Millionaire Secrets Can Help All Families

advertisement

Money Management

Secrets of Millionaires…

Presented by:

Jennifer Caravella

UW-Extension

Waushara County

Taken and adapted from the work of:

Dr. Thomas J. Stanley and William D. Danko

authors of “The Millionaire Next Door:

The Surprising Secrets of America’s

Wealthy”

1

Money Secrets of Millionaires…

This presentation is based on findings in the

book,

“The Millionaire Next Door: Surprising

Secrets of America’s Wealthy”

Authors: Drs. Thomas J. Stanley

and William D. Danko

Book is based on their research

of American millionaires since 1973

2

Thomas J. Stanley, PhD.

Dr. Stanley, is an author,

lecturer, and researcher who

has studied the affluent since

1973.

He is the author of numerous

best-selling books about affluence.

Dr. Stanley was formerly a professor of

marketing at Georgia State University

3

William D. Danko, Ph.D.

Dr. Danko is associate professor

at the University at Albany,

State University of New York.

Author of numerous

publications in leading academic journals.

In 1973, Dr. Danko assisted Thomas J.

Stanley with his first study of the affluent.

Since then, he has collaborated with

Dr. Stanley on numerous academic and

consulting studies.

4

***Presentation Disclaimer

Viewing one PowerPoint Presentation will not

cause a person or persons to become

“wealthy”

Adapting some or many of the daily strategies

self-made millionaires practice will likely lead

to increased

family financial security.

5

***Presentation Disclaimer (cont.)

*Financial security refers to a families’ ability to

meet ongoing economic needs and prepare for the

planned and unplanned future (like the death of a

spouse/job loss/illness)

Definition by Michael Gutter, Family Financial

Management Specialist, University of Florida.

6

Money Secrets of Millionaires…

Trivia question…..

If you want to be financially secure, who should

you “hang around” with?

a. Individuals who always seem to have

money to spend on “fun” things and places.

b. Individuals who drive really expensive

cars and live in big houses?

c. Individuals who keep track of what they

buy and always spend less than they earn.

7

Definition of wealth…

Webster defines wealth as:

“having an abundance of

material possessions.”

**The problem with this definition is that

many who display high consumption

lifestyles (with lots of material

possessions) have low net worth.

8

Drs. Stanley and Danko’s definition

of wealth…

1.) Individual has at least a million dollars in

net worth (assets – liabilities = net worth)

The authors argue that this level of wealth can be

attained in one generation.

2.) Not someone who earns a million dollars

annually and spends the entire amount

9

America’s wealthy…

7% of U.S. households have a net worth more

than $1,000,000

2007 data from William D. Danko survey

10

Assets – Liabilities = Net Worth

Assets

Savings Acct

500.00

Equity in home 40,000.00

Paid off car value 2,500.00

Retirement Acct. 40,000.00

Total Assets

83,000.00

House loan

30,000.00

Credit card

1,000.00

Total Liabilities 31,000.00

{

Liabilities

{

83,000 – 31,000 = [52,000.00 Net Worth]

11

Are you wealthy?

Stanley and Danko’s formula for determining

wealth:

Multiply your age times your realized pretax annual household income from all

sources except inheritances. Divide by

ten. This, less any inherited wealth is what

your net worth should be.

Example: 40yrs x $20,000 = 800,000

10 800000 = $80,000.00 in Net Worth

12

Assets – Liabilities = Net Worth

Assets

Savings Acct

500.00

Equity in home 40,000.00

Paid off car value 2,500.00

Retirement Acct. 40,000.00

Total Assets

83,000.00

House loan

30,000.00

Credit card

1,000.00

Total Liabilities 31,000.00

{

Liabilities

{

83,000 – 31,000 = [52,000.00 Net Worth]

13

“Millionaire Next Door”….

(Research from the book)

14

Research for

“The Millionaire Next Door”

Compilation of more than 30 years of

research of America’s wealthy

Personal interviews and focus group studies

with more than 500 millionaires

Surveys of more than 11,000 high-net worth

and/or high income respondents

Hundreds of hours analyzing in-depth

interviews with self-made millionaires

Interviews with millionaire’s financial advisors

15

American Millionaires…

Are male, average age of 57 years

Married with three children

About one in five is retired

About two-thirds are self-employed

Earn 70 percent or more of their

household’s income

16

American Millionaires…

Most consider themselves entrepreneurs

Types of businesses: welding contractors,

auctioneers, owners of mobile home parks, pest

controllers, coin & stamp dealers, paving contractors,

rice farmers

About half of their wives do not

work outside of the home

Annual taxable income of $131,000

(median) while average income is $247,000

(1994 data)

17

American Millionaires…

Live in older homes (30+ years)

Live in homes with an average cost of

($320,000) about 30% of $1 million

About half lived there for 20+ years

Most are still in their first marriage

Drive American made cars

18

American Millionaires…

Only 20% acquired their wealth through

an inheritance

80% built their wealth in a single

generation

Most have wives who are

planners and budgeters

Most have accumulated enough wealth

to live without working for ten or more

years

19

American Millionaires…

They are 6.5 times wealthier than their non-

millionaire neighbors

Fairly well educated… 4 out of 5 is college

educated…most hold advanced degrees

Most attended public schools, but 55% of

their children attend private schools

Spend heavily for education for their children

Buy high quality goods, not necessarily the

most expensive

20

American Millionaires…

Are frugal, frugal and frugal!

Have discipline!

Save, save, save

Live well beneath their means

Work between 45 and 55 hours per

week

Invest nearly 20% of their realized

household income

21

American Millionaires…

Recommend their children become

attorneys, accountants or others who

provide services to the wealthy

Believe that financial independence is

more important than displaying high

social status

Track how much they spend

22

American Millionaires…

Became wealthy by budgeting and

controlling expenses (and they maintain

their affluent status the same way)

Get professional financial advice

Review their receipts for errors before

leaving a store

23

American Millionaires…

Develop and use a personal

financial plan

Have a diversified portfolio of

investments

Spend an average of $267 on a

watch and less than $600 on their

most expensive suit

24

American Millionaires…

Spend considerable time learning about

their investments and hold on to them

for at least six years

Often use last year’s household

budgets to plan next year’s budget

Buy used cars (Most NEVER paid more than

$30,000 for a vehicle)

25

American Millionaires…

Are proficient in targeting market

opportunities

Chose the right occupation

Are very likely to frequently “clip

coupons”

Avoid debt especially credit card debt

26

American Millionaires…

Engage in comparison shopping before

making a significant purchase

May not produce millionaire offspring

Understand the difference between

“needs” and a “wants”

Understand the difference between a

“liability” and an “asset”

27

Millionaires Do Not…

Look like media’s portrait of a millionaire

Engage in

“recreational shopping”

Spend all of what they earn

Let their incomes define their budgets

28

Millionaires Do Not…

Live lavishly and spend extravagantly

Hyper-consume

Let society or advertising influence their

spending decisions

Provide economic outpatient care to

their adult children

29

Summarizing quote…

“The foundation stone of wealth

accumulation is defense, and this

defense should be anchored by

budgeting and planning.”

30

Are you “Millionaire Material?”

Building wealth takes discipline,

sacrifice and hard work!

For most individuals this would mean

re-orienting one’s current lifestyle

31

Tracking expenses is critical…

Tools for tracking expenses:

Note book

Checkbook register

On-line banking

Computer programs like Quicken, Quick

Books, or Excel

Billster: Free, on-line tool for organizing

shared and personal expenses

myspendingplan.com: Free Internet-based

budgeting program

32

Let’s look at Lynne’s Day-to-Day

expenses…

What expenses do

you feel Lynne HAD

to have?

Which expenses

could Lynne have gone

without?

http://www.dallasfed.org/ca/wealth/index.cfm

33

34

35

Using a spending plan is critical…

Spending plans (aka “budgets”), help

people control, monitor and plan for

expenses.

36

Sample spending plans

And other resources

like:

1. Fact sheets,

2. Short lessons

3. Activities on a

variety of financial

topics

37

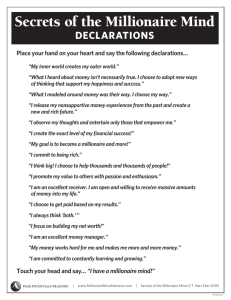

Personal beliefs about money…

Most spending decisions are

based on personal values & beliefs

about money.

Understanding our beliefs helps us

control our spending.

38

Discussion questions…

Can you think of how you might

apply some of this information to your

own personal finances?

39

Discussion questions…

How might you share some of this

information with family or friends?

40