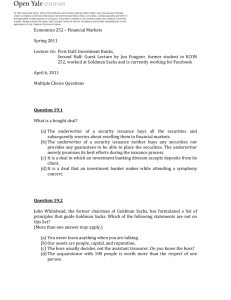

Goldman Sachs and Public Relations

advertisement

OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 1 Obliged: Goldman Sachs versus the U.S. Securities and Exchange Commission Abstract This case study highlights the public relations and external communications of financial services firm Goldman Sachs Group, Inc. prior to and amidst its 2010 lawsuit and eventual $550 million settlement with the U.S. Securities and Exchange Commission. Set against a backdrop of financial crisis, economic recession and increased government regulation of financial services firms, this case study underscores the importance of reputation management and the obligations of transparency in lieu of heightened public and legal scrutiny. Table of Contents I. Introduction: A One Sentence News Release II. Situation Overview II.a. A Financial Crisis for Financial Institutions II.b. The SEC versus Goldman Sachs III. Organization III.a. The Company III.b. Timeline of Key Events III.c. Goldman Sachs and Public Relations III.d. On Reputation IV. Obliged: On Trial V. Aftermath VI. Appendices VII. Sources and References OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 2 Introduction: A One Sentence News Release At 10:33 a.m. on Friday, April 16, 2010 the U.S. Securities and Exchange Commission (“SEC”), the chief government regulator of securities and trading firms in the United States, announced a civil lawsuit against Goldman Sachs Group, Inc. (“Goldman Sachs,” or “Goldman,” hereafter) alleging fraud in its structuring and marketing of a mortgage-backed synthetic collateralized debt obligation product named ABACUS 2007-AC1 (“ABACUS”). 1 Goldman Sachs’ media relations managers were quick in their initial response to the fraud allegations and that same day issued the following news release: “The SEC’s charges are completely unfounded in law and fact and we will vigorously contest them and defend the firm and its reputation.” (Goldman Sachs, April 16, 2010) One sentence, that was all. But this one sentence told enough—Goldman’s communications managers were engaged. A key word in the sentence was “reputation.” The SEC had compelled Goldman Sachs into engaging in a primary function of public relations, reputation management, and the firm was, by its own admission, on the defensive. A good reputation is an intangible asset that manifests its value and importance by catalyzing positive financial performance and fostering other non-financial benefits such as increased employee morale and the ability to attract and acquire talent. An organization’s reputation with its stakeholders must be affirmed, protected and maintained. When an organization’s reputation is threatened its resiliency is tested and its financial future is at stake. These are prominent refrains in management, communications and public relations literature (Coombs, 2010, p. 164). Goldman Sachs explicitly recognizes the value of its reputation in its business principles. From the section entitled, “Our People” on its website is this statement: “Our assets are our people, capital and reputation. If any of these is ever diminished, the last is the most difficult to restore”. For Goldman, the SEC trial’s threat to their reputation had immediate financial consequences. Weighing the SEC’s fraud charges, investors spooked on April 16, and at day’s end Goldman shares had dropped 13%, a loss on paper of $12 billion in equity market value. In the three months between the announcement of the SEC lawsuit on April 16 and its settlement on July 15, Goldman Sachs waged an unprecedented defense of its reputation in the news media, before congress, and in the courtroom. Goldman’s challenge was to counter the SEC’s charges, explain its business practices and its role in the financial system to government officials, and to regain the trust of its stakeholders, chief among them clients and investors. Goldman also found itself obliged to engage with the media in order to explain its core values to an American public whose opinions of the firm had grown increasingly negative.2 Relying on information culled from news releases, media interviews, government testimonies and exhibits, news articles, Goldman Sachs’ notes to shareholders, its company website and its public filings, this case study will present Goldman Sachs’ public relations and communications efforts prior to and amidst the 2010 SEC lawsuit. Refer to Appendix C “Quick Glossary of Financial Terms” for an explanation of synthetic CDO’s and other financial terms used in this case. 2 Even prior to the SEC trial, Goldman Sachs had engaged Public Strategies, a consulting firm, to poll individuals about the firm. It was reported that 49% of the poll’s respondents had a negative view of the firm. (Sorkin, April 1, 2010). 1 OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 3 Situation Overview A Financial Crisis for Financial Institutions3 It is useful to situate Goldman’s trial within the larger setting of financial crisis, economic recession and increased government intervention in financial markets and institutions. To achieve this we must turn back the clock. The end of the 1990’s through to 2005 saw a significant rise in housing prices. But by 2005 home prices began to fall dramatically and home foreclosures increased (see Figure 1 below). Indeed, a widely accepted thesis is that the fall in housing prices was a leading indicator for the beginning of the financial crisis (Yared, 2010). Figure 1 - Housing Bubble Burst4 Image Source: www.standardandpoors.com The year 2008 can safely be called one of the most dramatic years ever in the U.S. financial services industry. Throughout 2008, the industry suffered massive setbacks in the form of declining asset values, collapses in the subprime mortgage securities market, and bank failures. Beginning in March of 2008, the stalwart Bear Stearns, which a year earlier had traded in the $150 per-share range, fell to a two-dollar stock (www.finance.yahoo.com). A now globalized mortgage backed securities and 3 Acknowledgements to Dr. Pierre Yared, Assistant Professor of Finance and Economics at Columbia Business School for his insight into the key drivers of the financial crisis obtained during a personal telephone interview with The Author on November 15, 2010. 4 Unless noted, all figures included herein were created by The Author using public data. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 4 derivatives meltdown and subsequent credit crunch brought many banks and trading firms to the brink of failure. September 2008, perhaps the most dramatic month in the history of modern financial institutions, was punctuated with a variety of shakeups. Notable among these failures was the fall of Lehman Brothers, one of the oldest investment banks in the United States. Large banks such as Washington Mutual and large brokerage firms like Merrill Lynch saw revenues fold and they were acquired by better capitalized competitors. But even these acquiring companies could not avoid the financial crisis. The surviving institutions, firms such as J.P. Morgan and Bank of America, were eventually given bailout or “TARP” funds which are still being repaid and the effects and effectiveness of which are still being debated. The year 2008 ended with a bang and not a whimper with the unraveling of the largest Ponzi scheme in American history, the estimated $65 billion “Madoff Scandal” (Federal Reserve Bank of St. Louis, 2010). The figure below summarizes the key points of this narrative on the financial crisis. Figure 2 - Financial Services Industry Crisis 3/17/08 – Fall of Bear Stearns, purchased by J.P. Morgan for $236 million 3/16/09 – AIG bonus scandal 9/15/08 – Lehman Brothers files for bankruptcy, Bank of America buys Merrill Lynch 10/3/08 - $700bn Federal bailout passed 2009 2008 9/16/08 – Government buys 80% of AIG 9/26/08 – Washington Mutual – largest bank failure in U.S. history 7/15/09 – Goldman Sachs announces record bonuses and profit 12/11/08 – Bernard Madoff arrested Figure by The Author (Image Sources: The Wall Street Journal, The New York Times, Reuters, Bloomberg, www.sec.gov) The turbulence of the domestic economy compelled the U.S. Government to take aggressive financial policy actions during and after 2008. The following figure provides a pictorial depiction of government bailouts (a catch-all term for government assumption of debt and provisioning of funds in support of a failing enterprise), the colored circles indicating specific government interventions, the size of which is proportional to their dollar amount. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 5 Figure 3 - “Bailout Nation5” - A History of U.S. Government Bailouts (Original Image Source: www. propublica.org; Aggregate financial information from www.cnn.com) The largest beneficiaries of the recent bailout bills have been financial institutions (most prominently exemplified in the $700 billion, 2008 Troubled Asset Relief Program “TARP”). By his own admission, Goldman CEO and Chairman Lloyd Blankfein testified to the Federal Crisis Inquiry Commission (FCIC) that “without question, direct government support was critical in stabilizing the financial system. And we benefitted from it” (FCIC, January 13, 2010). 6 Financial institutions faced particular scrutiny for their catalyzing role and complicity in the financial crisis. One force behind the crisis was the mismanagement of financial innovation which involved the misvaluation of assets and the extensive pooling and slicing of risk in CDOs, the values of which did not capture the full impact of massive default risk (Yared, 2010). Derivative product innovation began as a key driver for wealth and value creation and a means of transferring risk. As Lloyd Blankfein explained to the FCIC, “You don’t want to fail to innovate on the one hand. And on the other hand, you don’t want to bear the consequences of innovation that goes poorly” (FCIC, January 13, 2010). But during the crisis, financial institutions collapsed under the trappings of their own ingenuity. One firm, however, was making headlines during the crisis for a different reason. Securities firm Goldman Sachs was profitable in 2008 and in July 2009 was announcing record profits and significant bonuses for its employees. It was expressed in the media as early as August of 2008 that “the bank that largely anticipated and avoided the problems with subprime securities and other financial instruments [was] Goldman Sachs” (Davidoff, 2008). But to some, Goldman’s success during the industry and economic downturn was anathema. As one journalist wrote in October 2009, “It’s a growing public relations nightmare for Wall Street’s dominant firm as it prepares to report another round of robust The term “Bailout Nation” is borrowed from the title of an eponymous 2009 book by writer Barry Ritholtz. To be noted, the financial bailouts have transcended executive administrations with TARP coming from the end of the Bush administration and the automotive bailout and financial “stimulus” bill coming from the Obama administration. 5 6 OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 6 profits and update its bonus pool, which is on a pace to top $20 billion for the year” (Eder, 2009). In other words, Goldman’s good news was bad news for its reputation. The SEC versus Goldman Sachs Given the complexity of the financial derivative product under question, the particulars of the SEC case are a challenge to articulate but at its most basic the SEC alleged fraud in Goldman’s structuring and marketing of a synthetic collateralized debt obligation product named ABACUS 2007AC1. The SEC complaint alleged that Goldman was responsible for “misstating and omitting key facts about a product tied to subprime mortgages as the U.S. market was beginning to falter” (SEC, April 16, 2010). Goldman’s alleged crime was one of omission and the SEC’s lawsuit hinged on the issue of inadequate disclosure. Among the key omissions cited by the SEC was Goldman Sachs’ failure to disclose the role played by hedge fund (and Goldman client) Paulson & Co. in the selection of residential mortgage backed securities (RMBS) contained in the product’s portfolio. The SEC alleged that after helping select the RMBS for the product’s portfolio, Paulson & Co., using the transaction services of Goldman Sachs, entered into a short position on those same securities. Thus, argued the SEC, Paulson & Co. “had an economic incentive to select RMBS that it expected to experience credit events in the near future” (SEC, April 16, 2010). To distill: a bad housing market would yield Paulson & Co. money and the Government was suing Goldman Sachs for not disclosing this. And also material, Goldman had accepted a fee, $15 million to be exact7. The SEC was attempting to elevate Goldman’s lack of disclosure in the ABACUS deal to the more severe allegation of fraud. Given the charges, Goldman was now obliged to explain its role in the ABACUS offering to its both its clients and its regulator, the SEC. Here it must be noted that financial institutions (particularly those with a securities brokerage function) are among the most highly regulated in business and even without the obligations of a subpoena from a government entity like the SEC, they already produce substantial disclosures. In the U.S. a full-service, financial services firm with banking, securities brokerage and wealth management services is regulated and reviewed by no fewer than 17 institutions.8 In addition to disclosing information to regulators, firms such as Goldman must disclose to potential investors the risks associated with investment in a product’s prospectus and marketing materials. But the ubiquity of regulators and supervisory bodies does not imply that these institutions embrace transparency in all of their dealings. In fulfilling their vital role of providing liquidity, enabling efficient markets and functioning as the engine behind economic growth, financial institutions strike a tricky balance between transparency and confidentiality. Full transparency is not the modus operandi of brokerage and transaction services firms. They must with one hand deliver extensive disclosures while with the other hand secure strict client records and information. Institutional clients do not want their own trading strategies revealed and neither Goldman nor their market making clients want to lose their competitive advantage by having their positions exposed. Trading strategies and negotiations are valued 7 Goldman would make sure in a second news release on April 16, 2010 that it had, all told, lost money on the ABACUS deal in the amount of $90 million. 8 The Author has specifically used the member institutions of the Financial and Banking Information Infrastructure Committee (FBIIC) chartered under the President’s Working Group on Financial Markets. The FBIIC includes Federal financial regulators, and associations of State financial regulators. Prominent among them are the Federal Reserve Board, the Department of The Treasury, the Commodity Futures Trading Association and the SEC. The new Dodd-Frank Bill passed in 2010 creates two additional Federal organizations, the Financial Stability Oversight Council and the Bureau of Consumer Protection. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 7 proprietary information (for example, by Goldman’s own admission, and here they must be regarded as experts, it is standard practice in market making not to reveal the buyer to the seller and vice versa) (Goldman Sachs, April 16, 2010). Goldman Sachs was keenly aware of the implications of the SEC allegations regarding its dealings with one stakeholder group in particular: its clients. At its annual meeting in May 2010, in the midst of the SEC trial Lloyd Blankfein remarked “Questions have been raised that go to the heart of this institution’s most fundamental value: how we treat our clients” (Morgenson & Story, 2010). If the fraud charge was true it implied that Goldman had perhaps favored the priorities of Paulson & Co. over the other clients involved in the ABACUS deal. It also suggested that Goldman was perhaps more interested in its fee than in the long-term success of the clients who were to invest in the ABACUS product. And the word “fraud” alone implied that Goldman’s actions were deliberate rather than unintentional. So with its clients, particularly those invested in ABACUS, there was substantial communications and public relations work to be done. Organization The Company Goldman Sachs is one of the oldest and largest financial intermediaries and brokerage firms in the United States. Goldman Sachs began in 1869 as the sole enterprise of Bavarian immigrant Marcus Goldman who would buy promissory notes from New York City merchants at a discount, giving them the cash needed to operate their businesses, and then sell those notes to commercial banks for a small profit or “spread.” After thirteen years as a one man show in the mercantile paper trade, in 1882 he took on as partner Samuel Sachs, the husband of his oldest daughter (Ellis, 2008). The firm’s partnership structure lasted 117 years until 1999 when Goldman Sachs sold equity shares in an initial public offering. Today it trades under the ticker “GS” and as of December 10, 2010 had an equity market value of $86 billion and over 35,000 employees worldwide. As written in its 2009 annual form 10-K, Goldman Sachs is a: “global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals”. (Goldman Sachs Form 10-K, 2009) Goldman’s three primary business segments are investment banking, asset management, and trading and principal investments. Investment banking involves capital raising, merger and acquisition advisory, and valuation assignments from which Goldman receives fee and underwriting income. Asset management (often used interchangeably with the term wealth management) involves the managing and investing of financial assets of large institutions like pension funds and corporations as well as high networth individuals. Goldman’s largest revenue segment (accounting for nearly 3/4 of its total revenue in 2009) is its trading and principal investments business. Goldman groups many of its trading and principal investment activities under the catch-all term “market making” which describes a variety of investing, trading and financial intermediary activities that “provide the necessary liquidity to help ensure that buyers and sellers can complete their transactions and markets can function efficiently” (FCIC, January 13, 2010). OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 8 Timeline of Key Events Below is a timeline of key events for Goldman Sachs and the financial services industry during the period under inquiry. 2008 2009 2010 September 8 – Bailout of mortgage finance companies Fannie Mae and Freddie Mac September 15 – Lehman Brothers files for bankruptcy September 22 – Goldman Sachs approved to become bank holding company, changing its primary regulator from the SEC to the Federal Reserve Board October 3 – President Bush signs the approximately $700 billion Troubled Asset Relief Program (TARP) in to law November 4 – Barack Obama elected 44th U.S. President February 17 – American Recovery and Reinvestment Act of 2009 (“Recovery Act,” or, “The Stimulus Package”) signed into law by President Obama May 20 – Establishment of the Federal Crisis Inquiry Commission (FCIC) June – Media reports that Goldman Sachs on pace to award record bonuses July 14 – Goldman Sachs posts its richest quarterly profit in history, confirms earmarking of $11.4 billion in employee compensation November 17 – Goldman Sachs initiates corporate social responsibility campaign, committing $500 million to its “10,000 Small Business Initiative” January 13 – Goldman Sachs CEO Lloyd Blankfein testifies before the FCIC at its first hearing April 16 – SEC files complaint against Goldman Sachs April 27 – Goldman Sachs employees appear before US Senate Permanent Subcommittee on Investigations (PSI) hearing in Washington May 7 – Goldman announces creation of Business Standards Committee to review business practices July 15, 2010 – Goldman Sachs agrees to pay $550 Million to settle SEC charges related to ABACUS 2007-AC1 amounting to “the largest fine levied on a Wall Street firm”9 July 21, 2010 – President signs financial reform bill Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) which creates new financial regulatory organizations and includes the “Volcker Rule,” a proposal to reform proprietary trading at brokerage firms (Sources: The New York Times, The Wall Street Journal, The Guardian, The Economist, Bloomberg, Reuters, www.sec.gov, www.gs.com, www.stlouisfed.org, www.treasury.gov) The words are the SEC’s own and uniquely qualified. The claim is measured because in 1988, Drexel Burnham Lambert (DBL) paid $650 million to settle a case with the SEC (Craig & Scannell, 2010). 9 OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 9 Goldman Sachs and Public Relations The following are quotes from Goldman Sachs’ partner, and current chief spokesperson and media relations contact Lucas van Praag: “There’s speculation, and there is stupidity. This speculation transcends the simply stupid and takes it to an entirely new level...giving credibility to tittle-tattle is pretty shoddy journalism.” “It is preposterous that The Wall Street Journal would even consider publishing such effluent.” “The speculation about compensation is ill-informed and, frankly, pretty stupid.” “There is nothing to be taken away from the story other than the fact that reporter fails to comprehend the subject matter.” “As prudent risk managers, we hedge our risk. To describe that activity as a cynical breaking of faith with clients is both misleading and horribly naïve.” (Pressler, 2010) When asked about Goldman’s strategy for relating with the media, van Praag told the UK newspaper The Guardian, “The approach we’ve adopted to media coverage is that we aggressively rebut and refute reports or commentary that we believe are wrong. And if you want it to be noticed, you’ve got to make it notable” (Clark, 2010). Indeed, an internal e-mail dated November 18, 2007 submitted as an exhibit to the Senate Permanent Subcommittee on Investigations (PSI) confirms this. In this e-mail exhibit, van Praag, in a message addressed to Lloyd Blankfein and copied to other C-suite executives writes, “GS gives in not in the story,” referring to a yet-to-be published story about Goldman’s “dodging of the mortgage mess” scheduled to be published in an unnamed publication the following day. Regarding the same story van Praag also writes, “Tomorrow’s story will, of course, have ‘balance’ (i.e. stuff we don’t like)”. What is apparent from this particular e-mail is that Goldman’s communications executives have the ear of management and vice-versa.10 The idea that Goldman Sachs’ managers may be purposefully oblique to people inquisitive about its business was brought up to Lloyd Blankfein by FCIC Vice Chairman Bill Thomas in the commission’s first hearing: “To what extent can you folks, even from a PR point of view, talk about simplification so that people can understand? Or is it kind of an agreement that you’re going to have a fraternity which gets paid highly and has the jargon—we run into that a lot in government; I used to run into it a lot in government—in which jargon was used to reduce the number of people they had to interact with (FCIC, January 13, 2010). As one author suggests, Goldman’s stance on public relations may date as far back as its founding. Charles D. Ellis writes in his 2008 book, “The Partnership: The Making of Goldman Sachs” that the family of founding partner Samuel Sachs “believed public relations was a bad thing and would have none of it.” There can be little assurance that this quote or sentiment is accurate but if correct then Goldman Sachs preferred being akin to an “invisible hand” behind wealth creation. Ellis continues: “The principle responsibility of those who labor in public relations is to minimize the number of articles about the firm, to discourage pieces about individuals, and to project a tone of modesty and moderation” (2008). 10 See Appendix B for a copy of this e-mail. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 10 Ellis makes clear in his book to reveal a conundrum about researching Goldman Sachs, that of access. Even he had difficulty getting interviews with employees and gaining access to the firm, to the point where he concluded that “anonymity is almost a core value at the firm” (Ellis, 2008). This makes teasing out the structure and strategy of Goldman’s public relations efforts a challenge for reporters, researchers and case study authors. On matters of advertising, the company’s stance is clearer—it does little to none at all. 11 It is an interesting supposition that the public relations strategy of Goldman would be no public relations at all. But this is inaccurate as well as a misconception. Based on their website, Goldman has a Media Relations department, the primary contact of which is the aforementioned spokesman Lucas van Praag. Media Relations is perhaps Goldman’s domestic euphemism for a Public Relations department. This is supposed only because it makes clear of its retaining of various agents of record for public relations in its foreign markets, but does not list an agent of record on its website for its North American operations. The following figure is the author’s attempt to place Goldman Sachs and its strategic publics in context with each other. Figure 4 - “The Triumvirate” - Goldman Sachs and its Strategic Publics Goldman Sachs Group, Inc. U.S. Government Publics SEC The Federal Reserve U.S. Congress U.S. Treasury Department Federal Crisis Inquiry Commission Protections Feedback Stakeholder Publics Tax-paying citizens Clients Shareholders / Investors “The Economy” Regulation (Securities Acts, SEC Enforcements) Legislation (Dodd-Frank Act, TARP) Figure by The Author The word “advertise” is nowhere to be found in Goldman’s 400+ page annual report form 10-K or their 2009 “glossy” Annual Report. This may be because it caters primarily to an institutional client base versus a retail client base, but one cannot be certain. What this section intends to emphasize is that without access to the firm and its employees the researcher is bound to such suppositions. 11 OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 11 Goldman inevitably maintains relationships with key stakeholder publics beyond its clients, including but not limited to the media, shareholders, and the U.S. Government. As the SEC trial demonstrates, its relationship with the government cannot be overvalued. Public relations, public affairs and external communication with stakeholders is unavoidable and a necessity. On Reputation Golden Slacks. Goldmine Sacks. The Firm. Or, as one Rolling Stone Magazine columnist recently dubbed them, “a great vampire squid wrapped around the face of humanity” (Taibbi, 2010). These are just a few nicknames for Goldman Sachs. Another is Government Sachs, because of the crossover activities many of its ex-employees have made into government positions both appointed and elected. Prominent Goldman alumni during this period under inquiry include Henry Paulson who was Secretary of the Treasury under President George Bush, and former New Jersey governor Jon Corzine. Another populist refrain is to liken the activities of market making/financial intermediary firms such as Goldman to that of a casino. Notice the language used by these New York Times writers: “Goldman’s bets against WaMu, wagers that took place even as it helped WaMu feed a housing frenzy that Goldman had already lost faith in, are examples of conflicting roles that trouble its critics and some former clients.” (Morgenson & Story, 2010) It is difficult and perhaps inadvisable to declare exactly what is meant by blanket terms such as “public at-large” or “public opinion” and “populist sentiment” but the terms do hold some currency. And it is important to note that though these nicknames and analogies are somewhat populist in nature and do not necessarily reflect the views of all or even most of Goldman’s stakeholders, they do exist. Goldman’s decline in reputation prior to the SEC trial seemed to concern its higher management. As CFO David Viniar told a reporter for The Wall Street Journal in 2009, “I would prefer people to be focused on the success of our business, how well we’re doing and how well our people are performing” (Bowley, 2009). The word here (if we are to take this quote as letter perfect) is the word “prefer.” Unfortunately for corporate communications managers, they cannot mandate or control what the media says about them. Viniar (nor does any company executive for that matter) does not have the privilege to tell the media exactly what to emphasize during the economic downturn. Furthermore, people were focusing on the success of the company and how well it was doing, they just seemed not to like it. Goldman appeared to have a split reputation, one with clients, investors and employees who remained loyal to it throughout the financial crisis and the SEC trial and one with the public at-large. Obliged: On Trial April 16, 2010 through July 15, 2010 would prove to be three trying months for Goldman Sachs. If the firm was to defend its reputation then it would face trials on two fronts, with the public at-large and with one of its primary regulators, the SEC. The three month trial period including both the Senate PSI hearing and Goldman’s media relations efforts during the SEC trial gave the public unprecedented insight into the firm. In April 2009, Goldman Chairman and CEO Lloyd Blankfein was explaining the mechanics and drivers of the financial crisis to investors and clients; a year later he was tasked with defending his firm’s potential complicity in the crisis in sworn testimony before members of the U.S. Senate. The PSI was making Goldman its special “case study” for its April 27, 2010 hearing entitled “Wall Street and the OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 12 Financial Crisis: The Role of Investment Banks.” The Senate hearing proved much less congenial than the January 13 FCIC hearing. Even PBS went with the language that U.S. Senators “vilified” Goldman executives who remained adamant throughout the hearing that they had not misled investors (PBS Newshour, April 27, 2010). The 910 pages of exhibits, including confidential memos, internal procedures, internal e-mails, proprietary research, and offering memoranda revealed the firm like never before. The wake of the SEC trial would induce more lobbying efforts from Goldman. A former Justice Department spokesperson was quoted as saying “Goldman relied on their top-level connections so they wouldn’t have to worry about the public relations and the crisis lobbying” (Schmidt, 2010). During the months of the SEC investigation, Goldman mined its reservoir of contacts to wage a public relations campaign in Washington. The company hiked up its spending on lobbying 72 percent from the previous year. In the words of one columnist, the lobbying team was tasked to stage “a more aggressive lobbying and public relations campaign, one aimed at making sure that when the history books are written, Goldman’s side of the story is told” (Tse, 2010). If the public prosecution of Goldman had begun as soon as the SEC’s announcement on April 16, then one might say that the public defense began eleven days later, on April 27 the day that Lloyd Blankfein gave no less than six major network television appearances. On that day, amidst the Senate PSI hearing, Lloyd Blankfein held TV interviews with FOX News, CNBC, CBS, Bloomberg, ABC News, and CNN. On April 29, Blankfein appeared on NPR. On April 30, broadcast journalist Charlie Rose had Blankfein, a first time guest, for the hour. Media appearances had become the newest part of Blankfein’s job description. By May, Lloyd Blankfein seemed to have gained some insight from his public interactions and on May 7 he announced the creation of a new Business Standards Committee designed to examine how the company conducts its business and manages its own reputational risk. A week later, at the firm’s annual shareholder meeting Blankfein acknowledged: “We recognize that there is a disconnect between how we view the firm and how the broader public perceives our roles and activities” (Goldman Sachs, May 14, 2010) It was a way of admitting that Goldman Sachs had an image problem. Aftermath In lieu of the SEC allegations and trial Goldman took three important actions, it increased its media exposure, increased its lobbying efforts and established a Business Standards Committee. Despite its lawsuit with the SEC and its decline in equity market value, Goldman maintained its market leadership during the summer of 2010, leading Wall Street league tables in M&A advisory deals (Hodgson, 2010). Ultimately, the SEC and Goldman Sachs agreed to a settlement. Goldman Sachs was fined $550 million on July 15, 2010, in what the SEC declared was the largest fine it had ever levied on a Wall Street firm. If there is one lesson to be learned from the New Deal it is that financial crisis imparts increased regulation. On July 15, 2010, the same day as Goldman’s settlement with the SEC, the U.S. Senate approved the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“DoddFrank Act”) which president Barack Obama signed into law days later. A new era of financial regulation was set to begin. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 13 But increased regulation might not translate necessarily into successful reform. In specific reference o Goldman’s trial with the SEC, Andrew Ross Sorkin, editor of The New York Times Wall Street focused “DealBook” section said “I’m not sure that this settlement, and all of those headlines, unfortunately, are actually going to shift the ethos and culture of Wall Street” (PBS, July 16, 2010). Perhaps hampering the regulation process is that under its mandate, the SEC cannot bring criminal charges only civil. Criminal charges are under the jurisdiction of the U.S. Department of Justice. As of the writing of this case in January 2010 the SEC enforcement has been the highest level of censure related to the issue. A civil settlement is akin to the criminal plea of nolo contendre thus, who “won” the trial is a subject of discussion and debate. Also debatable is whether or not Goldman Sachs’ public relations efforts will be effective in improving its reputation with the public at-large going forward especially if it continues to achieve record numbers in an as yet unresolved economic downturn. Alas, it is not the task of this case study to speculate. But what the SEC trial and public scrutiny (from individuals, journalists, investors, regulators, and elected officials) accomplished was to oblige Goldman into responding to attacks on its reputation thus enabling the public to better ascertain its public relations and corporate communications style and company ethos. --END OF CASE-- OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 14 Appendices Appendix A: Goldman Sachs SEC Trial Period Stock Price Analysis Relevance to Case Study: Displays equity market valuation as a measure of investor perception of Goldman Sachs during trial period of April 16, 2010 to July 15, 2010. Appendix B: Goldman Sachs Internal E-mail (November 18, 2007) Relevance to Case Study: This e-mail, submitted as an exhibit to the U.S. Senate Permanent Subcommittee on Investigations hearing provides color on the coordination activities within Goldman Sachs’ media relations department and company executives. Appendix C: Quick Glossary of Case Financial Terms Relevance to Case Study: Basic definitions of key financial terms used in case study. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 15 Sources and References Bae, J. & Cameron, G. (February 2006). Conditioning effect of prior reputation on perception of corporate giving. Public Relations Review. 32, pp. 144-150. Blodget, H. (December 1, 2009). Goldman Sachs's PR has been a bigger disaster than the exxon valdez. [Video webcast]. The Business Insider. Bowley, G. (July 15, 2009). With big profit Goldman sees big payday ahead. The New York Times. Bowley, G. (October 16, 2009). Bonuses put Goldman in public relations bind. The New York Times. Broom, G. M., Center, A. H., & Cutlip, S. M. (2005). Effective Public Relations (9th Edition). Alexandria, VA: Prentice Hall. Claeys, A-S., Cauberghe, V. & Vyncke, P. (2010). Restoring reputation in times of crisis: an experimental study of the situational crisis communication theory and the moderating effects of locus of control. Public Relations Review. 36(10), pp. 256-262. Clark, A. (March 2, 2010). Lucas Van Praag: Goldman Sachs’s cult PR man. The Guardian.co.uk. Coburn, T. (July 15, 2010). Financial reform’s empty promises. Real Clear Politics. Coombs, W. T. (2007). Protecting organization reputations during a crisis: the development and application of situational crisis communication theory. Corporate Reputation Review. 10(3), pp. 163-176. Coombs, W. T. & Holladay, S. (2008). Comparing apology to equivalent crisis response strategies: clarifying apology’s role and value in crisis communication. Public Relations Review. 34, pp. 252-257. Corkery, M. (May 6, 2010). Lloyd Blankfein is running for re-election. The Wall Street Journal. Craig, S. & Scannell, K. (July 16, 2010). Goldman settles its battle with the SEC. The Wall Street Journal. Davidoff, S. (August 20, 2008). A partnership solution for investment banks? The New York Times. Davidoff, S. & Henning, P. (July 16, 2010). Weighing the tradeoffs in the Goldman settlement. The New York Times. Drawbaugh, K. & Jones, H. (January 6, 2010). Global financial regulation overhaul seen in 2010. Reuters. Eder, S. (October 14, 2009). Pressure on Goldman to deal with image problem. Reuters. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 16 Egan, M. (February 22, 2010). Report: Goldman Sachs looks to outside public-relations gurus. FOX Business. Ellis, C. (2008). The Partnership: The making of Goldman Sachs. New York: Penguin. Ellis, D. (September 15, 2008). U.S. bank giant Lehman to file for bankruptcy. Cnn.com. (FCIC) Financial Crisis Inquiry Commission. (January 13, 2010). Testimony by Lloyd C. Blankfein Chairman and CEO, The Goldman Sachs Group, Inc. [Transcript of speech]. www.fcic.gov. (FCIC) Financial Crisis Inquiry Commission. (January 13, 2010). The official transcript, the first public hearing of the Financial Crisis Inquiry Commission. [Transcript of testimony]. www.fcic.gov. Federal Reserve Bank of St. Louis. The financial crisis: a timeline of events and policy actions. Retrieved April 14, 2010, from http://timeline.stlouisfed.org/pdf/CrisisTimeline.pdf.#) Feldman, L. (July 16, 2010). Financial reform bill another win for Obama, but will the public care? The Christian Science Monitor. Fidler, J. & Smallman, A. (June 23. 2010). Goldman Sachs may try ad campaign. The Wall Street Journal. Goldman, J., & Schmidt, R. (March 24, 2010). Big banks begin effort to improve image, set “record straight.” Bloomberg.com. Goldman Sachs. (November 17, 2009). Goldman Sachs launches 10,000 small businesses initiative. [News Release]. www.goldmansachs.com Goldman Sachs. (April 16, 2010). Goldman Sachs responds to SEC complaint. [News release]. www.goldmansachs.com Goldman Sachs. (April 16, 2010). Goldman Sachs makes further comments on SEC complaint. [News release]. www.goldmansachs.com Goldman Sachs. (May 14, 2010). Goldman Sachs announces details of Business Standards Committee. [News release]. www.goldmansachs.com Goldman Sachs. (July 15, 2010). Goldman Sachs & Co. agrees to settlement with SEC. [News release]. www.goldmansachs.com Grocer, S. (June 30, 2010). Has the SEC’s civil suit against Goldman cost it clients? The Wall Street Journal. Hitt, G., & Paletta, D. (May 21, 2010). Senate passes finance bill. The Wall Street Journal. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 17 Hodgson, J. (September 26, 2010). Goldman Sachs tops global Dealogic M&A advisory rankings. Dow Jones Newswires. Jones, A. (July 15, 2010). But who won? Sizing up Goldman’s deal with the SEC. The Wall Street Journal. Lica, M. (April 27, 2010). Goldman Sachs Hires PR Mark Fabiani to repair its image. what about transparency instead? Everything PR. Morgenson, G. & Story, L. (May 18, 2010). Clients worried about Goldman’s dueling goals. The New York Times. PBS (April 27, 2010). Senators vilify Goldman Sachs executives. [Video webcast]. PBS. (April 30, 2010). Lloyd Blankfein, Chief Executive Officer and Chairman of Goldman Sachs. [Video webcast]. [Television series episode]. In Charlie Rose. Retrieved from http://www.charlierose.com/view/interview/10989. PBS. (July 16, 2010). Goldman Sachs update. [Video webcast] [Television series episode]. In Charlie Rose. Retrieved from http://www.charlierose.com/view/interview/11128. PBS. (September 13, 2010). Andrew Ross Sorkin, The New York Times. [Video webcast]. [Television series episode]. In Charlie Rose. Retrieved from http://www.charlierose.com/view/interview/11202. Phillips, M. (April 19, 2010). Goldman Sachs vs. the SEC: what fellow wall streeters think. The Wall Street Journal. Pressler, J. (November 23, 2009). What should Goldman Sachs’s new PR strategy be? New York Magazine. Pressler, J. (February 1, 2010). A short history of Goldman spokesman Lucas Van Praag’s most withering rebuttals. New York Magazine. Rappaport, L. (October 18, 2010). Goldman pushes its image rehab. The Wall Street Journal. Roose, K. (September 29, 2010). In austere era, Goldman workers adopt lower profile. The New York Times. Scannell, K., Rappaport, L., & Catan, T. (September 23, 2010). SEC blasted on Goldman. The Wall Street Journal. Pp. 1, 8A. Scannell, K. (October 14, 2010). SEC cleared in Goldman case. The Wall Street Journal. Schnietz, K. & Epstein, M. (Winter 2005). Exploring the financial value of corporate social responsibility during a crisis. Corporate Reputation Review. 7(4), pp. 327-345. OBLIGED: GOLDMAN SACHS VERSUS THE U.S. SECURITIES AND EXCHANGE COMMISSION - PAGE 18 Schmidt, R. (April 27, 2010). Goldman Sachs turns to new lobbying playbook. Bloomberg.com. Schwartz, D. (April 19, 2010). Oh my! Goldman Sachs uses ‘Public Relations Officers’ to help manage the crisis. The PR News Blog: PR Newsonline. Sorkin, A.R. (April 1, 2010). Extreme makeover, Wall Street edition. The New York Times. Sorkin, A.R. (June 14, 2010). One crowd still loyal to Goldman Sachs. The New York Times. Starkman, E. (April 26, 2010). Goldman Sachs suffers the perils of PR spin. Forbes. Story, L. (July 17, 2010). The men who ended Goldman’s war. The New York Times. Taibbi, M. (April 5, 2010). The great American bubble machine. Rolling Stone Magazine. Tse, T. M. (April 29, 2010). Goldman Sachs adds to its ranks of lobbyists. The Washington Post. U.S. Securities and Exchange Commission (SEC). (April 16, 2010). SEC charges Goldman Sachs with fraud in structuring and marketing of CDO tied to subprime mortgages. www.sec.gov. U.S. Securities and Exchange Commission (SEC). (April 16, 2010). The SEC charges Goldman Sachs with fraud in connection with the structuring and marketing of a synthetic CDO. www.sec.gov. U.S. Securities and Exchange Commission (SEC). (July 15, 2010). Goldman Sachs to pay record $550 million to settle SEC charges related to subprime mortgage CDO. www.sec.gov. U.S. Securities and Exchange Commission (SEC). The investor's advocate: how the SEC protects investors, maintains market integrity, and facilitates capital formation. www.sec.gov. U.S. Securities and Exchange Commission (SEC). (September 2, 2009). The Securities and Exchange Commission post-Madoff reforms. www.sec.gov. United States Senate Permanent Subcommittee on Investigations (PSI). (April 27, 2010). Hearing on Wall Street and the financial crisis: The role of investment banks. [Exhibits]. http://hsgac.senate.gov. Uslaner, E. (2010). Trust and the economic crisis of 2008. Corporate Reputation Review. 13(2), pp. 110-123. Yared, Dr. Pierre. Assistant Professor, Finance and Economics, Columbia Business School. New York City, NY. Personal telephone interview conducted by The Author on November 15, 2010. Zuckerman, G., Craig, S., & Ng, S. (April 17, 2010). Goldman Sachs charged with fraud. The Wall Street Journal.