Basic Real Estate Appraisal, 9e e_PowerPoint

advertisement

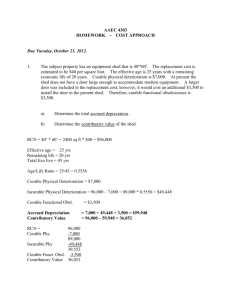

Chapter 12 ESTIMATING LOSS IN VALUE: ACCRUED DEPRECIATION Basic Real Estate Appraisal: Principles & Procedures – 9th Edition © 2015 OnCourse Learning STUDENT LEARNING OUTCOMES • Distinguish the Concept of Depreciation as it is used in Accounting from that used in Appraisal • Name and give the Causes of Three Types of Depreciation • Name Four Methods of Estimating Accrued Depreciation and Describe How they may be applied to a Valuation Problem © 2015 OnCourse Learning Page 376 2 12.1 DEPRECIATION DEFINED Depreciation Used In Accounting • In Accounting Practice – All Capital Assets except Land are considered Wasting Assets – Assets that Decline in Value over Time • Book Value – Original Cost or Cost Basis • Depreciation is a Deduction from Cost Basis • Depreciation as allowed by Laws (IRS) or Declining Cost Basis – Not Related to Value © 2015 OnCourse Learning Page 377 3 DEPRECIATION DEFINED (Con’t.) Page 378 Accrued Depreciation In Appraisals • Estimate of accrued depreciation in appraisal, is deducted from the estimated cost of the improvements as if new on the date of value, rather than from their historical cost basis • Accrued Depreciation represents the appraiser’s estimate of the market loss in value as compared to a new building – also referred to as Diminished Utility 4 © 2015 OnCourse Learning PURPOSE OF DEPRECIATION ESTIMATES Page 379 • Applied as a Deduction from Cost New on the Date of Value to Indicate the Depreciated Improvement Value • When Replacement Costs are Used, estimate does not include any Loss of Utility (i.e. Functional Obsolescence) • Accrued Depreciation Estimates can also be used in other approaches to value, not just the Cost Approach 5 © 2015 OnCourse Learning USE OF DEPRECIATION IN APPRAISALS Page 379 6 © 2015 OnCourse Learning 12.2 TYPES & CAUSES OF DEPRECIATION Page 380 • Physical Deterioration • Functional Obsolescence • External (Economic) Obsolescence Detailed on slides that follow © 2015 OnCourse Learning 7 CURABLE VS. INCURABLE DEPRECIATION Page 380 Curable… • if the cost to correct (cost-to-cure) the condition or defect is less than the amount of value restored. For example, items of Deferred Maintenance Incurable… • if the cost to correct the condition or defect is greater than the amount of value restored © 2015 OnCourse Learning 8 TYPES OF ACCRUED DEPRECIATION Page 381 Physical Deterioration • Reflects Age, Use, Level of Maintenance • Often caused by Deferred Maintenance Functional Obsolescence • Reflects Loss of Utility caused by faulty building design and/or floor plan • Over-improvement or Under-improvement Economic (or External) Obsolescence • Caused by factors outside the boundaries of the subject property itself © 2015 OnCourse Learning 9 12.4 METHODS OF MEASURING ACCRUED DEPRECIATION Page 385 Four Methods • • • • Straight-Line or Age-Life Method Sales Data (Market) Method Cost-to-Cure (Observed Condition) Capitalized Income (or Rent Loss) Detailed on slides that follow © 2015 OnCourse Learning 10 STRAIGHT-LINE OR AGE-LIFE METHOD Page 385 • Predicated on all Structures having a Total Useful Life or Economic Life… • the period over which improvements contribute to property value • Economic Life is often shorter than the Physical Life of a Structure; whereby “most buildings are torn down before they fall down” • For a 25 year-old building with an Economic Life Expectancy of 100 years, accrued depreciation is… 25 ÷ 100 = 0.25, or 25% 11 © 2015 OnCourse Learning SALES DATA (OR MARKET) METHOD Page 387 • Based on the Principle that Value Loss is determined by the Market… 12 © 2015 OnCourse Learning Page 390 COST-TO-CURE METHOD • Measures accrued depreciation by the cost to cure or repair any observed building defects (i.e. Observed Condition) • After inspection, the appraiser identifies each building defect, feature, or condition that reduces value • Classified as physical, functional, or economic (external) • Each must be determined to be either economically curable or incurable. © 2015 OnCourse Learning 13 COST-TO-CURE METHOD (Con’t.) Page 390 Physical Deterioration • Deferred Maintenance - Curable • Deferred Maintenance - Incurable • Short-Lived Items • Long-Lived Items 14 © 2015 OnCourse Learning COST-TO-CURE METHOD (Con’t.) Page 390 Functional Obsolescence • Curable – An Addition • Curable – A Replacement or Substitution • Curable – Super-Adequacy or OverImprovement • Incurable – A Deficiency • Incurable – An Over-Improvement 15 © 2015 OnCourse Learning CAPITALIZED INCOME METHOD Page 397 • Also referred to the Rental Loss Method • Used to Estimate either the Total Loss in Value from All Causes, or a Single Cause • Compares the Rent for the Subject as it exists on the Date of Value to the Rent of a New or Modern building that could take its place 16 © 2015 OnCourse Learning 12.4 COST APPROACH SUMMARY Page 399 17 © 2015 OnCourse Learning COST APPROACH SUMMARY (Con’t.) Page 400 18 © 2015 OnCourse Learning Page 401 CHAPTER SUMMARY Accrued depreciation for appraisal purposes is the estimated loss in market value of the improvements, when compared to their replacement or reproduction cost on the date of value. This value loss can be caused by physical deterioration, functional obsolescence, and/or economic obsolescence. Causes can be categorized as economically curable or incurable. © 2015 OnCourse Learning 19 CHAPTER SUMMARY (Con’t.) Page 401 Many types of physical deterioration, such as deferred maintenance, are curable by painting, fixing up, or doing repair work. Accrued depreciation may be estimated by the Straight-line/Age-Life Method, the Sales Data Method, the Cost-to-Cure/Observed Condition Method, or the Capitalized Income/Rent Loss Method. 20 © 2015 OnCourse Learning IMPORTANT TERMS & CONCEPTS Accrued Depreciation Economic Obsolescence Age-Life Method Effective Age Book Value External Obsolescence Capitalized Income Method Functional Obsolescence Cost Basis Loss of Utility Cost-to-Cure Method Misplaced Improvement Curable Depreciation Over-Improvement Current-Value Accounting Physical Deterioration Deferred Maintenance Rental Loss Method Depreciation in Accounting Sales Data Method Depreciation in Appraisal Straight-Line Method Economic Life Under-Improvement Page 402 21 © 2015 OnCourse Learning