Notes

advertisement

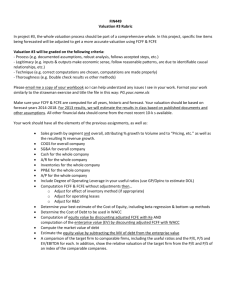

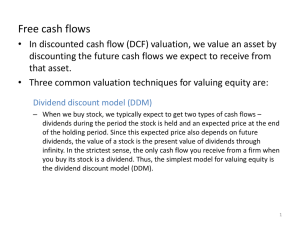

Equity Asset valuation Kevin C.H. Chiang Free cash flow valuation EAV, Chapter 4 Intrinsic value A major task of fundamental analysis is about finding the present values of future expected (deterministic) cash flow streams. Present values are also called intrinsic values, fundamental values, or economic values. Intrinsic values of stocks This topic is about finding intrinsic values of stocks. This task is more challenging than calculating intrinsic values of bonds. The main reason for this is that (1) future, expected cash flows of stocks are highly uncertain; thus, when we use deterministic methods, we are making strong assumptions; (2) there are many ways of defining cash flows for stocks; and (3) firms (and thus their stocks) can potentially have a infinite life. Uncertain cash flows When deterministic methods are used, the cash flow estimates are treated as if they are certain. We know this is not true. We usually rely on a sensitivity analysis to address this unrealistic assumption; we will talk about sensitivity analysis later. That is, a “range” of fundamental values. What cash flows? After-tax (corporate tax) cash flows. There are three (popular) different measures of cash flows used by practitioners: (1) expected cash dividends, (2) expected free cash flows to the firm (FCFF), and (3) expected free cash flows to equity (FCFE). Potential infinite life A potential infinite life means an infinite series of cash flows. It is impossible to individually discounting an infinite series of cash flows; there is no end of it. We need some assumptions to make the calculation doable. The usual assumption is to assume there is a constant growth rate in cash flows. Dividends as cash flows Dividends are the cash flows actually paid to equity investors. Expected dividends should be discounted by the required rate of return on equity (cost of equity). The required rate of return on equity can be estimated by the CAPM (or other asset pricing models): E(Ri) = Rf + i * (E(Rm) – Rf). FCFFs as cash flows FCFFs are cash flows available for distribution to debtholders and equityholders. Thus, the appropriate discount rate is the required rate of return on debt and equity. The discount rate is the WACC. WACC = (D / (D+E))*YTM*(1-Tax rate) + (E / (D+E))*E(Ri) if bonds are used to finance 100% of (long-term) debt. D is the market value of debt; E is the market value of equity. FCFEs as cash flows FCFEs are the cash flows available for distribution to equityholders. FCFEs can be lower or higher than dividends, depending on the firm’s cash generating capacity and the firm’s dividend policy. Like dividends, FCFEs should be discounted by the required rate of return on equity (cost of equity). Make infinite calculations possible The usual strategy is to assume a constant growth rate, g, in cash flows beyond certain year t, i.e., growing perpetuity. PVt = CFt+1 / (r – g). r is the appropriate discount rate. An example Suppose that we expect IBM will pay $2 per share as dividends in 3 years, and the dividends afterwards are able to grow at 5%. The required rate of return on equity is 10%. What is the price that we expected in 2 years? PV2 = CF3 / (r – g) = $2 / (10% – 5%) = $40. Calculating FCFF from net income, I FCFF is the after-tax cash flow available to debtholders and equityholders after all operating expenses and operating investments have been accounted for. FCFF = NI + net noncash charges + interest expense * (1 – tax rate) – net investment in fixed capital for the year – net investment in working capital for the year (eq. 4-7, p. 151). Noncash charges include depreciation expense, intangible-asset amortization expense, etc. Calculating FCFF from net income, II Net noncash charges must be added back because they reduce NI, but they are not cash outflows. After-tax interest expense must be added back because interest expense net of the related tax shield was deducted in arriving at NI and because interest expense is a cash flow available to debtholders, i.e., part of FCFF. Extra: note that if the firm issues preferred stocks, preferred stock dividends must be added back as well. Calculating FCFF from net income, III Net investment in fixed capital (long-term assets) is the cash outflow needed to sustain the firm’s current and future operations. For stock valuation, working capital is defined as: accounts receivable + Inventory – accounts payable. Another method for computing FCFF The benchmark method for computing FCFF is based on NI. FCFF can be computed from the statement of cash flows as well. FCFF = cash flow from operations + interest expense * (1 – tax rate) – net investment in fixed capital for the year See pp. 156-157. VTwares, I We have VTwares’ income statement and balance sheet for Year 0 and pro forma income statements and balance sheets for Year 1, Year 2, and Year 3. D: depreciation; A: Amortization. EBITDA Dep. Interest Taxable Income Taxes (30%) Net Income Year 0 Year 1 Year 2 Year 3 100 110 120 135 30 35 40 45 20 20 22 21 50 55 58 69 15 16.5 17.4 20.7 35 38.5 40.6 48.3 Cash A/R Inventory Fixed Assets Less: Acc. Dep. 30 40 40 400 60 A/P N/P L-T Debt Common Stock R/E 40 0 150 150 110 33 44 44 470 95 70 44 0 153.5 150 148.5 4 36 48 48 560 135 90 46 0 171.9 150 189.1 6 40 50 50 630 180 70 Net Capital 48 0 154.6 150 237.4 2 Net WC VTwares, II (calculating FCFF from NI) Year 1 Year 2 Year 3 NI 38.5 40.6 48.3 Plus: noncash 35 40 45 Plus: interest*(1-tax rate) 14 15.4 14.7 Less: fixed capital 70 90 70 Less: working capital 4 6 2 FCFF 13.5 0 36 VTwares, III The appropriate discount rate for FCFF is WACC. WACC may change over time. Analysts usually use target capital structure weights instead of current weights when calculating WACC. Nowadays, there are a number of information providers posting their WACC estimates on the internet, e.g., valuepro.net. Suppose that you find the WACC of VTwares to be 10%. VTwares, IV Suppose that your research show that the FCFFs of VTwares will grow at a constant rate of 5% after Year 3. That is, the FCFF for Year 4 is 36*(1+5%)=37.8. This means we can use: PV3 = CF4 / (r – g). Suppose that the market value of debt is 160. Note that the market value is different from the book value of debt, 150. Suppose that the number of shares outstanding is 15. VTwares, V Year Year Year Year 1 2 3 4 W ACC g FCFF PV(3) PV 13.5 12.2727 0 0 36 27.0473 37.8 756 567.994 607.314 160 0.1 447.314 0.05 29.8209 V(Firm) V(Debt) V(Equity) PV per share Calculating FCFE from FCFF FCFE is cash flow available to equityholders only. We need to reduce FCFF by interest paid to debtholders and to add net borrowing (debt issued less debt repayments) over the year. FCFE = FCFF – interest expense * (1 – tax rate) + net borrowing (eq. 4-9, p. 163). Net borrowing: the sum of net change in notes payable and long term debt. Alternative ways of computing FCFE FCFE = net income + net noncash charges – net investment in fixed capital – investment in working capital + net borrowing FCFE = cash flow from operations – net investment in fixed capital + net borrowing P. 164 VTwares, VI EBITDA Dep. Interest Taxable Income Taxes (30%) Net Income Cash A/R Inventory Fixed Assets Less: Acc. Dep. A/P N/P L-T Debt Common Stock R/E Year 0 Year 1 Year 2 Year 3 100 110 120 135 30 35 40 45 20 20 22 21 50 55 58 69 15 16.5 17.4 20.7 35 38.5 40.6 48.3 30 33 36 40 40 44 48 50 40 44 48 50 400 470 560 630 60 95 135 180 40 44 46 48 0 0 0 0 150 153.5 171.9 154.6 150 150 150 150 110 148.5 189.1 237.4 3.5 18.4 -17.3 Net Borrowing VTwares, VII (calculating FCFE from FCFF) Year 1 FCFF Less: interest*(1-tax rate) Plus: net borrowing FCFE Year 2 13.5 14 3.5 3 FCFE 0 15.4 18.4 3 PV(3) Year 1 Year 2 Year 3 Year 4 3 3 4 4.44 E(Ri) g 0.12 0.11 Year 3 36 14.7 -17.3 4 PV 2.678571 2.391582 2.847121 444 316.0304 323.9477 V(Equity) 21.59651 PV per share Dividends vs. FCFs About ½ of U.S. publicly traded firms do not pay dividends. This make the use of dividend discount models difficult. Practitioners tend to like FCF-based discount models better when (1) the firm does not pay dividends, (2) the firm pay relatively small amount of dividends relative to its capacity, and (3) outside investors may takeover the firm. FCFF vs. FCFE Practitioners tend to work with FCFFs for levered firms with negative FCFEs. Working with FCFEs tend to be more straightforward if firms’ capital structures are relatively stable over time. End-of-chapter EAV, Chapter 4: Problems 2, 5, 6, 7, 8, 9, 12, 14, and 16. Residual income valuation EAV, Chapter 5 Residual income Residual income (RI): net income less an equity charge (deduction) for common shareholders’ opportunity cost in generating net income. Residual income is a measure of valueadded. Equity charge = beginning (of the period) book value of equity * cost of equity Residual income for year T AXCI has a book value of equity $1 million at the end of year T-1. For year T, the net income is $91,000. The cost of equity based on the CAPM is 12%. What is the residual income for year T? RI = NI – equity charge = $91,000 $1,000,000 * 12% = -$29,000. AXCI does not earn enough to cover the cost of equity capital; there is a loss in value in year T. The residual income model V0 = B0 + RI1 / (1 + r) + RI2 / (1 + r)2 + RI3 / (1 + r)3 + …… where V0 is the value of a share today, B0 is current per-share book value of equity, and r is the cost of equity. RI valuation, I PUP’s expected EPS is $2.0, $2.5, and $4.0, for the next three years. BUP will pay dividends of $1.0, $1.25, and $1.5 for the three years. BUP’s current book value is $6.0 per share. The cost of equity based on the CAPM is 10%. The residual income beyond year 3 is expected to grow at 5% forever. RI valuation, II Year Beginning book value NI Dividends Add. to R/E Ending book value Cost of equity Equity charge RI Growth rate for RI 1 6 2 1 1 7 0.1 0.6 1.4 2 7 2.5 1.25 1.25 8.25 0.1 0.7 1.8 3 8.25 3 1.5 1.5 9.75 0.1 0.825 2.175 0.05 PV(3) 45.675 V(0) 44.7107438 4 2.28375 The clean surplus relation The validity of the RI model is based on the clean surplus relation. That is, the following equation hold: ending book value = beginning book value + period earning – period dividends. The assumption of the clean surplus relation may not be true when an accounting event bypasses the income statement and affect book value of equity directly; e.g., gains and losses on re-measuring available-for-sale financial assets. When the assumption is violated, adjustments need to be done (see pp. 234-249). End-of-chapter Problems 1, 2, 3, 4, 5, 8, 9, 11, 13, 14, and 15