Accumulated Depreciation Lesson

advertisement

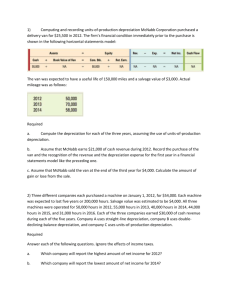

Math-in-CTE Lesson Plan Template Lesson Title: Accumulated Depreciation – The Straight Line Method Author(s): Phone Number(s): Richard Glueck 201-306-8618 Marc Foti 201-390-4527 Lesson # E-mail Address(es): rglueck@pcti.tec.nj.us mfoti@pcti.tec.nj.us Occupational Area: Business Education CTE Concept(s): Depreciation, Estimated Salvage Value, Estimated Useful Life. Math Concepts: Slope intercept formula, addition, subtraction, multiplication, division, and iteration. Lesson Objective: Calculate monthly and yearly depreciation expenses for machinery and equipment used for normal business operations. Supplies Needed: Projector, worksheets, calculators THE "7 ELEMENTS" 1. Introduce the CTE lesson. TEACHER NOTES (and answer key) Answers might include the car has been used, the car may be damaged, etc. Today we are going to learn to calculate depreciation expense for major equipment used by businesses during The students will pick various types of expensive equipment that the course of normal business operations. when resold will have to be sold at a reduced value due to usage, age, and remaining useful life. Why do you believe that a car that the original owner is trying to sell will not be resold at the original purchase The students will be able to use subtraction, multiplication, and price? division to find monthly depreciation and ultimately the total depreciation per year, and overall accumulated depreciation for the life of the equipment. 2. Assess students’ math awareness as it relates to the CTE lesson. If you bought a watch for $60 and wanted to sell it for $20, how much did the value go down by? $60(original cost) - $20(remaining value) = $40 reduction in the value of the watch. If you bought the watch for $60 and held it for two years, and you still want $20 for if after two years, how much ($60 - $20)/2 or $40/2 = $20 (decrease in value each year. value was lost each year. 3. Work through the math example embedded in the CTE lesson. Define the terms depreciation, original cost, salvage value, and estimated useful life. Depreciation is the loss of value of a piece of equipment due to the use of the equipment. The original cost is the original purchase price of the equipment. The salvage value is the estimated value a You purchased a BMW for $50,000. You expect the car to have a company expects to receive when they decide to sell the item. The salvage value of $5,000 estimated useful life is the number of years the piece of equipment is Step-by-step expected to be used. Write the formula for calculating annual depreciation. Express the formula as (Cost – Salvage Value)/Estimated useful life Calculate the yearly depreciation. Verify the remaining salvage value ($50,000 - $5,000)/10 = $4,500 annual depreciation. Total depreciation for 10 years on a car purchased on January 1st of the year current year $4,500 X 10 years = $45,000. $50,000 (Original Cost) - $45,000 (Accumulated depreciation) = $5,000 salvage value. 4. Work through related, contextual math-in-CTE examples. Solutions to worksheet element 4 Worksheet element 4 5. Work through traditional math examples. Solutions to worksheet element 5. Worksheet element 5 6. Students demonstrate their understanding. Worksheet element 6 Solution to worksheet element 6. 7. Formal assessment. Students should set the problem up as in elements 3, 4, and 6 Students will select an expensive piece of equipment of their own choosing (must be over $50,000). The students will choose their own salvage value with an “estimated useful life” of ten years. NOTES: