Platform for Profitable Growth

advertisement

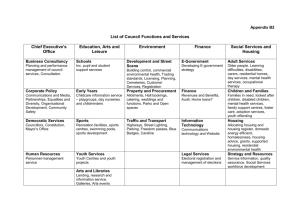

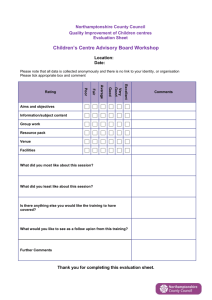

Investor Presentation August 2013 Forward Looking Statements & Non IFRS Measures This presentation contains forward looking statements that reflect management’s expectations regarding the future growth, results of operations, performance (both operational and financial) and business prospects and opportunities of BrightPath Group, Inc. (the “Corporation”). All statements contained in this presentation other than statements of historical facts are forward looking statements. Whenever possible, words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimate”, “forecast”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, have been used to identify forward-looking statements. Although the forward-looking statements contained in this presentation reflect management’s current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, the Corporation cannot be certain that actual results will be consistent with these forward-looking statements. A number of factors could cause actual results, performance, or achievements to differ materially from the results expressed or implied in the forward-looking statements including those listed in the “Risk Factors” section of the Company’s regulatory filings. These factors should be considered carefully and prospective investors should not place undue reliance on the forward-looking statements. Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause the Corporation’s actual results, performance, prospects and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. Although the Corporation has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date of this presentation and, except as required by applicable law, the Corporation assumes no obligation to update or revise them to reflect new events or circumstances. FFO, AFFO and Adjusted EBITDA are not measures defined by International Financial Reporting Standards (“IFRS”). They are presented because management believes these non-IFRS measures are relevant and meaningful measures of performance. FFO, AFFO, Adjusted EBITDA as computed may differ from similar computations as reported by other issuers and may not be comparable to those reported by such issuers. BrightPath’s MD&A contains a reconciliation of Net Income/Loss to Adjusted EBITDA, Net Income/Loss to FFO and the calculation of AFFO. 2 Overview • We have proven the model works • The market presents opportunity for development and consolidation • BrightPath has the team, the plan and the resources to capitalize on the opportunity • Success will be the result of: – Maximize return on capital at our centres – Reducing overhead costs – Layering on profitable growth • We will drive shareholder value 3 At a Glance … Where We’ve Come From • • • 11-centre acquisition in 2010 All located in Alberta Trailing 12 month revenue of $6.2MM (2010) Where We Are • • • • 50 centres in three provinces Diversified portfolio of child care and Montessori centres Revenue of $39.9MM trailing twelve months Adjusted EBITDA of $1.0MM in most recent quarter Proven • • • • Higher quality of care Profitable operations Strong operating model Strong development model • Benefits of scale Where We’re Going • • • Industry-leading child care provider; reputation for quality and excellence of programs Continued growth, leveraging size and brand for economies of scale Maximize returns to shareholders 4 Model is Proven: Successful Growth Early Stage 2012 Start-up 2010 / 2011 • IPO • $25MM Bank Facility • Acquisition focus • Started in Alberta; moved into British Columbia & Ontario • Acquired first Montessori centres • Executive leadership in place • $5MM convertible debenture • Four centres developed, including 2 new purposebuilt facilities • 3rd party validation of quality • 50 centres by year-end Performance-Driven 2013 • Stabilized centre portfolio at 90% occupancy • Two development centres at 87% occupancy • Sharpened focus on site selection and locations • Steps to maximize return on capital • New revenue streams • Leverage new ERP system 5 Business Model is Proven Occupancy Rates following BrightPath acquisition or centre opening 100 90 80 Portfolio Growth Centres Spaces 60 6,000 50 5,000 40 4,000 30 3,000 20 2,000 10 1,000 0 0 2010 2011 Centres 70 Revenue ($) 2012 Licensed Spaces Profitable Business Model Centre Margin ($) 40,000 12,000 35,000 60 10,000 30,000 8,000 25,000 20,000 50 6,000 15,000 4,000 10,000 2,000 5,000 0 40 2010 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2010 Acquisitions 2011 Acquisitions 2012 Acquisitions Developments Q4 Q1 0 2010 2011 Revenue 2012 Centre Margin 6 Market Opportunity: Supply Demand Imbalance in Many Markets • There are 2.1MM children in Canada under the age of 6 • 69% of these children’s mothers work outside the home • 75% of women whose youngest child is between 3 and 5 years old is working • The rate of child care expansion decreased from 2008 to 2010 • There are regulated childcare spaces to accommodate only 22% of children below 5 years old • Government estimates 165,000 need new child care spaces ($1.6B investment) • Evidence proves that children who participate in an early childhood education system perform better than those that do not • A U.S. study showed that participants of an early childhood education program were less likely to smoke, drink alcohol, and use drugs Sources: The State of Early Childhood Education and Care in Canada 2010: Trends and Analysis, Childcare Resource and Research Unit Early Childhood Education has Widespread and Long Lasting Benefits, TD Economics, November 2012 7 Market Opportunity: Fragmented Ownership The Solution: ECONOMIES OF SCALE The Market CHALLENGE • • • Fragmentation Smaller operators challenged to deliver quality programming at competitive prices Smaller operators capital constrained • • • • Improved programming Better service delivery Increased professionalism Access to financing 8% 1% 5% For-profit child care spaces provided as follows: Large Multi Centre (>15) Medium Multi Centre (11-15) Small Multi Centre (5-10) Very Small (1-4) Source: Early Childhood Education and Care, Resource and Research Unit 86% 8 The Company is Ready: Management Team to Build an Industry Leader Mary Ann Curran Dale Kearns Dean Michaels Chief Executive Officer President & Chief Financial Officer Senior Vice President, Acquisitions & Development • Senior level operator with >20 • Financial and Capital Markets • Most recently SVP Real Estate years in complex operations, managing functional elements (operations, IT, finance, audit, logistics) directly and integrating the whole • Most recently CEO of Jones Apparel Group Canada with operations across Canada • Developed and implemented channel expansion through opening of national retail chain • Academic credentials (MBA, ICD.D, CA) applied successfully expertise with >20 years in public and high growth companies • Successfully launched O+Y Properties in the public markets • CFO and COO roles in Western Canada and US based mid stage high growth companies, which enterprises were principally focused on markets in Europe and Asia. • Acquired, developed and licensed client side technology to global OEM’s Service and member of senior executive committee with Katz Group Canada, Inc. (Rexall national pharmacy business) • Led Rexall Pharma Plus retail roll-out and roll-up into a national chain, acquiring existing stores and constructing others in underserved markets • VP Real Estate, Winners Merchants Inc.; established nationally as a significant and profitable brand increasing store count from 14 to 200+ 9 Operating with Excellence: A Model for Profitable Growth Increased Occupancy Efficient Labour and Operating Expense Management Optimized overhead through improved business process / ERP implementation Exponential Growth in EBITDA Ancillary programming to support premium pricing and new revenue stream Growth to Leverage Investment 10 Strategic Imperatives #2 #1 Operating Imperative External Growth Imperative Increase earnings and cash flow from currently owned centres Grow the base to leverage the model with accretive investments Maximize Return on Capital 11 Strategic Imperatives: Enablers • Product model supporting operating excellence • Recognized quality of programming and delivery • Satisfied customers willing to share their experience • A model for profitable growth that includes both organic and external growth • Rebranding strategy to underpin and support organic and external growth 12 Product Model Exceeding Standards Curriculum Nutrition Technology Special Programs Desirable, Differentiated, Scalable Passionate and Competent Caregivers and Educators • Nationally standardized • Literacy, arithmetic and language • Registered Dietician & Nutritionist • Prepared fresh daily from scratch • Educational learning through personal programs • Track development and tailor • Partnering with national vendors • Dance, Music, Gymnastics, etc. 13 Delivering on the Quality Promise Accreditation • All Alberta centres maintain highest level of validation • BC and Ontario have their own validation programs by region • Montessori centres accredited by CCMA (Canadian Council of Montessori Administrators) or AMI (American Montessori Institute) ECERS-R Exceeding all quality standards (Early Childhood Environment Rating Scale – Revised) • Independent evaluation of quality being offered – widely considered the metric for evaluation of quality • Scored above all averages (national, provincial, for-profit and non-profit) 14 Delivering on the Quality Promise: Business Model Proven: Industry-Leading Quality of Operations ECERS-R Assessment The ECERs report is significant as it validates and highlights BrightPath’s early success in embracing the market opportunity to improve the [operational] quality of child care in Canada. • “Early Childhood Environment Rating Scale – Revised” • Assessed 17 individual BrightPath centres in Alberta that had benefited • • from implementation of Company’s programming Conducted by qualified, independent third party Scored particularly well with respect to physical space SCORES BrightPath Total Alberta Commercial Child Care Total Alberta Commercial and NFP 81% 66 73 15 Satisfied Customers What Our Customers are Saying “In the past year, our son has grown and thrived during his time at BrightPath. He continues to develop and grow daily and we are grateful for the care and attention that the BrightPath family has provided to date. We would not hesitate to recommend BrightPath as a child care facility.” - Ben “Our son has been attending “We would really like to thank BrightPath for the past 10 you and your staff for being so months and we have great with Jaxon. He has consistently had compliments learned so much in regards to from family and friends as to playing well with the other how advanced he is socially children, becoming in touch and linguistically. We have with his feelings and always found the caregivers expressing them, using good to be so warm and attentive mannerism and the best part always making sure to form a is all the preparation for special bond with each child. kindergarten. There is so I would definitely recommend much more to even list, it's BrightPath to any parent.” astonishing.” - Chelsea - Sarah 16 Platform for Profitable Growth: Organic and Ancillary Revenue Increases Increasing Occupancy • 90% overall occupancy rate • Track record of increasing occupancy rates Ancillary Programs • “After the Bell” programs to begin in September • Independent revenue stream • Increased penetration of community for awareness and enrollment Premium Price Strategy • Expanding curriculum offerings – languages and active programs – to all age groups • Differentiate and enhance our programming to support premium price 17 Platform for Profitable Growth: External Growth Models 18 Platform for Profitable Growth: Post-Acquisition Improvements (Deer Ridge) 120 Acquisition costs: Real estate Business CAPEX $1,044K 239 200 $1,483 100 80 Pre 60 Post 40 ROI = 25.2% 20 0 19 Capacity Enrollment Revenue COP New Developments Centre City Capacity Occupancy (Q1 2013) Highland Park Calgary, AB 72 95% Chestermere Chestermere, AB 247 75% Lawrence Avenue Kelowna, BC 144 81% McKenzie Towne Calgary, AB 247 99% 20 Real Estate Ownership 21 Recent Stock Information Trading Symbol BPE-V Recent Share Price $0.31 52-Week Range $0.25 - $0.77 Shares Outstanding 121.7 million Market Capitalization $37.1 million Credit facility $27.0 million Cash & Undrawn Credit Facilities $14.5 million (reported March 31, 2013) As the Company is under-leveraged with debt capital, there is potential for highly-accretive non-dilutive growth and creation of shareholder value 22 Subsequent files appendix only 23 The Company is Ready: Strategic Priorities Create and Leverage the Brand Model of care and development Brand promise Trust in the product Serve local interest Marketing to reinforce Parent reference / viral marketing Scalable platform Consumer / Capital market synergy Operate with Excellence Execution of brand promise Organizational infrastructure Standard operating policies and procedures Product, people, process, place Platform for Profitable Growth Leverage the platform Selective acquisitions Storefronts Greenfields Information and financial systems Real estate partnerships Organic growth Child development partnerships Improved pricing strategies Ancillary programs 24 Board of Directors to Provide Oversight and Support Growth Jeffrey Olin, Chairman President and CEO of Vision Capital Corporation, manager of the Vision Opportunity Funds; Managing Partner and Head of Investment Banking, Desjardins Securities; Managing Director, HSBC Securities Canada; Management positions with Bramalea Limited and with Olympia & York Developments; Significant shareholder, involved in well known and impressive growth stories. Adam Berkowitz Principal at Croft Properties LLC, a privately held company with ownership of multi-family and commercial properties in the United States; and analyst at High Rise Capital Management, a New York based real estate hedge fund from 2006 – 2008. Colley Clarke, CA Managing Director of Jadeco Inc. Previously CFO of Redknee Solutions Inc., Descartes Systems Group Inc. and Canadian Satellite Communications Inc. Significant public market experience in executive & directorship roles. Daniel F. Gallivan, QC, ICD.D Managing Partner, Cox & Palmer; Former Director of the Bank of Canada & Vice Chair of the Nova Scotia Securities Commission. Gary Goodman, CA Executive Vice President of Reichmann International Development Corporation between December 2007 and June 2010. Previously Chief Financial Officer (December 2001 – November 2006) and President and Chief Executive Officer (from December 2006 – December 2007) of IPC US REIT, a Toronto Stock Exchange listed Real Estate Investment Trust. Trustee of Boardwalk Real Estate Investment Trust, chairman and trustee of Huntington Real Estate Investment Trust, director of Gazit America Inc. Mitchell Rosen, CA EVP & CFO of Stock-Trak; Over 25 years experience in operating, financial, & strategic roles in private & public enterprises John Snobelen Minister of Education for the Province of Ontario (1995 – 1998); Minister of Natural Resources for the Province of Ontario (1998 – 1999). 25 Earnings Table Revenue Centre Margin Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 $ 3,502 $ 3,958 $ 4,877 $ 5,840 $ 8,030 $ 8,984 $ 8,818 $ 10,594 1,194 1,286 1,406 1,841 2,475 2,709 2,108 2,731 Centre Margin % 34 32 29 31 31 30 24 26 Adjusted EBITDA 144 137 (294) 192 673 616 (74) 590 FFO 71 (22) (314) 119 542 379 (285) 228 AFFO 136 100 (329) 211 727 566 (400) 320 All dollar figures are presented in thousands of Canadian dollars and non-cumulative 26 Occupancy Improves Post-Acquisition 100 90 80 70 60 50 40 2010 Q1 2011 Q2 2011 2010 Acquisitions Q3 2011 Q4 2011 2011 Acquisitions Q1 2012 Q2 2012 2012 Acquisitions Q3 2012 Q4 2012 Q1 2013 Developments 27 Investing In Our Future ERP Systems New Developments Product Facilities Facilities 28 Investing In Our Future ERP Systems Enhance ROI on invested capital Optimize labour ratios Reduce G&A Streamline payment and child administration Optimize the role of the Centre Director 29 Driving to Higher Acquired Growth Optimize real estate Advantaged by up-front planning in new developments Partnerships Ancillary revenue potential Value add – one stop show for parents 30 Driving to Higher Acquired Growth Ontario – disconnect with vendors and full day kindergarten Acquisitions Select Ontario markets Other provinces; Quebec and NB Alberta reasonably solid The average acquisition adds (100?) spaces to our portfolio 31 Model is Proven: Financial Results Centre Margin % 40 1200 1000 35 800 30 600 25 400 200 20 0 15 -200 -400 10 -600 5 -800 0 -1000 2010 • • Adjusted EBITDA ($000) 2011 2012 2010 2013 Consistent margins that hover around 30%; reduce in summer months and more so with addition of Montessori Recent investments in development centres will pay off as we move through 2013 and beyond. • • 2011 2012 2013 EBITDA of $1.0MM in Q1 2013 will grow as investments in development centres and corporate infrastructure pay off As the company continues to grow economies of scale will leverage the SG&A and investment in brand, curriculum, programming and facilities further 32