Presentation_Withholding_and_Depositing_Taxes_2009

advertisement

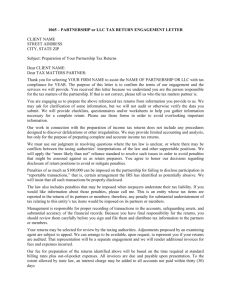

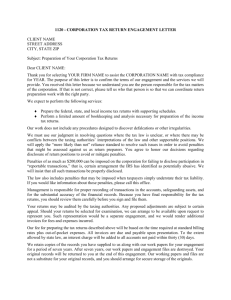

Depositing & Reporting Withheld Taxes Presented by Tracie M. Sawade, CPP EIN • Employer Identification Numbers – How to file – Why you need one – What does it do • Depositor Status • Deposit Requirements Tax Deposit Rules • Look-back Period – What period to look at – 941 – 945 – When does status change? • Shortfall Rule Depositing Taxes • EFTPS – Two methods • Form 9779 • Form 8109 and 8109-B • Penalties Reporting Withheld Taxes • Employment Tax Return form 941 and 941 schedule B • Non-payroll withholding form 945 and 945A • Agricultural reporting form 943 and 943A • Delinquent Employer reporting form 941M • Payroll outside the US forms 941PR and 941SS • Penalties Information Reporting for Employees and Non-employees • Form W-2 – Due dates – Terminated employees • • • • Form W-3 Form 1099 Series Form 1096 Penalties Electronic Forms • W-2s and W-2Cs – Employees, SSA – Tricks and tips – SSA website – APA website • 941 Correcting Reports and Information Returns • • • • Form 941C Form 843 Form W-2C Form W-3C Mergers & Acquisitions • Successor vs. predecessor • Who has responsibility? • 941D to reconcile • When are W-2s due? Third Party Representation • Form 2678 • Form 2848 Forms to Remember • • • • • • • Form SS4 941, 941 schedule B, 941M, 943, 943A, 945, 945A 8109, 8109-B 1099MISC, 1099R, 1096 W-2, W-3 941C, 843, W-2C, W-3C Questions Thanks for coming. • Remember – Study Hard – Take practice exams – Ask for help – Don’t give up! – Find success!