HSA Presentation - Ament Benefits, Inc.

advertisement

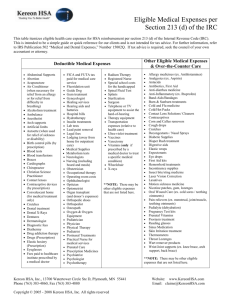

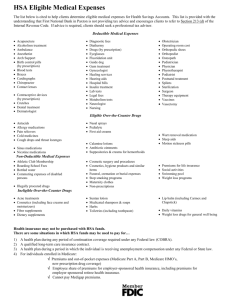

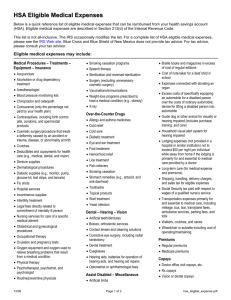

A Primer on Health Savings Accounts for Consumers Presented by National Association of Health Underwriters Health Savings Accounts (HSAs) Newly available as of January 1, 2004 Available to almost everyone if they have a qualified high deductible health insurance plan Under an HSA, the health plan is paired with a savings account to cover eligible medical expenses not covered by the insurance policy Individuals who are covered under another health plan that is not a qualified high deductible plan aren’t eligible – Specified disease coverage, hospital indemnity, and auto insurance do not count as other coverage – Vision, dental, accident, and disability also do not count as other coverage – If you are covered by your spouse’s plan and it is not a qualified high-deductible plan, you are not eligible, even if you have your own qualified high-deductible plan More on eligibility Individuals entitled to Medicare are not eligible to contribute to Health Savings Accounts – However, they can still spend money they have previously accumulated in their Health Savings Account Individuals that can be claimed as a dependent on another person’s tax return aren’t eligible – This means that dependent children should be covered if possible under a family HSA and high-deductible policy. – If they can still be claimed as dependents on a parent’s tax return, they can’t have their own HSA. Qualified High-Deductible Health Plans The annual deductible on your insurance policy must be at least $1,000 if you have individual coverage or $2,000 if you have coverage on your family The deductible, plus your share of covered expenses, can’t be greater than $5,000 if you have individual coverage and $10,000 if you have family coverage If your plan is a PPO (Preferred Provider Organization), your maximum share of expenses, including your deductible, coinsurance, and co-pays, if any, is calculated based on the use of in-network providers, not for services you obtain outside the plan network Preventive care services may be covered before you meet your deductible, but this is not required More on Qualified High Deductible Health Plans Under a qualified plan, coverage for doctor’s visits should be subject to the annual deductible like other expenses, not with a co-pay at the time of service Prescription drugs should also be covered like other expenses, subject to the annual deductible, not with copays under a drug card that pays benefits before the deductible is satisfied A qualified high-deductible plan can be obtained through an employer plan or can be purchased by an individual on their own New Treasury Department Guidance from March 30, 2004 Some questions have arisen as to what could be considered preventive care The new guidance from Treasury creates a beginning definition Includes routine health care, including: – – – – Prenatal care Smoking cessation Obesity weight-loss programs A variety of screening services These services are not REQUIRED to be included in plans but MAY be included without being subject to the overall deductible. New Guidance from March 30, 2004 Establishes transition relief for calendar year 2004 for eligible individuals who establish an HSA on or before April 15, 2005 Gives people who have a qualified high-deductible plan but who have had trouble finding a trustee to manage the funds in a health savings account more time to find a trustee Allows a person who was covered by a qualified high-deductible plan during 2004 to to use their HSA for expenses incurred during 2004 while they were covered by the plan as long as they open up an HSA account on or before April 15, 2005. New Guidance from March 30, 2004 Transition relief is provided for 2004 and 2005 for health plans that would meet the definition of qualified high-deductible plan except for a prescription drug rider or separate drug plan that pays benefits for prescription drugs before the deductible is satisfied. Transition relief is temporary – to allow plans to make modifications from their current form to qualify under the regulations. Contributions to an HSA Contributions must be made in cash Contributions can equal the amount of the insurance policy deductible, between $1,000 to a maximum of $2,600 for an individual or $5,150 for a family. Individuals 55 years of age or older can make extra contributions to their accounts. The amount allowed in 2004 for individuals between ages 55 and 65 is $500. Contributions by an eligible individual or a family member of the eligible individual are tax deductible by the eligible individual on an “above the line” basis This means a person doesn’t have to itemize deductions on their tax return in order to deduct their HSA contribution. Contributions to HSAs Both employers and employees can contribute to the account portion of the plan Contributions by an employer are not taxable income to the employee Individuals own their own HSAs, not employers who may or may not make contributions, or custodians or administrators of the account This means that individual owners of the account, not employers, are responsible for ensuring that contributions do not exceed the annual maximum allowed amount Contributions made by an employer are not deductible by the individual. Contributions to an HSA Contributions from all sources are counted equally to calculate the contribution maximum Funds in an HSA can be invested, and interest and investment earnings on contributions are not taxable Contributions may be made at any time of year in one or more payments, at the convenience of the individual or employer. The deadline for contributions is April 15 of the year following the year for which the contribution is made Using the Money in Your HSA Balances remaining in an HSA at the end of a year roll over to the next year A debit or credit card or a check can be used, if available through your trustee, to spend funds in your HSA. If you are no longer an eligible individual, for example, you turn age 65 or no longer have a qualified high deductible health plan, the funds remaining in your HSA can still be used, but only for qualified medical expenses If you are over age 65, you can use the funds for nonmedical expenses, but the funds used will be considered taxable income A person under age 65 can also use the funds for nonmedical expenses, but the funds will be considered taxable income AND there will be an additional 10% tax Using the Money in Your HSA When an HSA account holder dies, if the beneficiary listed on the account is his surviving spouse, the spouse will be the new owner of the HSA. If the beneficiary is other than the surviving spouse, the amount of funds in the HSA are taxable income to the beneficiary, except for medical expenses of the account holder paid within one year of death. The taxable amount will be reduced by the amount of estate tax paid due to inclusion of the HSA into the deceased individual’s estate What are Qualified Expenses? Prescription drugs Doctors visits, lab, x-ray, and other diagnostic and treatment services Qualified long-term care services and long-term care insurance COBRA premiums, and health insurance for those on unemployment compensation Medicare Part A and B premiums, Medicare HMO or Medicare Advantage premiums (but not Medigap) Retiree health expenses for individuals age 65 and older (but retiree health plans would not have to meet the $1,000/$2,000 minimum deductible requirements) Ensuring that expenses paid from the account are qualified medical expenses is the responsibility of the account holder. – The account holder must keep adequate records concerning the use of the HSA funds. Concerns About Prescription Drug Expenses Some individuals and employers are concerned about a high-deductible and whether prescription drug expenses will be affordable Many people are accustomed to a prescription drug card with a co-pay for prescription drugs Employees with chronic illness who take several medications may find that due to the actual cost of their medications, they meet their deductible very quickly and that the coinsurance of the high deductible plan is lower than the copays with the drug card. – Example: John and Mary and their son Steve take a total of eight medications each month. They currently have a health plan with a prescription drug card. Six of their eight medications are on their preferred drug list and have a co-pay of $20 per month. The other two medications are available in generic and have a co-pay of $10 per month. Actual Drug Costs Here is an example of the actual cost of the Smith family’s drugs: – – – – Mary Singulair Flonase Zocor Atenolol Total $ 95.59 $ 66.99 $ 78.77 $ 15.19 $256.54 Steve Singulair Allegra Advair Albuterol Total – Family Monthly Total Drug Cost – Total Copays* Currently $95.59 $ 68.99 $158.99 $ 19.89 $343.46 $600.00 $180.00 – *Copays do not count toward the policy out-of-pocket maximum with this drug card Here is another family: The Jones Family – – – – – – – – Jack Singulair Advair Allegra Albuterol Flonase Triam Zocor Atenolol Total $ 95.59 $158.99 $ 68.99 $ 19.89 $ 66.99 $ 9.99 $ 78.77 $ 15.19 $514.40 Janice Singulair Triam Synthroid Prevacid Pulmacort Astelin Inderol Sulindac Total Family Monthly Total Drug Cost – Total Copays* Currently $ 95.59 $ 9.99 $ 15.69 $134.99 $120.00 $ 67.59 $ 29.00 $ 30.00 $502.85 $1,027.25 $ 260.00 Plan Design Considerations These families aren’t unusual, they are dealing with such common ailments as allergies, asthma, high-blood pressure, and high-cholesterol. As you can see, some of these “average” families have high drug expenses. They may feel the security of a drug card is important Depending on the actual situation of a particular family and how many different family members are incurring claims, families may do as well or better without a drug card, allowing their drug expenses to go towards their health plan deductible Establishing an HSA Many insurance companies are either planning or already selling a packaged HSA product that will provide both the high-deductible health plan and management of the funds deposited into an HSA It’s not necessary to buy a packaged product to qualify Any qualifying high deductible plan can be used with a Health Savings Account – they don’t need to be provided by the same insurer In fact a person who already has an existing high deductible plan that meets the requirements of the law could open an HSA account at a bank or other institution A qualified plan can be either a group or an individual plan Establishing an HSA To find out how you can establish an HSA, contact your health insurance agent or broker To find an agent in your area, go to www.nahu.org, or http://www.nahu.org/consumer/HSAGuide.htm