Empirical Evidence : CAPM and APT

advertisement

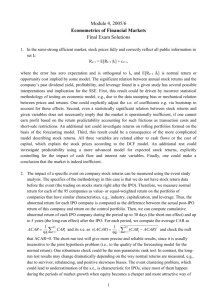

LECTURE 9 : EMPRICIAL EVIDENCE : CAPM AND APT (Asset Pricing and Portfolio Theory) Contents How can the CAPM be tested – by using time series approach – by using cross sectional approach Fama and MacBeth (1973) approach CAPM : Time Series Tests (ERi – rf )t = ai + bi(ERm – rf )t + eit Null hypothesis : ai = 0 Assume individual returns are iid, but allow contemporaneous correlation across assets : E(eit, ejt) ≠ 0 Estimation : maximum likelihood using panel data (N assets, T time periods) Early studies in the 1970s find ai = 0, but later studies find the opposite. CAPM : Cross-Section Tests Useing the Security Market Line (SML) Hypothesis : average returns (in a cross section of stocks) depend linearly (and solely) on asset betas Problems : – Individual stock returns are so volatile that one cannot reject the null hypothesis that average returns across different stocks are the same (s ≈ 30 – 80% p.a., hence cannot reject the null that average returns across different stocks are the same.) – Betas are measured with errors (to overcome these problems form portfolios) CAPM : Cross-Section Tests (Cont.) Two Stage procedure 1st stage : Time series regression, estimation of betas (ERi – rf )t = ai + bi(ERm – rf )t + eit (Time series regression has to be repeated for each fund, using ‘say’ 60 observations.) 2nd stage : ERi = l0 + l1 bhati + ui Cochane (2001) Testing the CAPM Sort all stocks on the NYSE into 10 portfolios on basis of size, plus 2 bond portfolios 1st stage : Estimating the betas for each of the 12 portfolios using time series data 2nd stage : sample average returns regressed against the 12 estimated betas CAPM seems to do a reasonable ‘job’. (but if sorted by book to market value, decile returns are not explained by market beta). Results : see graph on next slide Mean excess return (%) Size-Sorted Value-Weighted Decile Portfolio (NYSE – from 1947) 14 OLS cross-section regression Smallest firm decile 10 A 6 CAPM prediction = line fitted through NYSE value weighted return at A Corporate Bonds Gov. bonds 2 0 -2 0 0.2 0.4 0.6 0.8 1.0 1.2 Market Betas, bi,m 1.4 Fama and MacBeth (1973) Fama and MacBeth Rolling Regression Much used regression methodology that involves ‘rolling’ cross-sectional regressions Suppose – N stock returns for any single month – T months 1st stage : For each months (t) estimate : (simplified equation) R(t)i = a(t) + g(t)bi + d(t)Zi + e(t)i (For any month H0 : a(t) = d(t) = 0 and g(t) > 0) Will get T a’s, g’s, d’s Fama and MacBeth Rolling Regression (Cont.) 2nd stage : Testing the time series properties of the parameters to see if a E(a(t)) = 0 and g E(g(t)) > 0 If returns are niid, the following test can be conducted which is t-distributed gˆ t gˆ j sgˆ j / n where s(.) is the standard deviation of the monthly estimates and is are the number of months. Data and Model The data – Sample period : 1934 – June 1968, monthly data – NYSE common stock The model R(t)i = g0(t) + g1(t) bi + g2(t) bi2 + g3(t)si + e(t)i where s = measure of risk of security i not related to bi (e.g. Rit = ai + biRmt + eit with si = SD(eit)) Hypotheses Tested Hyp. 1 : Linearity E(g2(t)) = 0 Hyp. 2 : No systematic effects of non-beta risk E(g3(t)) = 0 Hyp. 3 : Positive return-risk trade off E(g1(t)) = [ERm(t) – ER0(t)] > 0 Main Results Coefficient and residuals from Risk and return regression are consistent with “efficient capital markets”. On average, positive trade off between risk and return (g1 (Hypothesis 3) is positive and statistically significant for the whole sample period.) Roll’s Critique Roll (1977) shows that for any portfolio that is efficient ex-post, in sample of data there is an exact relationship between the mean returns and betas. – If market portfolio is mean-variance efficient, then the CAPM/SML must hold in the sample – Violation of SML implies market portfolio chosen by researcher is not true ‘market portfolio’. – (true market portfolio should include maybe : land, commodities, human capital as well as stocks and bonds) Why proceed ? How far can a particular empirical model explain equilibrium returns ? CAPM, Multifactor Models and APT Fama and French (1993) US : cross sectional data Sample : July 1963 to Dec. 1991 (monthly data) 25 ‘size and value’ sorted portfolios, monthly time series returns on US stocks are explained by a 3-factor model Rit = b1iRmt + b2,iSMBt + b3iHMLt Rbari = lmb1i + lSMBb2i + lHMLb3i where Ri = excess return on asset i Rm = excess return on the market Rbar = mean return Fama and French (1993) (Cont.) Variables mimicking ‘portfolios’ for – Book-to-market ratio (HML) (Low B/M stocks have persistently high earnings) Variable defined as return on high book to market stocks minus low book to market stocks mimicks the risk factor in returns related to ‘distressed stocks’ – Size (SMB) Variable is defined as difference between return on small stock portfolio and large stock portfolio mimicks the risk factor in returns related to size Fama and French (1993) Findings For the 25 portfolios : sorted (i.) by size and (ii.) value (BMV) and (iii.) by value (BMV) and size. – Market betas are clustered in range 0.8 and 1.5 – Average monthly returns are between 0.25 and 1 (If CAPM is correct – expect positive correlation) Sorting portfolios by book to market rejects the CAPM (see graph) Success of Fama-French 3 factor model can be seen by comparing the predicted (average) returns with the actual returns (see graph) Average Excess Returns and Market Beta 1.2 Returns sorted by BMV, within given size quintile Excess return 1 0.8 0.6 Returns sorted by size, within given BMV quintile 0.4 0.2 0 0 0.2 0.4 0.6 0.8 Beta on Market 1 1.2 1.4 1.6 Actual and Predicted Average Returns FF - 3 Factor Model Actual 'mean' excess return 1.2 1 Growth stocks (ie. Low book to market for 5 different size categories) 0.8 0.6 Value stocks (ie. High book to market for 5 different size categories) 0.4 0.2 0 0 0.2 0.4 0.6 0.8 1 1.2 Predicted 'mean' excess return The two lines connect portfolios of different size categories, within a given book-to-market category. We only connect the points within the highest and lowest BMV categories. If we had joined up point for the other BMV quintiles, the lines would show a positive relationship, like that for the value stocks – showing that the predicted returns from the FamaFrench 3 factor model broadly predict average returns on portfolios sorted by size and BMV. Fama and French (1993) Findings (Cont.) If the R-squared of the 25 portfolios is 100%, then the 3 factors would perfectly mimic the 25 portfolio average returns APT model R2 lies between 0.83 and 0.97 Summary 2 stage procedure to test CAPM/APT Empirical test on CAPM/APT use portfolios to minimise the errors in measuring betas CAPM beta explains the difference in average (cross-section) returns between stocks and bonds, but not within portfolios of stocks Fama and French book to market and size variables should be included as additional risk factors to explain cross-section of average stock returns References Cuthbertson, K. and Nitzsche, D. (2004) ‘Quantitative Financial Economics’, Chapters 8 References Cochrane, J.H. (2001) ‘Asset Pricing’, Princeton University Press Fama, E.F. and MacBeth, J.D. (1973) ‘Risk, Return and Equilibrium : Empirical Tests’, Journal of Political Economy, pp. 607- 636 Roll, R. (1977) ‘A Critique of Asset Pricing Theory’s Tests’, Journal of Financial Economics, Vol. 4, pp. 1073-1103. Fama, E.F. and French, K. (1993) ‘Common Risk Factors in the Returns on Stocks and Bonds’, Journal of Financial Economics, Vol. 33, pp. 3-56. References More information about the supplementary variables HML and SMB can be found on Kenneth French’s website http://mba.tuck.dartmouth.edu/pages/faculty/ken.french END OF LECTURE