High-Income Households Fare Better than Middle

advertisement

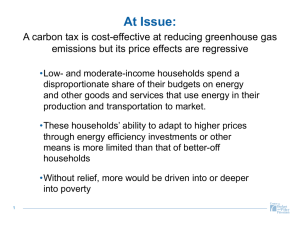

Minimizing the Pain of Federal Climate Legislation Jennifer Kefer Senior Climate Advisor Center on Budget and Policy Priorities www.cbpp.org Minimizing the Pain • Economic effects of climate change legislation • Guiding principles for consumer relief • Consumer relief in American Clean Energy and Security Act (HR 2454) • Next steps Climate Legislation Has Costs • Effective legislation will increase the cost of basic goods • Low-income households will be disproportionately burdened by this increase • Well-designed legislation can offset these costs Gross Costs as Share of After-Tax Income Source: Congressional Budget Office, based on 2020 program provisions applied to 2010 income levels High-Income Households Fare Better than Middle-Income Households Net Impact of House Bill as a Percentage of After-Tax Income, by Income Group Source: Congressional Budget Office, based on 2020 program provisions applied to 2010 income levels Guiding Principles for Consumer Relief 1. Protect the most vulnerable households 2. Use mechanisms that reach all or nearly all eligible households 3. Minimize red tape 4. Preserve economic incentives to reduce energy use efficiently 5. Do not focus solely on utility bills Do Not Focus Solely on Utility Bills Distribution of Cost Increase by Product for Bottom Quintile Source: CBPP calculations based on Consumer Expenditure Survey and CBO methodology Direct Consumer Assistance in House Bill Proceeds from the sale of 15 percent of the allowances offset higher costs for low-income households through two delivery mechanisms: 1. Energy Rebate 2. Earned Income Tax Credit Expansion for Childless Workers How Does the House Bill Measure Up? 1. Protect the most vulnerable households √ Fully protects average low-income households – Insufficient relief for those with above-average costs – Limited protection for moderate-income households 2. Reach all or nearly all eligible households √ Multiple mechanisms increase enrollment 3. Minimize red tape √ Relies on existing delivery mechanisms How Does the House Bill Measure Up? 4. Do not focus solely on utility bills √ Includes direct consumer relief – Allocates a large portion of allowances to utilities 5. Preserve economic incentives – Utility relief blunts price signal √ Size of rebate not tied to energy consumption How to Improve in the Senate • Preserve 15 percent for consumer relief. • Provide designated funding for the Low-Income Home Energy Assistance Program (LIHEAP). • Provide administrative funds to help states with the costs of operating the program. • Redirect a portion of the allocation to LDC business customers and extend well-targeted direct consumer relief to moderate-income families. High-Income Households Fare Better than Middle-Income Households Net Impact of House Bill as a Percentage of After-Tax Income, by Income Group Source: Congressional Budget Office, based on 2020 program provisions applied to 2010 income levels Next Steps • House passage (June 2009) • Environment and Public Works committee • Finance Committee • Copenhagen Jennifer Kefer Senior Climate Advisor Center on Budget and Policy Priorities Phone: 202-408-1080 E-mail: kefer@cbpp.org www.cbpp.org