Computerized Accounting with

advertisement

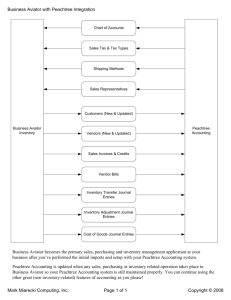

Computerized Accounting With PEACHTREE 2012 LECTURE NOTES Chapter 1 – Getting Started This chapter focuses on getting students familiarized with Peachtree Complete Accounting 2012. The processes for navigating the software are explored and students are made aware of the Help feature. Focus on hardware and storage issues that confront your respective school. Review the “Student Supplements” section starting on page xi of the text. Topics to be covered include installing Peachtree 2012 from the CD, extracting company files from the CD, and creating and naming company files. Instruct students on where they should create and save their company files. Show students how to navigate Peachtree with the Navigation Bar and Menu Bar. Explain the backup and restore feature at this point. Explain the purpose of accounting and review the accounting process. Chapter 2 – Setting Up a Company In this chapter students will learn how to create companies in Peachtree. The following accounting concepts will be introduced: the chart of accounts, the types of business organizations, and the concepts of debits and credits. Review the accounting concepts given above. Reinforce the idea of debits and credits. Define the different account types available with Peachtree. Explain how the selection of account ID, account description, and account type affect the account’s placement within the financial statements. Advise students to include their names at the end of each company name. Compare the “Build your own chart of accounts” option with the “Use a sample business that closely matches your company” option. Review the accrual basis and cash basis of accounting. Show students how to add, delete, and modify specific accounts. Demonstrate how to enter beginning balances. Advise students of the importance of reading several paragraphs ahead before performing an operation with the software. This will avoid problems associated with the step-by-step process approach. Chapter 3 – Entering Transactions for a Cash Business The focus of this chapter is entering transactions using the General Journal Entry function. In this chapter, only a cash business is addressed. Therefore, there are no accounts payable or accounts receivable. Transactions are demonstrated using a sample manual journal entry, and a step-by-step process is demonstrated. Additionally, students are introduced to Peachtree’s method of preparing financial statements, which will be covered in more detail in Chapter 7. © Paradigm Publishing, Inc. Page 1 Review the processes of journalizing and posting. Explain how the general journal and general ledger aid in the preparation of the financial statements. Make students aware that the sample general journal entries are in fact samples. Often students try to recreate these entries before starting the steps. Let them know that the entry is for illustration purposes only. Show students how to enter a transaction using the General Journal Entry function. Instruct students how to use the List, Save, Delete, and Recur options from the General Journal Entry window to edit, post/save, delete, and automatically create journal entries. Remind students that Peachtree will not allow posting unless the entry is balanced. Emphasize the importance of dates and accounting periods. Review the various financial statements including the balance sheet, income statement, and statement of changes in financial position. Chapter 4 – Accounts Receivable and Sales for a Business This chapter focuses on Peachtree’s treatment of sales and accounts receivable. There is a substantial discussion on the topics of accounts receivable and sales, including an introduction to subsidiary ledgers. Students will learn to process accounts receivable and sales transactions. In addition, the chapter addresses the treatment of uncollectible accounts. Remind students of the Navigation Bar, Main Menu bar, and their ability to access different areas of the software using several different methods. Demonstrate how to set up a customer account and the various information needed such as credit terms and sales defaults. Remind students to use the appropriate GL Sales account number when setting up a customer account and entering transactions. Explain the concept of discounts and Peachtree’s automated system for calculating discounts. Show students how to use the Sales/Invoicing function to enter sales transactions on account. Demonstrate how a partial receipt on a sale is entered. Explain the Alert function. Discuss uncollectible accounts in detail. Review available customer reports. Chapter 5 – Accounts Payable and Purchases for a Service Business This chapter focuses on Peachtree’s treatment of accounts payable and purchases. There is a substantial discussion on the concepts of accounts payable and purchases, including a description of accounts payable subsidiary ledgers. Students will learn to create vendor accounts in Peachtree and process accounts payable transactions. © Paradigm Publishing, Inc. Page 2 Reinforce the concept of controlling accounts and subsidiary ledger accounts. Reinforce the concept of purchase discounts. Demonstrate how to set up a vendor account and the various information needed such as credit terms and expense defaults. Show students how to use the Purchases/Receive Inventory function to enter purchase transactions on account. Demonstrate how a partial payment on a purchase is entered. Review available vendor reports. Chapter 6 – Cash Payments and Cash Receipts In this chapter, cash payments and cash receipts are discussed, and the processes for entering transactions in the cash receipts and payments windows are explained. Bank reconciliation is explained and demonstrated. Invoice discounts are reviewed. Emphasize the importance of cash management. Demonstrate how the Payments function is used to pay previously recorded transactions and the Write Checks function is used to pay unrecorded transactions. Explain the “Accounting Behind the Screens” feature. Remind students to print checks in blank check format. Demonstrate how to use the Account Reconciliation function from the Tasks menu to perform a bank reconciliation. Show how to print invoices. Chapter 7 – Preparing the Financial Statements The financial statements were introduced in Chapter 3. In this chapter, the financial statements are discussed in detail. In addition, students are introduced to the report formatting functions of Peachtree. The processes for changing the accounting period and closing the accounting period are explained. Explain the importance of adjusting entries and give several examples of each type. Remind students that all current balances are available from the trial balance or general ledger. They will need that information for adjusting entries. Review the different financial statements. Emphasize the statement of cash flows. Let students experiment with changing the look of financial statements. Review the flow of information through the accounting cycle. Demonstrate how to change the accounting period. Chapter 8 – Purchases of Inventory in a Merchandise Business Students are introduced to the accounting procedures associated with inventory transactions. The two basic inventory methods are introduced conceptually and explained. Basic Peachtree inventory methods are explained and demonstrated. Inventory subsidiary accounts are introduced and demonstrated. Inventory transactions are processed. © Paradigm Publishing, Inc. Page 3 Review the basic formula for determining the cost of goods sold. Emphasize and model the two inventory systems: perpetual and periodic. Explain the relationship between inventory and the cost of goods sold. Explain how the selection of an inventory valuation method (FIFO, LIFO, and Average) affects the gross profit. Emphasize Peachtree’s use of a perpetual inventory system. Explain the concept of purchases within the perpetual system. Model the different inventory costing methods. Demonstrate how to set up inventory items. Demonstrate the use of purchase orders using the Purchase Orders function and the receipt of goods using the Purchases/Receive Inventory function. Show how the Vendor Credit Memos function is used to record the return of goods to vendors. Reinforce the concept of discounts and the process for determining discounts. Review available inventory reports. Chapter 9 – Sales of Inventory in a Merchandise Business This chapter introduces the concepts behind accounting for the sale of merchandise. Students create sales tax accounts and create sales orders and invoices. The processing of sales transactions is explained and modeled. In addition, finance charges are reviewed and practiced. Demonstrate the use of sales orders using the Quotes/Sales Orders function and the selling of goods using the Sales/Invoicing function. Show how the Credit Memos function is used to record the return of goods from customers. Explain that there can be more than one income, or revenue, account. Reinforce the notion that businesses collect sales tax at the behest of the government and the sales tax is added to a customer’s accounts receivable. Remind students that Sales Tax Payable is a current liability. Demonstrate how to set up finance charges. Review available sales reports. Chapter 10 – Payroll Chapter 10 introduces students to payroll. The concepts are explained and modeled. The Peachtree Payroll Setup Wizard is introduced, explained, and demonstrated. Students make payroll transactions and print payroll reports. Review the payroll laws and regulations. Explain the payroll deduction process and both the employee and employer payroll tax liabilities. Be sure that students realize that FICA payments are collected from both the employer and the employee. © Paradigm Publishing, Inc. Page 4 Demonstrate the payroll setup process including the Payroll Setup Wizard, employee defaults, and employee records. Explain the difference between Peachtree-maintained and user-maintained payroll formulas. Demonstrate how to process payroll for an individual and for a group. Review the various payroll reports. Chapter 11 – Job Costing This chapter focuses on job costing. The concepts associated with job costing are introduced. The different phases and codes supported by Peachtree are explained and demonstrated. Students use the job costing tools at several levels, inputting transactions and printing reports. Emphasize the need for and benefits of job costing. Explain the phase codes and cost codes. Inform students of the importance of good estimates when bidding jobs. Review the various job costs: materials, labor, and overhead. Show how to set up jobs. Demonstrate how to apply inventory costs to a job using the Inventory Adjustments function. Demonstrate how to apply labor costs to a job using the Jobs option from the Payroll Entry window. Review available job reports. Chapter 12 – Partnerships and Corporations The characteristics, accounting concepts, and accounting treatment of partnerships and corporations are explained and modeled. The advantages and disadvantages of each business type are evaluated. Students create the accounts that are unique to partnerships and corporations and use these accounts in transactions. In addition, accounting for stock and dividends is explained and modeled. Review the advantages and disadvantages of the partnership and corporation forms of business organization. Explain the necessary equity accounts for each partner and how they are affected as a result of investments and withdrawals. Review the basic formula for determining retained earnings. Review the processes of changing an accounting period and closing the fiscal year using the Year-End Wizard. Explain the process for splitting profits according to partnership agreements. Remind students that calculations must be done manually and then entered in Peachtree. Review the types of stock. Demonstrate the journal entries for declaring and paying cash dividends. Explain the differences between a Statement of Retained Earnings and a Statement of Owner’s Equity. © Paradigm Publishing, Inc. Page 5 Appendix – Fixed Assets This is a topic not covered in many Peachtree Accounting textbooks. This chapter focuses on the tax and accounting treatment of fixed assets. Students are introduced to fixed assets and what constitutes a fixed asset. Along with the discussion of fixed assets is a discussion of depreciation. Several of the common depreciation methods are explained and modeled. Review the concept of depreciation. Model several depreciation methods. Emphasize the need for calculating tax and book depreciation. Demonstrate the adjusting journal entry for depreciation. Remind students that depreciation must be updated to the day of asset disposal. Explain how a gain or loss is determined on the disposal of a fixed asset. Demonstrate the journal entry to record either a gain or loss on a sale of a fixed asset. Comprehensive Problems There are two comprehensive problems included in this Instructor’s Guide. The first problem focuses on Chapters 1-7. The intent of this problem is to enhance the students’ process, application, and problem solving skills associated with a service business. The second problem, focusing on Chapters 8-11, deals with a merchandising business, inventory, payroll, and costing. Additions to the Instructor’s Guide In addition to the comprehensive problems, the Instructor’s Guide includes the following items: Sample course syllabi for semester- and quarter-long courses A glossary assembled from the margin terms of the text Answers to all end-of-chapter Content Check questions Answers to all end-of-chapter Case Problems, including required printouts in PDF format and backups of completed company files Mid-term and final objective tests Chapter quizzes and answers Objectives and overviews Additional Product Ancillaries Each textbook comes with a CD-ROM containing the education version of Peachtree Complete Accounting®2012. In order to install the Peachtree program, the students (and instructors) will need to enter a serial number. The serial number is available by registering the program at http://www.peachtree.com/student/regi. The education version of Peachtree®2012 program is only valid for 14 months from the date of registration. This CD-ROM also provides the students with all the necessary company files to complete the required assignments. These files can be downloaded to a network or to individual student’s computers—see page xii of the textbook for instructions. © Paradigm Publishing, Inc. Page 6