted to replicate buying this call, how much money would you need to borrow? b. If you wanted to replicate buying this call, how many shares of stock would you need to buy? 5. Go Video, a manufacturer of video recorders, was trading at $4 per share in May 1994. There were 11 million shares outstanding. At the same time, it had 550,000 one-year warrants outstanding, with a strike price of $4.25. The stock has had a standard deviation (in ln stock prices) of 60%. The stock does not pay a dividend. The riskless rate is 5%. a. Estimate the value of the warrants, ignoring dilution. b. Estimate the value of the warrants, allowing for dilution. c. Why does dilution reduce the value of the warrants. 6. You are trying to value a long term call option on the NYSE Composite Index, expiring in five years, with a strike price of 275. The index is currently at 250, and the annualized standard deviation in stock prices is 15%. The average dividend yield on the index is 3%, and is expected to remain unchanged over the next five years. The five-year treasury bond rate is 5%. a. Estimate the value of the long term call option. b. Estimate the value of a put option, with the same parameters. c. What are the implicit assumptions you are making when you use the Black-Scholes model to value this option? Which of these assumptions are likely to be violated? What are the consequences for your valuation? 7. A new security on AT&T will entitle the investor to all dividends on AT&T over the next three years, limit upside potential to 20%, but also provide downside protection below 10%. AT&T stock is trading at $50, and three-year call and put options are traded on the exchange at the following prices Call Options Put Options K 1 year 3 year 1 year 3 year 45 $8.69 $13.34 $1.99 $3.55 50 $5.86 $10.89 $3.92 $5.40 55 $3.78 $8.82 $6.59 $7.63 60 $2.35 $7.11 $9.92 $10.23 How much would you be willing to pay for this security? The Option to Delay 1. A company is considering delaying a project with after-tax cash flows of $25 million but costs $300 million to take (the life of the project is 20 years and the cost of capital is 16%). A simulation of the cash flows leads you to conclude that the standard deviation in the present value of cash inflows is 20%. If you can acquire the rights to the project for the next ten years, what are the inputs for the option pricing model? (The six-month T.Bill rate is 8%, the ten year bond-rate is 12% and the 20-year bond rate is 14%.) 2. You are examining the financial viability of investing in some abandoned copper mines in Chile, which still have significant copper deposits in them. A geologist survey suggests that there might be 10 million pounds of copper in the mines still and that the cost of opening up the mines will be $3 million (in present value dollars). The capacity output rate is 400,000 pounds a year and the price of copper is expected to increase 4% a year. The Chilean Government is willing to grant a twenty-five year lease on the mine. The average production cost is expected to be 40 cents a pound and the current price per pound of copper is 85 cents. (The production cost is expected to grow 3% a year, once initiated.) The annualized standard deviation in copper prices is 25% and the twenty-five year bond rate is 7%. a. Estimate the value of the mine using traditional capital budgeting techniques. b. Estimate the value of the mine based upon an option pricing model. c. How would you explain the difference between the two values? 3. You have been asked to analyze the value of an oil company with substantial oil reserves. The estimated reserves amount to 10,000,000 barrels and the estimated present value of the development cost for each barrel is $12. The current price of oil is $20 per barrel and the average production cost is estimated to be $6 per barrel. The company has the rights to these reserves for the next twenty years and the twenty-year bond rate is 7%. The company also proposes to extract 4% of its reserves each year to meet cashflow needs. The annualized standard deviation in the price of the oil is 20%. What is the value of this oil company? 4. You are analyzing a capital budgeting project. The project is expected to have a PV of cash inflows of $250 million and will cost $200 million (in present value dollars) to take on. You have done a simulation of the project cashflows and the simulation yields a variance in present value of cash inflows of 0.04. You have the rights to this project for the next five years, during which period you have to pay $12.5 million a year to retain the project rights. The five-year treasury bond rate is 8%. a. What is the value of project, based upon traditional NPV? b. What is the value of the project as an option? c. Why are the two values different? What factor or factors determine the magnitude of this difference? 5. Cyclops Inc, a high technology company specializing in state-of-the-art visual technology, is considering going public. While the company has no revenues or profits yet on its products, it has a ten-year patent to a product that will enable contact lens users to get no-maintenance lens that will last for years. While the product is technically viable, it is exorbitantly expensive to manufacture and the potential market for it will be relatively small initially. (A cash flow analysis of the project suggests that the present value of the cash inflows on the project, if adopted now, would be $250 million, while the cost of the project will be $500 million.) The technology is rapidly evolving and a simulation of alternative scenarios yields a wide range of present values, with an annualized standard deviation of 60%. To move towards this adoption, the company will have to continue to invest $10 million a year in research. The ten-year bond rate is 6%. a. Estimate the value of this company. b. How sensitive is this value estimate to the variance in project cash flows? What broader lessons would you draw from this analysis? The Option to Expand and Abandon 1. NBC has the rights to televise the Winter Olympics in 2 years and is trying to estimate the value of these rights for possible sale to another network. NBC expects it to cost $40 million (in present value terms) to televise the Olympics and based upon current assessments expects to have a Nielsen rating[1] of 15 for the games. Each rating point is expected to yield net revenue of $2 million to NBC (in present value terms). There is substantial variability in this estimate and the standard deviation in the expected net revenues is 30%. The riskless rate is 5%. a. What is the net present value of these rights, based upon current assessments? b. Estimate the value of these rights for sale to another network. 2. You are analyzing Skates Inc., a firm that manufactures skateboards. The firm is currently unlevered and has a cost of equity of 12%. You estimate that Skates would have a cost of capital of 11% at its optimal debt ratio of 40%. The management, however, insists that it will not borrow the money because of the value of maintaining financial flexibility and they have provided you with the following information. Over the last 10 years, reinvestments (net capital expenditures + working capital investments) have amounted to 10% of firm value, on an annual basis. The standard deviation in this reinvestment has been 0.30. The firm has traditionally used only internal funding (net income + depreciation) to a. b. meet these needs and these have amounted to 6% of firm value. In the most recent year, the firm earned $180 million in net income on a book value of equity of $1 billion and it expects to earn these excess returns on new investments in the future. The riskless rate is 5%. Estimate the value of financial flexibility as a percent of firm value, on an annual basis. Based upon part a, would you recommend that Skates use its excess debt capacity? 3. Disney is considering entering into a joint venture to build condominiums in Vail, Colorado, with a local real estate developer. The development is expected to cost $1 billion overall and, based on Disney’s estimate of the cashflows, generate $900 million in present value cash flows. Disney will have a 40% share of the joint venture (requiring it to put up $400 million of the initial investment and entitling it to 40% of the cashflows) but it will have the right to sell its share of the venture back to the developer for $300 million anytime over the next 5 years. (The project life is 25 years) a. If the standard deviation in real estate values in Vail is 30% and the riskless rate is 5%, estimate the value of the abandonment option to Disney. b. Would you advice Disney to enter into the joint venture? c. If you were advising the developer, how much would he need to generate in present value cashflows from the investment to make this a good investment? 4. Quality Wireless is considering making an investment in China. While it knows that the investment will cost $1 billion and generate only $800 million in cashflows (in present value terms), the proponents of expansion are arguing that the potential market is huge and that Quality should go ahead with its investment. a. Under what conditions will the expansion potential have option value? b. Assume now that there is an option value to expansion that exactly offsets the negative net present value on the initial investment. If the cost of the subsequent expansion in 5 years is $2.5 billion, what is your current estimate of the present value of the cash flows from expansion? (You can assume that the standard deviation in the present value of the cashflows is 25% and that the riskless rate is 6%.) 5. Reliable Machinery Inc. is considering expanding its operations in Thailand. The initial analysis of the projects yields the following results. The project is expected to generate $85 million in after-tax cash flows every year for the next 10 years. The initial investment in the project is expected to be $750 million. The cost of capital for the project is 12%. If the project generates much higher cash flows than anticipated, you will have the exclusive right for the next 10 years (from a manufacturing license) to expand operations into the rest of South East Asia. A current analysis suggests the following about the expansion opportunity. The expansion will cost $2 billion (in current dollars). The expansion is expected to generate $150 million in after tax cash flows each year for 15 years. There is substantial uncertainty about these cash flows and the standard deviation in the present value is 40%. The cost of capital for this investment is expected to be 12% as well. The riskfree rate is 6.5%. a. Estimate the net present value of the initial investment. b. Estimate the value of the expansion option. Equity in a Deeply Troubled Firm as an Option 1. Designate the following statements as true or false. a. Equity can be viewed as an option because equity investors have limited liability (limited to their equity investment in the firm). b. Equity investors will sometimes take bad projects (with negative net present value) because they can add to the value of the firm. c. Investing in a good project (with positive NPV) -- which is less risky than the average risk of the firm -- can negatively impact equity investors. d. The value of equity in a firm is an increasing function of the duration of the debt in the firm (i.e., equity will be more valuable in a firm with longer term debt than an otherwise similar firm with short term debt). e. In a merger in which two risky firms merge and do not borrow more money, equity can become less valuable because existing debt will become less risky. 2. XYZ Corporation has $500 million in zero-coupon debt outstanding, due in five years. The firm had earnings before interest and taxes of $40 million in the most recent year (the tax rate is 40%). These earnings are expected to grow 5% a year in perpetuity and the firm paid no dividends. The firm had a return on capital of 12% and a cost of capital of 10%. The annualized standard deviation in firm values of comparable firms is 12.5%. The five-year bond rate is 5%. a. Estimate the value of the firm. b. Estimate the value of equity, using an option pricing model. c. Estimate the market value of debt and the appropriate interest rate on the debt. 3. McCaw Cellular Communications reported earnings before interest and taxes of $850 million in 1993, with a depreciation allowance of $400 million and capital expenditures of $ 550 million in that year; the working capital requirements were negligible. The earnings before interest and taxes and net cap ex are expected to grow 20% a year for the next five years. The cost of capital is 10% and the return on capital is expected to 15% in perpetuity after year 5; the growth rate in perpetuity is 5%. The firm has $10 billion in debt outstanding with the following characteristics. Duration Debt 1 year $2 billion 2 years $4 billion 5 years $4 billion The annualized standard deviation in the firm's stock price is 35%, while the annualized standard deviation in the traded bonds is 15%. The correlation between stock and bond prices has been 0.5 and the average debt ratio over the last few years has been 60%. The three-year bond rate is 5% and the tax rate is 40%. a. Estimate the value of the firm. b. Estimate the value of the equity. c. The stock was trading at $60 and there were 210 million shares outstanding in January 1994. Estimate the implied standard deviation in firm value. d. Estimate the market value of the debt. 4. You have been asked to analyze the value of equity in a company that has the following features. The earnings before interest and taxes is $25 million and the corporate tax rate is 40%. The earnings are expected to grow 4% a year in perpetuity and the return on capital is 10%. The cost of capital of comparable firms is 9%. The firm has two types of debt outstanding - 2-year zero-coupon bonds with a face value of $250 million and bank debt with ten years to maturity with a face value of $250 million (The duration of this debt is 4 years.). The firm is in two businesses - food processing and auto repair – of equal size. The average standard deviation in firm value for firms in food processing is 25%, whereas the standard deviation for firms in auto repair is 40%. The correlation between the businesses is 0.5. The riskless rate is 7%. Use the option pricing model to value equity as an option. 5. You are valuing the equity in a firm with $800 million (face value) in debt with an average duration of 6 years and assets with an estimated value of $400 million. The standard deviation in asset value is 30%. With these inputs (and a riskless rate of 6%) we obtain the following values (approximately) for d1 and d2. d1 = - 0.15 d2 = - 0.90 Estimate the default spread (over and above the riskfree rate) that you would charge for the debt in this firm. Solutions to Option Pricing Problems Question 1 A. The values of the option parameters are as follows: S = $83 K = $85 t = 0.25 r = 3.80% Variance = 0.09 Value of call = $4.42 B. To replicate this call, you would have to: Buy 0.4919 Shares of Stock (this is N(d1) from the model) and Borrow K e-rt N(d2) = 85 exp-(0.038)(0.25) (0.4324) = $36.40 C. At an implied variance of 0.075, the call has a value of approximately $4.00 (the market price). Implied Standard Deviation = √0.075 = 0.2739 D. E. Value of Three-month Put = C - S + Ke-rt = $4.42 - $83 + 85 exp-(0.038)(0.25) = $5.62 Question 2 A. S = $28.75 K = $30 t = 0.25 r = 3.60% 2 = 0.04 PV of Expected Dividends = $0.28/(1.036)2/12 = $0.28 Value of Call = $0.64 B. The payment of a dividend reduces the expected stock price, and hence reduces the value of calls and increases the value of puts. Question 3 A. First value the three-month call, as above: Value of Call = $0.64 Then, value a call to the first (and only) dividend payment, S = $28.75 K = $30 t = 2/12 r = 3.60% 2 = 0.04 y = 0 (since it assumes exercise before the dividend payment) Value of Call = $0.51 Since the value of the three-month call is higher, there is no anticipated exercise. B. If the dividend payment is large enough, it may pay to exercise the call just before the ex-dividend day (before the stock price drops) rather than wait until expiration. This early exercise is more likely for call options: (a) the larger the dividend on the stock, and (b) the closer the option is to expiration. Question 4 A. You would need to borrow Ke-rt N(d2) = 90 exp(-0.04)(0.25) (0.4500) = $40.10 B. You would need to buy 0.575 shares of stock. Question 5 A. S= $4.00 K = $4.25 r = 5% t=1 Variance = 0.36 Value of Warrant = $0.93 B. Adjusted Stock Price = (Stock Price * Number of Shares Outstanding) + (Warrant price * Number of Warrants Outstanding)/(Number of Shares+Number of Warrants) = ($4.00 * 11,000,000 + $0.93 * 550,000)/(11,550,000) = $3.85 (To avoid the circular reasoning problem, the price from the no-dilution case is used.) Adjusted Exercise Price = $4.25 r = 5% t=1 Variance = 0.36 Value of Warrant = $0.80 (If you are using a spreadsheet with iterations turned on, and are feeding the option prices back to calculate the adjusted stock price, the value of the warrants is still $0.80.) C. Dilution increases the number of shares outstanding. For any given value of equity, each share is worth less. Question 6 A. S = 250 K = 275 t= 5 r = 5% 2 = (0.15)2 y = 0.03 Value of call = $29.09 B. Value of put with same parameters = $28.09 C. (1) The variance will be unchanged for the life of the option. This is likely to be violated because stock price variances do change substantially over time. (2) There will be no early exercise. This is reasonable and is unlikely to be violated. (3) Any deviations from the option value will be arbitraged away. While there are plenty of arbitrageurs eager to exploit deviations from true value, arbitraging an index is clearly more difficult to do than arbitraging an individual stock. Question 7 New Security = AT & T stock - Call (K=60) + Put (K=45) = $50 - $7.11 + $3.55 = $46.44 The call with a strike price of $60 is sold, eliminating upside potential above $60. The put with a strike price of $45 is bought, providing downside protection. Solutions: The Option to Delay Question 1 S = PV of $25 million a year for 20 years at 16% = $148.22 million K = Cost of Taking Project = $300 million t = 10 years Standard Deviation = 20% r = 12% y = Dividend Yield = 1/ Project Life = 10% Question 2 a. PV of Inflows = 400,000 * 0.85 * (1 - 1.04^25/1.07^25)/(.07 - .04) -400,000 * 0.40 * (1 - 1.03^25/1.07^25)/(.07 - .03) = $3,309,756 Fixed Costs associated with opening = -3,000,000 NPV = 3,309,756 -3,000,000 = $309,756 b. S = 3,309,756 K = 3,000,000 t = 25 r = 7% = 0.25 y = 1/25 = 4% Value of the Call Option = $828,674 c. The latter considers the option characteristics of owning the mine, i.e., that copper prices may go up, and that the mine-owner will be more likely to develop the mine at higher copper prices. Question 3 Current Value of Developed Reserve = 10,000,000 * ($20 - $6) = $140,000,000 Exercise Price = Cost of Developing Reserve = $120,000,000 t = 20 years r = 7% s = 20% y = 4% (Alternatively, you can use 1/20 or 5% as your cost of delay) Value of Call (Natural Resource Reserve) = $37,360,435 Question 4 a. NPV of Project = $250 - $200 = $50 million b. The option has the following characteristics: S = 250 K = 200 r = 8% t=5 Variance = 0.04 Dividend Yield = 12.5/250 = 5% Value of Call (Project Rights) = $68.68 c. The latter captures the value of delaying the project. The difference between the two values will increase as the variance in the project cash flows increases. Question 5 a. S = PV of Cash Inflows on Project = 250 K = Cost of Taking Project = 500 t = 10 years r = 6% s = 0.6 y = 10/250 = 4% Value of Call (Product Patent) = $95 million b. It is an increasing function of the variance in project cash flows. This analysis suggests that the rights to products in technologically volatile areas are likely to be worth a great deal, even though the products may not be viable now. Solutions to the Option to Expand Question 1 a. Net present value of the project = $ 30 - $ 40 = - $ 10 million b. Inputs S = Present Value of Net Revenues = $ 30 million K = Cost of televising the Olympics = $ 40 million t = Time until Olympics = 2 years r = Riskless rate = 5% Variance in value = 0.09 y = Cost of delay = 0 d1= -0.2302 N(d1) = 0.4090 d2 = -0.6545 N(d2) = 0.2564 Value of the Rights = 30 (0.409) - 40 exp (-0.05)(2) (.2564) = 2.99 c. Probability that rights will be profitable = 0.2564 - 0.4090 Question 2 a. S = Expected reinvestment needs as percent of firm value = 10% K = Reinvestment needs that can be met without excess debt capacity = 6% T = 1 year Standard deviation in reinvestment needs = 0.30 The option pricing value with these inputs is 4.32%. If we assume that the current excess returns (18% - 12%) continue in perpetuity, the value of flexibility is Value of flexibility (on an annual basis) = 4.32% * .06/.12 = 2.16% b. Based upon part a, would you recommend that Skates use its excess debt capacity? The value of flexibility exceeds what the firm would save by moving to its optimal (only 1%). The firm should not use its excess debt capacity. Question 3 a. Value of abandonment option S = PV of cashflows from development = $ 900 million* 0.4 = $ 360 million K = Abandonment value = $ 300 million T = 5 years Riskless rate = 5% Standard deviation = 40% Value of abandonment option = $ 63.51 million b. The net present value of this project to Disney is -$ 40 million. Net present value = -400 + 360 = -40 million The value of the abandonment option is greater than the negative net present value. I would advice Disney to make the investment. c. If you were the developer, you would need to make a net present value equal to at least $63.51 million to cover the cost of the abandonment option. PV of cash flows to developer = (63.51) + .6 (1000) = $ 663.51 million Question 4 a. For the expansion potential to have option value, Quality Wireless has to have exclusive rights to expand. b. Net present value of initial investment = - $ 200 million S = PV of cashflows from expansion (currently) = ? K = $2500 million T = 5 years Standard deviation in firm value = 25% Riskless rate = 5% Setting up the option value = $ 200 million and solving for S, we get S = $ 1511 million (Sorry. The only way to get there is by trial and error. An approximate answer would have been sufficient) Question 5 a. Net present value of initial investment = -750 + 85 (PV of annuity, 10 years, 12%) = - $269.73 million b. Value of expansion option S = 150 (PV of annuity, 12%, 15 years) = $1,021.63 million K = Cost of expansion = $ 2,000 million Riskless rate = 6.5% Standard deviation in value = 40% Life of the option = 10 years Value of expansion option = $ 477.28 million Solutions to Equity as an option in a deeply troubled firm Problem 1 a. True. Equity investors cannot lose more than their equity investment. b. False. They can make equity more valuable, not the firm. c. True. It transfers wealth to the bondholders. d. True. This is the equivalent of the life of the option. e. True. There is a transfer of wealth to bondholders. Problem 2 a. Reinvestment rate = g/ROC = 5%/12% = 41.67% Value of the firm = 40(1.05)(1-.5)(1-0.4)/(.10-.05) = $294 million b. The value of the equity is computed as a call option on the value of the firm, using the call option pricing formula, , where , d2 = d1 - t. S = $294 K = $500 t = 5 years r = 5% = 0.125 The equity or call option value can be written as 294 N(-0.8657) -500 e^-0.25 N(-1.1452). Since N(d1) = 0.1933; N(d2) = 0.1261, the option value is $7.75 million. Value of Call (Equity) = $7.75 million c. Value of Debt = $294 - $7.75 = $286.25 million Appropriate Interest Rate = (500/286.25)1/5 - 1 = 11.80% Problem 3 a. Value of firm Current free cashflow to firm = $ 850* (1-.4) – (550 – 400) = $ 700 million Year EBIT (1-t) Net cap ex FCFF PV 1 $612.00 $180.00 $432.00 $392.73 2 $734.40 $216.00 $518.40 $428.43 3 $881.28 $259.20 $622.08 $467.38 4 $1,057.54 $311.04 $746.50 $509.87 5 $1,269.04 $373.25 $895.80 $556.22 Terminal $1,332.50 $444.17 $888.33 I used a reinvestment rate of 33.33% (5/15) in the terminal year. Terminal value = 888.33/(.10-.05) = $ 17,766 Value of firm = 392.73 + 428.43 + 467.38 + 509.87 + 556.22 + 17766.60/1.15 = $13,386.28 million b. Value of equity as an option S = 13386.28 K = 10000.00 T = Weighted duration of debt = 3 years Riskless rate = 5% Variance in firm value = (.35)(.4)^2+(.15)(.6)^2+ 2 (.35)(.15)(.5)(.4)(.6) = .20 = 0.0403 Value of equity = $ 4958 million c. If the market value of equity = 30 * 210 = $ 6300 million Trial and error yields an implied standard deviation of 46.53%. d. Value of debt = Firm value – Value of equity = 13386 – 4958 = $8,428 million Problem 4 Value of firm = EBIT (1-t) (1- Reinvestment rate) (1+g)/(r – g) = 25 (1-.4) (1 – 4/10) (1.04)/(.09-.04) = $ 187.20 million Face value of debt = $ 250 + $ 250 = $ 500 million Average duration of debt = (2+4)/2 = 3 years Standard deviation in firm value = 0.252(.5)^2+0.42(.5)^2+ 2*.25*.4*.5*(.5)^2 = 28.39% Riskless rate = 7% Value of equity as an option = $ 3.30 million Problem 5 d1 = -0.15 =0.4404 d2= -0.90 =0.1841 N(d1) N(d2) Value of Equity = 400 (.4404) - 800 exp (-.06*6) (.1841) =$ 73.41 Value of Debt = 400 - 73.41= $ 326.59 Interest rate on debt = (800/326.59)^(1/6) - 1 = 16.08% Default spread on debt = 16.08% - 6% = 10.08% There are 99.4 million households in the United States. Each rating point represents 1% of roughly 994,000 households. [1]