Choice of Business Entity for Tax Purposes

advertisement

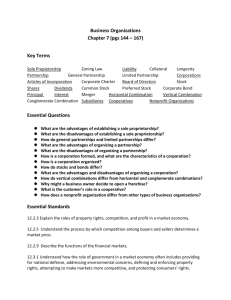

CHOICE OF A BUSINESS ENTITY FOR TAX PURPOSES For tax purposes there are three main business entity choices: sole proprietorship, partnership, and corporation. Do not confuse a State entity with a Federal Tax entity. A “Limited Liability Company” (LLC) is a State entity that may be taxed as either a Partnership, a Corporation, or even as a single person Sole Proprietorship. There are advantages and disadvantages to each. For most entrepreneurs, the easiest and usually most recommended form to begin with is that of a sole proprietorship. The sole proprietorship simply means one owner, and is the "default" form. If you do nothing else, you will be a sole proprietorship. The main feature of this form is that it is identified with and intertwined with you. If the business makes a profit, it automatically is income for you. If the business incurs a debt, it is your personal debt as well. If the business gets sued, you will be sued personally as well. This is both the strength and weakness of the sole proprietorship. You have complete flexibility, and can instantly shift the direction, policies and focus of your company. Yet, if there is a problem, the potential for the damage extending throughout your personal life is ever present. Next up is the Partnership. It is often likened to being married without being in love! It can destroy friendships, and you are completely liable for whatever your partner does. If he or she orders 5 thousand pet rocks, and then skips town with the money in your account, not only will you be out the money, but also you will be liable for paying for the pet rocks when they arrive. In spite of the above, Partnerships can work, when there is a clear division of responsibilities and abilities. If you are a good negotiator, salesperson and "people person," but your paperwork is usually a shambles, and your potential partner is meticulous and detail oriented, but fears selling and meeting strangers, the two of you might be a natural match. One other way partnerships benefit is to raise more capital. Your partner's contribution may be what you need to launch your business. The thing to do, if you do contemplate a partnership, is to have a clearly defined partnership agreement drawn up. Have it checked by a lawyer. The agreement should specify what happens if one of you decides to quit. What if either of you dies? Who will do what functions? How will decisions be made? What if you can't agree? Who will pay for what? These things all should be settled beforehand, before they have a chance to cause disruption in the business. Nothing kills a business faster than feuding partners do. The third form of business entity is the corporation. There are two main advantages to incorporating: 1. You can have people invest in your company and raise money. 2. Because the corporation exists legally as a separate entity, there is a liability shield between you and your assets and the business. If the company gets sued, you may not be. Company debts are separate from your own financial situation. There are two main types of corporation, the subchapter C and subchapter S. (They refer to subchapters of the tax code). The C Corporation is your "standard" corporation. All the companies listed on the stock exchange are C corporations. You can have unlimited shareholders. If you sell 100,000 shares at $10 each, you've got a million dollars in capital to work with. The investors can be people, mutual funds, companies, and foreigners. The disadvantage to the C Corporation is that of double taxation. If your business earns $100,000, the first thing that happens is that a corporate tax is paid. Then if you want to draw a salary (for in a corporation you are in fact an employee), you must declare that salary and pay personal income tax. The same money gets taxed twice before you get to spend any of it. Recognizing the unfairness of this to the small business, the S Corporation was formed. A very popular choice for a business entity is the SCorporation. S-Corporation income “flows through” similar to the Partnership and the net income is simply reported on the personal income tax returns of the shareholders. In exchange for this benefit, there are limits put on S corporation formation and ownership. Why should or shouldn't you incorporate? You should incorporate if you need the extra trademark and/or protection of your business name, if you have significant assets to protect, or if you are in a litigious type of business. Keep in mind that incorporating complicates your business operation as the corporation has much more formality to it then do partnerships or sole-proprietorships. It is suggested that you have a consultation with both an accountant and an attorney before making this decision. They will help you to understand all the ramifications of this decision, both operational and legal. The liability shield is particularly important when you have a lot of assets that would be vulnerable to business loss or lawsuit or if your business tends to be litigious in nature. If these situations do not exist for you, or not judged to be significant then you might be fine to cover your liability with business insurance. As is all matters regarding asset protection, be sure to seek competent advice. A popular form of business incorporation is the LLC, or Limited Liability Company. It combines many of the features of a partnership with those of a Corporation. It allows the reporting on personal income tax returns of the "members," but with the liability protection (generally speaking) of a corporation. It lacks many of the restrictions that apply to Corporations and has the much desired flexibility of the partnership. LLC’s with more than one member can choose to be taxed as either a partnership or an S Corporation. There is also an LLC for sole-proprietors know as the single member LLC. See articles on: S-Corp Insurance Deductions Officers of S-Corps wage compensation Health insurance for the self-employed For further information: Richard Garner 623-500-2654