Don't Give Fraud the Green Light - Cornerstone Credit Union League

Don’t Give Fraud the Green Light

Mitigating Fraud in Your Credit Union

2012 NCUA Credit Union Workshops

Agenda Items

• Fraud Losses

• Frequency & Severity

• Mitigation Steps

• Managing Fraud

• Case Studies

• Best Practices

• Resources

• Credit Union Protection Resource Center

• Risk Management Consultants

Fraud Losses – Identify, Measure & Control

• Claims

• Frequency & Severity

• Basic Loss Mitigation

• Measure Exposure

• Loss Control Techniques

Determine Your Credit Union’s Risk Appetite

Fraud Losses – Frequency & Severity

Claim Count

Claim Dollars

Incurred Losses, 2006-2010

Basic Loss Mitigation Steps

1

Identify

2

Measure

3

Control

Recognize

Exposure

Determine Impact,

Frequency & Severity

5 Techniques

Measure Risk/Exposure Matrix

High Frequency

Low Severity

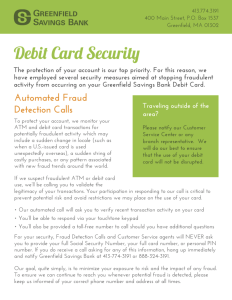

• Plastic card losses

• Deposit losses

Low Frequency

Low Severity

• Teller shortages

• Courtesy pay

High Frequency

High Severity

• Subprime lending

Low Frequency

High Severity

• Employee dishonesty

• Wire transfer fraud

Severity

Loss Control Techniques

AVOID

Avoid the exposure

Ex: Only perform in person wire transfer requests

LOSS PREVENTION

Prevent and/or reduce frequency

Ex: Well trained employees and good written procedures

LOSS REDUCTION

Reduce severity ($ loss)

Ex: Place a dollar limit on non face to face requests

SEGREGATION

Segregate or spread exposure

Ex: Have more than one employee involved in the process

TRANSFER

Transfer some of the risk to another entity

Ex: Buying insurance

Loss Control Techniques

High Frequency

Low Severity

LOSS PREVENTION

Low Frequency

Low Severity

RETAIN or ASSUME

High Frequency

High Severity

AVOID

Low Frequency

High Severity

TRANSFER or

REDUCTION

Severity

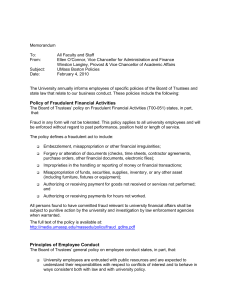

Managing Fraud

• Wire Transfers

• Fraudulent Deposits

• Lending

• Employee Dishonesty

Well Trained Employees Are Critical

Brainstorming

• Case study break out groups

– Wire Transfer

– Fraudulent Deposit

– Lending

– Employee Dishonesty

• Create a role play situation to combat fraud

– From your group; choose a note taker, narrator, appropriate

Credit Union employee(s) and a Credit Union member if applicable to case study

Wire Transfers

Wire Transfer Case Study

• $183,000 loss

• December 8, 2010: Fraudster contacted credit union by phone to request $183,000 advance against member’s Home Equity Line of

Credit (HELOC)

– Fraudster was able to answer basic security questions (member name, address, social security number, birth date, etc.)

– Funds transferred to deposit account

• December 8, 2010: Signed fax request received to wire $183,000 to

Sumitomo Bank in Japan

– Verified signature

• Performed callback verification to phone number on member’s account but number was changed shortly before the wire transfer request

Wire Transfer Case Study Discussion

Wire Transfer Loss Controls

Prohibit phone requests for advances against member

HELOCs

• A monetary threshold could be established for this purpose

Wire Transfer Loss Controls

Adopt a written wire transfer agreement with member specifying agreed upon security procedure for verifying the authenticity of wire requests

• Allows the credit union to shift liability for unauthorized wires to the member if the member’s negligence contributed to the compromise of the security procedure provided:

The security procedure is a commercially reasonable security procedure;

The credit union proves it acted in good faith; and

In compliance with the security procedure set forth in the wire transfer agreement

Wire Transfer Loss Controls

In the absence of a written wire transfer agreement, require members to request large dollar wires in-person at a branch office

• A monetary threshold could be established for this purpose

Callback verification to member using phone number on record

• Check member’s account to confirm phone number was not changed within last 30 days

• Use strong out-ofwallet questions to confirm member’s identity during callback

Wire Transfer Loss Controls

• Callback verifications are losing their effectiveness as a means of verifying the authenticity of wire transfer requests

– Fraudsters are controlling callback phone numbers

• Phone hijacking

• Contacting credit union to have member phone number changed

– Fraudsters build profiles on their victims to answer even the strongest security questions

Wire/HELOC Fraud In the News…

• January 25, 2011 article from CNNMoney.com

• Tobechi Onwuhara stole a confirmed $44 million in less than three years

– FBI believes the total may be anywhere from $80 million to

$100 million

– “He preferred credit union HELOCs: They were “soft targets”

Source: CNNMoney.com

Fraudulent Deposits

Fraudulent Deposit Case Study

• $20,700 loss

– New account fraud

• Account details

– Opened May 24, 2011

(savings and checking)

– Debit card issued

• Loss details

– Member deposited 7 checks totaling $22,000 at foreign ATMs during the period of June 9 - 16, 2011

Date of Deposit Check Amount

6/9/2011 $900

6/10/2011

6/13/2011

6/13/2011

6/15/2011

6/16/2011

6/16/2011

$2,500

$3,100

$3,000

$4,000

$3,200

$4,000

Fraudulent Deposit Case Study

• No holds placed on deposits

• Funds withdrawn via ATMs and in-person at credit union shared branches

• Checks returned unpaid – “Account Closed”

Fraudulent Deposit Discussion

Fraudulent Deposit Loss Controls

• New member identification

– Government issued photo ID

– Should not rely solely on photo ID as a means to verify a new member’s identity

• Fake ID kits

Fraudulent Deposit Loss Controls

• Screening tools for new accounts

– Assists in verifying identity of new members

• Identity verification/fraud service (e.g., Early Warning’s

IDENTITY CHEK and FIS’ FraudFinder)

• Verifies social security number and address

Fraudulent Deposit Loss Controls

– FIS ChexSystems

• Identifies account abuse reported by financial institutions

• Use for approving checking accounts and ATM/debit cards

– Credit Bureau Report

• Evaluate creditworthiness in approving checking accounts and ATM/debit cards

• Assists in identifying “high-risk” members

• Assists in verifying new member’s identity

• Signature card should notify the new member a credit report may be obtained

Fraudulent Deposit Loss Controls

• Most fraudulent deposit schemes are perpetrated on newer accounts within the first 6 to 12 months

• Focus check holds on newer accounts for the first 6 months or until account becomes established

– Reg CC allows extended holds on new accounts during the first 30 days of account opening

– Use regular and/or extended holds after new account period expires

• Flag new accounts on the system

– Assists tellers in identifying new accounts

Fraudulent Deposit Loss Controls

• Use longer holds on deposits to savings accounts

– Subject to state law

– Subject to Regulation Ds transfer limitations for savings accounts

• Automatic holds on ATM deposits

– 2 business day holds on deposits to proprietary ATMs

– 5 business day holds on deposits to nonproprietary ATMs

• Shared branching

– Establish probationary period before new members can use shared branching

– Impose check holds on deposits made at shared branches in accordance with the shared branch network’s rules

Lending

Lending Case Study

• A credit union receives an inquiry call on membership eligibility (call received through the call center)

– Potential member asks the following questions:

• What documentation is required for opening a new account?

• Does the credit union verify ChexSystems on new accounts?

• Is there a waiting period for obtaining a loan?

Lending Case Study

• Potential member then visits a branch office to open an account

• Credit union employee obtains credit report, completes an Office of Foreign Asset Control (OFAC) check and opens the account

• The member immediately applies for an unsecured loan

– The beacon score on the credit report is 737

• To provide excellent member service, the credit union uses auto approval for all consumer lending. (They credit union uses risk-based pricing)

Lending Case Study

• The loan is approved and the member wires the loan proceeds to an account they control at another financial institution

• No loan payments are received and the unsecured loan becomes delinquent

• The collection staff identifies that the credit report was for a deceased individual

• The credit union charges-off the unsecured loan

Lending Discussion

Lending Loss Controls

Alert all employees with the ability to open accounts of suspicious inquiry calls

Ask questions of members opening accounts in person without being too invasive

Look for identity theft red flags contained in the credit bureau reports

Ensure no credit freeze is in place

Scrutinize new loan request immediately following account opening

Lending Loss Controls

Review a sample of new loan requests

Inspect auto approval loans for signs of fraudulent activity

Multiple loans using the same or similar names

Duplicate social security numbers on application

Misspellings or inaccurate information (ex. Street instead of Road)

Ensure those processing wires are looking at the source of funds

Watch for first payment default loans

Employee Dishonesty

Employee Dishonesty Case Study

The credit union Supervisory Committee Chairman notifies the Branch Manager that he will be in the credit union at 8 AM the next day to conduct a quarterly verification of all cash supplies.

• A $30,000 cash shortage is discovered when counting the vault cash

Employee Dishonesty Case Study

• The Branch Manager states:

– Cash deliveries are accepted and bulk verification of sealed plastic bags are performed by her (the branch manager)

– Dual control is used when verifying cash deliveries

(counting individual bills)

– Vault cash is under dual control (two employees are required to be present when vault cash is accessed)

Employee Dishonesty Discussion

Employee Dishonesty Loss Controls

Implement forced dual control for receipt of currency shipments

Implement forced dual control of vault

Ensure when cash is counted both employees remain with the cash at all times

All “surprise” cash audits should be a surprise

The auditor should count the cash

Employee Dishonesty Loss Controls

Mandate employee time-off

Annual complete and comprehensive fraud policy

Provide fraud training for employees and volunteers

Emphasize fraud prevention and a comfortable whistleblower policy

Perform Bondability verification and background checks

Session Summary

• Credit unions of all asset sizes are exposed

• Loss controls must be implemented

• Fraud prevention can help your credit union avoid/reduce losses

• Powerful temptation for some… especially in today’s economy

• It just doesn’t just happen to other credit unions, all are at risk

CUNA Mutual Group Resources

• Risk Management Consultants

• Credit Union Protection Resource Center @ www.cunamutual.com

– 2012 Webinar Series & on-demand webinars

– Risk Alerts

– On-line self assessments

West –

Davis – CA (Central)

Terauchi – CA – (Northern)

Bowman – UT

Conner - OR

WA

Risk Management Consultants

MT

Central –

Davidson - WI

Eckes – MN

Otsuka – IL

Stolzer – MO

Roossien-MI

ME

ND

MN

OR

CA

NV

ID

UT

AZ

WY

NM

CO

SD

NE

KS

OK

TX

IA

MO

AR

LA

WI

IL

MS

MI

NY

VT

NH

CT

MA RI

IN

KY

TN

AL

OH

WV

GA

SC

PA

MD

NJ

DE

D.C.

VA

NC

East –

Bouvier – MA

Open – MD

Lovingood – NC

Molina – NJ

Petrone – ME

Pilch – PA

AK FL

South –

McDuffie – FL

McNeary – TX (Houston)

Law – GA

Regional Managers -

Joette Colletts – PA

Larry Forwood - CA

HI

Risk Management Services

• Robbery

• Burglary

• Hazard Liability

• ATM Security

• Business Continuity

• Fiduciary Liability

• Forgery/Fraudulent

Deposit

• Due Diligence

• Plastic Cards

• Employment Practices

• E-Commerce

• Data & Network Security

• Funds Transfer

• ACH

• Lending (all areas)

• Internal Dishonesty

• Internal Controls

Thank You

Credit Union Protection Risk Management

CUNA Mutual Group

This presentation was created by the CUNA Mutual Group based on our experience in the credit union and insurance market. It is intended to be used only as a guide, not as legal advice. Any examples provided have been simplified to give you an overview of the importance of selecting appropriate coverage limits, insuringto-value and implementing loss prevention techniques. No coverage is provided by this presentation/ publication, nor does it replace any provisions of any insurance policy or bond. Coverage may vary or may not be available in some states. Please read the actual policy for specific coverage, terms, conditions, and exclusions. For general information, please contact our company Sales Executive. Insurance products offered to credit unions, including the Fidelity Bond, is underwritten by CUMIS Insurance Society, Inc., a member of CUNA Mutual Group.

CUNA Mutual Group Proprietary and Confidential. Further Reproduction, Adaptation, or Distribution Prohibited.

© CUNA Mutual Group, 2012. All Rights Reserved.

CUP-FRAUD-0112