Fraud Avoidance Measures Presentation

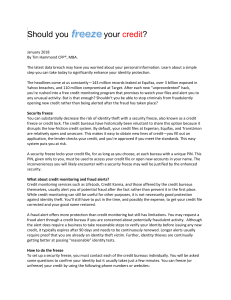

advertisement

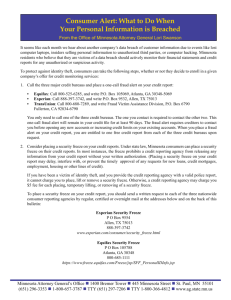

Preventative Maintenance Obtain a free copy of your credit report annually by visiting www.annualcreditreport.com or by calling 1-877-322-8228. Review your report carefully for any suspicious activity, accounts you don’t recognize, or delinquencies you do not remember. If you discover a discrepancy, file a dispute with the credit bureau. They have 30 days to investigate and respond. Register every phone number you own for the National Do Not Call List at www.donotcall.gov or by calling 1-888-3821222 from the phone you want to register. All legitimate calls should cease 31 days after registration. Therefore, any telemarketing call you receive after 31 days of registration is all but guaranteed to be a scam. Florida Do Not Call List: www.fldnc.com Only answer calls from numbers you know or recognize. Allow all other calls to go to voicemail for screening purposes. Block all numbers that are “fishy.” NEVER do business with unsolicited callers or door to door salesmen. Simply tell them “I do not do business with anyone who calls or visits me unannounced, please send me something in writing.” Afterwards, confirm the businesses legitimacy and business license before entering into a business deal. Including: Bank Statements; Tax Documents; Investment Portfolios; and any documents containing your Social Security Number, Credit Card Number, Bank Account Number, or any other Personal Identifying Information. Be sure to use a shredder that cross cuts in no larger than three inch strips. Keep your Social Security Card locked away in a safe place until it is absolutely required. Only carry with you the checks, debit cards, and credit cards you will need that day. Keep all extras locked away in a secure location until they are needed. Never give out your personal information over the phone or internet unless YOU initiated the contact, and you are CERTAIN of the receiving parties legitimacy. Use Direct Deposit for Government Benefits, Tax Refunds, and Paychecks whenever possible. To prevent Mail Theft, invest in a locking mailbox. This can also reduce the hassle of having someone collect your mail should you go out of town. If you do not use a locking mailbox, be sure to suspend your mail service should you leave town for any length of time. Opt-Out of Pre-Screened Credit Offers by visiting www.optoutprescreen.com or calling 1-888-567-8688. This will help to reduce the amount of “junk mail” you receive daily. Reduce the amount of “junk mail” you receive by visiting the Direct Marketing Association at www.dmachoice.org or calling 1-212-768-7277. DO NOT use public profiles for social media. Your privacy settings can be modified on all social media platforms. ▪ For Facebook, set to “Friends Only.” Only “friend” people on Social Media that your really know. Restrict the amount of information that you put online. Be careful about describing upcoming vacations, etc. Only post pictures of yourself out of town after you return home! Beware of and Avoid Fee Seminars, Hotel Stays, Trips, etc. While this can be a way to get a free trip, etc., the sales team is highly trained in sales tactics, and the pressure to buy will be extremely high. If you do attend a Free Seminar, leave your checkbook, credit cards, etc. at home or in the car. Never make a decision that night or even the next day. Think on it for a week and do your due diligence. A Fraud Alert informs creditors to contact the consumer by telephone to verify that the consumer wants to open a new account. The Alert is effective only for 90 days, but can be renewed an unlimited number of times. Upon Activation with one credit bureau, the Fraud Alert is effective will all three major credit bureaus. To place a fraud alert on your credit file, contact: Equifax: www.equifax.com or 1-888-766-0008. Experian: www.experian.com or 1-888-397-3742. Transunion: www.transunion.com or 1-800-680-7289 . Place a Credit Freeze on your Credit File: A Credit Freeze will prevent anyone from opening any new credit accounts on your Credit File. The Freeze can be lifted temporarily to allow yourself to open a new credit account. The Freeze will not affect your credit score in any way. The Freeze normally cost between $5-10 dollars when instituted, and again when removed. The Freeze will remain in place until you lift it temporarily or remove it entirely. Place a Credit Freeze on your Credit File by contacting each of the three major credit bureaus individually. REPORT IT: Local Police Department ▪ Financial Crimes Unit or Elder Abuse Unit Your State Attorney General or Consumer Services Division AND Local Consumer Services Division ▪ https://www.usa.gov/state-tribal-governments The Federal Government ▪ www.stopfraud.gov ▪ Be Aware: You may need to report to multiple Federal Agencies, sometimes up to three different agencies. Not only should you report to crime control agencies (FTC, SEC, etc.) but also to those entities with criminal investigative and prosecutorial powers (FBI, Local Police). ELDER CONSUMER PROTECTION PROGRAM 1401 - 61st Street South Gulfport, Florida 33707 Telephone: (727) 562-7888 Facsimile: (727) 345-1838 E-mail: ecpp@law.stetson.edu Website: http://www.stetson.edu/law/elderconsumers Twitter: @StetsonLawECPP 21