2007

advertisement

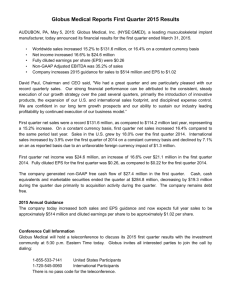

1st Quarter Conference Call 10:00 AM CDT March 12, 2007 Safe Harbor Statement SPARTECH: FORWARD-LOOKING STATEMENTS This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relate to future events and expectations, include statements containing such words as “anticipates,” “believes,” “estimates,” “expects,” “would,” “should,” “will,” “will likely result,” “forecast,” “outlook,” “projects,” and similar expressions. Forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which management is unable to predict or control, that may cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements. Important factors which have impacted and could impact our operations and results include: (a) adverse changes in economic or industry conditions generally, including global supply and demand conditions and prices for products of the types we produce; (b) the ability to compete effectively on product performance, quality, price, availability, product development, and customer service, (c) material adverse changes in the markets we serve, including the transportation, packaging, building and construction, recreation and leisure, and other markets, some of which tend to be cyclical; -continued2 Safe Harbor Statement SPARTECH: FORWARD-LOOKING STATEMENTS, continued (d) our inability to achieve the level of cost savings, productivity improvements, synergies, growth or other benefits anticipated from acquired businesses and their integration; (e) volatility of prices and availability of supply of energy and of the raw materials that are critical to the manufacture of our products, particularly plastic resins derived from oil and natural gas, including future effects of natural disasters; (f) our inability to manage or pass through an adequate level of increases to customers in the costs of materials, freight, utilities, or other conversion costs; (g) our inability to predict accurately the costs to be incurred, time taken to complete, or savings to be achieved in connection with announced production plant restructurings; (h) adverse findings in significant legal or environmental proceedings or our inability to comply with applicable environmental laws and regulations; (i) adverse developments with work stoppages or labor disruptions, particularly in the automotive industry; (j) our inability to achieve operational efficiency goals or cost reduction initiatives; (k) our inability to develop and launch new products successfully; (l) restrictions imposed on us by instruments governing our indebtedness, and the possible inability to comply with requirements of those instruments; (m) possible weaknesses in internal controls; and (n) our ability to successfully complete the implementation of a new enterprise resource planning computer system. We assume no duty to update our forward-looking statements. 3 1st Quarter Conference Call… Presentation Content 1st Quarter 2007 Performance Operating Highlights Details on Operating Results 2007 Guidance and Outlook Note: These slides should be read in conjunction with our 1st Quarter Earnings Release issued March 12, 2007. 4 Abbreviations: M = amounts in millions 1st Spartech Corporation… Quarter Performance Highlights Operating Results Volumes were lower when taking into account the extra week due to particularly weak November … growth in some key markets helped mitigate weakness in Heavy Truck, Manufactured Housing and RV Material Margin/lb continued to be solid at 35 cents per pound… stable with Q4 and Q1 last year Conversion costs/lb down from Q1 2006…Q1 ’07=24.1 cents, down from 25.1 cents in Q1 ’07, lower labor, freight, & utilities Net Earnings increased to $8.1 million from $5.7 million last year… EPS up to $0.25 from $0.18 Cash flow continued to be strong…setting a record for a first quarter at $17.2 million, up 16% from the previous record set last year 5 1st Quarter Performance Highlights Custom Sheet and Rollstock Earnings up to $16.0 million from $12.7 million Comparable sales volume weak at -3% Hard comparable with last year’s post Katrina surge Packaging and material handling were very strong Material margin and conversion cost both improved Color and Specialty Compounds Earnings down from $4.5 million to $4.0 million Comparable sales volume weak at -4% Automotive weak, Film packaging weak, Roofing strong Poor mix (less color due to year-end inventory destockings) drove lower material margins—partially compensated for with better conversion costs Engineered Products Earnings up to $1.6 million from $1.0 million Benefited by improved conversion costs on sales down 2% 6 Material Margin Trends Price/Ib $1.00 Sales Price $0.80 $0.60 Material Costs $0.40 Material Margin $0.20 2004 2005 2006 2007 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 0.792 0.795 0.821 0.834 0.896 0.973 0.954 0.967 1.024 1.013 1.014 1.019 1.001 Material Costs 0.461 0.464 0.488 0.511 0.566 0.633 0.616 0.627 0.672 0.655 0.662 0.665 0.648 Material Margin 0.331 0.331 0.333 0.323 0.330 0.340 0.338 0.340 0.352 0.358 0.352 0.354 0.353 7 Sales Price $0.00 Other Highlights Plant Restructurings…We have sold all idle facilities resulting from the 2005 and 2006 plant restructurings (last sale closing March ’07). Planned Capital…We have made solid progress on three key initiatives: Greenville Consolidation Ramos Mexico Expansion Oracle ERP Green Products Growth…Sales of 22.3M pounds in 1st Qtr of 2007 compared to 19.1M in 2006, up 17% Working Capital Performance: DSO improved 2.7 days from 1st qtr ‘06, 52.8 to 50.1 days Inventory turns were 8.9x, down slightly from 2006 1st qtr of 9.4x Net working capital represents 10.7% of Sales versus 12.9% at 1st qtr ‘06 Debt Position: Despite higher capital expenditures ($10.2 versus $4.0) and repurchase of shares of $10.4M, only borrowed $3.8M in qtr Debt outstanding of $299M, represents .68 to 1 (Debt/Equity) Availability totaling $241M 8 2007 Initiatives and Outlook Revised guidance of $1.55 to $1.62 Without special items Compares to $1.44 per diluted share in 2006 Weaker demand environment than 2006 (Auto, Housing, Heavy Truck) Benefits from 2006 cost reduction efforts and improved freight and utilities Some negatives from Greenville consolidation in advance of 2008 benefits Growth & Improvement Initiatives Green Products Initiative Greenville Consolidation Mexico Plant Expansion and Growth TPO heavy truck initiative 9 Supplemental Data Company Overview… Diversity of Markets Lawn & Garden Packaging & Material Handling Other Transportation 25% 21% 10% 4% SPARTECH 16% 7% 7% 10% Building & Construction Recreation & Leisure Appliance & Electronics Sign & Advertising Packaging Food Consumer Medical Material Handling Transportation Automobile Heavy Truck Aerospace Building & Construction Roofing Sanitaryware Windows & Doors Recreation & Leisure Pool & Spa RV Power Sports Marine Appliances & Electronics Refrigeration Medical Equipment Sign & Advertising Outdoor Sign POP Display Graphic Arts Lawn & Garden Lawnmower Wheels Agricultural Implement Customer End Markets – 1st Quarter of 2007 11 2007 Market Expectations… Weak Packaging & Material Handling Automotive Medium Growth High Growth Food Consumer Medical Material Handling Automotive Transportation Aerospace Heavy Truck Sanitaryware Building & Construction Windows & Doors TPO Roofing Recreation & Leisure RV Pool & Spa Marine Power Sports Outdoor Sign Sign & Advertising Lawn & Garden POP Displays Graphic Arts Lawnmower Wheels Agricultural Implements Appliances & Electronics Refrigeration Medical Equipment Refrigeration Grey Names = General Market expectations compared to Spartech. 12 Material/Gross/Operating Margins Results Per Pound Sold Quarterly Results: 2007 Year Per Pound Sold Sales Material Cost Material Margin Conversion Cost Gross Profit SG&A Amortization Special Charges/Option Expense Operating Earnings Depreciation and Amortization EBITDA (A) 1.001 0.648 0.353 0.241 0.112 0.057 0.003 0.003 0.049 0.030 0.079 1st Q 1.001 0.649 0.352 0.240 0.112 0.057 0.003 0.003 0.049 0.030 0.079 Year 1.017 0.663 0.354 0.233 0.121 0.050 0.003 0.005 0.063 0.028 0.091 4th Q 1.019 0.665 0.354 0.229 0.125 0.053 0.003 0.012 0.057 0.028 0.085 2006 3rd Q 1.014 0.662 0.352 0.222 0.130 0.050 0.003 0.003 0.074 0.028 0.102 2nd Q 1.013 0.655 0.358 0.233 0.125 0.045 0.002 0.003 0.075 0.026 0.101 1st Q 1.024 0.672 0.352 0.250 0.102 0.051 0.003 0.003 0.045 0.030 0.075 Year 0.949 0.612 0.337 0.233 0.104 0.048 0.003 0.014 0.039 0.027 0.066 4th Q 0.967 0.627 0.340 0.235 0.105 0.047 0.003 0.006 0.049 0.026 0.075 2005 3rd Q 0.954 0.616 0.338 0.229 0.109 0.046 0.003 0.023 0.037 0.027 0.064 2nd Q 0.973 0.633 0.340 0.223 0.117 0.049 0.004 0.024 0.040 0.026 0.066 1st Q 0.896 0.566 0.330 0.245 0.085 0.049 0.004 0.032 0.029 0.061 (A) We believe that EBITDA is a meaningful gauge of financial strength from continuing operations before financing costs, taxes on income, and depreciation and amortization. However, it should be viewed as supplemental data, rather than as a substitute or alternative to GAAP performance measures. 13 Cash Flow Trends From Operations and Free Cash Flow Quarterly Results (In 000's): Cash Flow Data (in 000's) Net Income Depreciation and Amortization Change in Working Capital Other Operating Cash flows Cash Flows from Operations Capital Expenditures Free Cash Flow (A) 2007 1st Q Year 8,065 10,387 (3,824) 2,535 17,163 (10,240) 6,923 38,798 40,698 31,551 16,496 127,543 (23,966) 103,577 4th Q 8,619 10,269 16,090 3,901 38,879 (9,581) 29,298 2006 3rd Q 10,614 10,261 19,474 7,389 47,738 (4,997) 42,741 2nd Q 13,909 10,119 (278) 2,360 26,110 (5,376) 20,734 1st Q Year 5,656 10,049 (3,735) 2,846 14,816 (4,012) 10,804 18,263 39,380 25,163 22,212 105,018 (39,265) 65,753 4th Q 5,164 9,753 19,347 6,080 40,344 (7,998) 32,346 2005 3rd Q 4,289 9,894 31,013 5,749 50,945 (8,034) 42,911 2nd Q 5,680 9,940 (2,329) 9,203 22,494 (9,759) 12,735 1st Q 3,130 9,793 (22,868) 1,180 (8,765) (13,474) (22,239) (A) We believe that free cash flow, a non-GAAP measure, is an important indicator of the Company's ability to generate excess cash above levels required for capital investment to support future growth. However, it should be viewed as supplemental data, rather than as a substitute or alternative to any GAAP performance measure. 14 Non-GAAP Measures GAAP to Non-GAAP Reconciliation Three Months Ended February 3, January 28, 2007 Operating Earnings (GAAP) 2006 $ 17,428 $ 14,871 238 466 Operating Earnings Excluding Special Item (Non-GAAP) $ 17,666 $ 15,337 Net Earnings (GAAP) $ 8,065 $ 5,656 148 289 Net Earnings Excluding Special Items (Non-GAAP) $ 8,213 $ 5,945 Earnings Per Diluted Share (GAAP) $ $ Restructuring and Exit Costs, net Restructuring and Exit Costs, net Special Items (Restructuring and Exit Costs) Earnings Per Diluted Share Excluding Special Items (Non-GAAP) .25 .01 - . $ .25 .18 $ .19 We believe that operating earnings, net earnings, and earnings per share excluding special items, which are non-GAAP measurements, are meaningful to investors because they provide a view of the Company’s comparable operating results. Special items (restructuring and exit costs) represent significant charges that we believe are important to an understanding of the Company’s overall operating results in the periods presented. Such non-GAAP measurements are not recognized in accordance with generally accepted accounting principles (GAAP) and should not be viewed as an alternative to GAAP measures of performance. The following reconciles GAAP to non-GAAP measures for operating earnings, net income, and earnings per share excluding special items used within this release. Amounts are unaudited and in thousands, except per share data. 15