The business plan - SHAD Queen's University

advertisement

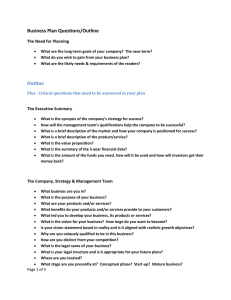

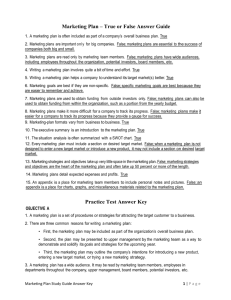

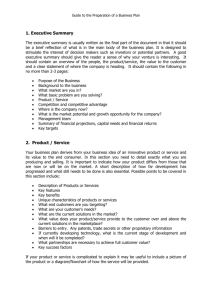

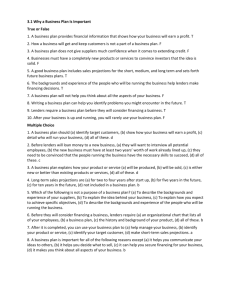

USING THE ICP EXERCISE TO BETTER UNDERSTAND THE BUSINESS PLAN July 8, 2014 Kelley A. Packalen, PhD Associate Professor of Entrepreneurship, Queen’s School of Business Shad Valley Alum (Carleton 1992) kpackalen@business.queensu.ca PURPOSE OF BUSINESS PLAN Reality Check—What’s it going to take? Living guide to the business Statement of intent for third parties Investors Bankers/lenders Potential management Strategic partners Suppliers PURPOSE OF BUSINESS PLAN Statement of intent for third parties Investors Bankers/lenders Potential management Strategic partners Suppliers FOR THE AUDIENCE FOR THE PLAN… A simple statement of what’s being offered to prospective investors… customers… suppliers… key employees… This is what we need Here is what is in it for you TYPES OF BUSINESS PLANS Business plans come in a variety of different types Summary business plan – “The 10 to 12 pager” The manageable plan – “The 18 to 20 pager” Full business plan – “The 40 to 50 pager” Operational (business) plan – “The Hernia Document” THE BUSINESS ITSELF: KEY AREAS TO ADDRESS Positioning Marketing & sales Problem Competition Solution Management team Business model Financial projections & key metrics Underlying magic (your competitive advantage) Current status, accomplishments to date, timeline & use of funds POSITIONING TEAM EXERCISE: STEP 1 Ability to provide a unique product or service Plot the main competitors that you identified in the following framework. Stupid companies Dotcom companies X Price competition Value to customer of the product or service Best place to be THE PROBLEM (AKA THE OPPORTUNITY) What is the customer’s pain that you are alleviating? Bring in market research as appropriate to demonstrate that this is the IDEAL time for this venture Need to demonstrate that a trend is in fact a trend Hit the high points in the text, put back up material in an appendix This is not a list making exercise – be clear about answering ‘the so what’ question for every point to you make THE SOLUTION Explain how you alleviate this pain Second of three places that you talk about your idea. More detail here than the executive summary and positioning statement, but less detail than the underlying magic What do you sell? What is your value proposition? If you already have customers mention them Stories are great to demonstrate impact BUSINESS MODEL How do you make money? Who pays you? How do you distribute your product? What are your gross margins? UNDERLYING MAGIC (COMPETITIVE ADVANTAGE) Describe the technology, secret sauce, or magic behind your product or service Use pictures and diagrams in lieu of text if appropriate EXAMPLE: PICTURES SIMPLIFY TEXT Deregulation has also significantly changed the structure of the industry, whereas in the past before deregulation the market structure was fairly simple as well head producers sold directly to pipeline companies, who in turn sold to distributors, and then to end users (Figure 4). After deregulation prices are no longer regulated at the well head, with the exception of pipeline transporters, who are still under federal regulation. In the unregulated natural gas market, the role of marketers has emerged as middle men who facilitate sales and transactions between the various parties (Figure 4). Today there are a large number of possible pathways for natural gas to proceed from producer to end user. MARKETING AND SALES Demonstrate you know your market(s) Who are your customers? How will you get to them? What will it cost you to get to them? Why will they buy? Convince the reader you have an effective go-to-market strategy COMPETITION Provide a complete view of the competitive landscape Remember to include substitutes Focus on why you are good versus why the competitors are bad THE TEAM The ‘team’ can & should consist of: The founders The management The employees The advisors Together, need to demonstrate that you are the BEST team to capitalize on the opportunity At the same time, don’t need to have everyone in place. Be honest about what you know & don’t know FINANCIAL PROJECTIONS AND KEY METRICS How much money will you need? When? From where? Cash flow statements are critical Will need the other financial statements as well, based on several scenarios Scenarios must be tied to your business’ critical success and key risk factors (see next slide) Key differentiating points: Demonstrate frugality and creativity Tie these plans explicitly back to your ‘context’ discussion DUE DILIGENCE AND VALUATION CRITERIA Technology Risk • Stage of Development • Impact & Application • Sustainable Advantage Market Risk IP Risk • • • • • • Nature and Scope IP Form Ownership Enforceability IP Building Freedom to Operate • • • • • Execution Risk • • • • Reputation / Leadership Commitment Market Knowledge Experience Size and Growth Dynamics Competition Customers Distribution Channels CURRENT STATUS, ACCOMPLISHMENTS TO DATE, TIMELINE & USE OF FUNDS What is the current status of your product or service? What does the near future look like? How will you use the money you are trying to raise? PUTTING ALL THE PIECES TOGETHER: COMMON RED FLAGS FOR INVESTORS We have no risks Scale up will be straightforward – it will take very little time and money Hockey stick revenue projections We have no competitors We only need .05 percent of our target market to meet our sales targets No explanation of how financial numbers were generated My brother-in-law, the real estate agent, is the ideal director of marketing for our Web 2.0 company No indication you have talked to your potential customers