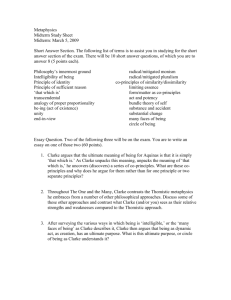

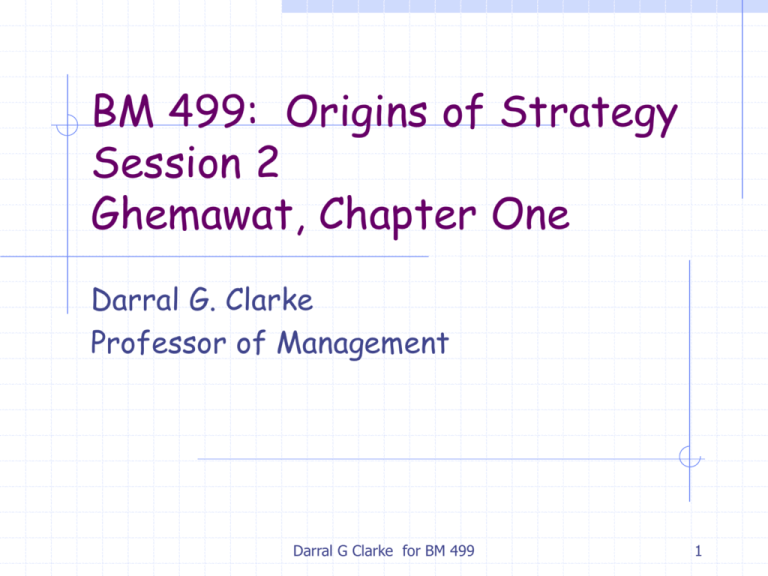

BM 499_Chapter One

advertisement

BM 499: Origins of Strategy Session 2 Ghemawat, Chapter One Darral G. Clarke Professor of Management Darral G Clarke for BM 499 1 Historical overview: Theory of the Firm Dismissed as a strategic planning paradigm: Too hard to understand Not linked to realm of top management But, it is fundamental to understanding strategy P Profit Q Darral G Clarke for BM 499 2 Historical overview: HBS and the Concept of Strategy Andrews, The Concept of Corporate Strategy, (1971) Strengths and Weaknesses Opportunities and Threats Nice managerial idea--but analytically limited No insight for: identifying SWOTs evaluating alternative strategies what to do Darral G Clarke for BM 499 3 Andrews’ Strategy Framework Environmental Conditions and Trends Economic Technical Physical Political Social Community Nation World Opportunities and Risks Identification Inquiry Assessment of Risk Distinctive Competence Consideration of all combinations Evaluation to determine best match of opportunity and resources Choice of Products and Markets Economic Strategy Capabilities: Financial Managerial Functional Organizational Reputation History Corporate Resources As extending or constraining opportunity Identification of strengths and weaknesses Programs for increasing capability Source: Kenneth R. Andrews, The Concept of Corporate Strategy, 1971 Darral G Clarke for BM 499 4 BCG Portfolio Model The first “strategic model” How to think about managing a collection of companies Based on three concepts Product life-cycle Experience--Costs decline with accumulated volume Relative market share Relative Share: High Market Growth Rate Low High Star Cash Cow Relative Share Dog Problem Child Low Darral G Clarke for BM 499 5 Conceptual underpinnings: the product life cycle The cash flow generated by a company varies predictably across its life $ Cost Revenue Positive Cash time Negative Cash Darral G Clarke for BM 499 6 Product life cycle & Market position The product life cycle profitability pattern can be approximated by a simple equation: Profit = Industry size(t0)* Industry growth rate * market position * company profit margin Industry growth rate and relative market share became the key BCG variables Darral G Clarke for BM 499 7 Experience Curve for Semiconductor Memories 1976 1977 75 (Millicent's) Price per bit 100 1978 50 1979 25 1980 10 1981 1982 0.1 1.0 10 1983 1984 100 Cumulated output (bits x 1012) Source: Integrated Circuit Engineering Corporation Darral G Clarke for BM 499 8 Conceptual Underpinnings: Experience log(Cost/unit) S’ S’’ B’ B’’ log(Experience) log(Cumulative Volume) Darral G Clarke for BM 499 9 Portfolio Underpinnings: Market Share ROI Market Share PIMS project: Buzzell, Gale, Schoeffler Darral G Clarke for BM 499 10 BCG Generic strategy: Price leadership $/ u n it Price Co st time Darral G Clarke for BM 499 11 Portfolio Models: Flow of Funds Low High Relative Share Low Market Growth Rate Cash Cow High Star (Harvest) (Build) Dog Problem Child (Divest) Darral G Clarke for BM 499 (????) 12 Problems in Portfolio Paradise: Experience log(Cost/unit) S’ Cost/unit S’’ S’ B’ B’’ S’’ B’ log(Experience (Cumulative Volume) B’’ Volume Experience advantages run out! What causes it in the first place? Darral G Clarke for BM 499 13 Problems in Portfolio Paradise: Market share Profitability not directly related to market share! Superior Value Delivery Market Share ROI Phillips and Antarasian Darral G Clarke for BM 499 14 Problems with BCG Approach Experience Declining costs are not universal—experience declines become minimal Focus on cost decreases innovation and long-run competitiveness Experience is not proprietary Portfolio models Classification problems—ambiguity and bias Capital may not be the only, or even a, constrained resource Balance is achieved by reducing the overall profitability of the combined firm May lead to analytical detachment at the expense of insight and creativity Neglect of technological development Darral G Clarke for BM 499 15 The Industry AttractivenessBusiness Strength Matrix Industry Attractiveness Business Strength High Medium Low High Investment and Growth Selective Growth Selectivity Medium Selective Growth Selectivity Harvest/ Divest Low Selectivity Harvest/ Harvest/ Divest Divest Harvest/ Harvest/ Divest Divest Two Determinants of Profitability Advantage Competitive Position Disadvantage Low High Environmental Attractiveness An Expanded Version of Generic Strategies Broader set of cost structures More diverse set of competitive environments Apply economic theory of long run average cost Cost/unit E x p e r i Scale e n c New technology e E x p e r i e n c e Darral G Clarke for BM 499 LRAC Volume 18 Strategy and long-run average cost Cost advantage from volume Low High Ability to differentiate product High Fragmented Profitable & Defensible Stalemate Volume Low Darral G Clarke for BM 499 19 Competitive Strategy and Long Run Cost/Differentiation I Volume Industry Low cost leadership type markets There is an advantage in scale or technology Stalemate Industry Can’t differentiate Economies of scale, experience common to competitors No process innovation Darral G Clarke for BM 499 20 Competitive Strategy and Long Run Cost/Differentiation II Fragmented Industry Differentiation is key competitive factor Niche strategy Volume in niches inadequate to achieve volume cost advantages Profitable and defensible industry Differentiated product Customer preference Low cost producer of differentiated product Transitory industry Cost advantage based on labor Cost advantage based on any other temporary advantage Darral G Clarke for BM 499 21 Use of Strategic Planning Paradigms Use for insight and structure Have I considered the important factors? Is structure consistent with “orthodox strategy?” What is inconsistent? Does it indicate a problem? Does it indicate an opportunity? Be creative in determining strategy Orthodox strategy can still be creatively defined and executed Unorthodox strategy can surprise competitors Test detail of strategy against “orthodox” Does the value chain make sense? Balance short run and long run considerations Darral G Clarke for BM 499 22