Email-20110213

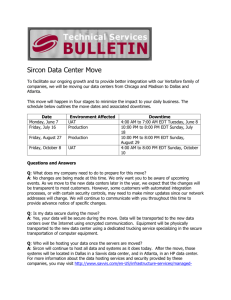

advertisement

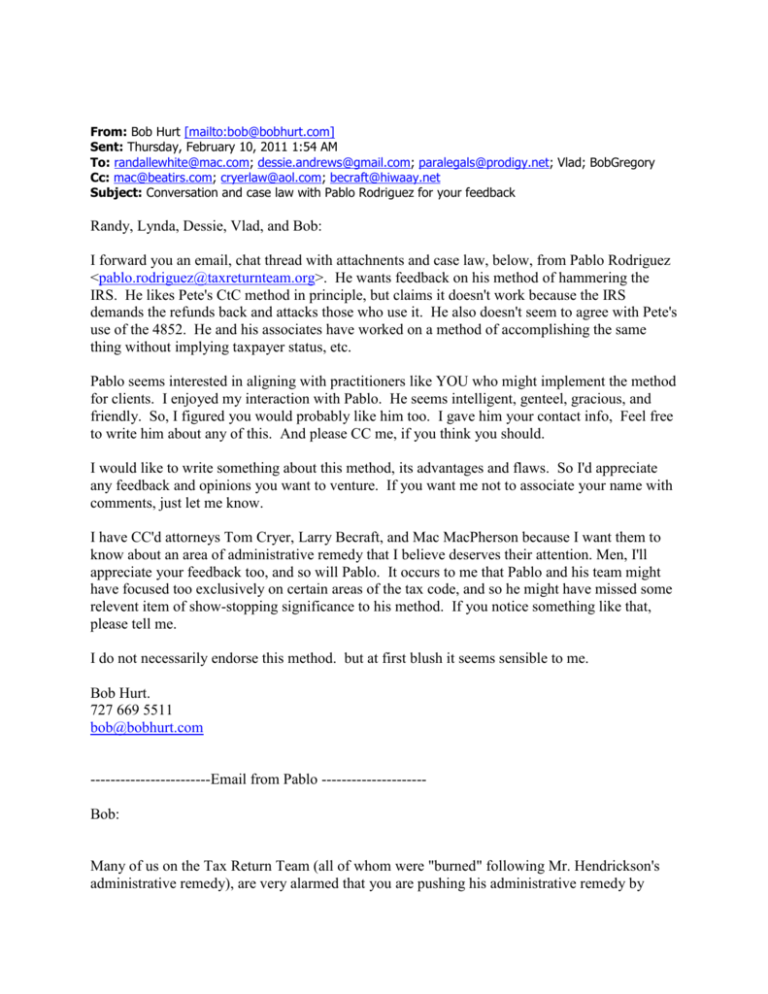

From: Bob Hurt [mailto:bob@bobhurt.com] Sent: Thursday, February 10, 2011 1:54 AM To: randallewhite@mac.com; dessie.andrews@gmail.com; paralegals@prodigy.net; Vlad; BobGregory Cc: mac@beatirs.com; cryerlaw@aol.com; becraft@hiwaay.net Subject: Conversation and case law with Pablo Rodriguez for your feedback Randy, Lynda, Dessie, Vlad, and Bob: I forward you an email, chat thread with attachnents and case law, below, from Pablo Rodriguez <pablo.rodriguez@taxreturnteam.org>. He wants feedback on his method of hammering the IRS. He likes Pete's CtC method in principle, but claims it doesn't work because the IRS demands the refunds back and attacks those who use it. He also doesn't seem to agree with Pete's use of the 4852. He and his associates have worked on a method of accomplishing the same thing without implying taxpayer status, etc. Pablo seems interested in aligning with practitioners like YOU who might implement the method for clients. I enjoyed my interaction with Pablo. He seems intelligent, genteel, gracious, and friendly. So, I figured you would probably like him too. I gave him your contact info, Feel free to write him about any of this. And please CC me, if you think you should. I would like to write something about this method, its advantages and flaws. So I'd appreciate any feedback and opinions you want to venture. If you want me not to associate your name with comments, just let me know. I have CC'd attorneys Tom Cryer, Larry Becraft, and Mac MacPherson because I want them to know about an area of administrative remedy that I believe deserves their attention. Men, I'll appreciate your feedback too, and so will Pablo. It occurs to me that Pablo and his team might have focused too exclusively on certain areas of the tax code, and so he might have missed some relevent item of show-stopping significance to his method. If you notice something like that, please tell me. I do not necessarily endorse this method. but at first blush it seems sensible to me. Bob Hurt. 727 669 5511 bob@bobhurt.com ------------------------Email from Pablo --------------------Bob: Many of us on the Tax Return Team (all of whom were "burned" following Mr. Hendrickson's administrative remedy), are very alarmed that you are pushing his administrative remedy by recommending people use Forms 4852 and "correcting" Forms 1099. We can emphatically tell you, "It doesn't work!!!" Our members are being charged with fraudulent filing, frivolous filings, deficient filings, failure to file, and more all because we filed "CtC-educated" returns as far back as four years ago. It is without a doubt that we all regret following his suggestions. As we've experienced, and over 200 other people have come to us and told us, if the IRS gives you a refund, you can be sure that within the subsequent 2-3 years, you will be forced to return all of it. Many of our members tried in vain to have their names removed from his "Victories" page but he refused because Mr. Hendrickson claimed that they were validly won and fraudulently stolen. But it was grossly misleading to let people believe that a certain number of folks had received $10m in refunds without discounting the number who've not only had to return that money, but who also paid additional "frivolous" fines, penalties, interest, and in many cases sanctions up to $5,000. I've tried to explain the problem presented by Mr. Hendrickson's administrative remedy in the attached document. We'd LOVE to host you on one of our twice-weekly meetings to discuss this with you. We had a standing offer to Mr. Hendrickson for over 18 months and he never responded to our requests, invitations, or our e-mails. We absolutely believe what Mr. Hendrickson uncovered about the tax laws of the country and we firmly support him. We encourage our members to help support him and his family, too. However, it's his administrative remedy that so many of us are fighting for our lives in tax court and other courts to get squared away. We're trying to hold a greased snake with oily hands on a freshly waxed floor filled with banana peels all the while trying to put it back into a stiletto-lined box without hurting ourselves or getting bit by the snake. You are cordially invited to spend time with us and see what we've uncovered. P.S. Feel free to post this e-mail and the accompanying document on the Lawmen site. Thank you, Pablo Rodriguez Tax Return Team - where pro se prey become the predator! +1 919.647.4768 Mon-Fri, 9 p.m. - 11 p.m. Eastern -------------------------- Chat Thread ---------------------February 9, 2011 [10:24:05 PM EDT] David C. Diemer: Bob! (snip) [10:31:20 PM EDT] Bob Hurt: Pete's method is good but the IRS are crooks.; [10:32:50 PM EDT] Pablo: Well, we agree the IRS are a bunch of crooks, liars, and snakes. [10:33:23 PM EDT] Bob Hurt: So you cannot rightly badmouth the method when the IRS breaks the rules and steals money from those who use CtC. [10:33:34 PM EDT] Pablo: But my whole point is that our team is struggling to overcome the mess we got into using his administrative remedy in the first place. That was the whole reason we formed - to learn to defend ourselves against the IRS. [10:33:39 PM EDT] Bob Hurt: You should badmouth the IRS, then. [10:34:06 PM EDT] Bob Hurt: If you want to get out of that problem, use David Miner's method, or sue the bastards, or both. [10:34:14 PM EDT] Pablo: But the problem is that the judicial setting is an adversarial process and we've got to "swing our swords" as Dr. Graves likes to say. [10:34:28 PM EDT] Bob Hurt: Meaning what? [10:35:08 PM EDT] Pablo: That means we figure out their game plan and beat the pants off them. Then we follow up the bar complaints, judicial misconduct complaints, sanctions for the attorneys, and criminal complaints against IRS employees. [10:36:03 PM EDT] Bob Hurt: What do you mean "we?" [10:36:06 PM EDT] Pablo: We've alreade figured out how NOT to make a frivolous formal claim for refund. But the fucking bastards are forcing us to sue them in court to listen to us. But we don't get fined $5k for doing so. [10:36:17 PM EDT] Pablo: We've learned how to beat the frivolous tax submission penalty in court. [10:36:25 PM EDT] Bob Hurt: How, in a nutshell? [10:37:08 PM EDT] Pablo: The frivolous penalty is based on being a "person" as defined in 667(b). Case law shows that the person MUST be so connected with a corporation that he filed a frivolous return. [10:37:39 PM EDT] Bob Hurt: What case? [10:37:50 PM EDT] Pablo: The IRS, in its court documents, states regularly that the taxpayer had a "duty to file taxes" but they don't say that was in a person's individual status, not as part of a corporation, as the case law shows... [10:38:00 PM EDT] Pablo: Hold one. I'l send you my notes... [10:39:07 PM EDT] Pablo: What's your e-mail address? [10:39:21 PM EDT] Bob Hurt: bob@bobhurt.com [10:40:25 PM EDT] Pablo: Just sent you some case law I found in researching over 300 cases dealing with 6671(b) that used in 6702 frivolous tax submission penalty. It begins with, "A person shall pay..." and that "person" is defined in 6671(b). [10:41:00 PM EDT] Pablo: We've preapred tax court petitions, motion for summary judgment, admissions, productoin,a dn interrogatories to beat the shit out them because they have the burden to prove this. [10:41:07 PM EDT] Pablo: And the plain fact is, they have nothing. [10:41:21 PM EDT] Pablo: Duty as defined "under ง 6671(b) has a much more focused meaning than the generalized duty of all taxpayers to pay taxes and is expressly limited to the duty that attaches to the position an employee holds within the corporation." United States v. Burger, 717 F.Supp. 245, 248 (S.D.N.Y.1989). [10:41:33 PM EDT] Bob Hurt: You ought to talk to Randy White about this. [10:41:48 PM EDT] Pablo: As we held in Graham, supra, 309 F.2d at 212, "the section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred" Pacific National Insurance v. United States, 422 F.2d 26 (9th Cir. 1970) at 30, 31 [10:41:53 PM EDT] Bob Hurt: randallewhite@mac.com [10:42:14 PM EDT] Pablo: [T]he section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred." United States v. Graham, 309 F.2d 210, 212 (9th Cir. 1962). DUDLEY v. UNITED STATES, 428 F.2d 1196 (9th Cir. 1970) [10:42:38 PM EDT] Pablo: Among the specific facts which courts have relied upon in determining whether individuals were persons responsible for the payment of taxes withheld from the wages of employees are: (1) the duties of the officer as outlined by the corporate bylaws; (2) the ability of the individual to sign checks of the corporation; (3) the identity of the officers, directors, and shareholders of the corporation; (4) the identity of the individuals who hired and fired employees; (5) the identity of the individuals who were in control of the financial affairs of the corporation. Braden v. United States, 318 F. Supp. 1189, 1194 (S.D.Ohio 1970), aff'd, 442 F.2d 342 (6th Cir.), cert. denied, 404 U.S. 912, 92 S.Ct. 229, 30 L.Ed.2d 185 (1971). GEPHART v. U.S., 818 F.2d 469 (6th Cir. 1987) [10:42:53 PM EDT] Pablo: Unfortunately, we got blown off LH for presenting just this kind of material. [10:43:15 PM EDT] Pablo: We can now PROVE that we NEVER had an employer pursuant to 3401(c) and (d). [10:43:26 PM EDT] Pablo: No employer, no employee and no wages. [10:43:54 PM EDT] Pablo: We now have the ability to PROVE conclusively that the ifnormation returns were fraudulently issued as Congress required for us to contest them. [10:44:41 PM EDT] Pablo: BTW, we don't disagree with Mr. Hendrickson's idea that you should rebut the Form W-2. Again, we can conclusively show that hte Form 4852 is not the right tool. That's all. There are better and more powerful ways to do that. [10:46:06 PM EDT] Bob Hurt: I haven't studied the form. I'd like to know your reasons. [10:46:43 PM EDT] Bob Hurt: The whole Hendrickson seems to imply status as a taxpayer by use of taxpayer forms. [10:46:57 PM EDT] Pablo: The Form 4852 is a "Substitute for a Form W-2" The case law and the regulations show that the form has the same effect as the original W-2, espeically if there is no employer. [10:47:24 PM EDT] Pablo: The worst part is that the form is signed under penalties of perjury by the "employee" himself. [10:47:25 PM EDT] Bob Hurt: Probably better to use no forms, or to deny taxpayer status in an affidavit attached to the form. [10:48:33 PM EDT] Pablo: That's what my attached document to my e-mail to you alludes to. The IRS allows, and case law supports the use of a formal claim for refund. All you have to do is write your own refund, state the facts and grounds in support, and sign it under penalties of perjury. It has the same weight and effect as the Form 1040. [10:48:50 PM EDT] Pablo: It's really that simple. And you avoid all the presumptions of being a taxpayer in the process. [10:49:01 PM EDT] Pablo: We have plenty of different claims for refund. Would you like to see one? [10:49:26 PM EDT] Bob Hurt: Of course. [10:49:28 PM EDT] * Pablo posted file Formal Claim for Refund.doc to members of this chat [10:50:08 PM EDT] Pablo: Here ya go. This is an example of a formal claim for refund. Now, you must also rebut the 3rd party information return as fraudulently issued because that's the only remedy Congress left us. [10:50:21 PM EDT] Pablo: here's an example of that for a Form W-2. [10:50:47 PM EDT] * Pablo posted file W-2 Explanation.doc to members of this chat [10:51:53 PM EDT] Pablo: Did you want to talk instead of chat? [10:54:48 PM EDT] Pablo: What should I tell Randall White? [10:55:02 PM EDT] Bob Hurt: Simple enough. No, I prefer to chat because 1) Maria sleeps, 2) I have time to think when I don't talk. [10:55:16 PM EDT] Pablo: Cool. [10:55:23 PM EDT] Pablo: Pretty simple, isn't it? [10:55:39 PM EDT] Bob Hurt: Very. Clean and simple. [10:55:42 PM EDT] Pablo: We have a hybrid formal claim for refund for those who actually have taxable income and non-taxable income. [10:55:56 PM EDT] Bob Hurt: Who has both? [10:55:58 PM EDT] * Pablo posted file Informal Claim for Refund - Hybrid.doc to members of this chat [10:56:34 PM EDT] Pablo: Well, someone who has had unemployment, Social Security, military retirement (among other gov't retirement), and others. [10:57:12 PM EDT] Pablo: These are all federally taxable benefits. [10:57:32 PM EDT] Pablo: One is engaging in a taxable activity directly receiving gov't money. [10:58:05 PM EDT] Bob Hurt: I got it. Still very simple. But what about the forms the IRS expects you to use, like the 1040, and willful failure to file them? [10:58:16 PM EDT] Pablo: Now, we haven't figured out how to rebut ALL the information returns: just the following: 1098, 1065 Schedule K, 109-B, 1099-C, 1099-G, 1099-INT, 1099MISC, 1099-R (needs work), and a 1099-S. [10:58:21 PM EDT] Pablo: Plus the W-2. [10:59:06 PM EDT] Bob Hurt: What about W-9? [10:59:08 PM EDT] Pablo: Well, the case law shows that you're supposed to file a Notice of Claim for Refund first. That tolls the statute of limitations. [10:59:13 PM EDT] * Pablo posted file Notice of Claim for Refund.doc to members of this chat [10:59:47 PM EDT] Pablo: This IS a return as defined in the regulations and in case law (these are documented in the paper I attached to my e-mail). [10:59:58 PM EDT] Pablo: This is one of the reasons we'd LOVE to have you visit us. [11:00:25 PM EDT] Pablo: Dan Pilla completely agreed with our approach but refused to participate. Most who actually give us a shot, like what they see and hear. [11:01:23 PM EDT] Pablo: We hold meetings every week on Wednesdays (9 p.m. Eastern) and Saturdays (8 p.m. Eastern). Right now, twenty of us are preparing for Tax Court trials in Feb/Mar. Mine in on Mar 7. [11:02:16 PM EDT] Pablo: But perhaps in mid-March you could come by to see who we are, what we do, adn offer your opinions on what we're doing. We look for knowledeable credible folks to critique our work and let us know if we're full of shit or not. [11:03:22 PM EDT] Pablo: The reason why we started the Tax Return Team was to provide a PRIVATE forum where folks to meet to help each other out preparing to defend themselves in TAx Court, Appeals, federal district court, CDP, claims for refund, and other IRS BS. [11:03:55 PM EDT] Bob Hurt: I know some people I'd like to ask about it. Several in the Lawmen group. I strongly urge you to send all the info to Randy White and get his feedback. If it looks like jail bait, he'll tell you and explain why. [11:05:03 PM EDT] Pablo: Oh, okay. That'd be cool. [11:05:14 PM EDT] Bob Hurt: I'd send it to Lynda Wall (paralegals@prodigy.net) and Dessie Andrews (dessie.andrews@gmail.com). [11:05:59 PM EDT] Pablo: What do you recommend I send them? [11:07:42 PM EDT] Pablo: We're also working with Dave Miner to get our IMF's fixed. Damn! The guy's a brain! And teh fraudulent CRAP that's in our IMFs would astound you. [11:07:42 PM EDT] Bob Hurt: The relevant part of this thread, and the docs you just forwarded, plus the email and an executive summary and request for comment. Also, any plan you have for making money or delivering service, such as by including their names as service providers who will do it for others who feel too inept to do it themselves. [11:08:01 PM EDT] Bob Hurt: I'd love to see what you discovered. [11:08:19 PM EDT] Bob Hurt: I LOVE Dave Miner. I respect him and wish him every success. [11:08:27 PM EDT] Pablo: oooh! That'd work. We've been looking for folks our members could turn to for additional help. Right now, we're doing it all ourselves. [11:08:56 PM EDT] Pablo: Well, Biggdooger and I are helping Dave in his federal trial. I get research and Biggdooger gets the ideas. Dave needs to clean up his web site. [11:09:57 PM EDT] Pablo: We've learned that the LAST place you want to be is Tax Court - a bunch of liars from the judge on down. We'd rather be in the court of federal claims. And then federal district court. [11:10:34 PM EDT] Pablo: We've learned to avoid talking to the Tax-takers Advocate Service because they are a bunch of patsies for the IRS. [11:11:27 PM EDT] Pablo: And the worst abuse is a "Collection Due Proces" hearing. We really believe the IRS menat to play a joke on us - THEY see is a COLLECTION DUE process hearing. We thought it meant Collection DUE PROCESS hearing. [11:11:56 PM EDT] Pablo: Well, I'll write the folks you've mentioned. [11:12:55 PM EDT] Bob Hurt: Did you look at http://www.uscourts.gov and the criminal complaint form? [11:14:06 PM EDT] Pablo: Bob, I'd like to show you a document I wrote explaining why you never had an employer. It was roundly and soundly rejected by the LH forum. [11:14:14 PM EDT] Bob Hurt: You now have a pristine example of the use of AO-091 and AO442. [11:14:17 PM EDT] * Pablo posted file You Never Had an Employer.docx to members of this chat [11:14:22 PM EDT] Pablo: thx [11:15:12 PM EDT] Pablo: Read it over and let me know what you think. [11:20:44 PM EDT] Bob Hurt: I read it. I notice it contains a lot of trick questions. [11:23:28 PM EDT] Pablo: Well, I could remove those. But the issue of "includes" operates on the general words, "officer, employee, or elected official" It does NOT operate on the other words, "of the United States," "of a State," etc. We have case law that discusses "includes" as being "a calculated indefiniteness" but at the end, the "of...." must still apply. It's not a direct cite but it's applicable because of how the court discussed "includes and including." [11:24:38 PM EDT] Bob Hurt: No, I only meant to joke with you a little. People reading it will go into a fog and think you have asked trick questions. However, Randy will love your pounding on the meaning of employee, employer, and includes. [11:25:08 PM EDT] Pablo: Wel, I'll include it to him. I wrote this over a year ago and it could use a little cleanup. [11:26:01 PM EDT] Pablo: If I cleaned it up some more, perhaps you work with me to simplify it, would you like to publish it anonymously on Lawmen? [11:26:35 PM EDT] Bob Hurt: I'll publish it any way you like. I believe in busting the IRS in the mouth. [11:26:38 PM EDT] Pablo: This is the kind of SHIT that scares the freaking daylights out of the IRS!! [11:27:01 PM EDT] Pablo: There's no defense and it's the ONE wekness against the presumptions of a Form W-2 or Form 4852. [11:27:11 PM EDT] Pablo: Oh yeah, back to why we don't like the Form 4852. [11:27:56 PM EDT] Pablo: 1. You subscribe the form under penalties of perjury. 2. You state that you had an employer (Line 5) 3. You state that you had Federal and/or FICA withholding (line 7) [11:29:14 PM EDT] Pablo: So, by your own admission, you declare that you had an employer, you are the employee, and you had withholding. The courts have ruled that only employees have withholding on wages. [11:29:39 PM EDT] Bob Hurt: Makes sense. [11:30:15 PM EDT] Pablo: So, if a person puts $14,000 on federal income tax withholding, then by the court's ruling, you MUST have had wages paid and your claim that you had $0 wages falls flat. --------------------------------------------------------------From: To: Subject: Date: Pablo Rodriguez <pablo.rodriguez@taxreturnteam.org> Bob@bobhurt.com 6671(b) "Person" Wed, 9 Feb 2011 19:39:51 -0800 (PST) (02/09/2011 10:39:51 PM) From Evernote: 6671(b) "Person" 26 U.S.C. ง 6671(b). Generally, "responsible persons are subject to a duty to apply any available unencumbered funds to reduction of accrued withholding tax liability." Mazo v. United States, 591 F.2d at 1154. Duty as defined "under ง 6671(b) has a much more focused meaning than the generalized duty of all taxpayers to pay taxes and is expressly limited to the duty that attaches to the position an employee holds within the corporation." United States v. Burger, 717 F.Supp. 245, 248 (S.D.N.Y.1989). Although "[t]his duty is generally found in high corporate officials charged with general control over corporate business affairs who participate in decisions concerning payment of creditors and disbursal of funds," Monday v. United States, 421 F.2d at 1214-1215, an individual is not a responsible person by "[t]he mere holding of [a] corporate office alone, ..." Schwinger v. United States, 652 F.Supp. at 467; see Monday v. United States, 421 F.2d at 1214 ("Corporate office does not, per se, impose the duty to collect, account for and pay over the withheld taxes. On the other hand, an officer may have such a duty even though he is not the disbursing officer"). Because "[t]he key element ... is whether that person has the statutorily imposed duty to make the tax payments" "the duty is considered in light of the person's authority ever an enterprise's finances or general decision making." O'Connor v. United States, 956 F.2d 48, 51 (4th Cir.1992). A responsible person, then, is generally "any person who has significant control over the corporation's affairs and participates in decisions concerning what bills should or should not be paid and when, and thus determines whether the United States or other creditors will be paid." United States v. Burger, 717 F.Supp. at 248. See Ruth v. United States, 823 F.2d at 1094 ("the `key to liability' is significant control or authority over an enterprise's finances or general decision making") (quoting Purdy v. United States, 814 F.2d 1183, 1188 (7th Cir.1987)). Knowledge is not a prerequisite. Davis v. United States, 961 F.2d 867, 873 (9th Cir. 1992) ("responsibility is a matter of status, duty and authority, not knowledge"); Gustin v. United States Internal Revenue Service, 876 F.2d 485, 491 (5th Cir.1989) (same); Mazo v. United States, 591 F.2d at 1156 (same). US v. McCombs-Ellison, 826 F. Supp. 1479 - Dist. Court, WD New York 1993 Several factors may indicate that a party is a responsible person under § 6672. The key element, however, is whether that person has the statutorily imposed duty to make the tax payments. This duty is considered in light of the person's authority over an enterprise's finances or general decision making. Ruth v. United States, 823 F.2d 1091, 1094 (7th Cir.1987); Godfrey, 748 F.2d at 1575. This authority is generally found in high corporate officials charged with general control over corporate business affairs who participate in decisions concerning payment of creditors and disbursement of funds. Monday v. United States, 421 F.2d 1210 (7th Cir.), cert. denied, 400 U.S. 821, 91 S.Ct. 38, 27 L.Ed.2d 48 (1970). O'Connor v. US, 956 F. 2d 48 (4th Circuit, 1992) The definition of "persons" in section 6671(b) indicates that the liability imposed by section 6672 upon those other than the employer is not restricted to the classes of persons specifically listed — officers or employees of corporations and members or employees of partnerships. "[B]y use of the word `include[s]' the definition suggests a calculated indefiniteness with respect to the outer limits of the term" defined. First National Bank In Plant City, Plant City, Florida v. Dickinson, 396 U.S. 122, 90 S.Ct. 337, 24 L.Ed.2d 312 (1969).[fn8] As we said in United States v. Graham, 309 F.2d 210, 212 (9th Cir. 1962): "The term `person' does include officer and employee, but certainly does not exclude all others. Its scope is illustrated rather than qualified by the specified examples."[fn9] The language is broad enough to reach corporations and other artificial entities, as well as natural beings. The Code expressly provides that unless "otherwise distinctly expressed or manifestly incompatible with the intent * * The term `person' shall be construed to mean and include an individual, a trust, estate, partnership, association, company or corporation." 26 U.S.C. § 7701(a)(1). And since artificial entities commonly provide operating, accounting, and management services for independent businesses, it is not "manifestly incompatible" with the intent of section 6672 to include them within its reach. We may assume that when the employer is a corporation the statutory language does limit liability under section 6672 to those who exercise the corporation's power to determine whether or not to pay over the withheld tax. But the definition of "persons" does not require that they be formally vested with the office or employed in the position normally charged with this function; the definition simply "includes" such persons.[fn10] Indeed, the language itself does not require that they be officers or employees of the corporation at all, so long as they are in fact responsible for controlling corporate disbursements.[fn11] As we held in Graham, supra, 309 F.2d at 212, "the section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred"; it reaches those who have "the final word as to what bills should or should not be paid, and when." Wilson v. United States, 250 F.2d 312, 316 (9th Cir. 1958). See also White v. United States, 372 F.2d 513, 517, 178 Ct.Cl. 765 (1967). Pacific National Insurance v. United States, 422 F.2d 26 (9th Cir. 1970) at 30, 31 [fn8] 26 U.S.C. § 7701(b) provides: "The terms `includes' and `including' when used in a definition contained in this title shall not be deemed to exclude other things otherwise within the meaning of the term defined." [fn9] See also United States v. Hill, 368 F.2d 617, 621 (5th Cir. 1966); Botta v. Scanlon, 314 F.2d 392, 394 (2d Cir. 1963). [fn10] Section 6672 liability was imposed upon persons who were neither "officers" nor "employees" of the corporate employer in United States v. Graham, 309 F.2d 210 (9th Cir. 1962) (member of board of directors). See also Botta v. Scanlon, 314 F.2d 392 (2d Cir. 1963); (substantial stockholders and possibly a director); Mulcahy v. United States, 237 F. Supp. 656 (S.D.Tex. 1964) (counsel). [fn11] Section 6672 liability was imposed upon persons formally outside the corporate structure in Walker v. United States, 68-1 U.S.T.C. ¶ 9370 (W.D.Okla. 1968) (representative of major creditor); Regan & Co. v. United States, 290 F. Supp. 470 (E.D.N.Y. 1968) (general contractor and its president; subcontractor was employer); Thurner v. United States, 260 F. Supp. 292 (E.D.Wis. 1966) (creditor and holder of stock option during portion of tax period); Melillo v. United States, 244 F. Supp. 323 (E.D.N.Y. 1965) (prospective purchasers of controlling stock interest under executory contract); National Bank of Commerce v. Phinney, 62-2 U.S.T.C. ¶ 9512 (D.C.Tex. 1965) (temporary administrator of estate of majority stockholder); Tiffany v. United States, 228 F. Supp. 700 (D.N.J. 1963) (controlling stockholder of parent corporation). See also Girard Trust Corn Exch. Bank v. United States, 66-2 U.S.T.C. ¶ 9510, at 86,601 (E.D.Pa. 1966) (jury charge; bank as creditor supervising corporate employers' financial transactions would be liable if it "had sufficient control to pay those taxes and failed to pay them"). This court has defined the "person" responsible for the payment of the tax as that individual who "had the final word as to what bills should or should not be paid, and when." Wilson v. United States, supra, 250 F.2d at 316. See also Pacific National Ins. Co. v. United States, supra, 422 F.2d at 31; Bloom v. United States, supra, 272 F.2d at 222; White v. United States, supra, 372 F.2d at 516, 518. "Final" means "significant, rather than exclusive control." Turner v. United States, supra, 423 F.2d at 449. "[T]he section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred." United States v. Graham, 309 F.2d 210, 212 (9th Cir. 1962). DUDLEY v. UNITED STATES, 428 F.2d 1196 (9th Cir. 1970) Thus section 6672 was enacted to impose personal liability upon those responsible for transmitting these trust funds should they divert the money to pay other pressing creditors. The section is applied to persons[fn5] who have sufficient control to divert the funds away from the IRS, usually officers and supervisory employees. But the courts have fashioned a functional definition of "responsible person" to include some who do not hold any official position with the company. See, e. g., Neckles v. United States, 579 F.2d 938 (5th Cir. 1978). Lenders and employees of lenders have been considered liable under section 6672 in particular circumstances. Adams v. United States, 504 F.2d 73 (7th Cir. 1974); Mueller v. Nixon, 470 F.2d 1348 (6th Cir. 1972), cert. denied, 412 U.S. 949, 93 S.Ct. 3011, 37 L.Ed.2d 1001 (1973); Turner v. United States, 423 F.2d 448 (9th Cir. 1970); Pacific Nat'l Ins. Co. v. United States, 422 F.2d 26 (9th Cir.), cert. denied, 398 U.S. 937, 90 S.Ct. 1838, 26 L.Ed.2d 269 (1970). Contra, United States v. Hill, 368 F.2d 617 (5th Cir. 1966). FIDELITY BANK, N. A. v. UNITED STATES, 616 F.2d 1181 (10th Cir. 1980) [17] It is well established that the test for determining the responsibility of a person under § 6672 is essentially a functional one, focusing upon the degree of influence and control which the person exercised over the financial affairs of the corporation and, specifically, disbursements of funds and the priority of payments to creditors. United States v. Davidson, 558 F. Supp. 1048, 1052 (W.D.Mich. 1983). Section (b) of the Internal Revenue Code of 1954 defines the word "person" to include "an officer or employee of a corporation . . . who as such officer or employee . . . is under a duty to perform the act in respect of which the violation occurs." [18] Among the specific facts which courts have relied upon in determining whether individuals were persons responsible for the payment of taxes withheld from the wages of employees are: (1) the duties of the officer as outlined by the corporate by-laws; (2) the ability of the individual to sign checks of the corporation; (3) the identity of the officers, directors, and shareholders of the corporation; (4) the identity of the individuals who hired and fired employees; (5) the identity of the individuals who were in control of the financial affairs of the corporation. Braden v. United States, 318 F. Supp. 1189, 1194 (S.D.Ohio 1970), aff'd, 442 F.2d 342 (6th Cir.), cert. denied, 404 U.S. 912, 92 S.Ct. 229, 30 L.Ed.2d 185 (1971). [19] More than one person can be a responsible officer of a corporation. Id. Essentially, liability is predicated upon the existence of significant, as opposed to absolute, control of the corporation's finances. Davidson, 558 F. Supp. at 1053. It is basically a factual inquiry. Generally, such a person is one "with ultimate authority over expenditure of funds since such a person can fairly be said to be responsible for the corporation's failure to pay over its taxes," or more explicitly, one who has "authority to direct payment of creditors." Barrett v. United States, 580 F.2d 449, 452, 217 Ct.Cl. 617 (1978). GEPHART v. U.S., 818 F.2d 469 (6th Cir. 1987) [38] The purpose of the 100 percent penalty provision "is to permit the taxing authority to reach those [persons] responsible for the corporation's failure to pay the taxes which are owing." White v. United States, 372 F.2d 513, 516, 178 Ct.Cl. 765 (1967). Though the legislative history is uninformative, "it is evident from the face of the section that [ § 6672] was designed to cut through the organizational form and impose liability upon those actually responsible for an employer's failure to withhold and pay over the tax." See Pacific National Insurance Co. v. United States, 422 F.2d 26, 31 and n. 12 (9th Cir.), cert. denied, 398 U.S. 937, 90 S.Ct. 1838,L.Ed.2d 269 (1970). Accordingly, "the section is generally understood to encompass all those officers who are so connected with a corporation as to have the responsibility and authority to avoid the default which constitutes a violation of the particular Internal Revenue Code section or sections involved, even though liability may thus be enforced on more than one person." White v. United States, 372 F.2d at 516. See also Feist v. United States, 607 F.2d 954, 960, 221 Ct.Cl. 531 (1979); Bolding v. United States, 565 F.2d 663, 671, 215 Ct.Cl. 148 (1977); Burack v. United States, 461 F.2d 1282, 1291, 198 Ct.Cl. 855 (1972); accord McCarty v. United States, 437 F.2d at 967; Scott v. United States, 354 F.2d 292, 296, 173 Ct.Cl. 650 (1965). [39] The overwhelming weight of case precedent requires the factfinder to look through the "mechanical functions of the various corporate officers", White v. United States, 372 F.2d at 516, to determine the persons having "the power to control the decision-making process by which the employer corporation allocates funds to other creditors in preference to its withholding tax obligations." Haffa v. United States, 516 F.2d 931, 936 (7th Cir. 1975). The inquiry required by the statute is "a search for a person with ultimate authority over expenditure of funds since such a person can fairly be said to be responsible for the corporation's failure to pay over its taxes." White v. United States, 372 F.2d at 517. See also Barrett v. United States, 580 F.2d 449, 452, 217 Ct.Cl. 617 (1979); Bauer v. United States, 543 F.2d 142, 148, 211 Ct.Cl. 276 (1976). Whether the plaintiff is a "person" with ultimate authority "hinges upon the application of the relevant facts to the . . . pertinent provisions of the Internal Revenue Code of 1954." Bauer v. United States, 543 F.2d at 144. As the Ninth Circuit commented in Pacific National Insurance Company v. United States, 422 F.2d at 30-31: [T]he definition of "persons" [in IRC § 6671] does not require that they be formally vested with the office or employed in the position normally charged with this function; the definition simply "includes" such persons. Indeed, the language itself does not require that they be officers or employees of the corporation at all, so long as they are in fact responsible for controlling corporate disbursements. . . . [I]t reaches those who have "the final word as to what bills should or should not be paid, and when." [Emphasis added.] GODFREY v. UNITED STATES, 748 F.2d 1568 (Fed. Cir. 1984) We are satisfied that Cooper never had the kind of control over G.T.O. financial affairs which would require or even allow him to control the disposition of these funds. We therefore affirm the decision of the district court on the ground that Cooper was not a "person" within the meaning of that term as used in 26 U.S.C. § 6671(b) and 6672. HAFFA v. UNITED STATES, 516 F.2d 931 (7th Cir. 1975) [19] Responsibility in this context is a matter of status, duty and authority. Mazo, 591 F.2d at 1156. Howard was a director, minority shareholder, Treasurer and Executive Vice-President of Eden during the second and third quarters of 1978. He ran Eden's day-to-day operations. He was the sole signatory on the corporation's main checking account for a substantial portion of that period, and shared check-signing authority with Rick Jameson for the remainder of the relevant period. During a prior quarter, it was he who directed that $8,000 in back taxes be paid the IRS. See Brown v. United States, 464 F.2d 590, 591 (5th Cir. 1972) ("responsible person" was person successful in securing payment of withholding taxes during prior quarter), cert. denied, 410 U.S. 908, 93 S.Ct. 962, 35 L.Ed.2d 270 (1973). Howard's duties, prerogatives, and prior acts are more than sufficient to establish that he was a "responsible person" for the purpose of section 6672(a) liability. Commonwealth National Bank of Dallas v. United States, 665 F.2d 743, 755 (5th Cir. 1982) (lending bank officer with power to see that corporate borrower's taxes were paid, and to make decisions as to disbursement of funds, was a "responsible person"); Mazo, 591 F.2d at 1155-56 (general manager in charge of corporation's day-to-day operations and possessing check-signing authority was a "responsible person"); Hornsby v. IRS, 588 F.2d 952, 953 (5th Cir. 1979) (corporate officer with check-signing authority was a "responsible person"); Neckles v. United States, 579 F.2d 938, 940 (5th Cir. 1978) (de facto corporate officer regarded by some as a "boss," who signed checks and had significant control over disbursement of corporate funds, was a "responsible person"); Adams v. United States, 504 F.2d 73, 75 (7th Cir. 1974) ("responsible person" need not be a corporate officer, but only someone with significant control over the disbursement of funds); Liddon v. United States, 448 F.2d 509, 513 (5th Cir. 1971) (50% shareholder and corporate agent with authority to sign checks was a "responsible person"), cert. denied, 406 U.S. 918, 92 S.Ct. 1769, 32 L.Ed.2d 117 (1972); Monday v. United States, 421 F.2d 1210, 1214-15 (9th Cir. 1970) ("responsible person" status generally attaches to "high corporate officials charged with general control over corporate business affairs who participate in decisions concerning payment of creditors and disbursement of funds."), cert. denied, 400 U.S. 821, 91 S.Ct. 38, 27 L.Ed.2d 48 (1970). HOWARD v. UNITED STATES, 711 F.2d 729 (5th Cir. 1983) There is no single factor that determines whether an individual is a responsible person.[fn8] Vinick, 205 F.3d at 8. Indicia of responsibility include whether the individual: (1) is an officer or member of the board of directors, (2) owns shares or possesses an entrepreneurial stake in the company, (3) is active in the management of day-to-day affairs of the company, (4) has the ability to hire and fire employees, (5) makes decisions regarding which, when and in what order outstanding debts or taxes will be paid, (6) exercises control over daily bank accounts and disbursement records, and (7) has check-signing authority.[fn9] Id. at 7 (citation omitted); see Lubetzky, 393 F.3d at 80. However, "the crucial inquiry is whether the person had the effective power to pay the taxes — that is, whether he had the actual authority or ability, in view of his status within the corporation, to pay the taxes owed." Vinick, 205 F.3d at 8 (internal quotation marks and citations omitted). Therefore, the final three factors in the above list are the most significant "because [they] identif[y] most readily the person who could have paid the taxes, but chose not to do so." Id. at 9. JEAN v. U.S., 396 F.3d 449 (1st Cir. 2005) [13] Two requirements must be met before one can be liable under section 6672. The taxpayer must: (1) be a "responsible person" under the statute, and (2) have "willfully" failed to pay over the taxes due. Id. The taxpayer bears the burden of proving that he is not a responsible person under section 6672 and that he did not act willfully in failing to pay over the taxes. McDermitt v. United States, 954 F.2d 1245, 1251 (6th Cir. 1992). [17] Moreover, liability requires the existence of only significant as opposed to absolute control of the corporation's finances. Id. "Generally, such a person is one `with ultimate authority over expenditure of funds since such a person can fairly be said to be responsible for the corporation's failure to pay over its taxes,' or more explicitly, one who has `authority to direct payment of creditors.'" Id. (citation omitted). KINNIE v. U.S., 994 F.2d 279 (6th Cir. 1993) [17] Corporate employers are required to withhold, from the wages of their employees, federal social security and income taxes. 26 U.S.C. § 3102(a) and 3401(a). Such withheld taxes "shall be held to be a special fund in trust for the United States." 26 U.S.C. § 7501. If the corporate employer fails to pay over this fund to the Government, a corporate officer or employee may be liable personally for the penalty prescribed by [26 U.S.C.] § 6672, which is generally called the "100% penalty," if during the period involved he was a "responsible person" under [26 U.S.C.] § 6671(b), and if he acted "willfully" in respect of the tax liability of the employer. [Hartman v. United States, supra, 538 F.2d at 1340.] [19] A corporate officer may be deemed a responsible person "if he has significant, albeit not necessarily exclusive, authority in the field of corporate decisionmaking and action where taxes due the federal government are concerned[.]" Hartman, supra, 538 F.2d at 1340. KIZZIER v. UNITED STATES, 598 F.2d 1128 (8th Cir. 1979) "In reaching a determination with respect to the person or persons upon whom to impose responsibility and liability for the failure to pay taxes, the courts have tended to disregard the mechanical functions of the various corporate officers, and, instead, have searched for the person or persons who could have seen to it that the taxes were paid, a person with ultimate authority over expenditures of corporate funds who can fairly be said to be responsible for the corporation's failure to pay over its taxes." (Citations omitted.) There is ample evidence to support the jury's verdict that Liddon was a responsible "person." He was one of two corporate agents at its home office who could sign checks, and the other was his righthand man. LIDDON v. UNITED STATES, 448 F.2d 509 (5th Cir. 1971) [26] Section 6672 provides that "any person" who willfully fails to pay withheld income taxes is personally liable for the full amount of the taxes not paid. Thus, [l]iability attaches if an individual meets two requirements. He must be a "responsible person" under the statute, and he must "willfully" fail to pay over to the government the amount due. [27] Gephart v. United States, 818 F.2d 469, 473 (6th Cir. 1987). [28] The test for determining whether a person is a "responsible person" is a functional one focusing mainly on 6671 the degree of influence and control which the person exercised over the financial affairs of the corporation and, specifically, disbursements of funds and the priority of payments to creditors. [29] Id. McDERMITT v. U.S., 954 F.2d 1245 (6th Cir. 1992) [5] To determine who within a company is a "responsible person" under § 6672, we undertake a pragmatic, substance-over-form inquiry into whether an officer or employee so "participate[d] in decisions concerning payment of creditors and disbursement of funds" that he effectively had the authority — and hence a duty — to ensure payment of the corporation's payroll taxes. O'Connor, 956 F.2d at 51. Stated differently, the "crucial inquiry is whether the person had the `effective power' to pay the taxes — that is, whether he had the actual authority or ability, in view of his status within the corporation, to pay the taxes owed." Barnett, 988 F.2d at 1454 (citations omitted). Several factors serve as indicia of the requisite authority, including whether the employee (1) served as an officer of the company or as a member of its board of directors; (2) controlled the company's payroll; (3) determined which creditors to pay and when to pay them; (4) participated in the day-to-day management of the corporation; (5) possessed the power to write checks; and (6) had the ability to hire and fire employees. See O'Connor, 956 F.2d at 51; United States v. Landau, 155 F.3d 93, 100-01 (2d Cir. 1998); Barnett, 988 F.2d at 1455. PLETT v. U.S., 185 F.3d 216 (4th Cir. 1999) [33] The question of debtor's liability under Section 6672 presents two issues: first, whether debtor is a responsible person; second, whether debtor willfully failed to collect or truthfully account for and pay over such tax. George v. United States, 819 F.2d 1008, 1011 (11th Cir. 1987). We will first address the responsible person issue. [34] A responsible person is a person required to collect, truthfully account for or pay over any tax.[fn5] Slodov v. United States, 436 U.S. 238, 98 S.Ct. 1778, 56 L.Ed.2d 251 (1978). Responsibility is a matter of status, duty or authority, not knowledge. Mazo v. United States, 591 F.2d 1151 (5th Cir. 1979). The responsible person need not be a corporate officer. Adams v. United States, 504 F.2d 73 (7th Cir. 1974). A person is responsible if the person has significant, though not necessarily exclusive, control over the employer's finances. United States v. Vespe, 868 F.2d 1328, 1332 (3d Cir. 1983). A person has significant control if he has the final or significant word over which bills or creditors get paid. Commonwealth National Bank of Dallas v. United States, 665 F.2d 743, 757 (5th Cir. 1982). QUATTRONE ACCOUNTANTS, INC. v. I.R.S., 895 F.2d 921 (3rd Cir. 1990) [8] It is true that by their terms I.R.C. §§ 6671-72 apply to all types of business organizations, from the sole proprietorship to the general partnership to the multinational corporation. In some cases, such as the general partnership, the provisions create an alternative source of responsibility to the one already imposed by state law. In other cases, such as the business corporation, the provision imposes additional responsibility that supplements liability imposed by state law. We discern no indication that Congress intended to eliminate or restrict state law liability for the payment of trust fund taxes; the only indication we find is to the contrary, i.e., that §§ 6671-72 were intended to create an additional avenue for the collection of trust fund taxes. REMINGTON v. U.S., 210 F.3d 281 (5th Cir. 2000) The Internal Revenue Service subsequently denied the company's claim that the funds were applied to the wrong taxes and assessed plaintiffs David and Peter Schon, as responsible corporate officers under sections 6671(b) and 6672 of the Internal Revenue Code, for the unpaid trust fund taxes. SCHON v. UNITED STATES, 759 F.2d 614 (7th Cir. 1985) A corporate officer or employee is a responsible person if he or she has significant, though not necessarily exclusive, authority in the general management and fiscal decision-making of the corporation. Whether a person is a responsible person must be decided by the unique facts of each case. Indicia of responsibility include the holding of corporate office, control over financial affairs, the authority to disburse corporate funds, and the ability to hire and fire employees. If an individual possesses sufficient indicia of responsibility, he or she is a responsible person under the law regardless of whether he or she has the final say as to which creditors should be paid or has the specific job within the corporate structure to see that the taxes are paid over to the government. The crucial inquiry is whether the person had the effective power to pay the taxes — that is whether he or she had the actual authority or ability, in view of his or her status within the corporation, to pay the taxes owed. SMITH v. U.S., 555 F.3d 1158 (10th Cir. 2009) [18] "[A] corporate officer or employee is responsible if he or she has significant, though not necessarily exclusive, authority in the `general management and fiscal decisionmaking of the corporation.'" Denbo, 988 F.2d at 1032 (quoting Kizzier v. United States, 598 F.2d 1128, 1132 (8th Cir. 1979)). In this circuit, we have set forth a non-exclusive list of factors demonstrating "indicia of responsibility." Specifically, we examine whether the person: (1) held corporate office; (2) controlled financial affairs; (3) had authority to disburse corporate funds; (4) owned stock; and (5) had the ability to hire and fire employees. Id. If an individual possesses sufficient indicia of responsibility, he is a "responsible person" under Section(s) 6672 regardless whether he: (1) has the final say as to which creditors should be paid, Bowlen v. United States, 956 F.2d 723, 728 (7th Cir. 1992); Gephardt v. United States, 818 F.2d 469, 475 (6th Cir. 1987); or (2) has the specific job within the corporate structure to see that the taxes are paid over to the government, see Denbo; 988 F.2d at 1032; McGlothlin v. United States, 720 F.2d 6, 8 (6th Cir. 1983) ("[I]t is not necessary that a [responsible] person be the one who prepared the tax returns, kept the books and records, paid the wages or withheld the taxes."). "The crucial inquiry is whether the person had the `effective power' to paythe taxes — that is, whether he had the actual authority or ability, in view of his status within the corporation, to pay the taxes owed." Barnett, 988 F.2d at 1454. Liability under Section(s) 6672 extends to all responsible corporate officers or employees, not just to the single "most" responsible individual. Turnbull v. United States, 929 F.2d 173, 178 (5th Cir. 1991); see Denbo, 988 F.2d at 1032 ("[T]here may be more than one responsible person."); accord Keller v. United States, 46 F.3d 851, 854 (8th Cir.), cert. denied, ___ U.S. ___ (1995); Thomas v. United States, 41 F.3d 1109, 1113 (7th Cir. 1994); Gephardt, 818 F.2d at 476. TAYLOR v. I.R.S., 69 F.3d 411 (10th Cir. 1995) [10] Under this section, the burden is on the taxpayer to disprove the Service's claim by a preponderance of the evidence. Ruth v. United States, 823 F.2d 1091, 1093 (7th Cir. 1987). Because Charlton does not contest the lower courts' finding that his failure to remit the taxes was willful, the only issue is whether the evidence was insufficient to establish that Charlton was not a "responsible person" for purposes of section 6672. [11] The Internal Revenue Code defines "person" as "an officer or employee of the corporation . . . who as such officer or employee . . . is under a duty to perform the act in respect of which the violation occurs." 26 U.S.C. § 6671(b). Whether such a duty exists depends on whether the taxpayer has "significant control or authority over an enterprise's finances or general decisionmaking." Ruth, 823 F.2d at 1094. Relevant factors include the holding of an entrepreneurial stake in a company, the holding of corporate office, the authority to disburse funds on behalf of the company, the ability to take out loans on behalf of the company and the ability to hire and fire employees. Bowlen v. United States, 956 F.2d 723, 728 (7th Cir. 1992); Thomsen v. United States, 887 F.2d 12 (1st Cir. 1989). The true objective of this inquiry, and the sine qua non of liability under section 6672, is a determination that the taxpayer had the authority to allocate funds to pay the company's other debts in preference to its debt to the IRS. Bowlen, 956 F.2d at 728; Monday v. United States, 421 F.2d 1210, 1214 (7th Cir. 1970). U.S. I.R.S. v. CHARLTON, 2 F.3d 237 (7th Cir. 1993) [47] Moreover, this court has interpreted similar terms in other statutes consistently with the Court's decision in Park. For example, the Internal Revenue Code (IRC) holds liable any "person required to collect, truthfully account for, and pay over any tax" under the IRC. 26 U.S.C. § 6672(a). The IRC defines "person" to include any "officer . . . under a duty to perform the act in respect of which the violation occurs." 26 U.S.C. § 6671(b). This court consistently has interpreted the term "person" to include corporate officers with authority to pay taxes, whether or not they exercise that authority. [48] In United States v. Graham, 309 F.2d 210, 212 (9th Cir. 1962), a member of the board of directors argued that he could not be a "person" as that term is used in 26 U.S.C. § 6671(b). This court rejected that argument, holding, instead: The statute's purpose is to permit the taxing authority to reach those responsible for the corporation's failure to pay the taxes which are owing. . . . The question is simply whether the board of directors had the final word as to what bills should or should not be paid, and when. [49] Id. (citation and internal quotation marks omitted). [50] More recently, in Purcell v. United States, 1 F.3d 932, 936 (9th Cir. 1993), this court addressed a corporate president's argument that he was not a responsible "person" under the IRC, because he had delegated the actual decision-making to a subordinate. This court held: [51] That an individual's day-to-day function in a given enterprise is unconnected to financial decision making or tax matters is irrelevant where that individual has the authority to pay or to order the payment of delinquent taxes. . . . [52] [Thus] . . ., we conclude that an individual may be said to have had the final word as to what bills should or should not be paid if such individual had the authority required to exercise significant control over the corporation's financial affairs, regardless of whether he exercised such control in fact. [53] Id. at 937 (citation and internal quotation marks omitted). See also Muck v. United States, 3 F.3d 1378, 1380-81 (10th Cir. 1993) ("Plaintiff argues that, because the day-to-day operations of Graystone were performed by a business manager who made the decisions about disbursal of funds, plaintiff is not a responsible party for purposes of the statute. . . . The existence of such authority, irrespective of whether that authority is actually exercised, is determinative. Liability is not confined to the person with the greatest control.") (citations omitted). [54] Taken together, the wording of the CWA, the Supreme Court's interpretations of the "responsible corporate officer" doctrine, and this court's interpretation of similar statutory requirements establish the contours of the "responsible corporate officer" doctrine under the CWA. Under the CWA, a person is a "responsible corporate officer" if the person has authority to exercise control over the corporation's activity that is causing the discharges. There is no requirement that the officer in fact exercise such authority or that the corporation expressly vest a duty in the officer to oversee the activity. U.S. v. IVERSON, 162 F.3d 1015 (9th Cir. 1998) [41] A person who may be found responsible under section 6672 "includes an officer or employee of a corporation . . . who as such officer [or] employee . . . is under a duty to perform the act in respect of which the violation occurs." 26 U.S.C. § (b). The mere fact that an individual is a corporate officer is not, by itself, sufficient to make that individual a responsible person within the definition of the statute. Rather, "[t]he key element . . . is whether that person has the statutorily imposed duty to make the tax payments." O'Connor v. United States, 956 F.2d 48, 51 (4th Cir. 1992). This duty, moreover, "is considered in light of the person's authority over an enterprise's finances or general decision making." Id. U.S. v. McCOMBS, 30 F.3d 310 (2nd Cir. 1994) [18] The district court concluded Running was a responsible person because he was an officer of Bethel, he possessed management responsibilities under the management and consulting agreement between Good Shepherd and HFC, and (based on Rieckhoff's testimony) had sufficient control over the facility's financial affairs. Running contends the document listing him as the Secretary-Treasurer of Bethel, a United States Department of Health and Human Services Ownership and Control Interest Disclosure Statement, was prepared before he resigned from Good Shepherd and is thus irrelevant because his resignation from Good Shepherd was also a resignation from the entities controlled by Good Shepherd. The district court was entitled to find otherwise. Running's resignation letter makes no mention of Bethel, and there is no evidence that he ever renounced his position in that facility. U.S. v. RUNNING, 7 F.3d 1293 (7th Cir. 1993) "Person" is defined to include "an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs." 26 U.S.C. § 6671(b). "Section 6672 imposes liability upon (1) a responsible person (2) who has willfully failed to perform a duty to collect, account for, or pay over federal employment taxes." Thosteson v. United States, 331 F.3d 1294, 1298-99 (11th Cir. 2003). Plaintiff contends that as a matter of law, she neither was a responsible person, nor willfully failed to perform a duty. (Doc. 23.) Defendant contends that, as a matter of law, Plaintiff both is a responsible person and willfully failed to perform her duties under the tax laws. (Doc. 19.) "A person is responsible within the meaning of § 6672 if he has a duty to collect, account for, or pay over taxes withheld from the wages of a company's employees." Thosteson v. United States, 331 F.3d 1294, 1299 (11th Cir. 2003). "Responsibility is a matter of status, duty and authority, not knowledge." George v. United States, 819 F.2d 1008, 1011 (11th Cir. 1987) (emphasis added). "Indicia of responsibility include[] the holding of corporate office, control over financial affairs, the authority to disburse corporate funds, stock ownership, and the ability to hire and fire employees." Thibodeau v. United States, 828 F.2d 1499, 1503 (11th Cir. 1987). However, "Section 6672 responsibility is a matter of the power and authority to make payment of withholding taxes, which is not dispositively determined by corporate title or position." Thosteson, 331 F.3d at 1299. That is, "[a]uthority to pay in this context means effective power to pay." Roth v. United States, 779 F.2d 1567, 1571-72 (11th Cir. 1986) (emphasis added). TODD v. U.S. (S.D.Ga. 9-29-2009) [3] 26 U.S.C. § 6671(b) provides: Person defined. — The term "person", as used in this subchapter, includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs. Case law has refined this statutory definition into the term of art "responsible person", which is a person who has the effective power to collect and pay the required taxes. Hochstein v. United States, 713 F.Supp. 119, 123 (S.D.N.Y. 1989). In re Leonard, 112 BR 67 - Bankr. Court, D. Connecticut 1990 In support of the district court Graham here contends that he was not a "person," as defined in § 6671(b), since he was simply a member of the corporation's board of directors, was not employed by the corporation and did not serve as an executive officer.[2] This is too narrow a reading of the section. The term "person" does include officer and employee, but certainly does not exclude all others. Its scope is illustrated rather than qualified by the specified examples. In our judgment the section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred. United States v. Graham, 309 F. 2d 210 - Court of Appeals, 9th Circuit 1962 Section 6671(b) has been read not to be exclusive: "In our judgment the section must be construed to include all those so connected with a corporation as to be responsible for the performance of the act in respect of which the violation occurred." United States v. Graham, 9 Cir., 1962, 309 F.2d 210, 212. United States v. Hill, 368 F. 2d 617 - Court of Appeals, 5th Circuit 1966 We believe that the findings and conclusions of law of the District Judge clearly implied that appellant was a "person" within the meaning of 26 U.S. C. § 6671(b) (1970). But we believe appellant also disputes whether he could legally be held to be such a person under § 6671(b) of the Internal Revenue Code, and therefore liable under 26 U.S.C. § 6672, which contains this definition: (b) Person defined. — The term "person", as used in this subchapter, includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs. This language does not by its specific words apply to appellant Mueller. He clearly was not an officer or employee of the corporation which owed these taxes. The government concedes this but claims that under settled case law the courts have expanded this definition to include someone who by a contract is given the full power of control associated with the powers of a corporate officer. In this respect the government relies upon Pacific National Insurance Co. v. United States, 422 F.2d 26 (9th Cir.), cert. denied, 398 U.S. 937, 90 S.Ct. 1838, 26 L. Ed.2d 269 (1970), and United States v. Graham, 309 F.2d 210 (9th Cir. 1962). This court has dealt with this same statute (and cited the Pacific National Insurance case) in Braden v. United States, 442 F.2d 342 (6th Cir. 1971). It does not appear, however, that we have passed on the question of interpreting the statutory definition of a "person" to include persons actually in control of a corporation, although only as de facto officers. Mueller v. Nixon, 470 F. 2d 1348 - Court of Appeals, 6th Circuit 1972 Moreover, this court has interpreted similar terms in other statutes consistently with the Court's decision in Park. For example, the Internal Revenue Code (IRC) holds liable any "person required to collect, truthfully account for, and pay over any tax" under the IRC. 26 U.S.C. § 6672(a). The IRC defines "person" to include any "officer ... under a duty to perform the act in respect of which the violation occurs." 26 U.S.C. § 6671(b). This court consistently has interpreted the term "person" to include corporate officers with authority to pay taxes, whether or not they exercise that authority. In United States v. Graham, 309 F.2d 210, 212 (9th Cir.1962), a member of the board of directors argued that he could not be a "person" as that term is used in 26 U.S.C. § 6671(b). This court rejected that argument, holding, instead: The statute's purpose is to permit the taxing authority to reach those responsible for the corporation's failure to pay the taxes which are owing.... The question is simply whether the board of directors had the final word as to what bills should or should not be paid, and when. Id. (citation and internal quotation marks omitted). More recently, in Purcell v. United States, 1 F.3d 932, 936 (9th Cir.1993), this court addressed a corporate president's argument that he was not a responsible "person" under the IRC, because he had delegated the actual decision-making to a subordinate. This court held: That an individual's day-to-day function in a given enterprise is unconnected to financial decision making or tax matters is irrelevant where that individual has the authority to pay or to order the payment of delinquent taxes.... .... [Thus] ..., we conclude that an individual may be said to have had the final word as to what bills should or should not be paid if such individual had the authority required to exercise significant control over the corporation's financial affairs, regardless of whether he exercised such control in fact. US v. Iverson, 162 F. 3d 1015 - Court of Appeals, 9th Circuit 1998 Upon what basis is the assessment here made? The applicable sections of the Code creating the asserted liability are §§ 6671 and 6672. Paraphrased briefly, any person [Thru-County] required to collect, but who wilfully fails to collect and pay over, a tax shall be liable to a penalty equal to the tax, to wit, 100%. Thru-County may be regarded as the primary taxpayer but it is bankrupt. However, a "person" includes an officer or employee of a corporation who "is under a duty to perform the act in respect of which the violation occurs" (Sections 6671(b), 6672, Code). Not every "officer" or "employee" of a corporation is subject to the "penalty" but only if he be "under a duty to perform the act," namely, be responsible for making the deductions and payments. The assessment provisions relating to a "tax" also refer to "penalties." Botta v. Scanlon, 288 F. 2d 504 - Court of Appeals, 2nd Circuit 1961 If a corporate employer fails to pay these withheld amounts over to the government, then section 6672 permits the government to look for payment to the person responsible for collecting, truthfully accounting for, and paying over the tax. Title 29 U.S.C. § 6671(b) provides that the term "person" includes, inter alia, "an officer or employee of a corporation * * * who, as such officer [or] employee, * * * is under a duty to perform the act in respect of which the violation occurs." This language is broad enough to reach corporations and other artificial entities as well as individuals. Pacific National Ins. Co. v. United States, 422 F.2d 26, 30 (9th Cir.), cert. denied, 398 U.S. 937, 90 S.Ct. 1838, 26 L.Ed.2d 269 (1970). Anderson v. United States, 561 F. 2d 162 Court of Appeals, 8th Circuit 1977 As noted, only a "person required under this title to collect, account for, and pay over" withholding taxes is criminally liable under § 7202. Thayer argues that only employers such as MIS and ELOP who are required to withhold employees' taxes under I.R.C. §§ 3402-03 qualify. Thayer contends he was merely an officer and part-owner of the corporations, and not an "employer" as defined by the Internal Revenue Code.[6] Because this is a question of statutory interpretation, we will exercise plenary review. See Parise, 159 F.3d at 794; Hayden, 64 F.3d at 128. I.R.C. § 6672(a), applying the same language in § 7202, imposes civil penalties on "any person required to collect, truthfully account for, and pay over any tax imposed by this title who willfully fails to collect such tax." In Slodov v. United States, 436 U.S. 238, 98 S.Ct. 1778, 56 L.Ed.2d 251 (1978), the Supreme Court held that § 6672(a) applies to corporate officers or employees responsible for the collection and paying over of withholding taxes. See id. at 244-45, 98 S.Ct. 1778.[7] Although the government in Slodov sought only civil penalties, the Court stated that persons civilly liable under § 6672(a) could also be held criminally liable under § 7202. See id. at 245, 247, 98 S.Ct. 1778. Thayer urges us not to follow this apparent dicta in Slodov. He contends that a corporate officer is a "person" for purposes of § 6672(a) only because § 6671(b) specifies that the term "person," as used in I.R.C. ch. 68, subchapter B, encompassing §§ 6671-6724, "includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs." But for purposes of § 7202, the term "person" is defined by identical language. See I.R.C. § 7343 ("The term `person' as used in this chapter 220*220 [I.R.C. ch. 75, encompassing §§ 7201-7344], includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs."). Therefore, Thayer, as the president and majority owner of MIS and ELOP, was properly charged and convicted as a "person" under § 7202. US v. Thayer, 201 F. 3d 214 - Court of Appeals, 3rd Circuit 1999 The administrative practice, at least, is that once net wages are paid to the employee, taxes withheld are credited to that employee for income and social security tax purposes, whether or not the employer pays them over to the Internal Revenue Service (IRS). Id. at 243 n.4, 98 S.Ct. at 1783 n.4. Thus section 6672 was enacted to impose personal liability upon those responsible for transmitting these trust funds should they divert the money to pay other pressing creditors. The section is applied to persons[5] who have sufficient control to divert the funds away from the IRS, usually officers and supervisory employees. But the courts have fashioned a functional definition of "responsible person" to include some who do not hold any official position with the company. See, e. g., Neckles v. United States, 579 F.2d 938 (5th Cir. 1978). Lenders and employees of lenders have been considered liable under section 6672 in particular circumstances. Adams v. United States, 504 F.2d 73 (7th Cir. 1974); Mueller v. Nixon, 470 F.2d 1348 (6th Cir. 1972), cert. denied, 412 U.S. 949, 93 S.Ct. 3011, 37 L.Ed.2d 1001 (1973); Turner v. United States, 423 F.2d 448 (9th Cir. 1970); Pacific Nat'l Ins. Co. v. United States, 422 F.2d 26 (9th Cir.), cert. denied, 398 U.S. 937, 90 S.Ct. 1838, 26 L.Ed.2d 269 (1970). Contra, United States v. Hill, 368 F.2d 617 (5th Cir. 1966). Fidelity Bank, NA v. United States, 616 F. 2d 1181 - Court of Appeals, 10th Circuit 1980 26 U.S.C.A. § 6671(b) defines "person" as used in § 6672, supra, as an officer of a corporation whose function it is to perform the acts in respect to which the violation occurs. Burden v. United States, 486 F. 2d 302 - Court of Appeals, 10th Circuit 1973 -************************************************* Bob Hurt - Home Page - +1 (727) 669-5511 2460 Persian Drive #70 - Clearwater, FL 33763 Donate to my Law Studies Learn to litigate: Buy and Study JURISDICTIONARY Stay up to date: Subscribe to Lawmen E-Letter Now ************************************************* __________ Information from ESET Smart Security, version of virus signature database 5860 (20110209) __________ The message was checked by ESET Smart Security. http://www.eset.com