Figure 5.1. Shifting From an Industry Focus to a Resource Focus

advertisement

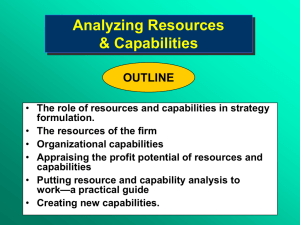

Analyzing Resources & Capabilities OUTLINE • The role of resources and capabilities in strategy formulation. • The resources of the firm • Organizational capabilities • Appraising the profit potential of resources and capabilities • Creating new capabilities. Rationale for the Resource-based Approach to Strategy • When the external environment is subject to rapid change, internal resources and capabilities offer a more secure basis for strategy than market focus. • Resources and capabilities are the primary sources of profitability The Evolution of Honda Motor Company 50cc 2-cycle engine Founding of Honda motor company 1948 1950 First product: clip-on engine for bicycles 405cc motor cycle 4 cycle engines 1955 Related products: ground tillers, marine engines, generators, pumps, chainsaws 1960 The 50cc super -cub 1965 1970 N360 mini car 1975 1980 1000cc Goldwing touring motor cycle 1985 1990 Acura Car division 1995 Canon: Products and Core Technical Capabilities Precision Mechanics Fine Optics 35mm SLR camera Plain-paper copier Compact fashion camera Color copier EOS autofocus camera Color laser copier Digital camera Basic fax Laser copier Video still camera Laser fax Mask aligners Inkjet printer Excimer laser aligners Laser printer Color video printer Stepper aligners Calculator Notebook computer MicroElectronics Evolution of Capabilities and Products: 3M Carborundum mining PRODUCTS Road signs Videotape & markings Floppy disks & Scotchtape Audio tape data storage products Acetate Post-it notes film Housewares/kitchen products Surgical tapes & dressings Pharmaceuticals Sandpaper Materials sciences Flexible circuitry Microreplication Health sciences CAPABILITIES Abrasives Adhesives Thin-film technologies New-product development & introduction The Links between Resources, Capabilities and Competitive Advantage COMPETITIVE ADVANTAGE INDUSTRY KEY SUCCESS FACTORS STRATEGY ORGANIZATIONAL CAPABILITIES RESOURCES TANGIBLE INTANGIBLE •Financial •Physical •Technology •Reputation •Culture HUMAN •Skills/know-how •Capacity for communication & collaboration •Motivation Appraising Resources RESOURCE Tangible Resources CHARACTERISTICS Financial Borrowing capacity Internal funds/ generation Physical Plant and equipment: size, location, technology flexibility. Land and buildings. Raw materials. Debt/ Equity ratio Credit rating Net cash flow Market value of fixed assets. Scale of plants Alternatives for fixed assets Technology Patents, copyrights, know how R&D facilities. Technical and scientific employees No. of patents owned. Royalty income R&D expenditure. R&D staff Reputation Brands. Customer loyalty. Company reputation (with suppliers, customers, government) Brand equity. Product price premium. Recognition. Training, experience, adaptability, commitment and loyability of customers Employee qualifications, pay rates, turnover. Intangible Resources Human Resources INDICATORS Firms with the Highest Ratios of Market Value to Book Value Juniper Networks Oracle (US) TIM (Italy) Broadcom Nokia (Finland) Yahoo (US) Cisco Systems (US) America Online (US) US West (US) Glaxo Wellcome (UK) Sun Microsystems (US) Charles Schwab (US) L.M. Ericsson (Sweden) Warner Lambert (US) EMC (US) Amgen (US) Dell Computer (US) Colegate Palmolive (US) SmithKline Beecham (US) SAP (Germany) Pfizer (US) Eli Lilly (US) Sprint PCS Group Softbank (Japan) 58.5 56.2 45.0 42.6 42.0 41.3 31.9 34.0 28.9 25.4 24.4 24.2 24.1 23.0 21.5 21.4 21.0 20.8 20.6 19.4 19.4 18.8 18.3 18.2 Computer software and services Computer software and services Telecommunications Computer software and services Telecom equipment Computer software and services Telecom equipment Telecommunications Telecommunications Drugs Computers Financial services Telecom equipment Drugs Electronics Source: Business Drugs Week, July 2000 Computers Personal care products Drugs Computer software and services Drugs Drugs Telecommunications Computer software and services The World’s Most Valuable Brands, 2000 Rank Company 1 2 3 4 5 6 7 Coca-Cola Microsoft IBM Intel Nokia Genera Electric Ford Brand value ($bn.) 72.5 70.2 53.2 39.0 38.5 38.1 36.4 Rank 8 9 10 11 12 13 14 Company Brand value ($bn.) Disney McDonald’s AT&T Marlboro Mercedes Hewlett-Packard Cisco Systems 33.6 27.9 25.5 22.1 21.1 20.6 20.0 Source: Interbrand Identifying Organizational Capabilities : Functional Approach FUNCTION Corporate Management CAPABILITY Financial management Strategic Control Coordinating decentralized business units Managing Acquisitions EXEMPLARS Exxon, Coca Cola General Electric, Emerson Electric, GE ABB, Shell Nationsbank, ConAgra MIS Speed and responsiveness through rapid information transfer American Airlines LL Bean R&D Research capability Development of innovative new products Merck, AT&T Sony, 3M Manufacturing Efficient volume manufacturing Continuous Improvement Flexibility Briggs & Stratton Nucor, Motorola Benetton Design Marketing Design Capability Brand Management Sales & Distribution Promoting reputation Responsiveness to market trends Sales Responsiveness Efficiency and speed of distribution Customer Service Apple, Swatch, Proctor & Gamble, PepsiCo American Express The Gap Microsoft, Glaxo Federal Express Walt Disney The Porter Value Chain FIRM INFRASTRUCTURE SUPPORT ACTIVITIES HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT INBOUND LOGISTICS OPERATIONS OUTBOUND MARKETING LOGISTICS & SALES SERVICE PRIMARY ACTIVITIES A Hierarchy of Capabilities: A Telecom Manufacturer New product development capability Customer support capability operations capability R & D and design capability MIS capability Marketing and sales capability Human resource mgt. capability Manufacturing capability Materials management capability Process engineering capability Product engineering capability Test engineering capability SPECIALIZED CAPABILITIES (Manufacturing related only) Printed circuit-board assembly Telset assembly System assembly SINGLE-TASK CAPABILITIES (Only those related to PCB assembly) Automated through-hole component insertion Manual insertion of components CROSS FUNCTIONAL CAPABILITIES BROAD FUNCTIONAL CAPABILITIES ACTIVITY RELATED CAPABILITIES (Operations related only) Quality management capability Surface mounting of components Wave soldering INDIVIDUALS’ SPECIALIZED KNOWLEDGE The Rent-Earning Potential of Resources and Capabilities THE EXTENT OF THE COMPETITIVE ADVANTAGE ESTABLISHED THE PROFIT EARNING POTENTIAL OF A RESOURCE OR CAPABILITY Scarcity Relevance Durability SUSTAINABILITY OF THE COMPETITIVE ADVANTAGE Mobility Replicability Property rights APPROPRIABILITY Relative bargaining power Embeddedness of resources Appraising VW’s Resources and Capabilities 10 Superfluous Strengths Key Strengths Relative 5 Strength Zone of Irrelevance 1 1 Key Weaknesses 5 Strategic Importance 10 Appraising the Capabilities of a Business School (illustrative only) Superfluous strengths Relative Strength Superior Key strengths 6 9 3 5 Parity 2 Inconsequential weaknesses 8 4 12 11 Deficient 10 7 Not important 1 Key weaknesses Critically important Importance C1 Alumni relations C2 Student placement C3 Teaching C4.Administration C5 Course devlpmnt C6 Student recruitment C7 Research C8 Corporate relations C9 Marketing C10 IT C11 PR C12 HRM Amoco’s Appraisal of Organizational Capabilities (illustrative only) Superfluous strengths Superior Key weaknesses 6 9 4 Performance 5 Parity 2 Inconsequential weaknesses 11 3 1 10 Deficient Not important 7 1 Needed to play Importance 8 Key strengths Needed to win 1. Effective deal making 2. Rapid new product development 3. Relentless cost forms 4. Product quality 5. JV management 6. Superior EH&S management 7. Managing culturally diverse workforce 8. Fast decision making 9. Customer segmentation 10.Capture synergies across divisions 11. Effective procurement Distinctive Capabilities as a Consequence of Childhood Experiences Company Capability Past History Exxon Financial management Exxon’s predecessor, Standard Oil (NJ) was the holding co. for Rockefeller’s Standard Oil Trust RD/ Shell Coordinating decentralized global empire Shell a j-v formed from Shell T&T founded to sell Russian oil in China, and Royal Dutch founded to exploit Indonesian reserves BP “Elephant hunting” Discovered huge Persian reserves, went on to find Forties Field and Prudhoe Bay ENI Deal making in politicized environments The Enrico Mattei legacy; the challenge of managing government relations in post-war Italy Mobil Lubricants Vacuum Oil Co. founded in 1866 to supply patented petroleum lubricants 2 Approaches to Capability Development 1) Linking strategy to Human Resource Management--developing individual competencies 2) Greenfield development in separate organizational unit (IBM & the PC, Xerox & PARC, GM & Saturn) 3) Product sequencing (Intel , Sony, Hyundai) 4) Change management to transform values and behaviors (GE, BP) Product Sequencing to Build Capabilities: Hyundai Capabilities •Assembly •Production engineering •Local marketing SKD CKD Ford Cortina Products 1968 •Auto styling &design •Casting & forging •Chassis design •Tooling •Body production •Export mktg. Pony 1970 •Hydrodynamics •Thermodynamics •Fuel engineering •Emission control •FWD •Lubrication engineering •Kinetics& vibration •CAD/CAM •Ceramics •Assembly •Electronic control control systems systems •Large-scale •Advanced design integration component •Global logistics handling •Lifecycle engineering Excel 1974 ‘Alpha’ engine 1985 Accent Avante Sonanta 1994-95 Summary: A Framework for Analyzing Resources and Capabilities 4. Develop strategy implications: (a) In relation to strengths--How can these be exploited more effectively and fully? (b) In relation to weaknesses --Identify opportunities to outsourcing activities that can be better performed by other organizations. --How can weaknesses be corrected through acquiring and developing resources and capabilities? 3. Appraise the firm’s resources and capabilities in terms of: (a) strategic importance (b) relative strength 2. Explore the linkages between resources and capabilities 1. Identify the firm’s resources and capabilities STRATEGY POTENTIAL FOR SUSTAINABLE COMPETITIVE ADVANTAGE CAPABILITIES RESOURCES Knowledge Management and the Knowledge-based View of the Firm OUTLINE 1) Why the surge of interest in knowledge management (KM)? --kn. as the key resource of the firm --giving us a better understanding of management 2) What is KM? 3) What progress have we made, what are the key gaps, which areas are likely to add most value? 4) Developing strategy: Exploiting strengths, protecting and eliminating weaknesses 5) Building the capability base: Can it be done? How? 6) What can be learn from Knowledge Management? 7) Implications for organizational structure. Knowledge Processes within the Organization Knowledge Creation Knowledge Generation (“Exploration”) • Training Knowledge Acquisition Knowledge Integration Knowledge Sharing Knowledge Application (“Exploitation”) • Research Knowledge Replication Knowledge Storage & Organization • Recruitment • Intellectual property licensing • Benchmarking • New product development • Operations • Strategic planning • Communities of practice • Best practices transfer • On-the-job training • Databases • Standard operating practices Knowledge Measurement • Intellectual capital accounting • Competency modeling Knowledge Identification • Project reviews • Competency modeling Nonaka’s Knowledge Conversion Matrix Tacit Knowledge Tacit Knowledge TO SOCIALIZATION Sharing of tacit knowledge among individuals and from the organization to the individual Explicit Knowledge EXTERNALIZATION The articulation and systematization of tacit into explicit knowledge. Use of metaphor to communicate tacit concepts FROM Explicit Knowledge INTERNALIZATION Instructions and principles are converted into intuition and routines COMBINATION A key role of information systems is to combine different units of information and other forms of explicit knowledge What is Knowledge Management? IT On-thejob Training Research Courses & Seminars Benchmarkin g New Product Development Communications Strategic Alliances Intellectual Capital Accounting Intellectual Property Protection Customer & Market Analysis Scenario TQM Analysis Best Practice Transfer Definition: “The systematic leveraging of information and expertise to improve organizational innovation, responsiveness, productivity and competency.” (Lotus division of IBM) Knowledge Types and Knowledge Conversion Levels of knowledge Individual Explicit Types of Knowledge Tacit Information Facts Scientific kn. Organization Databases Systems & procedures Intellectual property ‘INDUSTRIAL’ ENTERPRISES CRAFT ENTERPRISES Skills Organizational capabilities Knowledge Transfer Mechanisms D I S S E M I N A T I O N B R E A D T H M a n y Rules, procedures & directives Modular integration Manuals & reports Communities Communities -of-interest -of-practice F e w E-mail Group -ware Internal consultants Personnel transfer Shared data bases Training seminars Video & conferencing courses Meetings On-the job training Informal visits Data exchange Fax Telephone Low (know-how & contextual kn..) ABILITY TO CODIFY High (explicit kn.. & information Designing a Knowledge Management System • What kn. processes which are critical to creating value & competitive advantage? --Dow: creating and exploiting patents --McKinsey & Co.: sharing kn. & retaining experienced consultants --Andersen Consulting: systematization.) • What are the characteristics of the relevant kn.? • What mechanisms are needed for the generation and application of the relevant kn.? • What organizational conditions need to be in place in order for knowledge management mechanisms to work? ---Organizational structures ---Incentives to contributors and users ---Behavioral norms and values