Business Taxes - Mackenzie Chaffee's Portfolio

advertisement

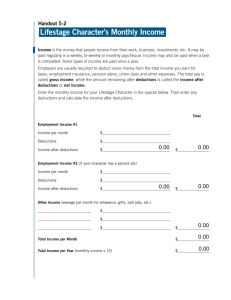

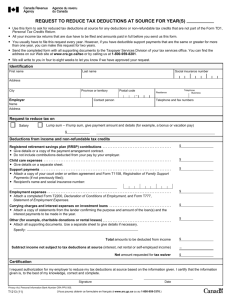

BUSINESS TAXES Types of Taxes, Deductions, & Different Choices Mackenzie Chaffee TYPES OF TAXES There are many types of taxes that accompany money making. The following are some of the common ones for most businesses. Some might seem familiar because you pay them as a worker, such as income tax, and sales tax. However, not all businesses will have the same list of taxes to pay, for reasons based on things such as workers and the type of business they are, be it a privately owned piazza shop or a franchise. TYPES OF TAXES • Federal Income Tax • This is distributed by national government on a business’s income annually. The federal income tax bracket is what informs you of the rate that the money you bring in will be taxes. It is only applied to your taxable income, which is a plus. • State/Local Income Tax • This tax is distributed based on annual income by state or local and is not given in all states. • Michigan has a flat rate on income tax of 4.25%. The local governments may add an additional 1%-2.5% on top of this, besides regular local taxes. • Payroll Tax • This includes, Medicare, Social Security, and FICA. It has the ability to withhold and/or pay for employees based on their salary. TYPES OF TAXES • Unemployment Tax • This is used to fund unemployment, as it’s name states. Employers pay these for employees based on FUTA, and they are required if the employees paid at least $1500 in wages during a calendar quarter. • Sales Tax • Sales tax is different in each state. In Michigan, it is 6%. It technically takes away from the businesses income because it causes consumers to buy less, because their totals increase with the tax significantly. TYPES OF TAXES • Foreign Tax • Income taxes paid to another country based on the income they earned. “In general, only income, war profits and excess profit taxes qualify for the credit.” • Value-Added Tax • This is collected at each stage of production/consumption of goods. The tax depends on the political climate. The weight of it is felt by the consumer, not the producer or distribution members, because it avoids double taxation this way. Double taxation is a tax placed on a tax. FUN FACT! Michigan was the first state that guaranteed a tax-paid high school education to each child. DEDUCTIONS There are certain ways to get around paying all sorts of money to the government on the money that you make. These are all legal, of course, and they allow you to save money so that you don’t pay a tax that can be covered in a tax deductions. DEDUCTIONS • Auto Expenses • Traveling for work can be deducted. This comes in the form of no taxes on the gas money you paid and it can be brought up to 57.5 cents per work mile driven that you receive tax free. • Capital Expenses • Starting a business can be considered a capital expense, and $5,000 can be deducted the first year and then the rest can be equally divided over the next 15 years. DEDUCTIONS • Interest • Using interest in this sense means that you are funding your business with personal proceeds or with credit is fully tax deductible. • Charity • Donating to charity is a tax deduction. Even giving it throughout your business is a tax deduction which goes through to you. DEDUCTIONS • Sponsoring and Advertising • These are both tax deductible, and it ranges from the goods it takes to produce yellow page ads to the paper and ink for business cards, and other countless utilities. Also, if the sponsoring is done through goodwill, it can be linked to your company, and this will increase the consumers rate, because goodwill appeals to people. SMALL BUSINESS DIFFERENCES There are many types of businesses that one can start and all have their advantages and disadvantages. These are a few of the most common ones. Some might be more suitable for some businesses rather than others, but it is up to the small business owner to decide which would be most beneficial for their particular business. DIFFERENCES • Partnerships • Partners do not need to be issued W-2 forms, as they are not employees. • These types of businesses do not pay income tax and pass income and losses to its partners. • In a partnership, each person contributes and shares losses and gains. They don’t pay taxes on the profits, bit it declares both losses and gains to the IRS. They also send in forms for each partner with their personal tax return. DIFFERENCES • LLC/LLP • In these, owners are called members. • When owned by one person, they can elect to be treated as otherwise (not an individual), but if they don’t, they are “disregarded as separate from its owner for income tax purposes”. DIFFERENCES • Corporations • “A corporation is recognized as a separate taxpaying entity for federal income tax purposes.” • If they make $10 million or more, at least 250 returns must be filled out. • These are the only type of businesses that pay income taxes on their profits. The others are taxed on their personal tax returns, while corporations do not. • If the owners work for the corporation, they pay income taxes on their salaries and bonuses like the other employees. However, salaries and bonuses are deductible, so they don’t pay a double tax. • Corporations sometimes feel the double tax. While they get tax deductions of start up, operating expenses, and other assets, they can be double taxed, which is not beneficial and can be harmful. DIFFERENCES • Sole Proprietorship • These are not the same as the sole owner of an LLC/LLP. • They must report all business income and losses on the say tax return as their personal, and it cannot be taxed sperately. SOURCES • http://www.investopedia.com/walkthrough/corporate-finance/2/taxes/types-taxes.aspx • http://www.nolo.com/legal-encyclopedia/top-tax-deductions-small-business-30176-2.html • http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/A-Z-Index-for-Business • http://www.efile.com/tax-service/tax-calculator/tax-brackets/ • http://www.efile.com/efile-michigan-income-tax-return-file-mi-state-taxes-forms-refund/ • http://www.irs.gov/Businesses/Foreign-Tax-Credit-1 • http://www.nolo.com/legal-encyclopedia/how-corporations-are-taxed-30157.html