here - Urban Innovation21

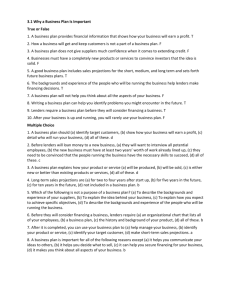

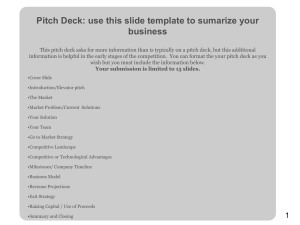

advertisement

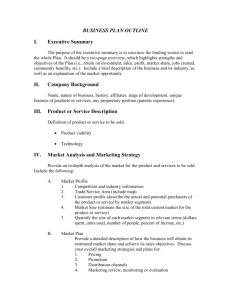

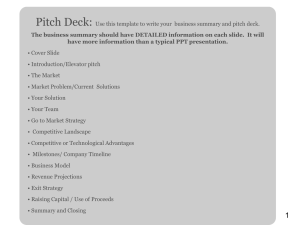

What Are the Financial Assumptions on a Business Plan? by William Pirraglia, Demand Media Business plans are required for all small businesses seeking loans or investors. Financial assumptions and projections are critical components of all business plans. Three universal financial presentations are expected in all business plans. You must include a projected income statement, balance sheet and cash flow statement for the coming three to five years. Along with the numbers, include a narrative that explains your assumptions and how the line items were computed Financial assumptions are often the most critical components of good business plans. WARNING: Making financial projections based on solid assumptions is wonderful. But you must explain the derivation and calculations to give business plan readers’ confidence in your data. Don't commit newer entrepreneur mistakes. Many spend hours pouring over data and create reasonable financial projections. However, newbies often forget or feel inadequate to explain their assumptions in text format. Assuming that loan officers are experts in reading business plans is smart. However, assuming they are experts in your industry is a mistake. Write as detailed a narrative as possible for your financial assumptions, with references that your loan officer can verify. EXPERT INSIGHT: Making valid financial assumptions, and explaining them clearly, can make the difference in receiving the funds you need or suffering rejection by lenders or investors. Often, the primary reason for approval or rejection relates to your display of expertise in your industry. Perform your industry and competition research diligently and with a total focus on becoming an expert. You must then make financial assumptions based on this expertise -- and communicate this clearly in your business plan. Your financial assumptions will be challenged. Have knowledgeable answers ready for these challenges. Entrepreneurs often make two basic assumptions about a new business: that they have a product consumers will want and that the business owner can make and sell the product profitably. An investor or partner will want to see that you’ve done your homework and can support more key assumptions than those two, with research and data. Product or Service Need One of the first and most important assumptions to address in a business plan is that there is a demonstrated need for your product or service in the marketplace. You can do this with a competition analysis, showing that others are making this product or offering this service and selling it profitably. If you believe you have a new idea no one has tried yet, demonstrate that there’s a need or desire for the benefit you offer, which can include showing how other companies currently address this consumer need, but not as well as your new idea will. Sufficient Customer Base Another key assumption is that enough consumers want your product or service that you can generate adequate sales to make a profit for the long run. You will need to demonstrate that there are many more people in your target market than you need, because all of them won’t buy, and many will buy from competitors. There is no specific formula businesses use to calculate this number, but your excess potential customer base should be more than just a percentage of your sales need. For example, if you need 100 people to buy from you each day, don’t plan on surviving in an area with 120 or 130 potential customers. Plan on needing an exponential number, which might be five to 10 times the number of customers you need. Profitability Every entrepreneur assumes he will be profitable, but that assumption must be borne out by market research, budgeting and sales projections. Profitability does not depend only on sales -- it centers around your cost to make and sell your product. Once you have calculated your manufacturing and overhead costs, review the various price levels at which you might sell your product to determine if you can pay off your start-up costs, then start making a profit. You can choose a pricing strategy that generates high sales volumes by selling at a low price or by trying to maximize profit margins with a higher price. Management Expertise A product doesn’t make itself, and a company doesn’t run itself. One of the key assumptions of a business plan is that the principals can run a business profitably. The creator of a widget might make the best widget the marketplace has ever seen, but that doesn’t mean she knows how to organize a company, handle accounting, create marketing strategies, develop budgets, handle legal issues, prepare taxes and perform the many tasks required to operate a business. A business plan should demonstrate that the principals not only know how to make a product or deliver a service, but also will be able to manage all aspects of the business. Adequate Capitalization Even when a business starts making a profit from operations, it might still take months or years to pay off the initial start-up costs. Many small businesses fail because the owner believes he can fund the operations on sales. Sales volumes that will be more than adequate for making a profit in year two or three might not even be close to helping you meet your debt service obligations your first year. Demonstrate in a business plan that you have sufficient capitalization to run the business until breakeven and afterward, or provide the amount of investment or loan you’ll need to start the business. Income Statement Construct your income statement on a month-to-month basis for the first one to two years. You can then switch to quarterly projections for years three through five. One key item dominates this presentation. Base your income and expense assumptions on factual, verifiable information. For example, if your product competitively sells for $25 to $40, refrain from using a $60 selling price to craft your sales projections. Also, base your sales volume assumptions on realistic statistics, easily verified by a quick market analysis. Balance Sheet Assumptions for balance sheet presentations should be conservative and based on reasonable expectations of asset acquisitions in the coming five years. Of particular concern to lenders and investors are inventory and accounts receivable. Both are functions of sales. Therefore, carefully match your inventory assumptions with your gross income projections. Unless accounts receivable are typically large in your industry, do not project high balances. Because cash is usually in short supply for small businesses, tying up this precious resource in excessive inventory or accounts receivable can be damaging. Cash Flow Statement If you have a new small business or a modest company needing financing or investment, the projected cash flow Statement may be the most important financial assumption you make. While both lenders and investors want your small business to generate solid net income and have a strong balance sheet, cash flow is more important. It is from cash flow that you can repay loans or distribute cash to investors from profits. When it comes to writing a top-notch business plan, the devil is in the details. While broad overviews and assumptions should start your plan, investors, lenders and partners want as much research and support as possible to determine whether your idea will fly. Even if you’re not looking for funding or help, the more questions you can answer in your business plan, the more valuable it is. Organization An excellent business plan is organized in a logical, thoughtful way that makes it easy to move from your assumptions to your justifications. The more organized your document, the easier it is to follow and to review later when you need specific information. Include a detailed contents page, an executive summary that tells what’s coming, sections on your product or service, the marketplace and financial numbers, a summary and supporting documents. Executive Summary Many professional business plans start with an executive summary at the front of the document, rather than at the end. This summary tells the reader the business idea, the reasoning behind it, what factors make you think it will work and the estimated startup costs, break-even period and eventual profits. An executive summary is often only a half-page or less, containing no detailed market research or financial numbers. The goal of the executive summary is to get the reader interested in reviewing the business plan. Company Overview This section includes a description of your product or service, its benefits, how it differs from the competition and what brand, or image, you will create for it in the marketplace. Don’t get into your manufacturing costs or profits at this point -- your goal here is simply to prove that there is a need for your product and its benefit in the marketplace. A weak business plan tries to convince readers that an idea is “great.” An excellent business plan proves that there’s a consumer demand for a product or service. Marketing Section The marketing section of a thorough business plan goes beyond discussing advertising, public relations and promotions. It begins by presenting market research that supports the fact that your idea will sell. This includes information about the marketplace, target customer, competition and current sales figures of competing products. Include a discussion of the distribution channels you’ll use and why. Once you’ve completed this information, present your advertising, PR and promotions strategies and tactics, referring to your market research to show why you are recommending these. Financials The most useful business plans provide detailed financial information, including startup expenses, manufacturing and overhead costs, sales expenses, break-even point and profit projections. Include more than one budget in your business plan to show readers you’ve done your homework: a budget outlining your startup costs, an annual master budget, budgets that break out overhead and manufacturing costs and a cash flow statement. Provide enough detail so that if someone hands you a check for your requested amount, you won’t need to spend money on anything that isn’t already in your business plan. Support Add an appendix to your business plan that includes research, data, charts and graphs that help prove the information you’ve supplied in your plan is sound. Once you’ve proved you have a viable concept, explained what it will take to fund the launch of and initial operating costs and forecast the profits, demonstrate that you are qualified to do this. Include your biography, highlighting any experience you have relevant to the business. Explain whom you will hire or use as contractors.