Tobacco Plain Packaging PIR * Appendix A

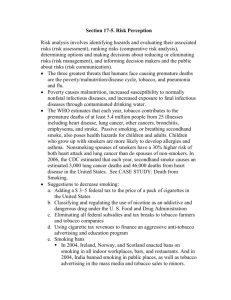

advertisement