Probability judgment Ec101 Caltech

advertisement

Probability judgment

Ec101 Caltech

• How are probability distributions judged?

• Normative:

– Optimal inference using laws of statistics

– Bayesian updating

P(H1|data)/P(H2|data)=[P(H1)/P(H2)]xP(data|H1)/P(data|H2)]

posterior odds

prior odds

likelihood ratio

•Behavioral: TK “heuristics-and-biases” program

– c. ‘74: Heuristic processes substitute for explicit calculation

– Representativeness, availability, anchoring

– Heuristics can be established by the "biases" from optimality

– c. ‘03: System 1 is heuristics, system 2 is rational override

•Note: Controversial! (see Shafir-LeBoeuf AnnRevPsych ’02)

1

Examples

• P(event)

– Will Atty General Alberto Gonzales resign?

– Will Tomomi return to Japan after Fulbright?

– Will the TimeWarner-AOL merger succeed?

• Numerical quantities

– Box office gross of “Spiderman 3”

– Inflation rate next year

– Where do I rank compared to others?

2

Major topics

1. System 1-2

2. Attribute substitution

3. Prototype heuristics

4. Partition-dependence

5. Optimism and overconfidence

6. Mis-Bayesian approaches

7. Probabilities expressed in markets

8. Research frontiers

3

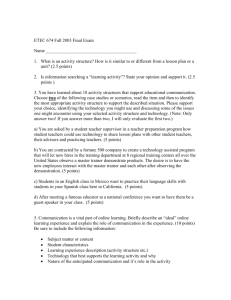

1. A two-system view

4

Systems 1 and 2 in action

• “Mindless” behavior (Langer helping

studies)

• A bat and ball together cost $11

• The bat costs $10 more than the ball

• How much does the bat cost?

5

Systems 1 and 2 in action

•

•

•

•

•

•

•

•

•

A bat and ball together cost $11

The bat costs $10 more than the ball

How much does the bat cost?

System 1 guess $10

System 2 checks constraint satisfaction

x+y=11

x-y=10

System 1 “solves” x+y=11, x=10, y=1

System 2 notices that 10-1 ≠ 10

6

Provides a tool to study individual

differences

• Cognitive reflection test (CRT, Frederick JEP 05)

7

CRT scores

High CRT are more patient and risk-neutral

8

2. “Attribute substitution” by system 1

•

“...when an individual assesses a

specified target attribute of a judgment

object by substituting another property of

that object—the heuristic attribute—which

comes more readily to mind.” (Kahneman

03 p 1460)

– Like the politician’s rules: Answer the question

you wish were asked, not what was actually

asked.

9

Attribute substitution: Examples

• “Risk as feelings” (Loewenstein et al):

• Question: “Is it likely to kill you?”

• Substitute: “Does it scare you?”

– Role of lack of control and catastrophe

• Mad cow disease (labelling, Heath Psych Sci),

terrorism?, flying vs driving (post 9-11, Gigerenzer 04

Psych Sci)

• Personal interviews (notoriously unreliable):

– Question: “Will this person do a good job?”

– Substitute: “Do you like them, are they glib, etc?”

10

Example: Competence judgment by

outsiders highly correlated with actual

Senate election votes (Todorov et al Sci 05)

11

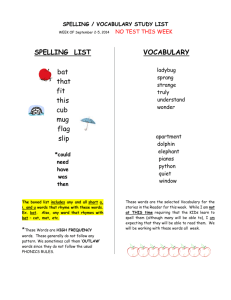

3. Prototype heuristics

• Tom W:

Neglect college major

base-rate when

prototype matching is

accessible

12

Conjunction fallacy

• Stereotypes can

violate conjunction

laws

• P(feminist bank

teller)>P(bank teller)

• Easily corrected by

“Of 100 people like

Linda..”

13

Which attribute is substituted depends

on “accessibility” (cf. availability)

• What is area? (top)

• What is total line

length? (bottom)

• Implies that displays

matter

• Role for supply-side

“marketing”

14

Availability (c. 1974)

• Is r more likely to occur as 1st or 3rd letter?

• “illusory correlation” (Chapman ’67 J AbnPsych)

– E.g. gay men draw muscular or effeminate people in D-A-P test

– Resistant to feedback because of encoding bias and availability

• Confirmation bias: Overweight +/+ cell in 2x2 matrix

– Secret to astrology

• “Something challenging is going on in your life…”

– Wayne Lukas horse trainer…winningness in Breeder’s Cup! (and

losingest)

15

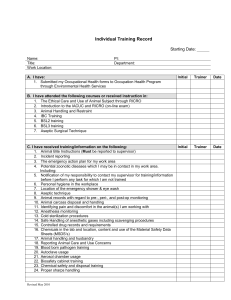

Mystique of horse trainer

D. Wayne Lukas

- Has been the dominant

trainer in the Breeders' Cup

and is the only trainer to have

at least one starter every year.

Is the career leader in purse

money won, starters and

victories. Ten of his record 18

wins have come with 2-yearolds: five colts and five fillies.

Has also won the Classic

once, the Distaff four times,

the Mile once, the Sprint

twice …(ntra.com)

– http://www.ntra.com/images/2006

_MEDIA_Historical_trainers.pdf

–

16

Mystique of horse trainer

D. Wayne Lukas

- Has been the dominant

trainer in the Breeders' Cup

and is the only trainer to have

at least one starter every year.

Is the career leader in purse

money won, starters and

victories. Ten of his record 18

wins have come with 2-yearolds: five colts and five fillies.

Has also won the Classic

once, the Distaff four times,

the Mile once, the Sprint

twice …(ntra.com)

Wayne

Lukas

All

others

Shug

McGaughey

Won 18

98

9

(%)

(12.4%)

(12.7%) (18.8%)

Lost

127

769

39

– http://www.ntra.com/images/2006

_MEDIA_Historical_trainers.pdf

–

17

Illusions of transparency

• Hindsight bias:

– Ex post recollections of ex ante guesses tilted

in the direction of actual events

• Curse of knowledge

– Hard to imagine others know less (Piaget on

teaching, computer manuals…)

• Other illusions of transparency

– Speaking English louder in a foreign country

– Gilovich “Barry Manilow” study

18

4. Partition-dependence

• Events and numerical ranges are not always naturally

“partitioned”

–

–

–

–

E.g.: Car failure “fault tree”

Risks of death

Income ranges (e.g. economic surveys)

{Obama, Clinton, Republican} or {Democrat, Republican}

• Presented partition is “accessible”

– Can influenced judged probability when system 2 does not

override

– Corollary: Difficult to create the whole tree

– “When you do a crime there are 50 things that can go wrong.

And you’re not smart enough to think of all 50”– Mickey Rourke

character, Body Heat)

19

1/n heuristic in portfolio allocation

(Benartzi-Thaler AER)

20

Probabilities are sensitive to the

partition of sets of events

(Fox, Clemen 05 Mgt Sci, S’ss are Duke MBAs judging starting salaries)

21

Prediction markets for economic

statistics (Wolfers and Zitzewitz JEcPersp 06)

An Example: Price of Digital Options

Auction on Retail Trade Release for April 2005; Held May 12, 2005

.1

.094 .092

.087

.08

.087 .085

.074

.065

.06

.052

.04

.035

.063 .063

.052

.051

.034

.025

0

.015

.017

.011

-0 <

.2 -0

0 .2

0

t

-0 o .1 0.1

0

t 0

0. o 0

00 .0

t 0

0. o 0

10 .1

t 0

0. o 0

20 .2

t 0

0. o 0

30 .3

t 0

0. o 0

40 .4

t 0

0. o 0

50 .5

t 0

0. o 0

60 .6

t 0

0. o 0

70 .7

t 0

0. o 0

80 .8

t 0

0. o 0

90 .9

t 0

1. o 1

00 .0

t 0

1. o 1

10 .1

t 0

1. o 1

20 .2

t 0

1. o 1

30 .3

to 0

1.

40

>1

.4

0

.02

22

Debiasing partition-dependent

forecasts improves their accuracy

(Sonneman, Fox, Camerer, Langer, unpub’d)

• Suppose observed F(x) is a mixture of an unbiased B(x)

and diffuse prior (1/n)

F(x)=αB(x)+(1-α)(1/n)

compute B*(x|α)=(1/α)[F(x) – (1-α)(1/n)]

(e.g. B(.6<retail<.7|α=.6)=(1/.6)[.094 – (.4)(1/18)]=.120)

• Are inferred B(x) more accurate than observed F(x)?

– Yes: α=.6 mean abs error .673

(α=1 .682)

– Correction w/ α=.99 improves forecasts 58.2% (n=153, p<.01)

23

|

R

ü

d

i

g

e

r

F

.

P

o

h

l

2

,

|

E

d

g

a

r

E

r

d

f

e

l

d

e

r

2

,

Anchoring

• An “anchor” is accessible

• System 2 must work hard to override it

• E.g. % African nations in the UN (TK 74)

– (visibly random) anchor 10 median 25

anchor 45 median 65

• “Tom Sawyer” pricing

|

T

i

n

a

–

S

a

r

a

h

A

u

e

r

2

24

“Tom Sawyer” pricing of poetry reading

(+/- $5 anchor)

(Ariely et al)

25

5. Optimism and overconfidence

• Some evidence of two “motivated

cognition” biases:

– Optimism (good things will happen)

– Overconfidence

• Confidence intervals too narrow (e.g. Amazon

river)

• P(relative rank) biased upward (“Lake Woebegone

effect”)

26

Relative overconfidence and

competitor neglect

• Entry game paradigm (Camerer-Lovallo ‘99 AER):

– 12 entrants, capacity C (2,4,6,8,10)

– Top-ranked C earn $50 total. Bottom -$10

– Ranks are random, or based on skill (trivia)

– Also guess number of other entrants

27

Earn more $ in random compared to skill

(aren’t thinking about competitor skill)

28

Competitor neglect

• Joe Roth (Walt Disney studio head) on why big

movies compete on holidays:

• Substitute “Is my movie good?” attribute for “Is

my movie better?”

29

• “Hubris” of CEO’s

correlated with

merger premiums (Roll,

’86 JBus; Hayward-Hambrick

97 ASQ)

30

Narrow confidence intervals

• Surprising fact:

– 90% confidence intervals too narrow (50% miss)

– Feb. 7, Defense Secretary Donald Rumsfeld, to U.S. troops in

Aviano, Italy: "It is unknowable how long that conflict will last. It

could last six days, six weeks. I doubt six months.“

– Paul Wolfowitz, the deputy secretary of defense at the time, was

telling Congress that the upper range [60-95 B$] was too high and

that Iraq's oil wealth would offset some of the cost. "To assume

we're going to pay for it all is just wrong," Wolfowitz told a

congressional committee.

– Nonfatal examples: Lost golf ball or contact lens, project costs/time

(planning fallacy)

• But ask: How many will be wrong? People correctly say 5

of 10 (Sniezek et al)!

31

Inside/outside view

(Kahneman-Lovallo 93 Mgt Sci, HBR 03)

• How could each decision be wrong but

aggregate statistics be right?

• Inside view:

– Rich, emotive, narrative, rosy

• Outside view:

– Abstract, acausal, statistical

• Examples: Marriage, merger

• No formal model of this yet

32

6. ‘Mis-’Bayesian approaches

• Start with Bayesian structure

• Relax one or more assumptions

• Choose structure so resulting behavior

matches stylized facts

• Find new predictions

33

‘Mis-’Bayesian approaches (cont’d)

• Confirmation bias (Rabin-Schrag, QJE 97)

• Law of small numbers (Rabin, QJE 01?)

• Overconfidence (Van de Steen, AER; Santos-Pinto &

Sobel, AER)

• Preference for optimistic beliefs (BrunnermeierParker AER)

• …many more

34

Confirmation bias

• States A and B. Signals a, b.

• Signal a more indicative of A

(P(a|A)>P(a|B)

• P(A)>P(B) a perceived correctly, b

misperceived with some probability (“see it

when you believe it”)

• mistaken belief can persist a long time

35

Relative overconfidence

• People differ in production functions based

on skill bundles (Santos-Pinto, Sobel AER)

• Invest in skills to maximize ability

• Compare themselves to others using their

own production function

– i.e,. implicitly overrate the importance of what

they are best at (cf. Dunning et al 93 JPSP)

• Prediction: Narrowly-defined skill will erase

optimism; it does

36

7. Probability estimates

implicit in markets

• Do markets eliminate biases?

Pro: Specialization

– Market is a dollar-weighted average opinion

– Uninformed traders follow informed ones

– Bankruptcy of mistaken traders

• Con: Investors may not be selected for probability judgment

– Short-selling constraints

– Confidence (and trade size) may be uncorrelated with information

– Herd behavior (and relative-performance incentives) may reduce

capacity to correct mistakes (Zweibel, LTCM tale of woe)

• Example study:

– Camerer (1987)

• Experience reduces pricing biases but *increases* allocation biases

37

Representativeness

bias is perceptible but

diminishes with

experience (bottom,

Camerer 87 AER)

38

8. Research frontiers

• Aggregation in markets

• Novice system 2 deliberate calculations become

replaced by expert system 1 “intuitions” (cf.

“Blink”)

– How? And are they accurate?

• Reconciling mis-Bayesian and system 1-2

approaches

• Applications to field data

• Where are systems 1-2 in the brain?

• System 1-2 approach predicts fragility of some

results (e.g. Linda the bank teller)… how can

system 2 be turned on?

39